Filed Pursuant To Rule 433

Registration No. 333-275079

February 6, 2025

MANAGING DIRECTOR, CANACCORD GENUITY, PAT MCEVOY: Alright, um, hi, uh, my name's Pat McEvoy. I work at Canaccord Genuity. I'm lucky enough to, uh, work with Vin every day, so if you need any dirt, just see me after. Um, so thank you to, um, Vinnie, Todd, Eric, James, Craig, and Stacy for this wonderful event. We, um, many of us have been coming out here for a long time, and I think it was overdue to sort of, um, get together in a more formalized way and celebrate the, uh, strength of the industry in the Phoenix and Scottdale area. So, um, welcome everybody to Vinny's Desert Kin Sierra. This has been a, um, wonderful couple days and, um, you know, we look forward to, uh, hanging out later today and tomorrow with, with many of you. Um, it's an honor to be here today. Um, I wanted to just start by sort of going through, um, sort of the last, you know, month or so. It seems like an eternity. I mean, people say that crypto happens, you know, what happens in crypto in a week happens in most industries in a year. And I think the last month has been no, uh, no different. Um, president Trump took office and started issuing executive orders. We saw, um, you know, an executive order right away to end regulation by enforcement, which was certainly something that I personally wanted to see. We saw Hester Pierce at the SEC is acting Commissioner and Mark, uh, Uyeda, um, issue a staff accounting bulletin 122, which repealed SAB 121, which made it, you know, let's just say onerous for banks to be able to custody Bitcoin. Um, so that was a huge move. Uh, President Trump established a working task force with some of the, uh, most important, uh, regulators in the industries, um, in various industries, and notably left the FDIC off that list. Um, interestingly, and, and just now, um, Twitter's been blowing up with, um, the CEO, Nate McCauley, the founder of Anchorage Digital, which, uh, business probably some of you're familiar with. He's testifying in front of Congress today. And Representative Haggerty, who just this week introduced a stablecoin bill, um, by Iverson legislation in the house. He, um, he asked Nate to read a, um, a document that was sent to, um, NYIC by the FDIC, essentially asking them to stop doing business with anybody that touches crypto. And I think this is something that many of us in the industry thought was happening. We've heard grumblings of it. We probably experienced that to some degree in any efforts we've made at our firms in crypto. But to hear this from an industry leader like me at a congressional hearing, I think is, is really damning and, um, you know, it makes me, um, all the more excited about what the future holds for us. And so today, um, really excited to have two friends here. Um, Ray Sharif-Askary here from Grayscale Investments with many of you're familiar with and Ryan Lessard here from Fidelity Digital. Um, Ray, um, Grayscale has come a long way since I met Barry and Michael in 2015. Um, you guys had one product, GBTC, which everybody in this room is familiar with, of course. Um, GBTC is a storied asset. You know, the first, the first, uh, Bitcoin product of its kind first to become an ETF. Um, and when I met you guys, uh, back then it was just two people. And now you're probably well over a hundred, but I think you had $25 million of AUMand today over 30 billion of AUM 24 products in the country. So, um, do you want to just introduce yourself real quick and tell us what you do at Grayscale?

MANAGING DIRECTOR, GRAYSCALE INVESTMENTS, RAYHANEH SHARIF-ASKARY: Yeah, so thank you Pat for that gracious introduction of Grayscale. Um, it's great to meet everybody. Um, my name's Ray Sharif-Askary. I lead product and research at Grayscale. I have been with Grayscale for about seven years now, which is, as Pat said, a very long time in crypto. Um, before that I worked for an investment bank for 10 years for, you know, doing LBOs, um, syndicated loans. So I have a tradfi background, like a lot of people at Grayscale. And in my role today, um, you know, we we're really bridging crypto back to tradfi. That's the goal of Grayscale. And so whether that's tools and frameworks from an educational perspective and our research, or it's the products that we're gonna talk a lot more about, like GBTC, which is the first of many about 30 products now. Um, that's our goal is, is to really bring crypto back to traditional investors and help investors think about investing in the pretty vast quickly evolving, um, asset class in the way they would think about traditional assets and basically kind of doing the work and looking around the corner so that investors don't have to. Um, it's very exciting to be here. Thanks for having me.

