DEXUS Property Group Announces Consideration for Cash Tender Offer for Notes

31 May 2012 - 1:58AM

Business Wire

DEXUS Property Group (ASX: DXS) (“DEXUS”) today announced the

reference yield, Total Consideration and Tender Offer Consideration

for the previously announced cash tender offer (the “Offer”) by

DEXUS Funds Management Limited (ABN 24 060 920 783), in its

capacity as responsible entity of DEXUS Diversified Trust (the

“Company”), to purchase up to US$175,455,000 maximum aggregate

principal amount, which may be increased in the sole discretion of

the Company, of the outstanding 7.125% Guaranteed Senior Notes due

2014 (the “Notes”) of the Company and DEXUS Funds Management

Limited, in its capacity as responsible entity of DEXUS Office

Trust. The terms and conditions of the Offer are set forth in the

Company’s Offer to Purchase dated 15 May 2012 (as amended, the

“Offer to Purchase”) and the related Letter of Transmittal, as

previously amended by the DEXUS media release dated 30 May

2012.

The Offer will expire at 11:59 p.m., New York City Time, on 12

June 2012 unless extended or earlier terminated (such time and

date, as the same may be extended, the “Expiration Date”). Holders

of Notes who validly tendered and did not validly withdraw their

Notes on or before 5:00 p.m., New York City time, on 29 May 2012

(the “Early Tender Deadline”), and whose Notes are accepted for

purchase will receive the Total Consideration (as described below).

Holders of Notes who tender their Notes after the Early Tender

Deadline and on or before the Expiration Date will be eligible to

receive the “Tender Offer Consideration,” which is equal to the

Total Consideration minus the early tender payment of US$30 per

US$1,000 principal amount of Notes accepted for purchase (the

“Early Tender Payment”).

The “Total Consideration” per each US$1,000 principal amount of

Notes validly tendered and accepted for payment pursuant to the

Offer was calculated by Deutsche Bank Securities Inc., the Dealer

Manager for the Offer, at 10:30 a.m., New York City time, on 30 May

2012, in the manner described in the Offer to Purchase by reference

to a fixed spread over the reference yield, each as specified in

the table below, and assuming that the Payment Date (as defined

below) will occur on 13 June 2012. The Early Tender Payment is

included in the calculation of the Total Consideration and is not

in addition to the Total Consideration. Tendering holders will also

receive accrued and unpaid interest on their Notes up to, but

excluding, the date of payment of the consideration for Notes

accepted for purchase (the “Payment Date”). Subject to the terms

and conditions of the Offer, the Payment Date will follow promptly

after the Expiration Date.

CUSIP Numbers

Title of Security Reference U.S.

Treasury

Security

Reference Yield Fixed

Spread

(Basis

points)

Total Consideration per US$1,000 Principal Amount(1)

Tender Offer Consideration per US$1,000 Principal Amount

252391AA5 and Q3200PAA6 7.125% Guaranteed Senior Notes due 2014

0.25% U.S. Treasury Note due April 30, 2014 0.279% 180 US$1,114.58

US$1,084.58

_____________________________

(1) Total Consideration per US$1,000 principal amount of Notes

accepted for purchase includes the Early Tender Payment of US$30

per US$1,000 principal amount of Notes accepted for purchase.

Previously tendered Notes may not be validly withdrawn after the

“Withdrawal Time,” which expired at 5:00 p.m. New York City time,

29 May 2012, and any Notes tendered after the Withdrawal Time may

not be validly withdrawn, unless in either case the Company is

otherwise required by applicable law to permit the withdrawal or

the Company elects to allow such withdrawal.

Notes accepted for purchase in accordance with the terms and

conditions set forth in the Offer to Purchase may be subject to

proration so that the Company will only accept for purchase Notes

up to a maximum aggregate principal amount of US$175,455,000.

The Offer is not conditioned upon any minimum amount of Notes

being tendered, but is subject to a number of other terms and

conditions, including the receipt by DEXUS of sufficient net

proceeds from the sale of its United States central portfolio to

affiliates of Blackstone Real Estate Partners VII for a sale price

of US$770,000,000, as publicly announced by DEXUS on 16 April 2012.

The transaction is expected to close mid-June 2012, subject to

closing conditions as set forth in the related sale agreement.

The Company’s obligations to accept any Notes tendered and to

pay the applicable consideration for them are set forth solely in

the Offer to Purchase and the related Letter of Transmittal. This

media release is neither an offer to purchase nor a solicitation of

an offer to sell any Notes. Except as supplemented by this media

release with respect to consideration, the Offer is made only by,

and pursuant to the terms of, the Offer to Purchase, and the

information in this media release is qualified by reference to the

Offer to Purchase and the related Letter of Transmittal. Subject to

applicable law, the Company may amend, extend, waive conditions to

or terminate the Offer.

Deutsche Bank Securities Inc. is the Dealer Manager for the

Offer. Persons with questions regarding the Offer should contact

Deutsche Bank Securities Inc. at 1-212-250-7527 (collect) or

1-855-287-1922 (toll-free) (Attention: Liability Management Group).

Requests for copies of the Offer to Purchase, the related Letter of

Transmittal and other related materials should be directed to

Global Bondholder Services Corporation, the Information Agent and

Depositary for the Offer, at (212) 430-3774 (for banks and brokers

only) or (866) 873-7700 (for all others and toll-free).

Certain statements contained in this media release include

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995 and which are subject to

certain risks, trends and uncertainties. In particular, statements

made that are not historical facts may be forward-looking

statements. Words such as “should,” “may,” “will,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

and similar expressions identify forward-looking statements. Such

statements are not guarantees of future performance and are subject

to risks and uncertainties that could cause actual results to

differ materially from the results projected, expressed or implied

by these forward-looking statements. Factors that could cause or

contribute to such differences include those matters disclosed in

the Offer to Purchase. The Company does not undertake any

obligation to update any forward-looking statements.

About DEXUS

DEXUS is one of Australia’s leading property groups specialising

in world-class office, industrial and retail properties with total

assets under management of $14bn. In Australia, DEXUS is the market

leader in office and industrial and, on behalf of third party

clients, a leading manager and developer of shopping centres. DEXUS

is committed to being a market leader in Corporate Responsibility

and Sustainability. www.dexus.com (The information on the

Group’s website is not part of this release.)

DEXUS Funds Management Ltd ABN 24 060 920 783, AFSL 238163, as

Responsible Entity for DEXUS Property Group (ASX: DXS)

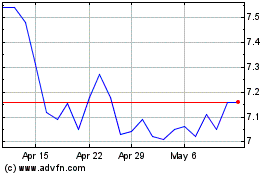

Dexus (ASX:DXS)

Historical Stock Chart

From Feb 2025 to Mar 2025

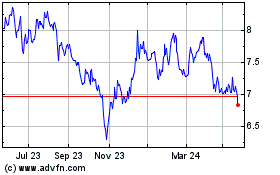

Dexus (ASX:DXS)

Historical Stock Chart

From Mar 2024 to Mar 2025