TIDMAYM

Trading Symbol

AIM: AYM

19th July 2022

Anglesey Mining plc

("Anglesey" or "the Company")

Grängesberg PFS Highlights Post-tax NPV8 of US$688m

Anglesey Mining plc (AIM:AYM) is pleased to announce the results from the

recently completed Pre-Feasibility Study ("PFS") Update for the Grängesberg

Iron Ore Project in Sweden, which has been compiled by leading mining

consultant, Micon International Limited. Anglesey holds an almost 20% interest

in the Grängesberg project, together with management rights and a right of

first refusal to increase its interest to 70%.

Study Highlights

* Production of 2.3 - 2.5Mtpa of iron ore concentrate grading 70% Fe that

generates strong economic returns including:

+ Post-tax net present value (NPV) of US$688 million (8% discount rate)

+ Internal Rate of Return (IRR) of 25.9% (post-tax)

+ Operating costs of US$53.60/t FOB to the port of Oxelösund

+ Net cashflow (post-tax) of US$2.08bn, for an average annual net

cashflow of US$130 million

+ Pre-production capital of US$399 million

+ 3.6 years payback

* The study assumed an iron ore price of US$120/t (62% Fe benchmark, CFR

China) with sensitivities indicating a long-term price of US$80/t to

achieve a positive return at a discount rate of 8%

* 82.4Mtpa of Probable Ore Reserves mined over a 16-year mine life with

throughput of 5.3Mtpa

+ 72% conversion of Indicated Resources to Ore Reserves

* A 25-year Mining Concession was awarded for the Grängesberg Iron Ore

Project in May 2013

* Low environmental impact with underground mining, partial tailings

backfill, use of existing brownfields site for location of processing plant

and tailings storage with existing rail infrastructure

* Potential for additional revenue stream from c.210ktpa of apatite

concentrate (17-19% P) that could be sold into the global fertiliser

feedstock market

Micon concluded that the Grängesberg Project demonstrates an economically

viable project using the stated price assumptions, cost estimates and technical

parameters generated by the PFS, with the sensitivity analysis indicating

positive returns can be achieved even with a 30% fall in the assumed underlying

iron ore price of US$120/t.

Commodity prices are currently experiencing significant volatility due to

uncertainty regarding recession fears, ongoing conflict between Russia/Ukraine

and Covid related shutdowns in China, the world's largest buyer of iron ore.

The iron ore price at the date of the report was US$130/t (62% Fe benchmark,

CFR China).

Based on the positive outcome of the Pre-Feasibility Study Update, Anglesey

will now look advance the project towards production by starting the work on a

Feasibility Study, including completing recommended drilling to obtain samples

for both geotechnical and metallurgical testwork, and to update the resource

and reserve estimates to refine the metallurgical domains within the orebody.

Jo Battershill, Chief Executive of Anglesey Mining, commented: "We are very

pleased to deliver a very positive update of the PFS for the Grängesberg

project. The project has the potential to be restarted as one of Europe's

largest individual producers of iron ore concentrates. When combined with the

high-grade nature of the concentrate and proximity to European steel mills, the

asset clearly demonstrates highly strategic positioning."

"We believe the results from the study represents another promising stage in

our development of the project and provides Grängesberg with a very solid

foundation."

"The opportunity for Anglesey Mining is now to advance the project through to a

Financial Investment Decision. This could be completed along with securing a

strategic investor, offtake partner, separate listing, or a combination of

these options. However, we recognise that there is still a lot of work to

complete at Grängesberg, including consolidation of the asset, as well as

updating both the resource and reserve models and undertaking environmental

assessment studies as preliminary steps to preparing a Feasibility Study."

Key Project Metrics

The key project metrics are shown in the tables below.

