New Star Investment Trust PLC (NSI) New Star Investment Trust

PLC: Interim ANNOUNCEMENT for the Six Months to 31 12 2022

21-March-2023 / 11:29 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

NEW STAR INVESTMENT TRUST PLC

This announcement constitutes regulated information.

UNAUDITED RESULTS FOR THE SIX MONTHSED 31st DECEMBER 2022

INVESTMENT OBJECTIVE

The Company's objective is to achieve long-term capital

growth.

FINANCIAL HIGHLIGHTS

30th June %

31st December 2022

2022 Change

PERFORMANCE

Net assets (GBP '000) 123,225 123,978 (0.61)

Net asset value per Ordinary share 173.50p 174.56p (0.61)

Mid-market price per Ordinary share 124.50p 125.00p (0.40)

Discount of price to net asset value 28.6% 28.4% n/a

Six months ended Six months ended

31st December 2022 31st December 2021

Total Return* 0.19% 2.59% n/a

IA Mixed Investment 40-85% Shares (total return) 0.89% 4.18% n/a

MSCI AC World Index (total return, sterling adjusted)

3.50% 7.86% n/a

MSCI UK Index (total return) 5.39% 7.42% n/a

Six months ended

Six months ended 31st December

31st December

2022

2021

REVENUE

Return (GBP'000) 735 405

Return per Ordinary share 1.04p 0.57p

Proposed dividend per Ordinary share 0.90p -

Dividend paid per Ordinary share 1.40p 1.40p

TOTAL RETURN

Return (GBP'000) 241 3,584

Net assets (dividend added back) 0.19% 2.59%

Net assets (0.61)% 1.88% * The total return figure for the Group represents the revenue and capital return shown in the consolidated statement of comprehensive income plus dividends paid.

INTERIM REPORT

CHAIRMAN'S STATEMENT

PERFORMANCE

Your Company generated a positive total return of 0.19% over the

six months to 31st December 2022, taking the net asset value (NAV)

per ordinary share to 173.50p. By comparison, the Investment

Association's Mixed Investment 40-85% Shares Index rose 0.89%. The

MSCI AC World Total Return Index rose 3.50% in sterling over the

period, the MSCI UK Total Return Index rose 5.39% while UK

government bonds fell 12.06%. Further information is provided in

the investment manager's report.

Your Company made a revenue profit for the six months of

GBP735,000 (2021: GBP405,000).

GEARING AND DIVIDS

Your Company has no borrowings. It ended the period under review

with cash representing 14.63% of its NAV and is likely to maintain

a significant cash position. In recent years, your Company has

invested in income-yielding assets with the aim of increasing its

revenue and dividend. Its revenue and retained earnings are now

sufficient for your Directors to pay a maiden interim dividend of

0.9p per share (2021: nil). Your Directors intend to maintain this

policy of paying an interim dividend and recommending a final

dividend to shareholders. Your Company paid a dividend of 1.4p per

share (2021: 1.4p) in November 2022 in respect of the previous

financial year.

DISCOUNT

Your Company's shares continued to trade at a significant

discount to their NAV during the period under review. The Board

keeps this issue under review.

OUTLOOK Although inflationary pressures have reduced, the lagged

impact of rising interest rates may lead to recessions in the US

and Europe over the coming months. This will affect corporate

profits but equity markets may benefit from easing inflation as

investors anticipate a turn downwards in the interest rate cycle.

Your Company entered 2023 with above-average holdings in emerging

market equities relative to collective funds with the same

benchmark. Emerging markets are trading on relatively-low

valuations and have the potential to outperform as China relaxes

its zero-Covid-19 policies. Your Company's significant cash

holdings have benefitted from rising deposit rates in recent months

and can be deployed should other attractive opportunities

emerge.

NET ASSET VALUE

Your Company's unaudited NAV at 28th February 2023 was

178.10p.

Geoffrey Howard-Spink

Chairman

21st March 2023

INVESTMENT MANAGER'S REPORT

MARKET REVIEW

The leading central banks increased interest rates on four

occasions over the six months to 31 December 2022 to combat

inflation. The Federal Reserve and the Bank of England raised their

policy rates to 4.25-4.5% and 3.5% respectively while the European

Central Bank lifted the rate on its main refinancing operations to

2.5%. In February 2023, all three central banks increased rates

again, the Fed by a quarter point and the BoE and the ECB by half a

point. Investors were, however, anticipating a turn downwards in

policy rates further ahead on expectations that inflation would

reduce significantly.

US headline inflation peaked at 9.1% in June 2022 and declined

every month thereafter, falling to 6.4% in January 2023. Eurozone

and UK headline inflation proved more obdurate, standing at 10.6%

and 11.1% respectively in October 2022 before falling to 8.6% and

10.1% respectively in January 2023. Oil prices fell 16.85% in

sterling over the period under review, easing inflationary

pressures. UK and eurozone inflation may have peaked later partly

because of the impact of elevated gas prices following Russia's

invasion of Ukraine.

