Australia Banks on Bitcoin Tech to Keep Tabs on Stocks

07 December 2017 - 3:26PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australia's main securities exchange is

betting on the record-keeping technology that underpins bitcoin to

process stock trading in the country.

The decision to adopt the technology to replace ASX Ltd.'s

current decades-old system offers a significant foothold in

mainstream finance for blockchain. ASX expects the shift will make

the sharing of vast volumes of data more efficient and lead to cost

savings for its customers.

ASX on Thursday said it would replace its system for recording

shareholdings and managing the clearing and settlement of equity

trades with blockchain ledger technology developed by Digital Asset

Holdings, a financial-technology company led by former JPMorgan

Chase & Co. executive Blythe Masters.

The exchange, which has been looking to replace its existing

system for more than two years, said it aimed to disclose the

proposed timing of the change and the functions the new technology

will initially have by the end of March. The cost of developing the

blockchain-backed system wasn't disclosed.

"This puts us ahead of other exchanges, which we know are

watching this closely," ASX Deputy Chief Executive Peter Hiom

said.

Commonly called blockchain, distributed ledger technology is an

electronic record of continuously maintained and verified

transactions that is shared by users on computer servers and

protected by cryptography. Financial companies around the world

have ramped up investment in the technology in recent years in the

hope it can simplify and reduce the cost of back-office

processes.

Several other exchanges have been experimenting with blockchain

technology. In May, Nasdaq Inc. and Citigroup Inc. said they would

introduce a system using blockchain technology to record and

transmit payments.

In late 2016, Deutsche Bundesbank and Deutsche Börse presented a

prototype for blockchain technology-based settlement of securities.

Earlier that year, International Business Machines Corp. said it

was working with Japan Exchange Group to test the potential of

blockchain technology in trading in low-transaction markets.

Although similar ledger technology is used to track digital

currencies, the system proposed by ASX would operate on a secure

private network where users are known, have permission to access

and must comply with enforceable obligations. The platform would

synchronize and standardize the exchange's database of equity

trades.

"After so much hype surrounding distributed ledger technology,

today's announcement delivers the first meaningful proof that the

technology can live up to its potential," Ms. Masters said.

Ms. Masters, who helped pioneer credit-derivatives markets in

the 1990s, said Digital Asset and ASX have shown the technology

works and can meet requirements for "mission-critical" financial

infrastructure.

Last year, Wall Street banks including JPMorgan and Citigroup

Inc. successfully tested blockchain ledger technology on

credit-default swaps. JPMorgan in October rolled out its latest

pilot program to use blockchain to enable faster, more secure

transfers of cross-border payments between it, Royal Bank of Canada

and Australia & New Zealand Banking Group Ltd.

In July, ANZ and fellow Australian bank Westpac Banking Corp.,

along with IBM and shopping-center operator Scentre Group, said

they had successfully tested the ledger technology to eliminate the

need for paper-based bank guarantee documents, which could reduce

the potential for fraud and offer a single source of

information.

ASX bought a small stake in Digital Asset early last year,

lifting it to an 8.5% interest for a further US$7.2 million a few

months later when it also appointed the company as its preferred

partner to develop blockchain ledger technology. It said Thursday

it would exercise its right to take part in Digital Asset's recent

fund raising, buying US$3.5 million in convertible notes.

The exchange has been looking at the possible adoption of the

technology for more than two years as an alternative to developing

an update for its Clearing House Electronic Subregister System, or

Chess, which was introduced more than 20 years ago as a replacement

for paper share certificates. The company and Digital Asset have

been testing "enterprise-grade" blockchain technology for

post-trade functions to ensure it has the capacity and security to

manage Australia's financial marketplace and meet regulatory

standards, ASX Chief Executive Dominic Stevens said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 06, 2017 23:11 ET (04:11 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

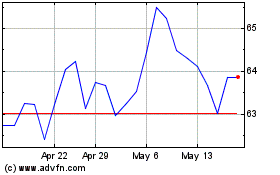

ASX (ASX:ASX)

Historical Stock Chart

From Nov 2024 to Dec 2024

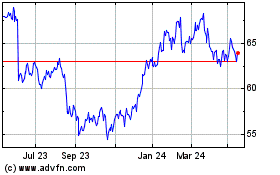

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2023 to Dec 2024