Key Metric Unit 2022 PFS Update

Ore to Mill Mt 82.3

Life of Mine Years 16.0

Contained Fe Mt 30.6

Recovery % 85

Recovered Fe Mt 26.0

Outgoing Concentrate Mt 37.2

Concentrate Grade % Fe 70

Average annual Concentrate Output Mt 2.3

Cash cost* US$/t Conc 53.60

All-in Sustaining Cost** US$/t Conc 57.80

Pre-production capital US$m 399

Post-tax NPV8% % 688

Post-tax Internal Rate of Return % 26

Project payback Years 3.6

Average annual Post-tax Operating US$m 130

Cashflow ***

* Cash costs are inclusive of mining costs, processing costs, site G&A,

transportation charges to port and royalties

** All-in Sustaining Cost includes cash costs plus sustaining capital and

closure cost

*** Post-tax Operating Cashflow based on iron ore price forecast of US$120/t

China CFR 62% Fe benchmark

Details of the study are provided in the summary below.

Grängesberg Iron Ore Project Pre-Feasibility Summary

Context

The Grängesberg Mine produced iron ore from the late sixteenth century until

1990 when the mine closed due to unfavourable iron ore prices at that time.

Grängesberg was one of Sweden's most important iron ore mines, next only to

Kiruna and Malmberget. At the time of closure significant amounts of iron ore

were reported to still remain in the mine. Grängesberg Iron AB ("GIAB") intend

to re-open the iron ore mine for future production.

Micon International Co Limited (Micon) was contracted by Anglesey to update the

2012 Pre-Feasibility Study (PFS) for the Grängesberg Iron Ore Project. This

assignment included a review of the previous reports and an update of the

project economics based on updated iron prices and forecasts.

Location

The Grängesberg Iron ore project is located 10 km to the southwest of Ludvika

in Dalarna County, central Sweden, within the Bergslagen mining district. It is

situated approximately 200 km northwest from Stockholm, the capital of Sweden

Project Summary

Mining Ore Reserve (Mt) 82.4

Annual Mining Rate (Mtpa) 5.3

Life of Mine (years) 16

Head Grade (% Fe) 37.2

Mining Recovery (%) 85

Processing Annual Processing Rate 5.3

(Mtpa)

Concentrate production (Mt) 37.2

Concentrate Grade (% Fe) 70

Cost Estimates

Capital costs from the original 2012 Pre-Feasibility Study for mining were

estimated by GIAB, Roscoe Postle Associates ("RPA") and Outotec. Capital costs

for the process plant and pellet plant are derived from February 2012 estimates

made by Outotec and are based on their equipment lists with itemised supply,

freight and installation costs provided in SEK or ? depending on the source of

supply (local or import). Costs for electrical, piping and valves were factored

from the mechanical equipment costs. Civil and structural costs were estimated

from similar installations.

Capital costs as updated for 2022 by Micon were escalated using the Swedish

Producer Price Index (PPI) from Statistics Sweden for Swedish Krona and the

Euro Zone PPI from OECD.org for Euro prices.

As this is a Pre-Feasibility Study, the cost accuracy is estimated at ± 25% and

has a base date of June 2022. Capital cost estimates are provided below.

Capital Cost Estimates US$m

Pre-production Capital 398.6

Life of Mine Sustaining Capital 161.0

Including Rehabilitation & Closure 13.2

Total 559.6

Pre-production capital estimates are summarised in the table below.

Pre-production Capital Estimates US$m

Mine development 90.3

Concentrator & Tailings 122.6

Infrastructure 105.9

Indirect 79.8

Total 398.6

Operating costs averaged across the life of mine are provided in the table

below.

Life of Mine Average Operating costs Unit Value

Mining US$/t 11.02

Processing US$/t 5.66

Site Services US$/t 0.86

Tailing Disposal & Dewatering US$/t 0.44

Rail Transport & Storage US$/t 4.51

General Administrative US$/t 1.59

Royalty US$/t 0.13

Total US$/t Processed 24.21

Financial Analysis

Key Financial Metrics Unit Value

FX rates SEK / US$ 8.9

? / US$ 0.95

Iron Ore Price US$/t CFR (62% Fe Benchmark) 120

Post-Tax NPV (8% DCF) US$m 688.4

Post-Tax IRR % 25.9

Payback post Construction Years 3.6

Sensitivity Analysis

The sensitivity of the project base case to forecast iron ore prices was tested

over the range of US$80/dmt to US$150/dmt CFR China. The results suggest that

the Grängesberg base case requires a price of US$80/dmt in order to achieve a

positive return at a discount rate of 8%.

