Bear of The Day: Sherwin Williams (SHW) - Bear of the Day

30 July 2013 - 6:30PM

Zacks

Sherwin Williams (SHW), Zacks Rank #5 (Strong

Sell), is a manufacturer and distributor of paints and coating

products. Given that conventional wisdom favors growth in the

housing sector, it feels awkward painting a negative outlook for

Sherwin Williams. However, the company is richly valued and

seeing its earnings estimates cut. The combination could

leave your portfolio colored red instead of black.

Valuation is stretched:

The trade is extremely optimistic toward Sherwin Williams based

on the forward earnings outlook, and as a result the bar for

exceeding earnings estimates may be high. The stock is priced

at about 19.5 times forward 12 month earnings. This compares

to a 10 year average of 14.8 and minimum and maximum values of 10.2

and 22.3 respectively. The stock is less expensive based on

its PEG ratio (price to earnings ratio to earnings growth) of 1.33,

which is near average. However, no one wants average in their

portfolio. The recent rise in mortgage rates and slowdown in

pending home sales suggest there is risk that the growth rate in

earnings slows. Higher mortgage rates may not only reduce new

home buying, but the drop in refinance activity may cut household

spending power and the dollars available for remodel.

Earnings estimates are falling:

The Zacks Consensus EPS Estimate for the September 2013 quarter

has fallen $0.20 over the past 30 days, while the December 2012

quarter estimate has declined $0.23 to $1.37. There have also

been notable declines for the outlook for 2014 earnings where the

Zacks Consensus Estimate has dropped $0.60 to $9.24.

No analysts have revised earnings estimates up for the coming

quarters or 2014 for the past 30 days, while estimates have

declined in the past 30 days for 2013 and 2014. There is

strong agreement for a reduction in the earnings outlook.

The price and consensus chart shows the peak in earnings

estimates and the recent decline. The stock prices has followed the

direction in earnings revisions.

An Alternative:

Investors looking for exposure to the paint and coating market

may want to examine Valspar (VAL), Zacks Rank #2 (Buy). Earnings

estimates for Valspar have trended flat to higher over the past 30

days and the few analyst revisions that have occurred have been up

and not down. The PEG ratio is about 1.05 and near the lower

end of the 10 year range. Valspar has stronger upward

momentum to earnings revisions and looks less expensive than

Sherwin Williams.

SHERWIN WILLIAM (SHW): Free Stock Analysis Report

VALSPAR CORP (VAL): Free Stock Analysis Report

SPDR-SP HOMEBLD (XHB): ETF Research Reports

To read this article on Zacks.com click here.

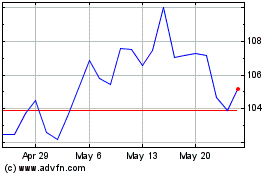

SPDR S&P Homebuilders (AMEX:XHB)

Historical Stock Chart

From Dec 2024 to Jan 2025

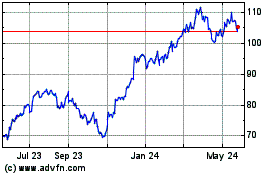

SPDR S&P Homebuilders (AMEX:XHB)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about SPDR S&P Homebuilders (American Stock Exchange): 0 recent articles

More Spdr S&P Homebuilders Etf News Articles