Inflation Data Remains Key Driver for the S&P 500 This Week

12 December 2022 - 9:18AM

Finscreener.org

In the last week ended on

December 9, mixed economic data drove equity indices lower.

Investors and Wall Street are concerned over the possibility of a

recession in the United States as the Federal Reserve remains rigid

about lowering inflation rates.

The Dow

Jones fell 2.8%, while indices such as the S&P

500 and Nasdaq

fell by 3.4% and 4%, respectively, in the last five trading

sessions. Treasury yields had a slow start to the week before

rebounding higher. Crude oil prices continued to lose momentum as a

worsening global outlook continued to impact demand. The price of

the West Texas Intermediate (WTI) crude

fell 10% to $71 per barrel.

The Securities and Exchange

Commission recently issued a new set of guidelines for companies

that now have to disclose their crypto exposure to shareholders.

The ripple effects following the collapse of FTX and other major

crypto players in 2022 are now beginning to spread.

What next for the S&P 500 and

investors?

The BLS or Bureau of Labor

Statistics will release the Consumer Price Index (CPI) data for

November on Tuesday, which is an indicator of inflation. Prices are

expected to rise 7.6% year over year, compared to the 7.7% gain

witnessed in October and a peak of 9.1% in June.

Core inflation data excludes

energy and food costs and is expected to rise 6.2% year over year,

compared to 6.3% in October and a four-decade high of 6.6% in

September.

The FOMC (Federal Open market

Committee), which sets interest rates, will conclude the monetary

policy meeting for December on Wednesday. Wall Street expects

interest rates to increase by 50 basis points this month, setting

benchmark rates between 4.25% and 4.5%. The Fed has increased

benchmark rates by 375 basis points in 2022, which is the fastest

monetary tightening cycle in more than 40 years.

Retail sales data for November

will be reported on Thursday. A key indicator of consumer spending,

retail sales might fall by 0.1% in November (compared to the prior

month) and rise 7.9% year over year. Despite higher input prices,

retail sales continue to surge higher.

Finally, the personal savings

rate has fallen to the lowest level since 2005 to 2.3% as consumers

are spending a higher proportion of their income to finance

purchases.

Will the S&P 500 index experience another

sell-off?

According to Rich Weiss, the

chief investment officer at American Century Investment Management,

the obsession with policy hikes of the Federal Reserve have blinded

investors from economic realities.

The tech-heavy Nasdaq Index is up

10% from 52-week lows despite weak economic data from housing and

manufacturing and several earnings downgrades.

Weiss is worried the “pivot”

narrative might blindside investors from noticing deteriorating

fundamentals which might accelerate the sell-off next

year.

Historically, by the time the Fed

pivots and aims to lower interest rates, the economy is usually too

beat-up, triggering a broader market sell-off.

He explained, “The storm’s coming

now. Whether it’s going be a tropical rainstorm or a Category 4

hurricane is where people are betting. It’s just a question of how

severe and long-lasting it’s going to be.”

The triple threat of red-hot

inflation, earnings contraction, and a restrictive monetary policy

will continue to act as headwinds for equity investors in

2023.

Since the 1970s, the stock market

has fallen by 24% on average after a pivot towards a more

accommodative monetary policy.

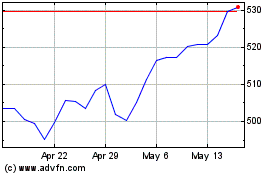

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024