MCEVOY: Thanks Ray. Um, Ryan Lessard from Fidelity Digital. Um, I think Fidelity is the name synonymous with finance and certainly in our business. Um, a longstanding juggernaut, um, across the broker dealer business and, you know, servicing, you know, all our clients and, and dealers. Um, I think many people don't understand what an effort Fidelity has made on the Fidelity digital side, so Abby Johnson, of course, whose father founded the firm, she's a, you know, unabated crypto enthusiast. She's been very outspoken in favor of innovation, um, coming out of, um, crypto, um, Fidelity was mining Bitcoin back in 2014. Not many people know that. So it's been a crypto-forward business for a very long time. And so I'm really excited to know Ryan here, who's gonna share a little bit about what he does at Fidelity.

DIGITAL ASSET STRATEGIST, FIDELITY DIGITAL, RYAN LESSARD: Thanks, Pat. Thanks to the SDA Arizona for having me. Ryan is our digital asset strategist at Fidelity in one of two commercial businesses, believe it or not, focused on crypto or digital assets as an asset class and on the asset management side. And Pat's comments are spot on. I've now been five years of digital assets, specifically at the firm, right? Has to be, I thought five years was long enough, uh, to be a veteran of the industry at this point and seen a lot along the way. But to the commons, it's a 10 year journey growing on Fidelity's side at this point, all the way back in 2014 when our incubation group started just trying to figure out what Bitcoin is or what it might be. And along the way, we've built both the digital asset custody and trade execution business. It's been running for six years now, and then an asset management organization, you know, an extension of 80 years of history of fidelity focused on crypto as an asset class. And so there's a lot more to come into this future. And, you know, we're probably a little behind today than maybe where Grayscale is on the cutting edge of all this. But we continue to stay leaning in from that incubation lens of what's coming next. And, you know, portion to or portion to the conversation today, what's the focus of the regulatory front and what can we do in a call it fidelity form on a go forward basis? So as a digital asset strategist, my role day to day is representing both asset class fidelity products and really where this goes from an industry lens to all sorts of customers and clients at our firm, both old and new, which is really unique to our firm in terms of the avenues and verticals of new clientele that we're operating in, in this emerging asset class.

MCEVOY: So let's start with the low hanging fruit, which has been the success of these ETPs. Um, you know, people often say ETFs, they're actually ETPs. Um, the industry is excited to perhaps see some new products launch this year. But, um, Ray, maybe just talk about the evolution of GBTC and how your products sort of start and, and where you try to get them to eventually. Because GBTC and ETG have both lived a, um, arduous lifecycle, I guess I would say.

SHARIF-ASKARY: Indeed. So, um, we basically, so GBTC and ETHE as well as BTC and ETH, the minis, they're ETPs now. We don't say ETF anymore. Um, there are 33 ACT products that are exchange listed on national exchanges. Um, but we have, believe it or not, 26 other products. And so once upon a time long, even before I joined Grayscale, GBTC came into this world, it was actually called the Bitcoin Investment Trust, or the BIT, remember the BIT. Um, and like all of our products, the first stage in their lifecycle is that we basically create a vehicle through a private placement where investors, accredited investors, family offices, institutions can get exposure to a digital asset in the form of a security, which means buying it, um, you know, putting it in IRA. And so the first stage of all of our products is that they start as, uh, direct sales to accredited investors through a private placement. That's step one. And so today we have 11 products that we launched last year, um, that are in that stage. And after a year, so under rule, and we'll get to stage two, um, under Rule 144, before these types of products can trade publicly on an exchange, meaning they can change hands between retail investors, they have to be held for a year by accredited investors. So GBTC was a private placement after a year, I think it was a little longer than a year, but now it takes about a year. Um, it like 14 other products today got uplisted to OTC markets where it started trading, just like any stock. Um, so today in that second stage, we have 14 products. So we've talked, you know, you may know GBTC and ETHE, but we have, you know, GLMK, we have pro products for Solana, we have a product for file coin, chain link. Um, so there's actually 14 more tickers that are trading on OTC that are in that stage two of the lifecycle. Um, and that also includes what I'm gonna call stage three, which are the products that are SEC reporting. So as some of you may know, and something's trading on OTC markets, it is conforming to the alternate reporting standards. Some of our products we've actually taken and we voluntarily started reporting to the SEC, which means they file 10 Ks and 10 Qs. So that is the third stage. And that is, again, before GBTC became an ETF, that is what GBTC was. Um, and then the fourth stage is that the goal for all our products is to ultimately get uplisted to be an ETF. And so I think that, um, you know, the, the, the journey of GBTC has been certainly a very interesting one. Um, and I think it's important, you know, to note that it's one of many products like it that are at different stages at this life cycle and that are meant to do exactly what GBTC did once in a time, once upon a time before Bitcoin was as well known as it is today potentially. Um, and that is to provide access to investors in a form of security in their brokerage accounts, um, at many of your firm that investors, you know, access through many of your firms who are here today. Um, and that's going to continue to be the goal.

