Rio Tinto 2Q Iron-Ore Output Rose 3% on Year -- Commodity Comment

19 July 2023 - 11:18AM

Dow Jones News

Rio Tinto on Wednesday said it expects 2023 iron-ore shipments

to reach the top half of company guidance, but downgraded

production expectations for a number of other commodities,

including alumina and refined copper. Here are some remarks from

the miner's second-quarter report.

On Pilbara iron ore mines:

"We produced 81.3 million [metric tons] in the second quarter,

3% higher than the corresponding period of 2022. The ramp-up of

Gudai-Darri continued to plan, with the mine reaching nameplate

capacity on a sustained basis during the period. Challenges at the

Yandicoogina mine associated with materials handling and plant

reliability, highlighted in the first quarter, continued into the

period.

Shipments of 79.1 million tons were 1% lower than the second

quarter of 2022, and 4% lower than the prior quarter. This was

primarily due to planned major maintenance at the Dampier Port and

a train derailment on 17 June. The rail line was reopened on 21

June.

With ongoing operational improvements across the Pilbara system,

and uplift from implementation of the Safe Production System, full

year shipments are expected to be in the upper half of the original

320 to 335 million ton range. With higher production anticipated in

the second half, SP10 is expected to be a larger proportion of

shipments (first half 2023 = 10%)."

On alumina operations:

"Alumina production of 1.9 million tons was in line with the

second quarter of 2022 as improved operational stability at our

Yarwun and Vaudreuil refineries was offset by unplanned plant

downtime at Queensland Alumina Limited (QAL). As a result, our full

year alumina production has been reduced to 7.4 to 7.7 million tons

(previously 7.7 to 8.0 million tons), as QAL implements initiatives

to improve plant stability and production rates."

On bauxite output:

"Bauxite production of 13.5 million tons was 5% lower than the

second quarter of 2022 as our Weipa operations were impacted by the

higher-than-average first quarter rainfall, which continued to

reduce pit access and led to longer haul distances. Production was

further affected by equipment downtime at both Weipa and Gove. As a

result, our bauxite full year production is expected to be at the

lower end of our 54 to 57 million ton range, as we implement plans

to recover lost production at both operations through the remainder

of the year."

On refined copper production:

"Refined copper production was 56% lower than the second quarter

of 2022 as we commenced the largest rebuild of the smelter and

refinery in Kennecott's history in May 2023. The [circa] $300

million rebuild has incorporated approximately 300 engineering and

maintenance projects and we are on track to complete the full scope

of work.

While inspecting the integrity of the flash converting furnace,

we identified additional work necessitating a full rebuild, rather

than the planned partial rebuild. The full rebuild is expected to

further improve asset stability and process safety management,

however as a result the consolidated scope of work is now expected

to be completed in September 2023 (previously August 2023)."

As a result of the extension, refined copper production guidance

has been reduced to 160,000-190 tons, from an earlier estimate of

180,000-210,000 tons, and copper C1 unit cost guidance has been

increased to $1.80 to $2.00 a pound from $1.60 to $1.80 a pound

previously, the miner said.

On Escondida copper mine:

"Mined copper production was 6% lower than the second quarter of

2022 due to 10% lower concentrator throughput rates following

unplanned maintenance, and lower crusher and conveyor availability.

In addition, there was also a 16% decrease in copper recoverable

from ore stacked for leaching due to lower grades and volume of

stacked material."

On Oyu Tolgoi underground project:

"We continue to see strong performance from the underground

mine, with a total of 54 drawbells opened from Panel 0, including

18 drawbells during the quarter. To date we are yet to lose a

drawbell or draw point from the underground mine.

Shaft sinking rates improved during the quarter and at the end

of June, shafts 3 and 4 reached 627 meters and 740 meters below

ground level, respectively. Final depths required for shafts 3 and

4 are 1,148 and 1,149 meters below ground level, respectively. As

reported in our presentation materials for the Oyu Tolgoi site

tour, we now expect both shafts to be commissioned in the second

half of 2024 (previously first half of 2024) with shaft sinking

rates now meeting those required for completion."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 18, 2023 21:03 ET (01:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

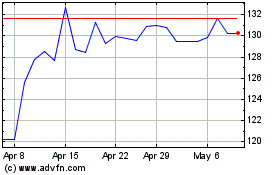

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

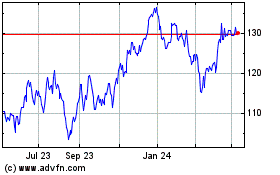

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024