Fed hawkishness was founded on the strength of the labour

market, with unemployment just 3.4% in January 2023, and the

resilience of consumer spending. Unemployment tends, however, to be

a lagging indicator and is typically low at the start of a

recession. Inflation is widely regarded as "sticky" when it becomes

entrenched in pay increases but real wages fell over the period

despite the strength of the labour market.

Rising interest rates proved a headwind for global bonds, which

fell 1.78% in sterling. UK government bonds were particularly weak,

falling 12.06%. The government's September announcement of unfunded

tax cuts led to some pension funds becoming forced sellers of

gilts. The BoE intervened, announcing UK government bond purchases

of up to GBP65 billion to ensure financial stability.

PORTFOLIO REVIEW

Your Company's total return over the period was 0.19%. By

comparison, the Investment Association (IA) Mixed Investment 40-85%

Shares sector, a peer group of funds with a multi-asset approach to

investing and a typical investment in global equities in the 40-85%

range, rose 0.89%. The MSCI AC World Total Return Index rose 3.50%

in sterling while the MSCI UK Total Return Index rose 5.39%. Your

company benefited from holding value-oriented equity investments

and investments in gold miners and Indian stocks. A low overall

exposure to bonds also helped performance. Performance suffered,

however, from weakness among US and Chinese technology stocks,

which resulted in falls for Polar Capital Global Technology and

Matthews Asia ex Japan Dividend.

Your Company's allocation to equity increased from October to

December 2022 by approximately GBP6 million at the expense of cash

because inflation appeared to be close to peaking, increasing

expectations that easier monetary policy could be on the horizon.

In October, your Company invested GBP2 million in Redwheel Global

Equity Income, which has a disciplined approach to

income-investing. All investments must yield at least 25% more than

the market average at the time of purchase and profits are taken on

stocks that appreciate to the point where they yield less than the

market average. The managers aim to select high-quality stocks

while excluding stocks that may be at risk of cutting dividends.

The addition of holdings managed in accordance with an income

mandate should support your Company's ability to pay dividends.

More accommodative monetary policy may result in outperformance

for growth-oriented investments and approximately GBP1 million was

invested in the iShares S&P 500 exchange-traded fund, which

tracks the US market, and GBP1 million was added to Lindsell Train

Japanese Equity, which holds a concentrated portfolio of growth

stocks including consumer-related companies that should benefit

from increased Chinese tourism as China's zero-Covid-19 policies

are relaxed.

The remaining GBP2 million was invested in emerging markets,

with GBP1 million added to Vietnam Enterprise Investments in

October and GBP1 million added to Somerset Asia Income in November.

Some emerging markets trade on low valuations relative to developed

markets and dollar strength, which has proved a headwind for

emerging markets, may subside in anticipation of easier monetary

policy. In December, Beijing relaxed its zero-Covid policies,

leading to gains for Chinese stocks.

Value stocks typically outperformed growth stocks over the

period because rising interest rates affected longer-duration

assets. Technology stocks were hurt because future cash flows from

these high-growth stocks are discounted more aggressively at higher

interest rates. US technology stocks fell 5.39% in sterling over

the period, contributing to an 8.86% fall by Polar Capital Global

Technology, but your Company's largest holding, Fundsmith Equity,

rose 3.49%, despite its growth style and significant technology

holdings. Gains by Novo Nordisk, one of its 10 largest holdings,

fuelled the rise as investors warmed to the potential of its

anti-obesity drugs.

UK equities modestly outperformed, rising 5.39%, but smaller

companies lagged, gaining 2.97%. Amongst value-oriented

investments, Man GLG Income and Aberforth Split Level Income, a

small-company investment trust, gained 9.60% and 11.22%

respectively. Aberforth Split Level Income also benefited from the

gearing provided by its zero-dividend preference shares. Chelverton

UK Equity Income, another small-cap specialist, gained 2.99%.

Trojan Income rose 2.30%, underperforming because of its focus on

consumer-related stocks such as Diageo, Procter & Gamble,

Reckitt Benckiser and Unilever. All these investments delivered

income in excess of global equities, contributing to your Company's

ability to pay dividends.

Equities in Europe excluding the UK outperformed, rising 9.35%

in sterling. BlackRock Continental European Income and Crux

European lagged, however, up 7.82% and 8.55% respectively although

both benefited from holding Novo Nordisk among their 10 largest

investments.

Equities in Asia excluding Japan and emerging markets fell 2.91%

and 1.81% respectively in sterling, with Chinese stocks, which

account for the largest proportion of both indices, falling 11.10%.