MCEVOY: Yeah, what's so interesting about the Grayscale products, and I think where, um, you know, the innovation 10 years ago, it was quite obvious what the innovation was because they were, they were the only ones doing it, but it allows people to get access to and exposure to digital asset products in a retirement account in an IRA or in just a traditional brokerage account. So those, you know, that's been the real innovation here. We'll see, you know, we'll see what this regulatory environment portends for these products being up listed. But I think we're all pretty excited to see, you know, Solana, a light coin, a Bitcoin cash ETF in the near future. Um, Ryan, um, fidelity has had astounding success with their, um, Bitcoin and Ethereum ETFs. I think you just mentioned to me, almost 23 billion in a UM. Um, these products are just a year old, so the launches have been wildly successful. Um, could you maybe touch on, on the success of the ETF launches and then maybe just get into the, um, more, you know, sort of crypto native side of your asset mentioned business with, um, bitcoin and, and your custody offerings?

LESSARD: Yeah, I think many people in this room have probably heard some of these stats before at this point. But the category, even starting back a step of Bitcoin ETPs coming to market is the most successful launch of any ETP or ETF asset class category ever, right? When I say category, there was 10 of these that launched on the same day of last year, January 11th, including GBTC'S conversion into this ETP wrapper. And so this wave of demand is even more impressive when you contextualize Fidelity's success alongside all of these other behemoths that are having equal or more success. And so FBTC or Bitcoin ETP has $22 billion in it after one year or so at market and Fidelity's perspective, that is our largest ETF of any asset class, any category after just one year. Now, in fairness, Fidelity's a little later to the ETF game and the 80-year-old mutual fund company, but the point stands of all this research, the history that got us to this point of 10 years was listening to customers. And what kept coming back is a repetitive feedback of we want access and access, right? You mentioned that's a key word of how do we provide it at the end of the day. And this is the vehicle that was finally, you know, allowed us to have that access for clients in this ETP wrapper. And so we've seen demand, and we'll get over this in the conversation across all different client segments, really in just that one year in market, but have been even blown away internally onto the degree of that dollar demand. And I say still such early names despite a $22 billion number in our fund alone, thinking about, you know, probably many of the firms you work at at the room and many that I'm aware of where in the wealth management broker bank ecosystem that still really clients of yours maybe can't fully access these products quite yet, right? And that varies quite significantly. Home office to home office of what the rules of the road are and where they're going, and probably changing quite a bit under this new administration. But despite all the success, all the dollars we've flown in, it's still been with, you know, hands behind our back of who we're trying to distribute this to. But it allows us to sit in this unique point, Pat, of, you know, we have this parallel access I call it, to clients of both custody of spot Bitcoin and Ethereum at this point, and then ETPs as well that allow that in a more traditional sense in your brokerage account, your IRA, your trust, what have you. And so from our lens and Fidelity, we have this power of choice to our end clients of we will help you get access to this asset class or these, you know, assets in any way that works for you. And then there's just trade-offs of why ETP versus spot Bitcoin, right? Very logistical, operational considerations of your account types or cost efficiencies or trade-offs on market hours and market structure where you can access it. So there's a lot of considerations, but we've got to this point now where we're just trying to service those customers whatever way works for them.