The sensitivity results show that Grängesberg is most sensitive to product

price, and that the project is only

slightly more sensitive to operating costs than to capital.

Resources and Reserves

The resource and reserve estimates for Grängesberg are provided below.

Resource Tonnes Fe P Contained Fe

Category (Mt) (%) (%) (Mt)

Grängesberg Indicated 115.2 40.2 0.78 46.3

Inferred 33.1 45.1 0.91 15.0

Total 148.3 41.3 0.81 61.3

Resources were calculated to a cut-off grade of 20% Fe and with a minimum

mining width of 10m applied.

Reserve Tonnes Fe Contained Fe

Category (Mt) (%) (Mt)

Grängesberg Probable 82.4 37.2 30.7

Total 82.4 37.2 30.7

Reserves were calculated to a cut-off grade 25% Fe and with a minimum mining

width of 15m applied. The estimate also assumed 85% mining recovery and 15%

mining dilution with a long-term pellet price of 180 US¢/dmtu Fe

As part of this update of the PFS, Micon has not performed a re-estimate of the

Mineral Reserves and Resources, however Micon is confident that the Mineral

Resources and Reserves presented in the 2012 PFS are reliable for use in this

updated PFS and financial model. Micon has recommended a drilling programme to

gather samples for both geotechnical and metallurgical testwork, and to update

the resource and reserve estimates to refine the metallurgical domains within

the orebody.

Mineral Reserves were estimated using an 85% mining recovery and 15% mining

dilution.

Mineralisation

The Grängesberg iron ore mineral deposit is one of the largest homogenous iron

ore bodies in northern Europe, with a high iron ore grade. The grade of iron

ore in the Grängesberg Mining District ranges between 40% and 64% in iron.

The apatite-iron oxide ore at Grängesberg consists mainly of magnetite (Fe3O4)

ore with approximately 20% hematite (Fe2O3) ore with apatite (Ca5(PO4)3

(F,Cl,OH)). Some richer hematite mineralisation occurs in some areas

particularly at the northern end of the deposit and may be related to oxidation

associated with the intrusion of shallow-dipping (-30° to -45°) barren

pegmatite sills and dykes that crosscut the deposit. The hematite content

decreases steadily with depth and the mineralisation becomes practically pure

magnetite.

The magnetite ores are fine to medium-grained and massive with a quite distinct

"grainy" appearance. The hematite rich ores generally consist of massive, fine

to medium-grained, often platy hematite, often with magnetite blasts. Almost

all the ore types show a variable degree of banding. Apatite and accessory

silicates mostly dominate the bands, occurring as fine-grained aggregates.

The phosphorous content of the ore, contained mainly within the apatite, ranges

from 0.7% to 1.3% and may represent a future resource for phosphorous. In

addition, the apatite is a potential source for rare earth elements (REE).

Grängesberg Underground Mine

Following dewatering of the mine, the 2012 PFS assumed the continuation of

historic sublevel caving as the preferred mining method for Grängesberg.

However, there is some elevated risk that using a sublevel caving mining method

for the production level below the main fault could trigger some movement along

the Export Fault that cuts the orebody. In the 2022 Updated PFS, Micon

recommends that sublevel open stoping with backfilling of mined stopes be

considered for future mine designs as a more optimal method for extraction of

ore at Grängesberg.

An alternative underground mining method such as sublevel stoping might have a

higher relative operating cost per tonne than sublevel caving, but the overall

mining costs could be lower considering a higher mining recovery, lower mining

losses and short haul for waste backfilling in mined-out stopes.

Shaft hoisting with an underground crusher, ore passes and a transfer level is

the main hauling system proposed for hauling 5.33 Mtpa to feed the plant - this

is equivalent to a ROM feed of 666 t/h to the concentrator plant.

Run of mine (ROM) ore is transported underground to the crusher station

consisting of an 80 m3 feed hopper with a bypass channel, a grizzly feeder

separating oversize material at 900 mm, a single toggle jaw crusher and a

vibrating feeder to a conveyor transporting the <250 mm crushed ore to the skip

hoist. From the skip hoist the crushed ore is conveyed to covered surface

stockpiles.