Chinese equities were hurt by Covid lockdowns, political

interference in companies to promote wealth redistribution,

so-called common prosperity, and high property sector debts. Within

your Company's portfolio, the most resilient performers were JP

Morgan Global Emerging Markets Income Trust, JP Morgan Emerging

Market Income Fund and Somerset Asia Income, up 3.87% and down

1.88% and 2.20% respectively. Their income mandates proved

defensive during a period in which lower-yielding Chinese

technology stocks such as Tencent and Alibaba fell significantly.

Matthews Asia ex Japan Dividend, however, fell 10.21%. Its mandate

permitted it to hold lower-yielding Chinese technology stocks

provided it had an above-market yield overall. Indian stocks rose

9.99% against the trend in sterling although Stewart Investors

Indian Subcontinent Sustainability gained only 8.00%.

Your Company achieves diversification through its allocations to

cash, including dollar cash, gold equities and low-risk multi-asset

holdings. Interest income rose as your Company benefited from

higher interest rates on its deposits. BlackRock Gold & General

rose 5.85% as gold prices increased 1.77% in sterling. Trojan and

EF Brompton Global Conservative, both lower-risk holdings, fell

0.20% and 1.17% respectively. OUTLOOK

Inflationary pressure from higher oil prices subsided somewhat

in early 2023 but global economic growth is likely to slow over the

year. Employment data were strong but falls in real incomes imply

inflation had not become entrenched. Economic data in January and

February 2023 were stronger than anticipated but the lagged

transmission of tighter monetary policy may mean the full impact of

tightening is yet to come. In March 2023, higher interest rates led

to the collapse of Silicon Valley Bank in the US and the forced

takeover of Credit Suisse by UBS. Central banks moved swiftly to

contain the fallout and protect depositors. Banks are generally

more tightly regulated and have higher levels of capital adequacy

than at the time of the credit crisis in 2007 - 2008 but these

signs of distress may militate against tighter monetary policy. At

the end of the period under review, prospects for equities overall

appeared positive despite the likely deterioration in some

companies' earnings because monetary policy easing was on the

horizon. Emerging market equities appeared particularly attractive

because of low valuations relative to some developed markets, signs

of an end to zero-Covid polices and potential respite from dollar

strength.

Your Company holds a diversified portfolio of assets including

sterling and dollar cash, gold equities and lower-risk multi-asset

investments. Investment in private equity is currently low. At the

period end, your Company had more cash at the expense of bonds and

higher allocations to emerging market equities at the expense of US

and European equities than the average for the IA Mixed Assets

40-85% Shares peer group.

Portfolio diversification provides some protection in falling

markets when dollar cash and other low-risk investments may be

sought by investors as safe havens. At the period end, your Company

had approximately GBP18 million in cash. This cash is benefitting

from higher deposit interest rates and is available for investment

should attractive opportunities arise. Higher interest income and a

bias towards income-oriented equity investments support the growth

in your Company's dividend.

Brompton Asset Management Limited 21st March 2023

DIRECTORS' REPORT

PERFORMANCE

In the six months to 31st December 2022 the total return per

Ordinary share was 0.19% (2021: 2.59%) and the NAV per ordinary

share decreased slightly to 173.50p, whilst the share price

decreased by 0.40% to 124.50p. This compares to an increase of

0.89% in the IA Mixed Investment 40-85% Shares Index.

DIVID

The Directors propose an interim dividend of 0.90p per Ordinary

share in respect of the six months ended 31st December 2022 (2021:

GBPnil). The dividend will be paid on 28th April 2023 to

shareholders on the register at the close of business on 31st March

2023 (ex-dividend 30th March 2023).

INVESTMENT OBJECTIVE

The Company's investment objective is to achieve long-term

capital growth.

INVESTMENT POLICY

The Company's investment policy is to allocate assets to global

investment opportunities through investment in equity, bond,

commodity, real estate, currency and other markets. The Company's

assets may have significant weightings to any one asset class or

market, including cash.

The Company will invest in pooled investment vehicles, exchange

traded funds, futures, options, limited partnerships and direct

investments in relevant markets. The Company may invest up to 15%

of its net assets in direct investments in relevant markets.

The Company will not follow any index with reference to asset

classes, countries, sectors or stocks. Aggregate asset class

exposure to any one of the United States, the United Kingdom,

Europe ex UK, Asia ex Japan, Japan or Emerging Markets and to any

individual industry sector will be limited to 50% of the Company's

net assets, such values being assessed at the time of investment

and for funds by reference to their published investment policy or,

where appropriate, their underlying investment exposure.

The Company may invest up to 20% of its net asset value in

unlisted securities (excluding unquoted pooled investment vehicles)

such values being assessed at the time of investment.

The Company will not invest more than 15% of its net assets in

any single investment, such values being assessed at the time of

investment.

Derivative instruments and forward foreign exchange contracts

may be used for the purposes of efficient portfolio management and

currency hedging. Derivatives may also be used outside of efficient

portfolio management to meet the Company's investment objective.