MCEVOY: Yeah. Um, I think it's important for everybody in this room to know, you know, Ryan and Ray are here. We, we hope that by bringing them to these, um, industry events that people can be, um, become more familiarized with their products and, and you know, the compliant nature in which they run their business, extremely compliant nature, overly compliant nature in which they run their businesses. Um, because I think these products are extremely important. Um, you know, starting from the issuer to the banks and broker dealers like us on the banking side, it's important to us on the trading side, it's extremely important to us. And then back down to the order flow providers and brokers who are in here because clients want access to these products. And if you don't allow access to these products, they're just gonna go buy it somewhere else. And I think those are some of the conversations that we're having here. There's still a lot of sticky points in, in this industry. And so, um, and Ray, maybe you could just touch a little bit on, you know, some of the hurdles that you guys have been sort of jumping over for years to, to get your products to where they are and, you know, just how Grayscale has been a leader in that way.

SHARIF-ASKARY: Yeah, definitely. So I think you made a compelling point. Um, a lot of people in traditional investing, I think still, you know, think that perhaps crypto is the wild, wild west, and it's certainly new, it's certainly emerging and there's a lot out there. Um, we talk to advisors all the time and they are getting endless questions demand from their clients. And so on the one hand, they have a couple of options when there's not, when they don't have, you know, like for instance, our products on their platform, so they don't have crypto products on their platform, one option is that they, you know, kind of tell the client like, Hey, just go figure it out and buy it on your own. Um, which is pretty unambiguously a bad outcome because they want to provide that guidance. Um, or what you're seeing is a lot of grassroots efforts to try to get crypto solutions on these platforms. And so, um, from the time, you know, we have our chief operating officer here, I'm not gonna call him out and embarrass him, but we've been working together, um, for a long time. And our goal is to take something that is a different type of asset, a digital bear asset, and put it, bring it further into the regulatory perimeter. And, um, we can break down a little bit what that means. So for instance, um, folks are likely familiar with KYCEAML and you probably think like, oh, you don't have that in crypto, right? It's all anonymous, everybody's just, you know, laundering money and terrorists are sending tokens around. And um, well, I can tell you when you're a regulated entity like Grayscale, that is not what happens. Instead, um, every dollar for instance, that we take in for our private placements, we run extensive KYC on when we onboard clients, we have forensic tools to literally check the same thing. Um, because, you know, on crypto you can, the blockchain is, is, um, transparent and you can look at the providence of tokens. We have forensic tools to think about, to see exactly where tokens have come from and make sure they're clean, so to speak. Um, and this is, we do this all when we're creating new shares of our products.

MCEVOY: I think, sorry, just on that point, um, can you just, so if you create a Grayscale product, if I want to create $50,000 share, $50,000 worth of GSOL, what she's saying is that the product, you, you send them a check for $50,000, but in order for the subsequent shares to be created in the trust, somebody needs to go buy $50,000 worth of solana. And they have to do that somewhere, that at the end of the day, they can look FINRA and the SEC in the face and say, we know where this coin came from. And so that's what she's saying is like the, the KYC process doesn't start and end at Grayscale with creating a trust. It goes all the way down to where are they sourcing the tokens

SHARIF-ASKARY: From and the cash that's coming in and the background, you know, so, um, and I think that, and, and the reporting standards, I think for us, you know, everything we do from the review that we do for our, you know, research that we put out into the world and the approval process to take in new clients, um, you know, I encourage anybody to, you know, come talk to us or even start going through our process and you'll see that it is very, very rigorous and very robust. And that's something that, um, I think, you know, as, as the industry has evolved, we've really always prioritized doing things in a really compliant way and bringing everything further into the regulatory perimeter. And that includes going to the SEC, going to the regulator and saying like, Hey, we're gonna start filing these financial statements, these 10 Ks and 10 Qs. Um, so, you know, I really see Grayscale as the leader in that space and that's in that space. And I think that's why we have become sort of a trusted advisor to, um, folks and, and in ways to the advice community who are trying to navigate kind of the new and turbulent waters associated with, um, with this asset class.

