TIDMSHNJ

26 June 2023

Rogue Baron Plc.

("Rogue Baron" or the "Company")

Half Year Report

for the six-month period ended 31 March 2023

In spite of challenging conditions in the capital market, Rogue Baron has

achieved significant advancements during the six-month period leading up to 31

March 2023.

Following the successful completion of transitioning to our new USA distributor

in September 2022, the Company resumed full-scale sales operations in October.

During the fourth quarter of 2022, Rogue Baron sold around 930 cases of Shinju

whisky worldwide, marking an impressive growth of approximately 100% compared

to the corresponding period in 2021.

Sales of Shinju whisky decreased during the first quarter of 2023 as Q1 tends

to be the slowest quarter in the spirits industry. This seasonal trend is not

unique to our brand but is rather a characteristic of the industry as a whole.

During this period, consumers typically reduce their spending after the holiday

season, focusing on other priorities and expenditures. A reduction in consumer

spending plays a significant role in how our customers and distributors plan

their buying cycles. While this slowdown may impact our short-term sales

figures, we project an increase in sales as we move further into the Spring and

Summer months.

Another contributing factor to the sales slowdown in Q1 2023 is the significant

number of orders placed by our customers prior to their year-end on December

31, 2022. This surge in Q4 orders naturally resulted in a subsequent lull in

demand during the following months. However, we view this as a positive

indication of our customers' perspective on our brand, and we anticipate a

rebound in sales as we progress further into the year.

Moreover, it is important to mention that our current inventory levels are

relatively low. Due to this, we have made a strategic decision to adjust our

sales and marketing efforts during this period. By reducing the intensity of

these activities, we aim to ensure that our available inventory can

sufficiently meet the demand until our next round of production arrives in the

market. This measured approach allows us to maintain consistency in the

availability of our products, which is the cornerstones of our brand's

reputation. Shinju whisky sold so quickly, and far exceeded our expectations,

in Europe that it depleted our inventory levels much faster than anticipated.

The need to resupply those markets is vital to the business.

While we acknowledge the temporary impact of these factors on our sales

performance, we remain steadfast in our commitment to continued growth. We are

currently in the process of our next round of production on both the Shinju

3-year and Shinju 8-year. Our marketing campaigns will be carefully aligned

with the timing and availability of our inventory levels.

The Shinju brand has made a remarkable entry into the UK market, experiencing

robust sales growth right from the start. A significant contributing factor to

this success has been the introduction of the highly anticipated 8-year-old

'Black Pearl' extension. This new addition to our portfolio has added

significant value to the brand overall and established a strong foundation for

the brand's presence.

Furthermore, our distribution network in the UK has significantly expanded.

This growth can be attributed, in part, to the availability of Shinju products

on popular platforms such as Amazon and the Whisky Exchange. By leveraging the

reach and convenience of these online marketplaces, we have been able to

connect with a wider audience and make our offerings easily accessible to

consumers.

Additionally, our dedicated brand manager based in the UK has achieved notable

progress in securing listings for Shinju in various trade locations,

particularly in London. This strategic push has allowed us to establish a

strong presence in key markets and cater to the discerning tastes of whisky

connoisseurs. We will continue to look to expand additional sales across

multiple EU countries, thereby expanding our footprint within the European

market.

The Company anticipates a favourable outlook for sales and margins in the

second half of 2023. This positive projection is primarily attributed to the

resolution of shipping issues that have plagued the Company in recent years,

but maintaining proper inventory levels will be necessary to continue the

growth. Additionally, there is potential for significant growth as the Company

intends to launch the 8-year-old Shinju expression into the United States

market for the first time, projected in Q3 2023.

With an established distribution network in both Europe and the US, Rogue Baron

is confident that securing the required capital would enable the Company to

achieve a substantial increase in revenue within the short to medium term. At

the time of releasing these accounts, the Company is actively engaged in

discussions with multiple potential investors. There is an optimistic outlook

that the necessary funds can be raised, leading to higher levels of revenue and

profitability in the future.

Ryan Dolder

CEO

The half yearly results to 31 March 2023 have not been reviewed by the

Company's auditor.

The directors of the Company accept responsibility for the contents of this

announcement.

