VelocityShares initially sought to shake up the broad

exchange-traded market with its innovative lineup of VIX-focused

ETNs. The company soon branched out into various metal and energy

centric products as well, although it doesn’t appear that this is

the end for the upstart by any means.

Instead, VelocityShares, via a couple SEC filings, looks to

expand its product lineup beyond its ETNs and into the ETF world.

In the filings, the company revealed plans for five ETFs in total,

two that look to target the large cap American market with lower

risk, and then three focused in on various segments of the emerging

market world via depository receipts.

The new additions, if ever approved by the SEC, will expand the

company’s lineup from 22 to 27 funds and will also mark the first

forays of the firm into the equity world. Given this, the potential

products could be interesting additions to the lineup and may also

be somewhat novel funds in the broader ETF space as well.

In light of this, we have highlighted some of the key details

from the filings that investors should be aware of at this time.

While all the details were not yet available—ticker symbols and

expenses ratios were not in the filings at this time—we discuss

some of the top points from these still-in-registration funds

below:

VelocityShares Emerging Markets DR ETF

This proposed product looks to track the BNY Mellon Emerging

Markets DR Index, a benchmark of depository receipts of companies

in emerging markets. The underlying index is focused on

shares in Brazil (21%), Russia (17.5%), and China (14.2%), although

it also includes a smattering of other nations as well (read Get

True Emerging Market Exposure With These Three ETFs).

VelocityShares Russia Select DR ETF

This still-in-registration fund looks to track the BNY Mellon

Russia Select DR Index, a benchmark of ADRs and GDRs of companies

located in Russia. Seemingly, this fund will have a heavy focus on

the energy industry as this constitutes a huge chunk of Russia’s

economic output and especially its publically traded firms.

VelocityShares Emerging Asia DR ETF

This product looks to give investors a new way to play Asian

markets by tracking the BNY Mellon Emerging Market Asia DR Index.

This benchmark looks to roughly have about 30% in both China and

South Korea, and then 21.7% in Taiwan, and 14.4% in India to round

out the top four (see Asia Ex-Japan ETF Investing 101).

VelocityShares Tail Risk Hedged Large Cap

ETF

This proposed ETF looks to follow the VelocityShares Tail Risk

Hedged Large Cap index, which looks to follow in the trend of

offering investors large cap exposure with less levels of risk. The

fund hopes to do this by allocating 85% of the portfolio to three

large cap ETFs (SPY, VOO, and IVV) while putting the remaining 15%

in two ‘geared’ VIX-focused ETFs (UVXY and SVXY).

VelocityShares Volatility Hedged Large Cap

ETF

This fund looks to follow a similar strategy to the previous

ETF, except it will target the VelocityShares Volatility Hedged

Large Cap Index. This invests in the same five ETFs as its

counterpart above, but it does so in a different proportion with

this ETF allocating 1/3 to UVXY and 2/3 to SVXY (of the 15% total

volatility allocation) compared to a 45/55 breakdown for the

previous product (read Three Defensive ETFs for a Bear Market).

ETF Competition

As of right now, it is hard to say how popular or competitive

these proposed ETFs will be when compared to the broad ETF world.

The emerging market focused funds are particularly interesting as

the space could definitely afford to have a few more ETFs in it,

although it remains to be seen how different VelocityShares’

exposure to these key regions is.

The volatility hedged funds, on the other hand, could see some

competition from a few products already on the market from a number

of issuers. These funds include First Trust’s

VIXH, Barclays VEQTOR ETN (VQT), and a

few ‘volatility response shares’ from Direxion such as

VSPR and VSPY.

While many of these funds are new, most have failed to attract a

decent following, at least so far. In fact, only VQT has managed to

attract a good deal of assets, coming in at just over $360 million

in AUM (read Guide to the 25 Most Liquid ETFs).

Given this as well as the uncertainty over emerging markets, it

remains to be seen if VelocityShares will see the same level of

interest as it has seen in some of its leveraged and inverse ETNs

already on the market. Either way, should the firm manage to pass

SEC scrutiny for these five funds, they could offer up some

interesting exposure that some investors may want to take a closer

look at should they not feel that the current options in the market

meet their portfolio’s needs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

PRO-SH VIX STF (SVXY): ETF Research Reports

PRO-ULT VIX STF (UVXY): ETF Research Reports

BARCLY-SP VEQTR (VQT): ETF Research Reports

DIR-SP15 RC VRS (VSPR): ETF Research Reports

DIR-SP5 RC VRS (VSPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

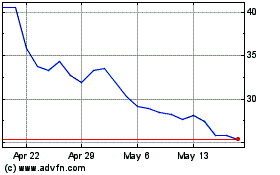

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Jan 2025 to Feb 2025

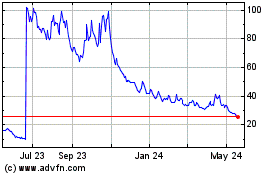

ProShares Ultra VIX Shor... (AMEX:UVXY)

Historical Stock Chart

From Feb 2024 to Feb 2025