MCEVOY: Yeah, I remember the days when you and your colleagues were spending a lot of time in DC and every time they seemed to go down there, it was like, sort of like the Forest Gump scene on the bus where they would try to go sit next to somebody to talk to 'em and they'd say seats taken, you know, they were like, just please stay away from me. I don't want anything to do with this industry. It's all about money. You know, they, they take a, something they hear from, um, congresswoman, my, say, Elizabeth Warren, who has had some very good points and some I think unfair points about the industry and money laundering. And, um, you know, people forget that the number one most used, um, device or, or monetary, you know, instrument for money laundering and drugs all over the world, this is the US dollar, you know, it's not tether and it is not USDC and it is certainly not Bitcoin or Ethereum. So, um, Ryan, maybe we can shift, um, a little bit, um, to talk about the regulatory side of things. Um, how Fidelity's thinking about the shift, um, the changing tides here, um, and, um, you know, just sort of any insights you wanna share with this, this group here.

LESSARD: Yeah, we can talk about this for an hour alone. Uh, but I think where we're at today as a firm probably gives you a read of where we've been as much as anything else, right? We've had operated this space for 10 years, and yet really the only assets we have been supporting are Bitcoin, Ethereum. And that, that's twofold. That's one been for us demand of what have our investors asked for in terms of on a consistent basis. But secondarily we're the last panel ended in terms of policy. And we were talking about FIT 21. It's, we don't have market structure on any of this stuff still at this point. We don't have rules of the road on what these assets are, how they're gonna be regulated by whom. And then we went from, as I described it, four years of headwinds from all facets on the regulatory front and hoping that the winds would just die down to those actually changing to more tailwinds overnight. And so that's been, you know, trying to drink from the fire hose now of understanding where all this is going in real time, who are the key counterparties and what rules may or may they not put in place. And so it's an imperfect answer at this point because it's still a lot of to be determined. But I think the encouraging part of it is on our end, it's almost how fast it might this accelerate, right? We could be at a point where we revisit this convo next year here at this conference, and there's assets or ETPs for any asset you can think of under the sun, or there's diversified product and ETF or ETP wrappers, or you quickly go from not even just having to think about how do we get our clients' bitcoin exposure to just understanding the entire asset class. So a lot of our conversations and how that's changed over the last month or two has been, if you've been still sidelined on this, is we really, really are encouraging you to get up to speed just on the stuff that's been here. Because we're gonna go from the what was to the, what could be just as soon as after anything else. So really at this point we're trying to understand what's the market structure, I think, on how these assets will be regulated and to fit them into the traditional Fidelity mold and then figure out from product landscape where is their demand at the end of the day too, to help serve those customers.

MCEVOY: So before we get to the demand side of the equation, which is obviously vital to this whole thing, continuing to work or working depending on where, where you can stand on that, um, what, um, what does this look like at Fidelity when the walls get torn down and, you know, there's potentially bipartisan legislation, um, whether it's a wellness calibrated bill or a FIT 21 bill, we get a stablecoin bill. Like is, is there a world where I log into my Fidelity account and I see my, you know, my mutual funds and my, uh, penny stocks that are going to zero, and then my, um, you know, my Bitcoin and my e and my USDC all in one place.

LESSARD: That world kind of already exists today in Fidelity. So we built this custody business six years ago, and then the question of the last couple years was how do you just integrate custody of digital assets into traditional fidelity customers and client experiences? And so we built this product called Fidelity Crypto. And so what that is, is what you're describing Pat, is you open a crypto account and link it to your brokerage account and you log into fidelity.com, your Fidelity app, and you have your brokerage I your trust, and then you have your Fidelity crypto account right under that. And so then we get into the little bit speculative phase of what the world looks like in 20 years. And this is my opinion as much as anything else, but I view wallets, you know, where you hold coins natively as just a warehouse or a garage, right? No different than an account. The brokerage account today is the warehouse or the garage for your traditional investments. And so these are just places to aggregate your exposure to some asset, and so they can coexist or maybe we live in a world even more so where wallets continue to each share of the traditional accounts from a demographic lens, and then everything is in token form of some format, right? And it all lives in a wallet infrastructure. So that's evolving. I think we are there and as much as you even we're confident in this matters, it's not the, if anymore, it's almost day by day the how exactly we're trying to figure out with everyone else how this fully materializes in the 1, 3, 5, 10 picture in serving that. So we're getting to that place already. Um, what we're allowed to do will probably determine, you know, how fast we keep going.

