Forensic Accounting ETF (FLAG) Hits the Market - ETF News And Commentary

01 February 2013 - 10:17PM

Zacks

While a broad market approach is a popular investment style for

many, some like to take a more concentrated look at large cap

stocks. One way of narrowing down the field is by looking at

earnings quality.

This technique looks to use publically available financial

reports to hone in on aggressive accounting practices. These

bookkeeping tricks can often be an attempt by management to cover

up weakness and thus are issues that investors want to know about

before getting into a stock (read 3 Multi-Asset ETFs for Juicy

Yields and Stability).

Generally speaking, finding these issues is known as ‘forensic

accounting’ which is a process that looks to find a number of ‘red

flags’ which can signal weak earnings quality, and possibly future

troubles for a stock. These include, among others, the following

issues: fictitious revenue, inventory problems, ratio adjustments,

accelerated revenue recognition, and unsustainable margin

expansion.

By identifying these issues, investors can avoid these weak

earnings companies and instead zero in on those who have high

quality balance sheets and other financial statements. While this

somewhat time consuming process can be done on a stock-by-stock

basis, it is now available in ETF form as well.

This is thanks to a new product from Exchange Traded Concepts,

the Forensic Accounting ETF (FLAG). The ETF looks

to track the Del Vecchio Earnings Quality Index, charging investors

85 basis points a year in fees for this low earnings quality

avoiding exposure (see Can You Beat These High Dividend ETFs?).

FLAG in Focus

The underlying index looks to take all 500 stocks in the S&P

500 and grade them on a traditional A-F scale on a monthly basis

for their earnings quality. Firms that are rated ‘A’ make up 40% of

the index, while those graded ‘B’ ‘C’ or ‘D’ make up the remaining

60% of the fund (with each grade taking up 20% each).

Stocks that receive a grade of ‘F’ are not included in the fund,

leaving a portfolio of about 400 stocks. It should also be noted

that within each letter grade, stocks are equally weighted, giving

the portfolio a tilt towards the top grade level which are the

stocks that have the best earnings quality.

For the purposes of the index, this earnings quality is defined

as the degree of sustainable earnings as reported by a company.

Some of the key areas that are analyzed with the proprietary

methodology include looking at gross profit for reserve concerns,

COGS for inventory issues, and revenues for aggressive recognition

procedures.

Can It Succeed?

The fund is based on the work of John Del Vecchio who has made a

name for himself in the forensic accounting-based investment world.

He is already the co-manager of the short-only fund HDGE which

looks to bet against firms that have low earnings quality (see The

Truth about Low Volume ETFs).

This ETF is only of the only short focused products on the

market and costs a pretty penny at 3.3% in net expenses a year.

Still, the ETF has close to $200 million in AUM so investors have

clearly embraced the strategy for their portfolios.

Now that the ability to look at earnings quality is available in

a long-only product, we could see a similar level of interest for

FLAG despite its relatively high—when compared with products like

SPY or VOO—expense ratio of 85 basis points a year.

This will be especially true if FLAG can provide investors with

a solid level of outperformance, and if the tilt away from low

earnings quality firms can reduce volatility and improve

risk-adjusted returns for investors (see 4 Best New ETFs of

2012).

If this is the case, Del Vecchio could have another winner on

his hands with the forensic accounting-focused ETF, giving more

credence and publicity to the investing style for all stripes of

investors.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

(FLAG): ETF Research Reports

ACTIVE-BEAR (HDGE): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VANGD-SP5 ETF (VOO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

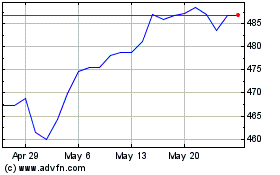

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Feb 2025 to Mar 2025

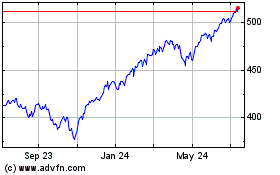

Vanguard S&P 500 (AMEX:VOO)

Historical Stock Chart

From Mar 2024 to Mar 2025