For further information, please contact:

The Company

Ryan

Dolder

rdolder@roguebaron.com

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

+44 (0) 20 7469 0936

AQSE Corporate Broker:

Peterhouse Capital Limited

Lucy Williams

+44 (0) 20 7469 0936

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 31 MARCH 2023

Unaudited Unaudited

Period ended Period ended

31 March 2023 31 March 2022

Note US$'000 US$'000

Revenue 164 66

Cost of sales (104) (52)

Gross profit 60 14

Other administrative expenses (277) (387)

Exchange differences movement (47) 12

Total administrative expenses (324) (375)

Loss from operations (264) (361)

Finance costs - -

Loss before taxation (264) (361)

Tax charge - -

Loss after taxation (264) (361)

Loss from assets held for sale - (52)

Loss for the year (264) (413)

Other comprehensive income for the period

Exchange difference on translating foreign (10) (19)

operations

Total comprehensive loss for the year, (274) (432)

attributable to owners of the company

Total comprehensive loss attributable to

Non-controlling shareholders - -

Equity holders of the parent (274) (432)

(274) (432)

Loss per share

Total basic and diluted loss per share (cents) 3 (0.29) (0.40)

from continuing operations

Total basic and diluted loss per share (cents) 0.00 (0.06)

from operations held for sale

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2023

Unaudited Audited

31 March 2023 30 September 2022

Assets Note US$'000 US$'000

Non-current assets

Goodwill 1,239 1,239

Intangible assets 4 2,352 2,352

Total non-current assets 3,591 3,591

Current

Inventories 567 659

Assets held for resale - -

Receivable on sale of subsidiaries 75 75

Trade and other receivables 252 268

Cash and cash equivalents 33 43

Total current assets 927 1,045

Total assets 4,518 4,636

Liabilities

Current

Trade and other payables 479 342

Loans payable 5 186 167

Liabilities of assets held for resale - -

Total current liabilities and total liabilities 665 509

Equity

Issued share capital 6 119 119

Share premium 6 6,627 6,627

Share based payment reserve 4 4

Exchange reserve (252) (242)

Retained earnings (2,618) (2,354)

Equity attributable to the equity holders of the 3,880 4,154

Company

Non-controlling interest (27) (27)

Total equity 3,853 4,127

Total equity and liabilities

4,518 4,636

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 31 MARCH 2023

Share Share Exchange Share based Retained Total equity Non-controlling Total equity

capital premium reserve payment earnings attributable interest

account reserves to the owners

of the

company

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 114 6,294 (174) - (1,512) 4,722 (41) 4,681

October 2021

Share issue 5 360 - - - 365 - 365

Share issue costs - (27) - - - (27) - (27)

Transactions with 5 333 - - - 338 - 338

owners

Profit for the - - - - (413) (413) - (413)

period

Exchange - - (19) - - (19) - (19)

difference on

translating

foreign

operations

Balance at 31 119 6,627 (193) - (1,925) 4,628 (41) 4,587

March 2022

Share based - - - 4 - 4 - 4

payments

Transactions with - - - 4 - 4

owners - 4

Loss for the - - - - (429) (429) 14 (415)

period

Exchange - - (49) - - (49) - (49)

difference on

translating

foreign

operations

Balance at 30 119 6,627 (242) 4 (2,354) 4,154 (27) 4,127

September 2022

Issue of shares - - - - - - - -

Transactions with -

owners - - - - - - -

Loss for the - - - - (264) (264) - (264)

period

Exchange - - (10) - - (10) - (10)

difference on

translating

foreign

operations

Balance at 31 119 6,627 (252) 4 (2,618) 3,880 (27) 3,853

March 2023

ROGUE BARON PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 31 MARCH 2023

Unaudited Unaudited

Period ended Period ended

31 March 2023 31 March 2022

US$'000 US$'000

Operating activities

Loss after tax (264) (361)

(Increase)/decrease in inventories 92 (69)

(Increase)/decrease in trade and other receivables 10 (20)

Increase in trade and other payables 156 3

Net cash outflow from operating activities (6) (447)

Financing activities

Proceeds from issue of share capital - 365

Share issue costs - (27)

Loans received - 4

Net cash inflow from financing activities - 342

Net change in cash and cash equivalents (6) (105)

Cash and cash equivalents at beginning of period 43 271

Exchange difference on cash and cash equivalents (4) 13

Cash and cash equivalents at end of period 33 179

ROGUE BARON PLC

NOTES TO THE INTERIM REPORT

FOR THE PERIODED 31 MARCH 2023

The financial information set out in this interim report does not constitute

statutory accounts as defined in Section 434 of the Companies Act 2006.The

Company's statutory financial statements for the year ended 30 September 2022

have been completed and filed at Companies House.

1. ACCOUNTING POLICIES

Basis of preparation

The Company's ordinary shares are quoted on the Aquis Stock Exchange and the

Company applies the Companies Act 2006 when preparing its annual financial

statements.

The annual financial statements for the year ending 30 September 2023 will be

prepared in accordance with the UK adopted International Accounting Standards,

and the principal accounting policies adopted remain unchanged from those

adopted in preparing its financial statements for the year ended 30 September

2022.