MCEVOY: Yeah. And I think honestly, um, you know, we're probably a little bit further away having conversations with you guys and others in the industry. We're a little bit, these things always seem to move a little bit slower than everybody gets all excited about executive orders and a new administration, and this is gonna be the dawning of a new day. And I think we believe that, but also these things, these, these changes are tectonic and they take time. Um, so before I move on to like the demand side of things, does anybody have any questions that they'd like to ask now? Anybody has any questions for Ray or Ryan?

LESSARD: Everything's fair game. Everything's fair game.

MCEVOY No, we'll come back, we'll save a little time at the end too. Um, so let's maybe get into the demand side of things here. Um, Ray, can you talk about the, like the, the sales effort at Grayscale, who you're talking to right now, um, where you guys are spending time. Um, I know for years these efforts were, they were pretty futile, right? They they were frustrating. It was very, very educational without, you know, seeing money on the other side of it. I mean, obviously that has changed with ETPs, but um, we'd love to hear, you know, we'd love to hear about what you guys are up to there.

SHARIF-ASKARY: Definitely. So when I started, um, we were having a lot of different types of conversations and a lot of those conversations were Bitcoin 101, what is this? This is internet money, this is, how can I even conceptualize something that doesn't have cash flows or real value? Um, and that was the conversation we were having. Um, family offices, a lot of high net worth individuals over time that's shifted pretty dramatically. We're still talking to those folks. Um, we're talking to a lot more institutions now, and we have, um, you know, a national sales force with folks all over the country in every territory.

MCEVOY: How many people are in your sales force?

SHARIF-ASKARY: Oh, I think 20. Oh yeah. Is that right? Um, and, and we are, I think the developments over the last few years, the approval of ETPs has really opened the floodgates to a whole new market, which is the advice market. And we've touched on that before. Um, but these folks are seeing a lot of demand from their clients and they're looking for solutions. And it does feel, ironically not like crypto and the Bitcoin egalitarian kind of the ethos of how it came to be created. It does feel a little bit grassroots because, um, you know, you have different advice teams, RIAs or you know, parts of teams associated with warehouses over the country who have clients, who have these needs, who have these demands. Um, and not just demands for, you know, how can I, what is crypto and how can I buy Bitcoin? But folks want, nowadays folks want, you know, they want active exposures. They want diversification just like you'd see with, you know, any other asset class. They want to think about how their Bitcoin fits into a portfolio. Does it, you know, do they allocate away from tech or commodities or venture? Um, you know, people are thinking about, you know, I have Bitcoin exposure. How do I think about Gfi? You know, the percentage of Ethereum I might have or other, you know, layer one blockchains like Solana or Suite. So the conversations have changed, um, and we're seeing a real demand for these folks and almost a friction to get more options on the platforms that they can offer their clients. And that's something that's ongoing and um, you know, we're starting to see, see more movement there. The conversations are becoming more and more tactical. Um, and, you know, we are continuing to be educators in the space, but it's a very different conversation from like, what is this and why would we want it more so to, hey, how can we get it for our clients in a way that doesn't, you know, send them to trade away.

MCEVOY: Yeah. And I think, you know, having in, in your colleagues, Dave lab ball who runs ETFs for you, crystal, and she's on the ETF team, I think some of you probably have seen Krista, she's, she's been, um, at a few of the, um, security traders events most recently. I think she was in Chicago on a panel. But it's nice to see, nice to see, um, people from the crypto digital asset asset management making their way into the mainstream, um, of, you know, our industry because it's important that we continue to innovate and embrace the innovation that is right here on the doorstep. Um, Ryan, um, how about from your perspective? I mean, you've been traveling like a madman. I know you flew in from Austin where you were there for a couple days. I know you were traveling last week when Ray and I had a call with prep call with you. So, um, you're obviously in high demand. Where, where are you seeing the demand?

