Stereotaxis Reports 2024 Second Quarter Financial Results

13 August 2024 - 6:05AM

Stereotaxis (NYSE: STXS), a pioneer and global leader in surgical

robotics for minimally invasive endovascular intervention, today

reported financial results for the second quarter ended June 30,

2024.

“We made significant progress over the last

quarter on strategic innovation efforts that are establishing a

solid foundation upon which to build a substantial and successful

company,” said David Fischel, Chairman and CEO. “Key milestones

achieved include successfully obtaining CE mark in Europe and

submitting a 510(k) application in the US for GenesisX, substantial

progress with regulatory reviews of MAGiC in Europe and the US, and

closing the acquisition of Access Point Technologies (APT).” In a

separate press release issued concurrent with this release,

Stereotaxis introduced its next-generation robotic system

GenesisX.

“We have attempted to realize our strategic

transformation while maintaining commercial momentum and preserving

financial strength. Commercial results for the first half of the

year were below expectations with delayed recognition of revenue

from our capital backlog. Our visibility into the second half of

this year provides high confidence in significantly improved

revenue and cash flow. Multiple Genesis systems are in transit to

customers with revenue to be recognized and cash received at

delivery. We have an active late-stage pipeline with additional

orders expected near-term.

2024 Second Quarter Financial

ResultsRevenue for the second quarter of 2024 totaled $4.5

million, compared to $7.9 million in the prior year second quarter.

System revenue of $0.2 million and recurring revenue of $4.3

million, compared to $3.3 million and $4.6 million, respectively,

in the prior year second quarter. System revenue was weaker than

expected due to delays in hospital construction schedules but does

not reflect normalized expectations. Recurring revenue was in line

with recent quarters.

Gross margin for the second quarter of 2024 was

74% of revenue. Operating expenses in the second quarter of $9.3

million include $2.5 million in non-cash stock compensation

expense. Operating expenses in the quarter were impacted by higher

acquisition-related legal costs and regulatory-related activities

counteracted by the reversal of a historical accrued

liability. Excluding non-cash stock compensation

expense, adjusted operating expenses in the quarter were $6.8

million, compared to $6.9 million in the prior year second

quarter.

Operating loss and net loss for the second

quarter of 2024 were ($6.0) million and ($5.8) million,

respectively, compared to ($5.3) million and ($5.0) million in the

previous year. Adjusted operating loss and adjusted net loss for

the quarter, excluding non-cash stock compensation expense, were

($3.5) million and ($3.3) million, respectively, compared with

($2.7) million and ($2.4) million in the previous year. Negative

free cash flow for the second quarter was ($3.1) million.

Cash Balance and LiquidityAt

June 30, 2024, Stereotaxis had cash and cash equivalents, including

restricted cash, of $15.2 million and no debt.

Forward Looking

ExpectationsStereotaxis expects greater than $14 million

in revenue in the second half of this year given stable recurring

revenue and current Genesis system shipments. Full year revenue is

expected to be approximately equal to the previous year. These

expectations do not incorporate contributions of revenue from APT

or potential revenue from the launch of GenesisX and MAGiC.

Stereotaxis expects to end this year with

approximately $13 million cash and no debt. Stereotaxis expects its

balance sheet to allow it to advance its transformative product

ecosystem to market, fund its commercialization, and reach

profitability without the need for additional financing.

Conference Call and

WebcastStereotaxis will host a conference call and webcast

today, August 12, 2024, at 4:30 p.m. Eastern Time. To access the

conference call, dial 1-800-715-9871 (US and Canada) or

1-646-307-1963 (International) and give the participant pass code

7734844. To access the live and replay webcast, please visit the

investor relations section of the Stereotaxis website at

www.Stereotaxis.com.

About StereotaxisStereotaxis

(NYSE: STXS) is a pioneer and global leader in innovative surgical

robotics for minimally invasive endovascular intervention. Its

mission is the discovery, development and delivery of robotic

systems, instruments, and information solutions for the

interventional laboratory. These innovations help physicians

provide unsurpassed patient care with robotic precision and safety,

expand access to minimally invasive therapy, and enhance the

productivity, connectivity, and intelligence in the operating room.

