How Will the S&P 500 Index Start Q4 of 2022

03 October 2022 - 4:31AM

Finscreener.org

The month of September has been

the worst-performing month for stock market investors

historically, and this trend continued in 2022 as well. In

September 2022, the

S&P 500 index fell

9.3%, while the Nasdaq Composite Index declined 10.5%, and the

Dow Jones index was down

8.8%.

The equity markets ended the last

trading session of September in the red soon after the Commerce

Department’s PCE Price Index report indicated inflation accelerated

more than expected in August. Each of the three indices fell more

than 1.5% on Friday.

The Vice Chairman of the Federal

Reserve, Lael Brainard, emphasized the regulatory body will

continue to tighten monetary policy to offset inflation and

confirmed it wouldnU+02019t pull back on these efforts

prematurely.

In the upcoming week, the labor

market of the United States will be under the spotlight, as the

nonfarm payrolls report will be released for September on Tuesday

by the Labor Department. Further, the JOLTS or Job Opening and

Labor Turnover Survey report for August and ADP’s private-sector

report will also be released this week.

These reports will provide us

with insights into the labor market of the United States and how it

has held up against the Fed’s hawkish monetary policy strategies.

The purchasing manager index (PMI) survey reading and the Institute

for Supply Management will offer updates on recent performance of

the U.S. manufacturing sector.

Job market data

According to experts, the JOLTS

report might indicate a scale back of job openings to 11.1 million

in August from 11.2 million in July. Job openings stood at an

all-time high of 11.9 million in March 2022. The JOLTS report will

also showcase the total number of hires, separations, and

quits.

ADP, which is a payroll provider,

will release the National Employment Report tracks growth in

private-sector payrolls for September on Wednesday. It will offer a

preview of what to expect from the Labor Department’s detailed jobs

report on Friday.

Economists expect the nonfarm

payrolls report to show 250,000 job additions in September, down

from 315,000 additions in August. While the hiring pace slows, the

unemployment rate is expected to remain unchanged at 3.7% amid a

tight labor market.

The U.S. jobs market has

demonstrated resilience in 2022 despite rising interest rates which

could very well topple the economy into a recession. In fact, the

labor market recovered all job losses at the onset of COVID-19 as

of July 2022.

PMI Survey data

The S&P Global will

publish the Manufacturing PMI survey on Friday for the month of

September. This tracks business activity and executive confidence

within goods-producing sectors.

The PMI index rose marginally to

51.8 last month, from 51.5 in August, compared to a pandemic-era

high of 63.4 in August 2021. A PMI reading of below 50 is an

indicator of deteriorating business conditions.

In 2022, supply chain

disruptions, falling customer demand, and higher commodity prices

have all contributed to a slowdown in the manufacturing sector this

year.

In addition to the macroeconomic

data, the equity markets will be impacted by corporate earnings for

Q3 later this month. A strong U.S. dollar might act as a massive

headwind for companies in the next year.

The USD is trading at a

two-decade high and might be a major headwind for several

companies. The DXY, also known as the U.S. dollar index, is up 21%

year over year. For every 1% change in the DXY, the S&P 500

earnings will fall by 0.5%. So, in Q4, the S&P 500 earnings

might fall by at least 10%.

Why is a strong USD bad news for

S&P

500? A strong dollar generally results in lower exports. So,

companies with a higher percentage of international sales will be

hit hard. The wild swings in currencies further pressurized the

global economy, which is already wrestling with interest rate hikes

and red-hot inflation.

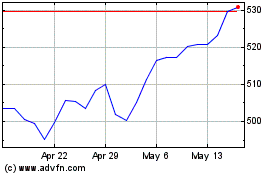

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024