Processing

Due to the significant history of production, no metallurgical testwork was

completed for either the 2012 PFS or the update referenced in this

announcement. However, Outotec (now Metso-Outotec) have prior experience of

iron ore processing in Sweden and the concentrator design reflects existing

practice in Sweden for beneficiation of low grade finely disseminated iron ore.

Grängesberg ores contain high phosphorus contents (0.5% P) attributable to the

presence of apatite, so separation of the apatite from the magnetite (42% Fe)

and hematite (25% Fe) by froth flotation significantly reduces the phosphorus

content of the concentrate (0.013% P).

The unit processes are assumed around crushing, primary autogenous grinding

(AG), classification, secondary semi-autogenous grinding (SAG), magnetic

separation, froth flotation and solid:liquid separation with un-thickened

tailings sent directly to the Tailings Management Facility.

The concentrator is designed to treat 5,330,000 t of ore per year at a nominal

processing rate of 666 t/h. Operating time is stated to be 8,000 hours (333

days) per year implying an availability of 91%. The concentrator plant building

has a total length of 150 m and a width of 40 m and is divided into grinding,

separation, flotation and filtration halls. Additional rooms contain the plant

control room, utilities, reagent makeup, electrical switchgear and Motor

Control Centres (MCC's).

Stockpiled ore will be discharged by vibrating feeders onto a conveyor belt

which will feed the AG primary grinding mill via a rock box feed chute. Pebbles

originating from the AG-mill are captured by a trommel screen and used as

grinding media in the secondary SAG mill. Product discharged from the AG mill

will be classified by screw classifiers. Classifier oversize will be recycled

back to the AG mill and undersize will pass to the primary wet Low Intensity

Magnetic Separators (LIMS).

The primary LIMS stage will provide an initial upgrade of the magnetite iron

ore prior to secondary grinding. The non-magnetic slurry containing hematite

will gravitate to thickener 1 for dewatering and the thickener underflow pumped

to primary high-gradient magnetic separation utilising SLon Vertical ring and

Pulsating High-Gradient Magnetic Separators (SLon VPHGMS). These separators

have been demonstrated to provide better separation performance than previous

Wet High Intensity Magnetic Separators (WHIMS), as well as other advantages

such as higher operating ratio, higher ore throughput capacity, no matrix

blockage problems and easier maintenance.

The primary SLon separation provides an initial upgrade of the hematite iron

ore prior to secondary grinding. Tailings from SLon separation are discharged

to tailings. The secondary SAG mill will liberate the fine magnetite and

hematite minerals and is operated in closed circuit with a hydrocyclone cluster

to provide an hydrocyclone overflow product with a p80 size of 40 µm. The

hydrocyclone overflow will be sent to a second stage of LIMS separators. The

non-magnetic slurry containing hematite will gravitate to thickener 2 for

dewatering and the thickener underflow will be pumped to secondary

high-gradient magnetic separation utilising SLon VPHGMS. The magnetic slurry

from LIMS will go to flotation. The magnetic slurry from SLon VPHGMS will go to

flotation and the non-magnetic slurry will be discharged to tailings.

A reverse flotation circuit will lower the sulphur and phosphate content of the

magnetite and hematite concentrates from magnetic separation. The flotation

tailings (iron ore concentrate) will be pumped to thickener 4 for dewatering.

The flotation concentrate containing sulphur and phosphorus (apatite) will be

discharged to tailings. Underflow from thickener 4 will be dewatered in

pressure filters and discharged as a filter cake product. The target moisture

content of the filter cake is 8% w/w (typically needs to be below 10% for

shipping). The cake will be transferred by conveyor belt to storage before

either a) shipment as filter cake; or b) further processing to produce iron ore

pellets in a pellet plant. Overall recovery of Fe to the iron ore concentrate

is 85% Fe with a target grade of 70% Fe. The iron ore concentrate is predicted

to have a P content of 0.013%.

Filtrate from the filters will be returned to the flotation tailings (iron ore

concentrate) thickener. Overflow water from all thickeners is recirculated to

the plant via a 40,000 m3 water reservoir and 4,000 m3 process water tank.

It has been recommended that adequate metallurgical testing is carried out

during the subsequent Feasibility Study to verify process design criteria and

provide data for equipment selection and sizing.