Stereotaxis technology has been used to treat over 100,000 patients

across the United States, Europe, Asia, and elsewhere. For more

information, please visit www.Stereotaxis.com.

This press release includes statements that may

constitute "forward-looking" statements, usually containing the

words "believe”, "estimate”, "project”, "expect" or similar

expressions. Forward-looking statements inherently involve risks

and uncertainties that could cause actual results to differ

materially. Factors that would cause or contribute to such

differences include, but are not limited to, the Company's ability

to manage expenses at sustainable levels, acceptance of the

Company's products in the marketplace, the effect of global

economic conditions on the ability and willingness of customers to

purchase its technology, competitive factors, changes resulting

from healthcare policy, dependence upon third-party vendors, timing

of regulatory approvals, the impact of pandemics or other

disasters, statements relating to our recent acquisition of APT,

including any benefits expected from the acquisition, and other

risks discussed in the Company's periodic and other filings with

the Securities and Exchange Commission. By making these

forward-looking statements, the Company undertakes no obligation to

update these statements for revisions or changes after the date of

this release. There can be no assurance that the Company will

recognize revenue related to its purchase orders and other

commitments because some of these purchase orders and other

commitments are subject to contingencies that are outside of the

Company's control and may be revised, modified, delayed, or

canceled.

Company

Contacts: David

L. FischelChairman and Chief Executive Officer

Kimberly R.

Peery Chief

Financial Officer

314-678-6100Investors@Stereotaxis.com

|

STEREOTAXIS, INC. |

|

STATEMENTS OF OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| (in thousands, except share