LESSARD: Yeah, we have really unique perspective even too in that obviously we're an asset manager running these funds, but as all of you're aware, we're a booker shop at the end of the day too, and have clients in different segments that with ETFs or ETPs the challenges. You traditionally don't know who owns them, right? Outside of when people are filing 13 Fs or other ways of collecting and aggregating that data. So we have fairly granular but imperfect data on some of this stuff. And most people wouldn't be surprised that our Bitcoin ETF to generalize for a second is, you know, 70% or so retail, right? And at the end of the day, that's not surprising. Because Bitcoin has been around for 16 years, was a retail first asset in phenomenon. So that trend is persisting, but that 70% now was 80% in the first quarter of last year in terms of retail. And so what that means is we're seeing this institutional growth quarter over quarter of all types of investors. Whether like Ray is saying these are advisors in the wealth management channel, family offices, hedge funds, pensions, you name it, every investor type is starting to be represented in the ownership of not just Fidelity's product, but all of the Bitcoin ETPs at large. And so as that ownership grows, so do our conversations in the demand from, you know, your peers in the industry to understand how they provide access. And I think those are two important combos that we're having in parallel now is always the investment case for Bitcoin or other cryptocurrencies, but the business management or practice management case I call it, of, depending on who you sit as as a firm, how do we provide that access, both literally speaking and what products, but then also from a rollout in the best interest of our clients, how do we position it? How do we do this thoughtfully? Which of the products and partners are we choosing to work with, educate them at large? And so my day job is running around, you know, having those conversations on all different levels of both what I described as the legacy clients of Fidelity, which were kind of the bread and butter and traditional distribution, and then the new clients. One of the biggest ownership segments of our fund, at least in particular, is actually hedge funds. And so these are all blue chip names, the millenniums, the rent tax, the .72s of the world. And they're not all directionally long Bitcoin, to be fair. Many of them are, you know, basis trading or harbing out where they can, and you know, some of the inefficiencies that still exist in this market for a variety of reasons due to its maturation cycle, right? It's getting there, but it's not perfect with traditional assets at large. And so that to us as our firm has been a really unique eye opener of we've never historically distributed proprietary investment product to hedge funds. We service them in our prime business, our prime brokerage business for the many of their needs day to day, but we've never even made an effort to proactively bring to them our product, right? So we're seeing new channels of distribution and I think all it speaks to is back to some of my earlier comments, is the demand from whomever exists, whatever type of investment entity they are, they are there now. And it's more about going down further those versions of, you know, rolling adoption downstream.

MCEVOY: Can we go back to, um, you mentioned conversations, um, with these institutional clients, if you are, if you're in there educating or, or pitching your your custody product, what is the, not that this is an investment panel, but I think it's important to just touch on what, what is the framework that is resonating with investors right now? Like is it, is it the digital gold framework? Is it the, is it the inflation? Is it non sovereign money? Is it, is it my keys, my coins? Is it a combination of all those things?

LESSARD: Yeah, it depends. If you're talking, I think Bitcoin or just about everything else in crypto, everything else, and to bucket that together easily for a second is a totally different conversation. Often of what is the value prop of these token and networks and more of a technology venture play often on the unique, unique, you know, propositions, Bitcoin has started to make more and more sense every time I've done this over four years, like month over month, where people are understanding that the basement in the United States and what that means to their purchasing power and how do you hedge that to some degree with some sort of store of value or aspiring store of value asset. And they don't have to believe me, even, you know, gold is trading at all time eyes probably for the same reasons, right? So you're, you're understanding this in real time domestically for sure. More recently than not. And one part I even didn't touch on, which is net new distribution to our world is the amount of international interest and activity that there's been at Bitcoin in large, but even in our products, given the locality of them relative to the local market products that might exist somewhere else in the world. So we're seeing interest across the world, but in the US in particular that, you know, growing debt burden the basement of the US dollar and seeking out alternatives to the traditional 60 40 portfolio, which includes private assets beyond Bitcoin, has really started to resonate, we probably should open our eyes to this idea.

MCEVOY: Yeah, we're, we're saying the same thing. Um, you know, with our clients, um, Ray, we, you know, they think about Bitcoin, you know, and then kind of everything else but Grayscale, you know, part of your ingenuity and what you guys, you know, built your business upon is trying to offer clients a myriad of products, right? So there's gonna be 24 publicly traded trusts, knock on wood, you know, sometime this year. Um, you know, what are the other products that you're excited about or that you're seeing uptake, you know, with, with your clients in the private placement or secondary market?