There may be potential to utilise ore sorting technologies which were not

economically available a decade ago. This can improve feed grade and reduce

throughput to the concentrator and can also be used in the comminution circuit

to remove scats, so it is recommended that ore sorting is investigated.

Infrastructure

The surface infrastructure from the previous mining and processing operations

is still in existence and includes roads, administrative buildings, workshops

and processing buildings. When the mine closed all the mine's facilities were

transferred into community ownership. The offices and workshops are in

generally excellent state of repair and to a large extent available for use

should the mine be re-opened.

Access shafts from former underground mining operations are visible at the

surface and the former open pit has been allowed to fill with water, as has the

underground mine. The former concentrator was dismantled at the time of

closure; however the footprint remains. The main Tailings Storage Facility

(TSF) associated with previous processing operations now has extensive tree

cover. Two additional TSFs associated with former Grängesberg operations are

now owned by an exploration company and are being assessed for re-processing as

a separate project.

Regional power lines and switchgear are located in close proximity to the

Grängesberg mine site. The proposed project will use the municipal power

supply, which is sourced from wind power, subject to any necessary permits. The

municipal water supply in Grängesberg is obtained from Norra Hörken Lake. Water

supply for the proposed project will be sourced predominantly from recycled

mine water via the dewatering process. Administrative buildings will be

connected to the municipal water supply, subject to any necessary permits. The

municipal waste collection service will also cater to domestic waste from

administrative facilities, subject to any necessary permits.

Marketing and Logistics

The railway line associated with previous mining operations at Grängesberg is

still largely intact, though not in use, and connects the mine site to the port

of Oxelösund. The proposed project will use this existing railway line, subject

to any necessary upgrades and permits.

When last reviewed in 2012, the port of Oxelösund was deemed well-equipped for

handling of iron ore products, with all necessary conveyors and storage areas,

although a new rail unloading station would be required. This situation should

be reviewed during the Feasibility Study to confirm that the port still has

sufficient capacity and infrastructure to handle 2.5 Mt/a of product and to

determine the cost of any additional equipment required.

With a maximum draft capacity of 16.4m, the port of Oxelösund is capable of

loading Panamax vessels.

Closure and Rehabilitation

A preliminary closure and rehabilitation plan will be developed as part of the

Environmental Permit application, which includes all aspects of the proposed

mining and processing operations and an outline of annual financial security

payments.

Permitting

A valid mining (exploitation) concession is currently in place for the

Grängesberg Iron Ore Mine. This was granted in 2014 to Grängesberg Iron AB

(GIAB) and is valid for 25 years, renewable every 10 years thereafter. The

mining concession application included a preliminary environmental impact

assessment. Swedish law requires that once a Mining Permit is granted, a more

detailed Environmental Impact Assessment is prepared to support an

Environmental Permit Application. There is currently no Environmental Permit in

place for Grängesberg and therefore despite the mining permit, no mining or

processing operations can take place. Public Consultation is a requirement for

the Environmental Permit application under Swedish Law, but not for the Mining

Permit, therefore to date only limited consultation has taken place, between

2010 and 2011.

Once a detailed Environment and Social Impact Assessment (ESIA) has been

undertaken and submitted to the authorities, the public consultation process

begins. Unlike many jurisdictions, currently in Sweden there is no defined time

limit for receiving comments on proposed mining projects. This uncertainty

around timing is a key risk for project development, as comments ultimately

have to be addressed in an updated ESIA before the Environmental Permit can be

granted.

Grängesberg Iron Ore Mine was previously owned by the Swedish State and ceased

operating in 1990. Restarting mining operations and any future developments

will be subject to Swedish laws, in particular the Minerals Act (SFS 1991:45),

the Environmental Code (SFS 1998:808) and the Regulation on Environmental

Impact Assessments (SFS 1998:905). Additional Swedish legislation will also

need to be considered, for example for water, air quality, forestry, and

cultural heritage. An indicative list of relevant Swedish legislation is

identified in Table 20.1. Relevant European legislation will also need to be

taken into account, as Sweden is an EU member state, as well as Sweden's

national Environmental Goals which are adopted at a regional and local level.