The accounting policies have been applied consistently throughout the Group for

the purposes of preparation of these condensed consolidated interim financial

statements.

In 2022 the Company amended the financial year end to 30 September. As a

result, the periods reported in this interim report differ from those used in

prior interim statements.

Segmental reporting

An operating segment is a distinguishable component of the Group that engages

in business activities from which it may earn revenues and incur expenses,

whose operating results are regularly reviewed by the Group's Chief Executive

Officer to make decisions about the allocation of resources and assessment of

performance and about which discrete financial information is available.

The Chief Executive Officer reviews financial information for and makes

decisions about the Group's performance as a whole. Revenue of $136,000 was

generated in USA in the period (2022: $66,000) and revenue of $28,000 was

generated in Europe (2022: $Nil).

The Group expects to further review its segmental information during the

forthcoming financial year.

Fees and Loans Settled in Shares

Where shares have been issued as consideration for services provided or loans

outstanding, they are measured at fair value. The difference between the

carrying amount of the financial liability (or part thereof) extinguished, and

the fair value of the shares, is recognised in profit or loss.

2. TAXATION

No tax is due for the period as the Company has made a taxable loss. The

Directors expect these losses to be available to offset against future taxable

trading profits. The Group has not recognised any deferred tax asset at 31

March 2023 (31 March 2022: £nil) in respect of these losses on the grounds that

it is uncertain when taxable profits will be generated by the Group to utilise

any such losses.

3. EARNINGS per share

The calculation of the basic earnings per share is based on the loss

attributable to ordinary shareholders divided by the weighted average number of

shares in issue during the period. The impact of the options and warrants on

the loss per share is anti-dilutive.

Unaudited Period Unaudited Period

ended ended

31 March 2023 31 March 2022

US$'000 US$'000

Loss after taxation (264) (361)

Basic and diluted profit/loss per - (52)

share from operations held for sale

Loss after taxation - total (264) (413)

Number Number

Weighted average number of shares 90,043,076 89,233,289

for calculating basic earnings per

share

Cents Cents

Basic and diluted earnings per (0.29) (0.40)

share - continuing operations

Basic and diluted profit/loss per 0.00 (0.06)

share from operations held for sale

4. INTANGIBLE ASSETS

Goodwill Brands & Licences Total

US$'000 US$'000 US$'000

Cost

At 1 October 2021 1,464 2,352 3,816

Additions - - -

At 31 March 2022 1,464 2,352 3,816

Additions

- - -

At 30 September 2022 1,464 2,352 3,816

Additions

- - -

At 31 March 2023 1,464 2,352 3,816

Amortisation and impairment

At 1 January 2022

- - -

Impairment

- - -

At 31 March 2022

- - -

Impairment (225) (225)

-

At 30 September 2022 (225) (225)

-

Impairment

- - -

At 31 March 2023 (225) (225)

-

Net book value at 31 March 2023 1,239 2,352 3,591

Net book value at 30 September 2022 1,239 2,352 3,591

Net book value at 31 March 2022 1,464 2,352 3,816

The Group owns several licences over liquor brands. The carrying value of

intangible assets have been reviewed for impairment and no impairment was

considered necessary.

5. LOANS

The movement in loans is shown below.

Unaudited Audited

31 March 2023 30 September

2022

Convertible loans $'000 $'000

Balance at beginning of period 124 151

Foreign exchange 14 (27)

Balance at end of period 138 124

Non-convertible loans

Balance at beginning of period 43 5

Loans received - 39

Foreign exchange 5 (1)

Balance at end of period 48 43

6. SHARE CAPITAL

The movement in ordinary shares and share premium in the period was as follows:

Number of Nominal amount Share premium

ordinary shares (USD $'000) (USD $'000)

As at 1 October 2021 86,185,934 114 6,294

Shares issued for cash 2,857,142 4 267

Shares issued in payment of 1,000,000 1 93

creditors

Share issue costs (27)

At 31 March 2022 90,043,076 119 6,627

Movement in period - - -

At 30 September 2022 90,043,076 119 6,627

Movement in period - - -

At 31 March 2023 90,043,076 119 6,627

7. ULTIMATE CONTROLLING PARTY

The Company has no ultimate controlling party

END

(END) Dow Jones Newswires

June 26, 2023 07:07 ET (11:07 GMT)

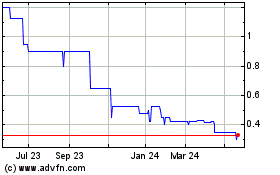

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

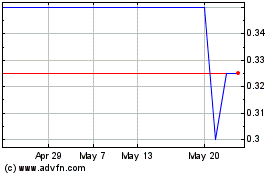

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Dec 2023 to Dec 2024