APG, Goodman: Bid For ProLogis European Properties Rejected

13 April 2011 - 4:39AM

Dow Jones News

APG Algemene Pensioen Groep N.V. and Australia's Goodman Group

(GMG.AU) Tuesday said that their joint takeover bid for ProLogis

European Properties (PEPR.AE), the Euronext-listed warehouses

developer, has been rejected.

APG and Goodman said that they had prepared a non-binding

indicative offer of EUR6 per unit to acquire the company, which

represents a premium of 20% over the April 11 closing unit price.

The transaction would be worth around EUR1.2 billion.

APG and Goodman are part of a wider consortium of investors.

The Dutch pension fund and Australian property company said that

they have attempted to discuss their proposal further with ProLogis

with a view to carrying out due diligence but that ProLogis have so

far rejected the proposal. APG and Goodman remain wiling to enter

discussions, they said.

"APG and Goodman believe that, if ProLogis were to reconsider

its rejection of the Indicative Proposal, a fully documented

proposal could be ready within six to eight weeks, with the full

cooperation of ProLogis, ProLogis Management Sarl and the

independent directors of the Board of PEPR," they said in a

statement.

ProLogis couldn't immediately be reached for comment.

Shares in PREP closed at EUR5 in Amsterdam on Tuesday.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

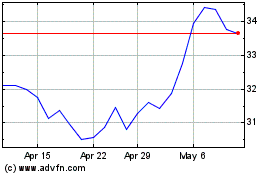

Goodman (ASX:GMG)

Historical Stock Chart

From Apr 2024 to May 2024

Goodman (ASX:GMG)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Goodman Group (Australian Stock Exchange): 0 recent articles

More Goodman News Articles