Key Risks

Environmental permitting is considered to be a risk to Grängesberg, as with any

mining project in

Sweden as there is no official time frame for awarding an Environmental Permit.

A valid mining (exploitation) concession is currently in place for the

Grängesberg Iron Ore Mine which was granted in 2014 to GIAB and is valid for 25

years, renewable every 10 years thereafter. Swedish law requires that once a

Mining Permit is granted, a more detailed Environmental Impact Assessment is

prepared to support an Environmental Permit Application. There is currently no

Environmental Permit in place for Grängesberg and therefore despite the mining

permit, no mining or processing operations can take place.

Micon has reviewed the mining method selection based on consideration of ore

deposit morphology, rock mechanics and cost. Some additional work is required

to optimise the mining method in and around the known faulted areas, but

generally, sublevel caving (SLC) is preferred to the historical block caving

process as it requires less upfront capital and much less time to reach full

production. It also allows for a slightly more selective extraction of the

orebody than is attainable through block caving. Sub-level open stoping with

backfilling of mined stopes is suggested for certain areas in future mine

designs, particularly for the Zone A production level below the fault, which

would reduce any risk of triggering movement on the fault.

Opportunities

A potential further upside to the project is the recovery of an apatite

concentrate. The global phosphate market is expected to grow by US$8.68 billion

during 2022 to 2026, progressing at a compound annual growth rate (CAGR) of

6.12% during this period (source: Infiniti Research Limited, Global Phosphate

Market 2022-26). Previous studies have demonstrated that the project could

potentially produce 210,000 tonnes of apatite concentrate per annum.

Micon also ran an alternative development scenario of producing pellets versus

concentrate. However, this demonstrated that economic returns diminish when

additional investment is made in pelletising the concentrate product prior to

sale. However, to a vertically integrated steel company, the production of

pellets may lead to an increased return across the business.

Recommendations

Micon has made a series of recommendations for work to progress the Grangesberg

project through to a Definitive Feasibility Study. These recommendations

include:

* Modelling of the apatite resource

* Conduct drilling programme to obtain samples for both geotechnical and

metallurgical testwork

* Additional modelling on alternative mining methods

* Conduct 3D numerical geotechnical modelling to optimise extraction sequence

* Investigate use of cone crushing / high pressure grinding rolls as an

alternative to AG/SAG milling; and,

* Commence baseline environmental studies

Micon International Limited

Micon is an independent consulting firm of geologists, mining engineers,

metallurgists and environmental consultants, all of whom have extensive

experience in the mining industry. The firm has offices in Norwich (United

Kingdom), Toronto and Vancouver (Canada). Micon is internally owned and is

entirely independent of Anglesey Mining plc and its affiliated companies.

Micon offers a broad range of consulting services to clients involved in the

mining industry. The firm maintains a substantial practice in the geological

assessment of prospective properties, the independent estimation of resources

and reserves, the compilation and review of feasibility studies, the economic

evaluation of mineral properties, due diligence reviews and the monitoring of

mineral projects on behalf of financing agencies.

Micon's practice is worldwide and covers all of the precious and base metals,

the energy minerals and industrial minerals. The firm's clients include major

mining companies, most of the major United Kingdom and Canadian banks and

investment houses, and a large number of financial institutions in other parts

of the world. Micon's technical, due diligence and valuation reports are

typically accepted by regulatory agencies such as the London Stock Exchange,

the US Securities and Exchange Commission, the Ontario Securities Commission,

the Toronto Stock Exchange, and the Australian Stock Exchange.

Competent Person

The information in this announcement which relates to Drilling Results has been

approved by Mrs. Liz de Klerk, M.Sc., Pr.Sci.Nat., MIMMM who is a professional

registered with the South African Council for Natural Scientific Professionals

(SACNASP: 400090/08) and independent consultant to the Company. Mrs. de Klerk

is the Senior Geologist & Managing Director of Micon International Co Limited

and has over 20 continuous years of exploration and mining experience in a

variety of mineral deposit styles. Mrs. de Klerk has sufficient experience

which is relevant to the style of exploration, mineralisation and type of

deposit under consideration and to the activity which she is undertaking to

qualify as a Competent Person as defined in the 2012 Edition of the

"Australasian Code for reporting of Exploration Results, Exploration Targets,

Mineral Resources and Ore Reserves" (JORC Code). Mrs. de Klerk consents to

inclusion in the announcement of the matters based on this information in the

form and context in which it appears.