The Company may take outright short positions in relation to up to

30% of its net assets, with a limit on short sales of individual

stocks of up to 5% of its net assets, such values being assessed at

the time of investment.

The Company may borrow up to 30% of net assets for short-term

funding or long-term investment purposes.

No more than 10%, in aggregate, of the value of the Company's

total assets may be invested in other closed-ended investment funds

except where such funds have themselves published investment

policies to invest no more than 15% of their total assets in other

listed closed-ended investment funds.

SHARE CAPITAL

The Company's share capital comprises 305,000,000 Ordinary

shares of 1p each, of which 71,023,695 (2021: 71,023,695) have been

issued and fully paid. No Ordinary shares are held in treasury, and

none were bought back or issued during the six months ending 31st

December 2022.

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks identified by the Board, and the steps the

Board takes to mitigate them, are discussed below. The audit

committee reviews existing and emerging risks on a six monthly

basis. The Board has closely monitored the geopolitical, societal,

economic and market focused implications of the events in 2021 and

2022.

Investment strategy: Inappropriate long-term strategy, asset

allocation and fund selection could lead to underperformance. The

Board discusses investment performance at each of its meetings and

the Directors receive reports detailing asset allocation,

investment selection and performance.

Business conditions and general economy: The Company's future

performance is heavily dependent on the performance of different

equity and currency markets. The Board cannot mitigate the risks

arising from adverse market movements. However, diversification

within the portfolio should reduce the impact. Further information

is given in portfolio risks below.

Macro-economic event risk: The Covid pandemic was felt globally

in 2021 and 2022 although economies and markets have recovered. The

scale and potential adverse impact of a macro-economic event, such

as the Covid pandemic, has highlighted the possibility of a number

of identified risks such as market risk, currency risk, investment

liquidity risk and operational risk having an adverse impact at the

same time. The risk may impact on: the value of the Company's

investment portfolio, its liquidity, meaning investments cannot be

realised quickly, or the Company's ability to operate if the

Company's suppliers face financial or operational difficulties. The

Directors closely monitor these areas and currently maintain a

significant cash balance.

Portfolio risks - market price, foreign currency and interest

rate risks: The largest investments are listed below. Investment

returns will be influenced by interest rates, inflation, investor

sentiment, availability/cost of credit and general economic and

market conditions in the UK and globally. A significant proportion

of the portfolio is in investments denominated in foreign

currencies and movements in exchange rates could significantly

affect their sterling value. The Investment Manager takes all these

factors into account when making investment decisions but the

Company does not normally hedge against foreign currency movements.

The Board's policy is to hold a spread of investments in order to

reduce the impact of the risks arising from the above factors by

investing in a spread of asset classes, geographic regions and

through investment funds.

Net asset value discount: The discount in the price at which the

Company's shares trade to net asset value means that shareholders

cannot realise the real underlying value of their investment. Over

a number of years, the Company's share price has been at a

significant discount to the Company's net asset value. The

Directors review regularly the level of discount, however given the

investor base of the Company, the Board is very restricted in its

ability to influence the discount to net asset value.

Investment Manager: The quality of the team employed by the

Investment Manager is an important factor in delivering good

performance and the loss of key staff could adversely affect

returns. A representative of the Investment Manager attends each

Board meeting and the Board is informed if any major changes to the

investment team employed by the Investment Manager are proposed.

The Investment Manager regularly informs the Board of developments

and any key implications for either the investment strategy or the

investment portfolio.

Tax and regulatory risks: A breach of The Investment Trust

(Approved Company) (Tax) Regulations 2011 (the 'Regulations') could

lead to capital gains realised within the portfolio becoming

subject to UK capital gains tax. A breach of the FCA Listing Rules

could result in suspension of the Company's shares, while a breach

of company law could lead to criminal proceedings, financial and/or

reputational damage. The Board employs Brompton Asset Management

Limited as Investment Manager, and Maitland Administration Services

Limited as Secretary and Administrator, to help manage the

Company's legal and regulatory obligations.

Operational: Disruption to, or failure of, the Investment

Manager's or Administrator's accounting, dealing or payment

systems, or the Custodian's records, could prevent the accurate

reporting and monitoring of the Company's financial position. The

Company is also exposed to the operational risk that one or more of

its suppliers may not provide the required level of service. The

Board monitors its service providers, with an emphasis on their

business interruption procedures.

The Directors confirm that they have carried out a robust

assessment of the risks and emerging risks facing the Company,

including those that would threaten its business model, future

performance, solvency and liquidity.

INVESTMENT MANAGEMENT ARRANGEMENTS AND RELATED PARTY

TRANSACTIONS

In common with most investment trusts the Company does not have

any executive directors or employees. The day-to-day management and

administration of the Company, including investment management,

accounting and company secretarial matters, and custodian

arrangements are delegated to specialist third party service

providers.