and per share amounts) |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

Systems |

$ |

240 |

|

|

$ |

3,313 |

|

|

$ |

2,852 |

|

|

$ |

5,134 |

|

|

Disposables, service and accessories |

|

4,262 |

|

|

|

4,546 |

|

|

|

8,530 |

|

|

|

9,273 |

|

| Total revenue |

|

4,502 |

|

|

|

7,859 |

|

|

|

11,382 |

|

|

|

14,407 |

|

| |

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

Systems |

|

187 |

|

|

|

2,703 |

|

|

|

2,087 |

|

|

|

4,400 |

|

|

Disposables, service and accessories |

|

1,002 |

|

|

|

969 |

|

|

|

2,016 |

|

|

|

1,944 |

|

| Total cost of revenue |

|

1,189 |

|

|

|

3,672 |

|

|

|

4,103 |

|

|

|

6,344 |

|

| |

|

|

|

|

|

|

|

| Gross margin |

|

3,313 |

|

|

|

4,187 |

|

|

|

7,279 |

|

|

|

8,063 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

2,273 |

|

|

|

2,647 |

|

|

|

4,516 |

|

|

|

5,393 |

|

|

Sales and marketing |

|

3,301 |

|

|

|

3,340 |

|

|

|

6,304 |

|

|

|

6,488 |

|

|

General and administrative |

|

3,760 |

|

|

|

3,477 |

|

|

|

7,226 |

|

|

|

7,078 |

|

| Total operating expenses |

|

9,334 |

|

|

|

9,464 |

|

|

|

18,046 |

|

|

|

18,959 |

|

| Operating loss |

|

(6,021 |

) |

|

|

(5,277 |

) |

|

|

(10,767 |

) |

|

|

(10,896 |

) |

| |

|

|

|

|

|

|

|

| Other income (expense) |

|

(3 |

) |

|

|

27 |

|

|

|

(3 |

) |

|

|

27 |

|

| Interest income, net |

|

191 |

|

|

|

293 |

|

|

|

430 |

|

|

|

565 |

|

| Net loss |

$ |

(5,833 |

) |

|

$ |

(4,957 |

) |

|

$ |

(10,340 |

) |

|

$ |

(10,304 |

) |

| Cumulative dividend on

convertible preferred stock |

|

(325 |

) |

|

|

(335 |

) |

|

|

(656 |

) |

|

|

(666 |

) |

| Net loss attributable to

common stockholders |

$ |

(6,158 |

) |

|

$ |

(5,292 |

) |

|

$ |

(10,996 |

) |

|

$ |

(10,970 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share attributed

to common stockholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.14 |

) |

|

Diluted |

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of

common shares and equivalents: |

|

|

|

|

|

|

|

|

Basic |

|

84,570,738 |

|

|

|

81,049,211 |

|

|

|

84,025,335 |

|

|

|

78,787,652 |

|

|

Diluted |

|

84,570,738 |

|

|

|

81,049,211 |

|

|

|

84,025,335 |

|

|

|

78,787,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEREOTAXIS, INC. |

|

BALANCE SHEETS |

|

|

|

|

| (in thousands, except share

amounts) |

June 30, 2024 |

|

December 31, 2023 |

|

|

(Unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

14,683 |

|

|

$ |

19,818 |

|

|

Restricted cash - current |

|

481 |

|

|

|

525 |

|

|

Accounts receivable, net of allowance of $640 and $672 at 2024 and

2023, respectively |

|

2,782 |

|

|

|

3,822 |

|

|

Inventories, net |

|

9,284 |

|

|

|

8,426 |

|

|

Prepaid expenses and other current assets |

|

842 |

|

|

|

676 |

|

| Total current assets |

|

28,072 |

|

|

|

33,267 |

|

| Property and equipment,

net |

|

3,059 |

|

|

|

3,304 |

|

| Restricted cash |

|

- |

|

|

|

219 |

|

| Operating lease right-of-use

assets |

|

4,767 |

|

|

|

4,982 |

|

| Prepaid and other non-current

assets |

|

116 |

|

|

|

137 |

|

| Total assets |

$ |

36,014 |

|

|

$ |

41,909 |

|

| |

|

|

|

| Liabilities and stockholders'

equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

4,146 |

|

|

$ |

3,190 |

|

|

Accrued liabilities |

|

2,698 |

|

|

|

2,972 |

|

|

Deferred revenue |

|

4,950 |

|

|

|

6,657 |

|

|

Current portion of operating lease liabilities |

|

458 |

|

|

|

428 |

|

| Total current liabilities |

|

12,252 |

|

|

|

13,247 |

|

| Long-term deferred

revenue |

|

2,121 |

|

|

|

1,637 |

|

| Operating lease

liabilities |

|

4,823 |

|

|

|

5,062 |

|

| Other liabilities |

|

54 |

|

|

|

43 |

|

| Total liabilities |

|

19,250 |

|

|

|

19,989 |

|

| |

|

|

|

| Series A - Convertible

preferred stock: |

|

|

|

|

Convertible preferred stock, Series A, par value $0.001; 21,683 and

22,358 shares outstanding at 2024 and 2023, respectively |

|

5,408 |

|

|

|

5,577 |

|

| Stockholders' equity: |

|

|

|

|

Common stock, par value $0.001; 300,000,000 shares authorized,

82,990,159 and 80,949,697 shares issued at 2024 and 2023,

respectively |

|

83 |

|

|

|

81 |

|

|

Additional paid-in capital |

|

559,499 |

|

|

|

554,148 |

|

|

Treasury stock, 4,015 shares at 2024 and 2023 |

|

(206 |

) |

|

|

(206 |

) |

|

Accumulated deficit |

|

(548,020 |

) |

|

|

(537,680 |

) |

| Total stockholders'

equity |

|

11,356 |

|

|

|

16,343 |

|

| Total liabilities and

stockholders' equity |

$ |

36,014 |

|

|

$ |

41,909 |

|

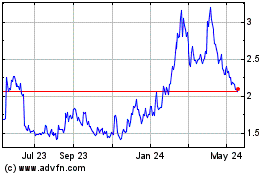

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Oct 2024 to Nov 2024

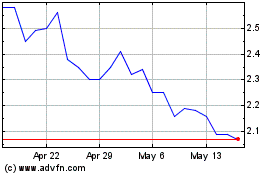

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Nov 2023 to Nov 2024