TIDMSREI

RNS Number : 0602U

Schroder Real Estate Inv Trst Ld

21 November 2023

Schroder Real Estate Investment Trust Limited

('SREIT' / the 'Company' / 'Group')

RESULTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2023

SECTOR LEADING LOW COST, LONG TERM DEBT PROFILE AND ASSET

MANAGEMENT INITIATIVES SUPPORTING FULLY COVERED DIVIDEND;

SIGNIFICANT PORTFOLIO REVERSION TO DRIVE FUTURE EARNINGS;

ANNOUCEMENT OF STRATEGIC EVOLUTION

Schroder Real Estate Investment Trust Limited, the actively

managed UK focused REIT, today announces its interim results for

the six months ended 30 September 2023. These are also available on

the Company's website, https://www.srei.co.uk and are available in

unedited full text on the national storage mechanism. The interim

results are also available as a PDF at the following link:

http://www.rns-pdf.londonstockexchange.com/rns/0602U_1-2023-11-20.pdf

Sector leading debt profile underpinning earnings and fully

covered dividend

- Net asset value ('NAV') declined marginally to GBP296.0

million or 60.5 pps (31 March 2023: GBP300.7 million, or 61.5 pps),

with a rise in real estate yields offset by a high income return

and estimated rental value ('ERV') growth of 2.4% (MSCI Benchmark:

1.7%)

- Dividends paid totalling GBP8.2 million, or 1.67 pps (30

September 2022: GBP7.8 million, or 1.60 pps), 102% covered by EPRA

earnings

- NAV total return 1.1% (30 September 2022: 0.8%)

- Long debt maturity profile of 10.2 years and a low average

interest cost of 3.5%, with 91% either fixed or hedged against

movements in interest rates

- Loan to value, net of all cash, of 36.6% (31 March 2023: 36.0%)

- Six month total return from the underlying portfolio of 1.9%

compared with the MSCI Benchmark at -0.6%

Increasing exposure to higher growth multi-let industrial

sector, with asset management initiatives capturing portfolio

reversion

- Sustained, long term outperformance of the underlying

portfolio with a total return of 6.7% per annum on a rolling three

year basis (MSCI Benchmark Index: 2.2% per annum)

- Like-for-like portfolio valuation declined 1.1%, net of capex,

as property valuations stabilised

- 56 new lettings, rent reviews and renewals across 505,782 sq

ft completed since the start of the period totalling GBP3.8 million

in annualised rental income, and 7% ahead of the opening ERV

- Attractive portfolio reversionary income yield of 8.1%, which

compares favourably with the Benchmark at 5.9%

- 99% of rent due collected

- Completion of Stanley Green Trading Estate 80,000 sq ft

operational net zero warehouse scheme in Manchester, with

approximately 60% of the GBP1.3 million ERV relating to the new

development let or in advanced negotiations

- Completed GBP4 million disposal of non-core office asset in

Rugby, in line with valuation at the start of the financial year,

with further disposals planned and in progress

Proposal to formally include sustainability at the centre of

Company's investment proposition, building on progress to date:

- Further improvement in the Company's Global Real Estate

Sustainability Benchmark ('GRESB') score, maintaining first

position amongst a group comprising six diversified REITs

- As announced separately today, the Company has issued a

circular proposing to formally include sustainability at the centre

of its investment proposition, with a focus on decarbonisation

strategies that improve existing buildings to achieve a Green

Premium and capitalise on mispricing

Board succession:

- Appointment of Sanjay Patel as an independent Non-executive

Director with effect from 1 January 2024

Alastair Hughes, Chair of the Board, commented:

"Although the short-term outlook clearly remains uncertain,

prudent steps taken by the Manager to secure low cost, long-term

debt for the Company, and increase exposure to higher growth

sectors, means the Company is well positioned to continue

outperforming the benchmark, deliver on its investment objective

and provide a progressive dividend over time.

"As announced separately today, the Company has issued a

circular proposing to formally include sustainability at the centre

of its investment proposition. As sustainability considerations

become even more important for investors and occupiers, we have a

strong conviction that it will clearly help to differentiate the

Company and drive more sustainable, risk-adjusted returns."

Nick Montgomery, Fund Manager, added:

"We continue to make good progress against our strategic

objectives to deliver dividend growth by improving the quality of

the underlying portfolio through a disciplined, research-led

approach to transactions, capital investment, active asset

management and operational excellence.

"In particular, we have increased our allocation to higher

growth sectors and larger assets with strong fundamentals. Asset

management initiatives have delivered rental growth ahead of the

MSCI Benchmark and we have a pipeline of positive activity

including regears with major tenants in return for sustainability

related asset improvements."

A webcast presentation for analysts and investors will be hosted

today at 9.00am GMT. In order to register, please visit:

https://registration.duuzra.com/form/feedback/SREIAnnualResultsJun23

For further information:

Schroder Real Estate Investment Management

Limited

Nick Montgomery / Bradley Biggins 020 7658 6000

Schroder Investment Management Limited

(Company Secretary)

Matthew Riley 020 7658 6000

--------------

FTI Consulting

Dido Laurimore / Richard Gotla / Oliver

Parsons 020 3727 1000

--------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCEADFEALDDFAA

(END) Dow Jones Newswires

November 21, 2023 02:00 ET (07:00 GMT)

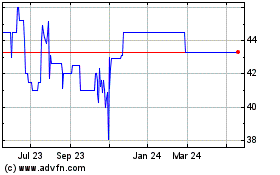

Invista Fnd Tst (AQSE:SREI.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Invista Fnd Tst (AQSE:SREI.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025