Know Labs, Inc. (NYSE American: KNW), an emerging developer of

non-invasive medical diagnostic technology, today reported

financial results for the fourth quarter and fiscal year ended

September 30, 2024.

Financial Highlights:

- Know Labs reported a net loss of $16.58 million dollars in

FY2024, compared to a net loss of $15.29 million dollars in FY2023,

an increase in net loss of 8.4%. This translates to Earnings Per

Share of a loss of $0.20, better than FY2023 Earnings Per Share

Loss of $0.41, an improvement of 51%, before preferred stock

dividends.

- In FY2024, recorded a non-cash charge to earnings of $4.93

million, compared to $4.77 million FY2023. The non-cash items

include (i) depreciation and amortization of $81,000; (ii) stock

based compensation-stock options of $2,958,000; (iii) issuance of

common stock for services of $277,000; (iv) amortization of

operating lease right-of-use asset of $189,000; amortization of

debt issuance costs of $831,000; and (v) interest expense for

extension of notes and warrants of $594,000.

- Research and development expense for FY2024 was $6.11 million

dollars as compared to $7.73 million dollars in FY2023, a decrease

of 21.0% year over year. The decrease in R&D expense was

related to decreases in engineering, third-party technical

services, and expenditures related to the development of our

Generation 2 device, which we completed and announced on February

27, 2024, as we continue to execute our path to FDA clinical trials

and commercialization.

- Selling, general and administrative expenses for the year ended

September 30, 2024 increased $2,538,000 to $9,109,000 as compared

to $6,571,000 for the year ended September 30, 2023. The increase

primarily was due to (i) an increase of $1,257,000 in salaries;

(ii) an increase in legal expenses of $669,000; (iii) issuance of

common stock for services of $277,000; and (iv) an increase in

other expenses of $335,000. As part of the selling, general and

administrative expenses for the years ended September 30, 2024 and

2023, we recorded $606,000 and $305,000, respectively, of investor

relationship and business development expenses.

- As of September 30, 2024, we have cash and cash equivalents of

$3.11 million, as compared to $8.02 million dollars at the end of

September 30, 2023. Net cash used in operations for FY2024 was

$12.83 million dollars compared with $10.35 million in the prior

year.

- During the year ended September 30, 2024, the Company made

adjustments to its fixed expenses and the impact of those

adjustments has significantly reduced our monthly burn rate. Given

the significant reduction in fixed expenses, the Company believes

that it has enough available cash and flexibility with its

operating expenses to operate through February 28, 2025. As we have

stated in our FY2024 10-K, we expect to raise additional funds

through the issuance of equity, preferred stock and convertible

debentures.

- Shareholder equity for the fiscal year 2024 was -$2.16 million

versus $3.74 million in fiscal year 2023.

Income Statement:

Years Ended, September 30, 2024 September 30, 2023 OPERATING

EXPENSES- RESEARCH AND DEVELOPMENT EXPENSES $

6,114,121

$

7,727,467

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

9,109,362

6,570,597

SELLING AND TRANSACTIONAL COSTS FOR DIGITAL ASSETS

-

(274,019

)

Total operating expenses

15,223,483

14,024,045

OPERATING LOSS

(15,223,483

)

(14,024,045

)

OTHER INCOME (EXPENSE), NET Interest income

155,248

127,145

Interest expense

(1,513,323

)

(389,626

)

Loss on debt extinguishment

-

(506,865

)

Other (expense)

-

(495,776

)

Total other (expense), net

(1,358,075

)

(1,265,122

)

LOSS BEFORE INCOME TAXES

(16,581,558

)

(15,289,167

)

Income tax expense

-

-

NET LOSS

(16,581,558

)

(15,289,167

)

Deemed dividends on Series C and D Preferred Stock

(313,536

)

(3,526,653

)

Common stock dividends on Series D Preferred Stock

-

(1,627,230

)

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS $

(16,895,094

)

$

(20,443,050

)

Basic and diluted loss per share $

(0.20

)

$

(0.41

)

Weighted average shares of common stock outstanding- basic

and diluted

86,067,999

49,581,467

Balance Sheet:

September 30, 2024 September 30, 2023

ASSETS CURRENT

ASSETS: Cash and cash equivalents $

3,110,755

$

8,023,716

Total current assets

3,110,755

8,023,716

PROPERTY AND EQUIPMENT, NET

66,796

81,325

OTHER ASSETS Other assets

149,174

15,766

Operating lease right-of-use asset

337,703

145,090

TOTAL ASSETS $

3,664,428

$

8,265,897

LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY

CURRENT LIABILITIES: Accounts payable - trade $

552,680

$

1,292,861

Accrued expenses

101,582

94,062

Accrued expenses - related parties

84,573

218,334

Current portion of convertible notes payable, net

2,855,058

1,301,005

Current portion of convertible notes payable - related parties

1,460,926

1,460,926

Current portion of operating lease right-of-use liability

108,560

154,797

Total current liabilities

5,163,379

4,521,985

NON-CURRENT LIABILITIES: Operating lease liability, net of

current portion

249,728

-

Non-current portion of convertible notes payable, net

407,522

-

Total liabilities

5,820,629

4,521,985

COMMITMENTS AND CONTINGENCIES (Note 11) STOCKHOLDERS’