Details of related party transactions are contained in the

Annual Report. There have been no unusual material transactions

with related parties during the period which have had a significant

impact on the performance of the Company.

GOING CONCERN AND VIABILITY

The Directors believe that it is appropriate to continue to

adopt the going concern basis in preparing the interim report as

the assets of the Company consist mainly of securities that are

readily realisable or cash and it has no significant liabilities

and limited financial commitments. Investment income has exceeded

annual expenditure and current liquid net assets cover current

annual expenses for many years. Accordingly, the Company is of the

opinion that it has adequate financial resources to continue in

operational existence for the foreseeable future which is

considered to be in excess of five years. Five years is considered

a reasonable period for investors when making their investment

decisions. In reaching this view the Directors reviewed the

anticipated level of annual expenditure against the cash and liquid

assets within the portfolio. The Directors have also considered the

risks the Company faces.

RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge:

As disclosed in note 1, the annual consolidated financial

statements of the Group are prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting".

The Chairman's statement and the Investment Manager's report

include a fair review of important events that have occurred during

the first six months of the financial year and their impact on the

financial statements;

The Chairman's statement, the Investment Manager's report and

the Directors' report include a fair review of the potential risks

and uncertainties for the remaining six months of the year;

The Director's report and note 8 to the interim financial report

include a fair review of the information concerning transactions

with the investment manager and changes since the last annual

report.

By order of the Board

Maitland Administration Services Limited

21st March 2023

SCHEDULE OF TOP TWENTY INVESTMENTS at 31st December 2022

30th June 2022 Purchases/

Market Movement 31st Dec 2022 GBP'000 % of Net Assets

GBP'000 (Sales)

Fundsmith Equity Fund 8,562 - 419 8,981 7.29

Polar Capital Global Technology 7,277 - (628) 6,649 5.40

iShares Core S&P 500 UCITS ETF 3,828 991 39 4,858 3.94

Matthews Asia Ex Japan Fund 5,158 - (563) 4,595 3.73

MI Chelverton UK Equity Inc Fund 4,581 - (25) 4,556 3.70

EF Brompton Global Conservative Fund (49)

4,454 - 4,405 3.57

First State Indian Subcontinent Fund 3,943 - 303 4,246 3.45

BlackRock Continental European Inc Fund 300

3,916 - 4,216 3.42

Aquilus Inflection Fund 4,242 - (130) 4,112 3.34

Baillie Gifford Global Income Growth 3,876 - 148 4,024 3.27

BlackRock Gold & General 3,710 - 223 3,933 3.19

MI Somerset Asia Income Fund 2,849 1,000 (150) 3,699 3.00

Vietnam Enterprise Investments 2,944 968 (451) 3,461 2.81

EF Brompton Global Equity Fund 3,361 - 75 3,436 2.79

Aberforth Split Level Income Trust 3,144 - 187 3,331 2.70

EF Brompton Global Opportunities Fund 65

3,198 - 3,263 2.65

EF Brompton Global Growth Fund 3,044 - 55 3,099 2.51

MI Brompton UK Recovery Unit Trust 101

2,798 - 2,899 2.35

Lindsell Train Japanese Equity Fund 2,650 1,000 (845) 2,805 2.28

TM Crux European Special Sits Fund 2,460 - 233 2,693 2.19

Man GLG UK Income Fund 2,468 - 157 2,625 2.13

82,463 3,959 (536) 85,886 69.70

Balance not held in investments above 16,987 2,483 (58) 19,412 15.75

Total investments (excluding cash) 99,450 6,442 (594) 105,298 85.45

Cash 24,530 (6,347) (159) 18,024 14.63

Other net current liabilities (2) (95) - (97) (0.08)

Net Assets

123,978 - (753) 123,225 100.00

All of the above investments are investment funds with the

exception of Aberforth Split Level Income Trust and Vietnam

Enterprise Investments which are investment companies.

The investment portfolio, excluding cash, can be further analysed as follows: GBP'000

Investment funds 94,942

Unquoted investments including loans of GBP1.2m 2,187

Investment companies and exchange traded funds 7,617

Other quoted investments 552

105,298

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31st December 2022 (unaudited)

Six months ended

31st December 2022

(unaudited)

Total

Revenue Return Capital Return

GBP '000 Return

GBP '000 GBP '000

Notes

INCOME

Investment income 1,101 - 1,001

Other operating income 191 - 191

Total income 2 1,292 - 1,292

GAINS AND LOSSES ON INVESTMENTS

Losses on investments at fair value through profit or loss 5

- (594) (594)

Legal and professional costs - - -

Other exchange gains - 99 99

Trail rebates - 1 1

1,292 (494) 798

EXPENSES

Management fees 3 (385) - (385)

Other expenses (163) - (163)

(548) - (548)

PROFIT/(LOSS) BEFORE FINANCE COSTS AND TAX

744 (494) 250

Finance costs - - -

PROFIT/(LOSS) BEFORE TAX 744 (494) 250

Tax (9) - (9)

PROFIT/(LOSS) FOR THE PERIOD 735 (494) 241

EARNINGS/(LOSS) PER SHARE

Ordinary shares (pence) 4 1.04p (0.70)p 0.34p

The total return column of this statement represents the Group's

profit and loss account, prepared in accordance with IFRS. The

supplementary Revenue Return and Capital Return columns are both

prepared under guidance published by the Association of Investment

Companies. All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

period.

