Grupo Aeroportuario del Pacifico Announces Issuance of Bond Certificates in Mexico for Ps. 5.4 Billion

28 March 2023 - 11:48AM

Grupo Aeroportuario del Pacífico, S.A.B. de C.V., (NYSE: PAC; BMV:

GAP) (the “Company” or “GAP”) announced today that it successfully

completed the issuance of 54 million long-term bond certificates in

Mexico (Certificados Bursátiles) at a nominal value of Ps. 100 each

(One hundred pesos 00/100), for a total value of Ps. 5.4 billion,

issued jointly. The amount of the issuance was up to Ps. 4.5

billion with a greenshoe option of up to 20%, which was reached at

the closing of the issuance. The order book reached an

over-subscription of 3.2x over the original issuance amount.

The bond certificates were issued in accordance

with the following terms:

- 11.2 million certificates were

issued under the ticker symbol “GAP23-L”, at a nominal value of Ps.

100 (one hundred pesos 00/100) each, for a total value of Ps.1,120

million (one thousand twenty million pesos 00/100). Interest will

be payable every 28 days at a variable rate of TIIE-28 plus 22

basis points. The principal will be due at maturity on March 23,

2026.

- 42.8 million bond certificates were

issued under the ticker symbol “GAP23-2L”, at a nominal value of

Ps. 100 (one hundred pesos 00/100) each, for a total value of Ps.

4,280 million (four thousand two hundred eighty million pesos

00/100). Interest will be payable every 182 days at a fixed rate of

9.65%. The principal will be due at maturity on March 18,

2030.

In accordance with the Sustainability-Linked

Bond Framework, GAP will annually publish, within its Annual

Sustainability Report, an update on the Key Performance

Indicator.

The Key Performance Indicator is the reduction

of absolute scope 1 and 2 greenhouse gas emissions and will be

verified by December 31, 2025, and audited by an external party, in

case the target is not met, there will be an upward adjustment of

0.2% to the nominal value of the “GAP23-L” at the expiration date,

while for the “GAP23-2L” 25 basis points will be added to the

coupon starting from February 28, 2026, and until its

expiration.

The issuance obtained the highest credit ratings

in Mexico, "Aaa.mx" by Moody's and "mxAAA" by S&P, both on a

national scale with a stable outlook. Additionally, the Company

obtained a Second Party Opinion from Sustainalytics, per the

industry’s best practices.

The proceeds from this issuance will be

allocated to the payment of the bond certificates under the ticker

symbol “GAP 20-2” issued on June 25, 2020, and maturing on June 22,

2023, for an amount of Ps. 602 million and the remainder will be

used for capital investments.

COMPANY DESCRIPTION

Grupo Aeroportuario del Pacífico, S.A.B. de C.V.

(GAP) operates 12 airports throughout Mexico ’s Pacific region,

including the major cities of Guadalajara and Tijuana, the four

tourist destinations of Puerto Vallarta, Los Cabos, La Paz and

Manzanillo, and six other mid-sized cities: Hermosillo, Guanajuato,

Morelia, Aguascalientes, Mexicali and Los Mochis. In February 2006,

GAP’s shares were listed on the New York Stock Exchange under the

ticker symbol “PAC” and on the Mexican Stock Exchange under the

ticker symbol “GAP”. In April 2015, GAP acquired 100% of Desarrollo

de Concessioner Aeroportuarias, S.L., which owns a majority stake

in MBJ Airports Limited, a company operating Sangster International

Airport in Montego Bay, Jamaica. In October 2018, GAP entered into

a concession agreement for the operation of the Norman Manley

International Airport in Kingston, Jamaica, and took control of the

operation in October 2019.

This press release may contain forward-looking

statements. These statements are statements that are not historical

facts and are based on management’s current view and estimates of

future economic circumstances, industry conditions, company

performance, and financial results. The words “anticipates”,

“believes”, “estimates”, “expects”, “plans” and similar

expressions, as they relate to the company, are intended to

identify forward-looking statements. Statements regarding the

declaration or payment of dividends, the implementation of

principal operating and financing strategies and capital

expenditure plans, the direction of future operations, and the

factors or trends affecting financial condition, liquidity, or

results of operations are examples of forward-looking statements.

Such statements reflect the current views of management and are

subject to a number of risks and uncertainties. There is no

guarantee that the expected events, trends, or results will

actually occur. The statements are based on many assumptions and

factors, including general economic and market conditions, industry

conditions, and operating factors. Any changes in such assumptions

or factors could cause actual results to differ materially from

current expectations.

In accordance with Section 806 of the

Sarbanes-Oxley Act of 2002 and article 42 of the “Ley del Mercado

de Valores”, GAP has implemented a “whistleblower”

program, which allows complainants to anonymously and

confidentially report suspected activities that June involve

criminal conduct or violations. The telephone number in Mexico,

facilitated by a third party that is in charge of collecting these

complaints, is 01 800 563 00 47. The website is

www.lineadedenuncia.com/gap. GAP’s Audit Committee will be notified

of all complaints for immediate investigation.

| Alejandra

Soto, Investor Relations and Social Responsibility Officer |

asoto@aeropuertosgap.com.mx |

| Gisela Murillo, Investor Relations |

gmurillo@aeropuertosgap.com.mx/+52 33 3880 1100 ext. 20294 |

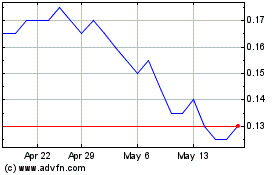

Gale Pacific (ASX:GAP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gale Pacific (ASX:GAP)

Historical Stock Chart

From Jan 2024 to Jan 2025