(DEFICIT) EQUITY Preferred stock - $0.001 par value, 5,000,000

shares authorized, Series C and D shares issued and outstanding as

follows: Series C Convertible Preferred stock $0.001 par value,

30,000 shares authorized, 17,858 shares issued and outstanding at

9/30/2024 and 9/30/2023, respectively

1,790

1,790

Series D Convertible Preferred stock $0.001 par value, 20,000

shares authorized, 10,161 shares issued and outstanding at

9/30/2024 and 9/30/2023, respectively

1,015

1,015

Common stock - $0.001 par value, 200,000,000 shares authorized,

108,097,936 and 80,358,463 shares issued and outstanding at

9/30/2024 and 9/30/2023, respectively

108,021

80,358

Additional paid in capital

136,468,855

125,501,537

Accumulated deficit

(138,735,882

)

(121,840,788

)

Total stockholders' (deficit) equity

(2,156,201

)

3,743,912

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY $

3,664,428

$

8,265,897

Cash Flow:

Years Ended, September 30, 2024 September 30, 2023 CASH FLOWS FROM

OPERATING ACTIVITIES: Net loss $

(16,581,558

)

$

(15,289,167

)

Adjustments to reconcile net loss to net cash (used in) operating

activities Depreciation and amortization

80,881

313,019

Stock based compensation - stock option grants

2,957,559

2,955,933

Issuance of common stock for services

277,011

-

Gain on debt settlement

-

(50,000

)

Loss on disposal of assets

-

549,431

Loss on debt extinguishment

-

506,865

Amortization of operating lease right-of-use asset

189,286

142,840

Amortization of debt issuance costs

830,948

-

Interest expense for extension of notes and warrants

594,761

349,721

Changes in operating assets and liabilities: Other long-term assets

(133,408

)

(1,999

)

Operating lease right-of-use liability

(178,408

)

(147,719

)

Accounts payable - trade and accrued expenses

(866,422

)

317,085

NET CASH (USED IN) OPERATING ACTIVITIES

(12,829,350

)

(10,353,991

)

CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of research

and development equipment

(66,352

)

(80,797

)

NET CASH (USED IN) INVESTING ACTIVITIES:

(66,352

)

(80,797

)

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from debt

offering

3,764,129

-

Repayment of note payable

(720,000

)

-

Proceeds from issuance of common stock offering, net

5,193,262

5,472,791

Payments of debt offering

(262,450

)

-

Proceeds from issuance of common stock for warrant exercise

7,800

387,334

Proceeds from issuance of common stock for stock options exercise

-

4,687

NET CASH PROVIDED BY FINANCING ACTIVITIES

7,982,741

5,864,812

NET (DECREASE) IN CASH AND CASH EQUIVALENTS

(4,912,961

)

(4,569,976

)

CASH AND CASH EQUIVALENTS, beginning of period

8,023,716

12,593,692

CASH AND CASH EQUIVALENTS, end of period $

3,110,755

$

8,023,716

Supplemental disclosures of cash flow information: Interest

paid $

241,000

$

140,000

Taxes paid $

-

$

-

Supplemental disclosure of non-cash financing activity:

Deemed dividends on Series C and D Preferred Stock $

313,536

$

3,526,653

Common stock dividends on Series D Preferred Stock $

-

$

1,627,230

Warrants issued for debt offering $

2,110,731

$

-

Common stock issued for debt payment $

240,000

$

-

Issuance costs from common stock offering $

670,149

$

1,527,209

A copy of the form 10-K filed with the SEC can also be

downloaded from the Company’s website. All holders, including

stockholders and bondholders, can request and receive a hard copy

of the complete audited financial statements free of charge.

Requests must be submitted to ask@knowlabs.co.

About Know Labs, Inc.

Know Labs, Inc. is a public company whose shares trade on the

NYSE American Exchange under the stock symbol “KNW.” The Company’s

platform technology uses spectroscopy to direct electromagnetic

energy through a substance or material to capture a unique

molecular signature. The technology is designed to able to

integrate into a variety of wearable, mobile or bench-top form

factors. The Company believes that this patented and patent-pending

technology makes it possible to effectively identify and monitor

analytes that could only previously be performed by invasive and/or

expensive and time-consuming lab-based tests. The Company’s first

expected application of the technology will be in a product

marketed as a non-invasive glucose monitor. The device is designed

to provide the user with accessible and affordable real-time

information on blood glucose levels. This product will require U.S.

Food and Drug Administration clearance prior to its introduction to

the market.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. These statements appear in a number of places in this

release and include all statements that are not statements of

historical fact regarding the intent, belief or current

expectations of Know Labs, Inc., its directors or its officers with

respect to, among other things: (i) financing plans; (ii) trends

affecting its financial condition or results of operations; (iii)

growth strategy and operating strategy; and (iv) performance of

products. You can identify these statements by the use of the words

“may,” “will,” “could,” “should,” “would,” “plans,” “expects,”

“anticipates,” “continue,” “estimate,” “project,” “intend,”

“likely,” “forecast,” “probable,” “potential,” and similar

expressions and variations thereof are intended to identify

forward-looking statements. Investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, many of which are beyond Know

Labs, Inc.’s ability to control, and actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. These risks and uncertainties also

include such additional risk factors as are discussed in the

Company’s filings with the U.S. Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

September 30, 2024, Forms 10-Q and 8-K, and in other filings we

make with the Securities and Exchange Commission from time to time.

These documents are available on the SEC Filings section of the

Investor Relations section of our website at www.knowlabs.co. The

Company cautions readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115257189/en/

Know Labs, Inc. Contact: Jordyn Hujar jordyn@knowlabs.co

Ph. (206) 629-6414

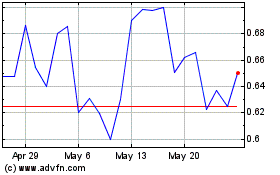

Know Labs (AMEX:KNW)

Historical Stock Chart

From Nov 2024 to Dec 2024

Know Labs (AMEX:KNW)

Historical Stock Chart

From Dec 2023 to Dec 2024