All income is attributable to the equity holders of the parent

company. There are no minority interests.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31st December 2021 and the year ended

30th June 2022

Six months ended Year ended

31st December 2021 30th June 2022

(unaudited) (audited)

Revenue Capital Total Revenue Capital Total

Notes Return Return Return Return Return Return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

INCOME

Investment income 1,001 - 1,001 1,837 - 1,837

Other operating income - - - 20 - 20

Total income 2 1,001 - 1,001 1,857 - 1,857

GAINS AND LOSSES ON INVESTMENTS

Gains/(losses) on investments at fair value

through profit or loss

5 - 3,114 3,114 - (15,188) (15,188)

Legal and professional costs - (60) (60) (60) (60)

Other exchange gains - 121 121 - 1,382 1,382

Trail rebates - 4 4 - 6 6

1,001 3,179 4,180 1,857 (13,860) (12,003)

EXPENSES

Management fees 3 (437) - (437) (837) - (837)

Other expenses (158) - (158) (320) - (320)

(595) - (595) (1,157) - (1,157)

PROFIT/(LOSS) BEFORE TAX 406 3,179 3,585 700 (13,860) (13,860)

Tax (1) - (1) - - -

PROFIT/(LOSS) FOR THE PERIOD 405 3,179 3,584 700 (13,860) (13,160)

EARNINGS PER SHARE

Ordinary shares (pence) 4 0.57p 4.48p 5.05p 0.98p (19.51)p (18.53)p

The total return column of this statement represents the Group's

profit and loss account, prepared in accordance with IFRS. The

supplementary Revenue Return and Capital Return columns are both

prepared under guidance published by the Association of Investment

Companies. All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

periods.

All income is attributable to the equity holders of the parent

company. There are no minority interests.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 31st December 2022 (unaudited)

Share

Share premium Special reserve Retained earnings

capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

At 30th JUNE 2022 710 21,573 56,908 44,787 123,978

Total comprehensive income for the period - - - 241 241

Dividend paid - - - (994) (994)

At 31st DECEMBER 2022 710 21,573 56,908 44,034 123,225

Included within retained earnings were GBP1,407,000 of Company

reserves available for distribution.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 31st December 2021 (unaudited)

Share

Share premium Special reserve Retained earnings

capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

At 30th JUNE 2021 710 21,573 56,908 58,941 138,132

Total comprehensive income for the period - - - 3,584 3,584

Dividend paid - - - (994) (994)

At 31st DECEMBER 2021 710 21,573 56,908 61,531 140,722

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30th June 2021 (audited)

Share

Share premium Special reserve Retained earnings

capital Total

GBP '000 GBP '000 GBP '000

GBP '000 GBP '000

At 30th JUNE 2021 710 21,573 56,908 58,941 138,132

Total comprehensive income for the year - - - (13,160) (13,160)

Dividend paid - - - (994) (994)

At 30th JUNE 2022 710 21,573 56,908 44,787 123,978

CONSOLIDATED BALANCE SHEET

at 31st December 2022

31st December 31st December 30th June

2022 2021 2022

Notes

(unaudited) (unaudited) (audited)

GBP '000 GBP '000 GBP '000

NON-CURRENT ASSETS

Investments at fair value through profit or loss

5 105,298 135,726 99,450

CURRENT ASSETS

Other receivables 152 126 258

Cash and cash equivalents 18,024 5,139 24,530

18,176 5,265 24,788

TOTAL ASSETS 123,474 140,991 124,238

CURRENT LIABILITIES

Other payables (249) (269) (260)

TOTAL ASSETS LESS CURRENT LIABILITIES

123,225 140,722 123,978

NET ASSETS 123,225 140,722 123,978

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

Called-up share capital 710 710 710

Share premium 21,573 21,573 21,573

Special reserve 56,908 56,908 56,908

Retained earnings 6 44,034 61,531 44,787

TOTAL EQUITY 123,225 140,722 123,978

NET ASSET VALUE PER ORDINARY SHARE (PENCE) 7 173.50p 198.13p 174.56p

The interim report was approved and authorised for issue by the

Board on 21st March 2023.