SHARIF-ASKARY: Yeah, definitely. So, so you know, Bitcoin is a stalwart digital gold narrative, but I think beyond that folks, um, one of the themes we're excited about and we're seeing clients really excited about, and I'll touch on three themes here. One is just scalability of you through experience as a stepping stone to massive option. I'm on chain, do all the time, I'm doing stuff. Um, I still, sometimes when I'm doing it like myself and sending money between wallets and, you know, doing trades on decentralized exchanges, I've definitely lost a few dollars here and there. And it is because we still have some ways to go in terms of the scalability and the user interface, um, aspect of that. So originally when you think about Ethereum in layer one platforms, it's like a decentralized computer, programmable money that people can build on, that you can use to do things. And increasingly there are new protocols like Solana and like SWE, we have a private placement for SWE, and then we have a, you know, private placement for Solana and GSO is publicly traded, um, that are like new versions of smart contract platforms that are scalable and that are extracting away some of these frictions from investors. So for instance, the suite protocol has created, you know, a wallet that you can log in with your email the way that you would, you know, using any kind of incumbent financial, financial infrastructure. Um, so those are things that I think thematically are really exciting for folks, um, because it's the next step in really onboarding crypto to new groups of people and, and having folks use crypto. I think the intersection of crypto and AI, I, you know, it'd be hard to, to find anybody that's not been, you know, just reading, you know, hearing about everything that's been going on in the AI space. Um, all of it's very exciting. I think from our perspective, centralized AI and the development, the proliferation of AI poses certain problems, certain risks, like, you know, bias in models for instance. Um, that, um, and verification of data that in a centralized way I think can be ultimately problematic and crypto, the decentralized nature of it, the way, you know, the very fact that blockchains are open egalitarian and that ownership is distributed, um, we think provide pretty compelling solution. And so that's something we're seeing investors engage on. Um, for instance, we have a decentralized AI fund. We have a private placement for, um, a, a protocol called Big Tensor, which has a token called TAU And that's sort of a marketplace for developing AI models that do different things and using blockchain focused incentives to make sure that it's fair and transparent, um, and transforming the traditional infrastructure. You know, when you think about, um, the legacy financial system, there's a lot of people that are excluded from it, and we think that through decentralized finance, um, which is open, which is transparent, everybody can access it and, um, through other protocols, like, you know what XRP is building, we have a Grayscale XRP trust, um, that's been something that folks have been focused on. We have an opportunity to make the existing financial infrastructure, um, more accessible, more efficient and faster.

MCEVOY: Thank you. Um, that's, there's a lot there. And Ray will be around after, if you can

SHARIF-ASKARY: Yes, if anybody answer any questions.

MCEVOY: See people trying to write down the Tencent or TAU and, um, there's a lot to double click on there and it's certainly super, super interesting stuff. I mean, I think just a, we have to, we have to wrap here, but you know, what Ray's saying here about, you know, this, this centralized nature of, of crypto that was born out of this decentralized blockchain, that, that is, that, that Bitcoin was built upon. Um, you know, everybody followed the deep seek story, um, Sunday to Monday. And so, like her point there is you can debate, did this Chinese company spend $6 million on their training? Like, nobody believes that, but you can debate it. What you can't debate is you can go to their open source code and if you can write code, you can see the way that they developed their learning model that was different than open AI and Google, Gemini and everybody else that's in that arms race. So it's, you know, it's, this is such an incredible emerging technology and you know, I urge all of you to stay in touch with Ray and, um, with Ryan. They're super accessible. Their teams travel all the time. They're here to be friends of our industry and educational and helpful. So, um, you know, let's, let's give a warm round of the applause.

Grayscale Bitcoin Trust ETF (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

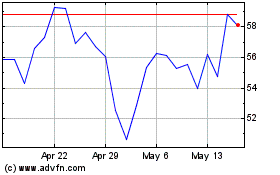

Grayscale Bitcoin Trust ... (AMEX:GBTC)

Historical Stock Chart

From Feb 2024 to Feb 2025