Although commodity prices have been under pressure for much of

2012, many have come back in recent weeks thanks to a sluggish

economy and extremely accommodative policies from central banks

around the world. With the promise by the ECB for unlimited bond

purchases and speculation over more QE in America, this trend

doesn’t appear to be ending anytime soon, putting hard assets and

producers of commodities in the spotlight once again.

In light of this trend, the recent launch by Global X in the

commodity market could be of some interest to metal-focused

investors. The company recently released its newest fund, the

Junior Miners ETF (JUNR) which looks to give broad

exposure to pint-sized firms in the mining world from around the

globe (see Could This Be The Year For These Mining ETFs?).

This new fund will contain just under 100 securities and charge

investors 69 basis points a year in fees for its services. The

product will track the Solactive Global Junior Miners Index which

is a benchmark of small cap mining firms that are engaged in

producing, smelting, or refining any of, but not limited to, the

following materials: coal, copper, gold, iron, nickel, silver,

titanium.

The benchmark is pretty well spread out, as the top holding only

accounts for 2.6% of assets, suggesting a very diversified

portfolio. In terms of a national breakdown, Canada takes the top

spot at 34% of assets and it is closely trailed by Australia at

26%. Beyond these two, the U.S. (18.4%), the UK (7.3%), and China

(4.3%) round out the top five, suggesting that a host of nations

from around the globe receive sizable chunks in the portfolio.

Why Junior Miners?

According to Global X research, small cap miners tend to benefit

in a rising price environment as large caps seek to shore up their

supply chains. Buying up small caps in mergers or acquisitions is

arguably easier than exploring for new mines and obtaining all the

necessary permits, and actually getting the mine to produce as well

(see more in the Zacks ETF Center).

Furthermore, large cap miners could see some competition on this

M&A front thanks to sovereign wealth funds, steelmakers and

pension funds which could all look to expand into the small cap

commodity market in order to provide long term growth and more

diversification for a portfolio. This could help to bid up shares

of small cap mining stocks, making them trade at favorable

multiples in the near term.

Lastly, small caps tend to be more volatile than their large cap

counterparts and they also tend to trade as a leveraged play on the

underlying metals. So, for investors who believe that metal prices

are on the rise, a closer look at small caps is the logical choice

for outsized returns going forward (see Silver ETFs Outshine

Gold).

ETF Competition

Luckily for Global X, the fund will face little in terms of

competition from other ETF issuers, at least for now. However, it

should be noted that there are a few ETFs that are relatively close

to JUNR in their focus, although none are identical.

First up is the PowerShares S&P SmallCap Materials

Portfolio (PSCM), a relatively unpopular fund that targets

the broad materials market. The ETF is cap-weighted and while much

of the portfolio is outside the mining space, the product does have

a heavy focus on micro cap securities.

This strategy has a great deal of potential, at least when

compared to the large cap counterpart in the space,

XLB. PSCM has thoroughly crushed its large cap

State Street counterpart over the past year, beating out the fund

by over 1,000 basis points in the time frame, suggesting that small

caps certainly have the ability to outperform in today’s market

environment.

Meanwhile, another fund that should be of interest to investors

considering JUNR is the Junior Gold Miners ETF

(GDXJ) from Van Eck. The fund is extremely popular with

over $2.6 billion in AUM and over 3.5 million shares traded on a

daily basis. Clearly, this junior mining product was in mind for

Global X when they first considered bringing JUNR online (see Has

the Junior Gold Mining ETF Lost Its Luster?).

Unfortunately, the broad gold mining market has been extremely

unfavorable over the past 52 weeks, forcing GDXJ to underperform

its large cap counterpart, GDX, by a pretty wide

margin. However, the reverse has also been true over shorter time

frames, as gold prices have come back in August and September.

So while JUNR isn’t likely to outperform broad metal mining ETFs

that are focused on large caps—like XME-- all the time, the new

Global X fund seems poised to lead in bull market runs. So, for

investors who are bullish on the mining market, JUNR could be an

interesting pick as it offers global, diversified exposure to an

often overlooked segment of the materials world (see Bet on a Gold

Comeback with the Gold Explorers ETF).

Just remember, the product is likely to see more volatility than

its large cap counterparts, suggesting that it probably isn’t for

the faint of heart, nor is it likely a good place to stash cash in

bear markets either. Instead, it could be a high risk, high

reward play for investors seeking more materials exposure who

believe that continued balance sheet expansion and intervention by

central banks around the globe will help to push hard assets back

to lofty heights once again to end the year.

(Investors should note that this fund is a conversion from the

Global X S&P/TSX Venture 30 Canada ETF. That product debuted in

March of 2011 but underwent a name change and a strategy adjustment

in order to turn it into the junior miner product that we have

today.)

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

GLBL-X JR MINER (JUNR): ETF Research Reports

SPDR-MATLS SELS (XLB): ETF Research Reports

SPDR-SP MET&MIN (XME): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

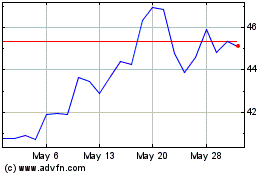

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

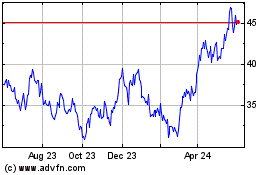

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Nov 2023 to Nov 2024