About Anglesey Mining plc

Anglesey Mining is traded on the AIM market of the London Stock Exchange and

currently has 280,175,721 ordinary shares on issue.

Anglesey is developing its 100% owned Parys Mountain Cu-Zn-Pb-Ag-Au deposit in

North Wales, UK with a 2020 reported resource of 5.2 million tonnes at 4.3%

combined base metals in the Indicated category and 11.7 million tonnes at 2.8%

combined base metals in the Inferred category.

Anglesey holds an almost 20% interest in the Grangesberg Iron project in

Sweden, together with management rights and a right of first refusal to

increase its interest to 70%. Anglesey also holds 11% of Labrador Iron Mines

Holdings Limited, which through its 52% owned subsidiaries, is engaged in the

exploration and development of direct shipping iron ore deposits in Labrador

and Quebec.

Note

The information contained within this announcement is deemed by the Company to

constitute Inside Information as stipulated under the Market Abuse Regulation

(EU) No. 596/2014 as it forms part of UK domestic law pursuant to the European

Union (Withdrawal) Act 2018, as amended. Upon the publication of this

announcement via a regulatory information service, this information is

considered to be in the public domain. The person responsible for arranging for

the release of this announcement on behalf of Anglesey is Jo Battershill.

For further information, please contact:

Anglesey Mining plc

Jo Battershill, Chief Executive - Tel: +44 (0)7540 366000

John Kearney, Chairman - Tel: +1 647 728 4106

Davy

Nominated Adviser & Joint Corporate Broker

Brian Garrahy / Lauren O'Sullivan - Tel: +353 1 679 6363

WH Ireland

Joint Corporate Broker

Katy Mitchell / Harry Ansell - Tel: +44 (0) 207 220 1666

Canaccord Genuity Limited

Joint Company Broker

James Asensio / Harry Rees - Tel: +44 (0) 20 7523 8000

Scout Advisory Limited

Investor Relations Consultant

Sean Wade - Tel: +44 (0) 7464 609025

Forward Looking Statements

This announcement includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would", "could" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that are not

facts. They appear in a number of places throughout this announcement and

include statements that relate to future events or future performance and

reflect current estimates, predictions, expectations or beliefs regarding

future events and include, but are not limited to, the Company's plans to

complete an updated mineral resource estimate for the Grangesberg Project and

the Company's plans to commence an environmental data collection program for

the Grangesberg Project and its plans to undertake various engineering studies

and complete a feasibility study for the Project. All forward-looking

statements are based on the Company or its consultants' current beliefs as well

as various assumptions made by them and information currently available to

them. There can be no assurance that such statements will prove to be accurate,

and actual results and future events could differ materially from those

anticipated in such statements. Forward-looking statements reflect the beliefs,

opinions and projections on the date the statements are made and are based upon

a number of assumptions and estimates that, while considered reasonable by the

respective parties, are inherently subject to significant business, economic,

competitive, political and social uncertainties and contingencies. By their

nature, forward-looking statements involve risk and uncertainty because they

relate to future events and circumstances. A number of factors could cause

actual results and developments to differ materially from those expressed or

implied by the forward-looking statements, including, without limitation: the

market price of iron ore; conditions in the public markets; the market position

of the Company; the earnings, financial position, cash flows, return on capital

and operating margins of the Company; the anticipated investments and capital

expenditures of the Company; changing business or other market conditions;

changes in political or tax regimes, exchange rates and currencies; and general

economic conditions. These and other factors could adversely affect the outcome

and financial effects of the plans and events described herein.

LEI: 213800X8BO8EK2B4HQ71

END

(END) Dow Jones Newswires

July 19, 2022 02:00 ET (06:00 GMT)

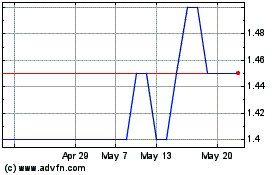

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024