CONSOLIDATED CASH FLOW STATEMENT

for the six months ended 31st December 2022

Six months Six months Year

ended ended ended

31st December 31st December 30th June

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP '000 GBP '000 GBP '000

NET CASH INFLOW FROM OPERATING ACTIVITIES 831 517 673

INVESTING ACTIVITIES

Purchase of investments (6,442) (2,885) (11,861)

Sale of investments - - 26,950

Legal and professional costs - (60) (60)

NET CASH (OUTFLOW)/INFLOW FROM INVESTING ACTIVITIES

FINANCING (6,442) (2,945) 15,029

Equity dividend paid (994) (994) (994)

NET CASH (OUTFLOW)/INFLOW AFTER FINANCING

(6,605) (3,422) 14,708

(DECREASE)/INCREASE IN CASH (6,605) (3,422) 14,708

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET FUNDS

(Decrease)/increase in cash resulting from cash flows (6,605) (3,422) 14,708

Exchange movements 99 121 1,382

Movement in net funds (6,506) (3,301) 16,090

Net funds at start of period/year 24,530 8,440 8,440

NET FUNDS AT OF PERIOD/YEAR 18,024 5,139 24,530

RECONCILIATION OF PROFIT BEFORE FINANCE COSTS AND TAXATION TO NET CASH FLOW FROM OPERATING ACTIVITIES

Profit/(loss) before finance costs and taxation * 250 3,585 (13,160)

Losses/(gains) on investments 594 (3,114) 15,188

Exchange gains (99) (121) (1,382)

Legal and professional costs - 60 60

Capital trail rebates (1) (4) (6)

Revenue profit before finance costs and taxation 744 406 700

Decrease/(increase) in debtors 106 109 (30)

Decrease in creditors (11) (1) (10)

Finance costs - (1) -

Taxation (9) - 7

Capital trail rebates 1 4 6

NET CASH INFLOW FROM OPERATING ACTIVITIES 831 517 673

* Includes dividends received in cash of GBP1,012,000 (30th June

2022: GBP1,653,000) (2021: GBP963,000), accumulation income of

GBP188,000 (30th June 2022: GBP149,000) (2021: GBP140,000) and

interest received of GBP189,000 (30th June 2022: GBP20,000) (2021:

GBP1,000).

NOTES TO THE INTERIM FINANCIAL STATEMENTS

for the six months ended 31st December 2022

1. ACCOUNTING POLICIES

The condensed consolidated interim financial statements comprise

the unaudited results of the Company and its subsidiary, JIT

Securities Limited (together "the Group"), for the six months ended

31st December 2022. The comparative information for the six months

ended 31st December 2021 and the year ended 30th June 2022 are a

condensed set of accounts and do not constitute statutory accounts

under the Companies Act 2006. Full statutory accounts for the year

ended 30th June 2022 included an unqualified audit report, did not

contain any statements under section 498 of the Companies Act 2006,

and have been filed with the Registrar of Companies.

The half year financial statements have been prepared in

accordance with International Accounting Standard 34 'Interim

Financial Reporting', and are presented in pounds sterling, as this

is the Group's functional currency.

The same accounting policies have been followed in the interim

financial statements as applied to the accounts for the year ended

30th June 2022, which were prepared in accordance with IFRSs.

No segmental reporting is provided as the Group is engaged in a

single segment.

2. TOTAL INCOME

Year ended 30th June

Six months ended 31st December 2022

Six months ended 31st December 2021 2022

GBP'000

GBP'000

GBP'000

Income from Investments

UK net dividend income 952 900 1,581

Unfranked investment income 125 85 219

UK fixed interest 24 16 37

1,101 1,001 1,837

Other Income

Bank interest receivable 191 - 20

191 - 20

Year ended 30th June

Six months ended 31st December 2022

Six months ended 31st December 2021 2022

GBP'000

GBP'000

GBP'000

Total income comprises

Dividends 1,101 985 1,800

Other income 191 16 57

1,292 1,001 1,857

3. MANAGEMENT FEES

Year ended 30th June

Six months ended 31st December 2022

Six months ended 31st December 2021 2022

GBP'000

GBP'000

GBP'000

Investment management fee 385 437 837

385 437 837

The Investment Manager receives a management fee, payable

quarterly in arrears, equivalent to an annual 0.75 per cent of

total assets after the deduction of the value of any investments

managed by the Investment Manager or its associates (as defined in

the investment management agreement).

