With the sequester deadline for the US Federal Government

looming large over the economy, it was not expected that stocks

would be able to rally. However, this has not been the case, as

equities have taken the proposed cuts in stride, allowing equities

to push higher.

This is despite the fact that the sequester is due to begin in

short order and that it could have a modest impact on the economy.

Some are predicting job losses and reduced growth, while others

aren’t betting on this pessimistic scenario (With Sequester Ahead,

Are Defense ETFs in Trouble?).

It appears as if this optimism is winning out for now, as the

market has rewarded investors will solid gains in the Wednesday

session. Index ETFs rallied more than 1% to provide investors with

a handful of gains before the sequester hits the economy.

The SPDR S&P 500 (SPY) rose 1.26%, the

SPDR Dow Jones Industrial Average ETF (DIA)

climbed 1.31%, the PowerShares QQQ Trust ETF (QQQ)

posted a gain of 1.02%, and the iShares Russell 2000 Index ETF

(IWM) closed the session rising 1.05%.

Beyond the sequester, it also didn’t hurt that Ben Bernanke’s

testimony to Congress was very dovish. It seemed to suggest that

low rates would be here to stay and that aggressive bond buying

campaigns wouldn’t be going anywhere soon.

Another factor which could have possibly led the market to

positive territory is the upbeat Pending Home Sales Data. The

National Association of Realtors reported that its Pending Home

Sales Index rose 4.5% to 105.9 in January from the downwardly

revised 101.3 in December. This further provides evidence of

recovery of the once grievous sector.

The housing sector should turn out to be the primary driver of

economic growth in 2013. For seven straight quarters spending on

home construction and home improvement activity had a positive

contribution to overall economic growth (Housing ETFs Rally on

Solid Data).

Given that the sequester hasn’t been much of an issue in terms

of growth predictions, and some of the solid housing data as of

late, investors may want to consider looking at real estate and

homebuilder ETFs at this time. These segments have been beaten

down, and now could be a great time to consider these ETFs for more

gains heading into March:

SPDR S&P Homebuilders ETF (XHB)

XHB appears to be very popular, as it has an asset base of $2.36

billion and offers liquidity as revealed by its trading volume of

more than 8 million shares a day. The fund charges a fee of 35

basis points a year (Top Ranked Homebuilder ETF in Focus: XHB).

The fund’s asset base is spread across 36 securities. Among

sectors, XHB has 28.7% of its asset base in homebuilding and 26.79%

in building products, while the rest is spread across home

furnishing retail, home improvement retail and household

appliances.

The fund does well to minimize company-specific risk thanks to

its equal weighting. It invests 36.49% of its asset base in the top

ten holdings. Among individual holdings, Mohawk Industries, Tempur

Pedic and Standard Pacific form the top line of the fund with

respective shares of 3.95%, 3.87%, and 3.78%.

In the previous trading session, the fund climbed 2.16% to close

at $28.37.

Vanguard REIT ETF (VNQ)

VNQ is the largest real estate ETF in the space with an AUM of

$32.3 billion. With holdings of 117 securities, the product puts

44.5% of its assets in the top 10 companies, suggesting a greater

concentration across individual firms (Is ROOF a Better Real Estate

ETF?).

Looking at real estate market exposure, the fund is well

diversified between retail REITs (27.40%), specialized REITs

(28.70%), residential REITs (17.1%), office REITs (13.9%),

diversified REITs (7.6%) and industrial REITs (5.30%).

Large caps account for about 45% of the assets while mid and

small caps make up the remaining portion of the basket. The fund is

liquid as it trades in higher volumes of more than 1 million shares

per day, signifying that no extra cost of investment is involved or

the bid/ask spread is minimal.

The product is one of the low-cost choices in the space,

charging only 10 bps in annual fees from investors.

Dow Jones U.S. Real Estate Index Fund (IYR)

IYR is another popular ETF in the real estate space. This ETF

provides liquidity to investors trading with a volume level of more

than seven million shares a day and an asset base of $5.4 billion

(The Introductory Guide to Real Estate ETF Investing).

The fund manages a basket of 89 real estate companies with 40.5%

of the asset base invested in the top 10 holdings. Among individual

companies, Simon Property Group takes the top spot with a share of

8.72%. Beyond SPG, American Tower Corp and HCP Inc occupy the

second and third positions with an asset investment of 5.34% and

3.91%, respectively.

Among sector holdings, Specialty REIT, Retail REIT and

Industrial REIT take the major chunk of the asset base,

collectively having a share of roughly half the portfolio

For this exposure the fund charges an expense ratio of 47 basis

points, putting it in a decent position in terms of total

costs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-DJ REAL (IYR): ETF Research Reports

SIMON PROPERTY (SPG): Free Stock Analysis Report

VIPERS-REIT (VNQ): ETF Research Reports

SPDR-SP HOMEBLD (XHB): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

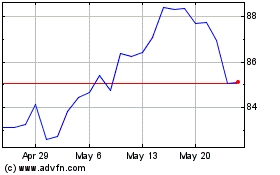

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Oct 2024 to Nov 2024

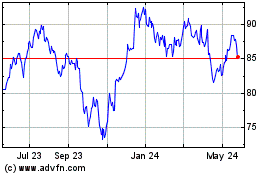

iShares US Real Estate (AMEX:IYR)

Historical Stock Chart

From Nov 2023 to Nov 2024