Despite the global worries of a further slump in commodity

prices going forward, gold managed to finish a little higher last

week, adding a few percentage points. This has pushed the precious

metal above the $1,450/oz mark again thanks to bleak US growth data

that raised hopes of the Fed keeping the current pace of bond

purchase intact this year (read: Have We Seen the Bottom in Gold

ETFs?).

This increase has also being felt in the ETF space with key

products like GLD, IAU and SGOL adding similar percentages last

week. While these performances have been good, events have been

even better in the gold mining ETF space.

Products in this category generally trade as a leveraged play on

the underlying commodities, so when gold prices are rising, these

mining ETFs are truly the winners.

In fact, the gold miner ETFs outpaced the broad market funds

like SPY by a wide margin in the same timeframe. This is because

revenues for gold mining companies are based on the prices of gold

as these do not hedge their entire production.

The firms in the mining space are undertaking various steps to

reverse their longer term trend of underperformance.

These include managerial changes, cost cutting programs and

increasing dividends (read: Gold Mining ETF Slump Continues).

Gold Miner ETFs in Focus

In this backdrop, we have highlighted a couple of the biggest

precious metal mining ETF winners for investors looking for some of

the short-term beneficiaries of the recent surge in gold prices

(see more ETFs in the Zacks ETF Center):

Global X Gold Explorers ETF (GLDX)

This is by far one of the largest and actively traded funds in

the mining space. The fund seeks to match the performance and yield

of the Solactive Global Gold Explorers index, before fees and

expenses. The stocks in the index comprise liquid international

stocks involved in gold exploration.

The ETF has managed assets worth $29.9 million since its launch

in November of 2010. It is widely spread across 20 small cap

securities with none of them holding more than 6.4% of assets. Atac

Resources, Lyndian International and Rubicon Mineral occupy the top

three positions in the basket (read: The Guide to Broad Metals and

Mining ETFs).

In terms of country exposure, Canada takes the top spot with

92.3% share, followed by United States (4.2%) and Australia (3.5%).

The product added over 4% over the last week and yields higher at

8.55% in annual dividends. It has a relatively tight bid/ask spread

given volumes of more than 100,000 shares per day and charges 65

bps in annual fees.

Global X Pure Gold Miners ETF (GGGG)

This fund tracks the Solactive Global Pure Gold Miners index,

which measures the performance of the largest and most liquid gold

mining companies globally. The product has amassed only $3.1

million in its asset base and is less liquid trading in a paltry

volume of roughly 4,000 shares while charging a fee of 59 bps.

With holdings of 24 securities, the product is diversified

across each asset class with 47% allocated to small caps, 39% to

mid caps and the rest to large caps. It does not put more than 6%

of its assets in a particular firm. The top three holdings include

Polyus Gold, Alamos Gold and Randgold Resources.

The ETF has a tilt towards Canadian firms with more than

two-fifths share in the basket while South African and United

Kingdom often get double-digit allocations with 14% and 10%,

respectively. GGGG was clearly the top performer in the gold mining

space last week, gaining over 7% in the same timeframe (read: Time

to Buy this Precious Metal ETF?).

Market Vectors Junior Gold Miners ETF

(GDXJ)

Launched in Nov 2009, this popular ETF looks to focus on the

small and mid cap firms in the gold and silver mining industry. It

does so by tracking the price and yield performance of the Market

Vectors Junior Gold Miners Index as closely as possible.

In total, the ETF has 78 securities in its basket with 86% going

to mid caps and the rest to small, giving the fund a weighted

average market cap of $1.8 billion. The fund charges investors 54

bps a year, and has incredible volume of over 3.6 million shares a

day.

In terms of holdings, Canada dominates at 58.1% of total assets

followed by a hefty Australia weight of just under 25%. It should

also be noted that the fund does a great job of spreading out

assets with no one firm accounting for more than 4.2%. Argonaut

Gold, Torex Gold Resources and China Gold are the top three

elements in the fund’s portfolio.

The ETF gained 4.08% in the past week and pays an attractive

dividend yield of 5.82%.

Global X Junior Miners ETF (JUNR)

This is the newest product in the space, initiated by Global X

in Sep 2012 (read: Global X Debuts Junior Miners ETF (JUNR)). The

ETF looks to give broad exposure to small cap firms in the mining

world from across the globe.

The fund seeks to match the performance of the Solactive Global

Junior Miners Index, which is a benchmark of small cap mining firms

that are engaged in producing, smelting or refining of coal,

copper, gold, iron, nickel, silver, titanium.

The product holds 94 securities in the basket and is highly

diversified across individual securities, sectors and countries.

Each security holds less than 3.5% of the assets, suggesting

minimal company-specific risk and prevention of heavy

concentration.

Precious metals enjoy the top position in the basket comprising

roughly half of the assets. The rest goes to broad metals and

minerals, coal and alternative energy, steel and aluminum.

In terms of a national breakdown, Canada and Australia take the

top two spots with 36% and 28% of assets, respectively. The U.S.

(18%), the UK (5%), and China (3%) round out the top five,

suggesting that a host of nations from around the globe receive

sizable chunks in the portfolio.

Thanks to the newness of the product, it trades in small volumes

of nearly 10,600 shares per day and has amassed $2.9 million in

AUM. This illiquid nature raises the cost for this fund in the form

of a wide bid/ask spread beyond the expense ratio of 0.69%. The ETF

has, however, added a solid 6.11% last week and pays an

above-market dividend of 17.70% (read: 3 High Yield ETFs for Your

IRA).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

GLBL-X PGM (GGGG): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

GLBL-X GOLD EXP (GLDX): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

GLBL-X JR MINER (JUNR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

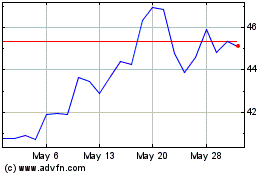

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

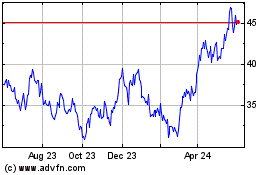

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Nov 2023 to Nov 2024