4. RETURN PER ORDINARY SHARE

Year ended 30th

Six months ended 31st December June

2022 Six months ended 31st December

2021 2022

GBP'000

GBP'000

GBP'000

Revenue return 735 405 700

Capital return (494) 3,179 (13,860)

Total return 241 3,584 (13,160)

Weighted average number of Ordinary 71,023,695 71,023,695 71,023,695

shares

Revenue return per Ordinary share 1.04p 0.57p 0.98p

Capital return per Ordinary share (0.70)p 4.48p (19.51)p

Total return per Ordinary share 0.34p 5.05p (18.53)p

5. INVESTMENTS AT FAIR VALUE THROUGH PROFIT AND LOSS

At

At At

30th June

31st December 2022 31st December 2021

2022

GBP'000 GBP'000

GBP'000

GROUP AND COMPANY 105,298 135,726 99,450

ANALYSIS OF INVESTMENT

PORTFOLIO

Six months ended 31st December 2022

Total

Quoted* Unquoted**

(level 1 and 2) (level 3)

GBP'000

GBP'000 GBP'000

Opening book cost 70,896 10,099 80,995

Opening investment holding gains/(losses) 25,941 (7,486) 18,455

Opening valuation 96,837 2,613 99,450

Movement in period:

Purchases at cost 6,092 350 6,442

Sales

- Proceeds - - -

- Realised gains on sales - - -

Movement in investment holding gains/(losses) 182 (776) (594)

Closing valuation at 31 December 2022 103,111 2,187 105,298

Closing book cost 76,988 10,449 87,437

Closing investment holding gains/losses 26,123 (8,262) 17,861

Closing valuation 103,111 2,187 105,298

* Quoted investments include unit trust and OEIC funds which are

valued at quoted prices. Included within Quoted Investments is one

monthly valued investment fund of GBP4,112,000 (30th June 2022

GBP4,242,000) (2021: GBP4,632,000).

** The Unquoted investments, representing just under 2% of the

Company's NAV, have been valued in accordance with IPEVC valuation

guidelines. The largest unquoted investment amounting to GBP700,000

(30th June 2022: GBP957,000) (2021: GBP14,842,000) was valued at

recent transaction price. The second largest investment has also

been valued at recent transaction price. A 10% increase or decrease

in the earnings of any of these investments would not have a

material impact on the valuation of those investments.

There were no reclassifications for assets between Level 1, 2

and 3.

5. INVESTMENTS AT FAIR VALUE THROUGH PROFIT AND LOSS

continued

Year

ended

Six months ended Six months ended

30th

31st December 2022 31st December 2021

June

GBP'000 GBP'000

2022

GBP'000

ANALYSIS OF CAPITAL (LOSSES)/GAINS

Realised gains on sales of investments - - 18,375

(Decrease)/increase in investment holding gains (594) 3,114 (33,563)

(594) 3,114 (15,188)

6. RETAINED EARNINGS

At At

At

31st December 2022 30th June

31st December 2021

GBP'000 2022

GBP'000

GBP'000

Capital reserve - realised 24,766 5,381 24,666

Capital reserve - revaluation 17,861 55,132 18,455

Revenue reserve 1,407 1,018 1,666

44,034 61,531 44,787 7. NET ASSET VALUE PER ORDINARY SHARE

31st December 2022 30th June

31st December 2021

GBP'000 2022

GBP'000

GBP'000

Net assets attributable to Ordinary shareholders

123,225 140,722 123,978

Ordinary shares in issue at end of period

71,023,695 71,023,695 71,023,695

Net asset value per Ordinary share 173.50p 198.13p 174.56p

8. TRANSACTIONS WITH THE INVESTMENT MANAGER

During the period there have been no new related party

transactions that have affected the financial position or

performance of the Group.

Since 1st January 2010 Brompton has acted as Investment Manager

to the Company. This relationship is governed by an agreement dated

17 May 2018.

Mr Duffield is the senior partner of Brompton Asset Management

Group LLP the ultimate parent of Brompton. Mr Duffield owns a

majority (59.14%) of the shares in the Company.

Mr Gamble has an immaterial holding in Brompton Asset Management

Group LLP.

The total investment management fee payable to Brompton for the

half year ended 31st December 2022 was GBP385,000 (30th June 2022:

GBP837,000) (2021: GBP437,000) and at the half year GBP192,000

(30th June 2022: GBP193,000) (2021: GBP219,000) was accrued.

The Group's investments include seven funds managed by Brompton

or its associates valued at GBP21,697,000 (30th June 2022:

GBP24,451,000) (2021: GBP24,194,000). No investment management fees

were payable directly by the Company in respect of these

investments.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB0002631041

Category Code: IR

TIDM: NSI

Sequence No.: 231525

EQS News ID: 1588237

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1588237&application_name=news

(END) Dow Jones Newswires

March 21, 2023 07:29 ET (11:29 GMT)

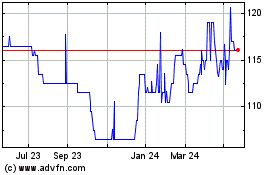

New Star Investment (AQSE:NSI.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

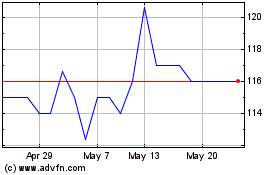

New Star Investment (AQSE:NSI.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024