2nd UPDATE:GDF Suez Looking Carefully At Italy Nuclear Market-CEO

15 October 2009 - 2:44AM

Dow Jones News

GDF Suez SA (GSZ.FR) is looking at opportunities to take part in

Italy's nuclear comeback as the French company aims to be among the

main energy players in the country, Chief Executive Gerard

Mestrallet said Wednesday.

"We are looking carefully at the opportunities in Italian

nuclear" after the government decided to allow atomic power

generation back into the country, he said at a press conference in

Rome on the joining of GDF Suez's companies Cofathec Servizi and

Elyo Italia under the energy services brand Cofely.

The government introduced legislation this year allowing nuclear

generation. It was banned in 1987 following the Chernobyl disaster

in the former Soviet Union.

The French company "aims to become one of the top energy

operators" as it plans to expand its electricity and natural gas

presence in Italy, Mestrallet said.

Its medium- to long-term objective is to become Italy's number

two player in the gas market and the third-biggest in the

electricity one, the company said.

GDF Suez will enter the Italian nuclear market only with a local

player and is open to a European company joining too, including

E.ON AG (EAON.XE) and Iberdrola SA (IBE.MC), said CEO Mestrallet at

the conference.

It already has a joint venture with Rome-based municipal utility

Acea SpA (ACE.MI).

In February, Enel SpA (ENEL.MI) and Electricite de France SA

(EDF.FR) agreed to a venture to build Italian nuclear sites as part

of a bilateral accord between aimed at promoting the use of French

nuclear technology in the peninsula. Italy's push to reintroduce

nuclear power generation, however, could face resistance from local

government likely to oppose hosting the sites.

Wednesday, GDF Suez' Mestrallet said the company will be looking

at Areva SA's CEI.FR) advanced third-generation EPR nuclear-reactor

technology for use in Italy.

GDF Suez also said it is planning to build a 100%-owned offshore

liquefied natural gas receiving terminal with an annual capacity of

5 billion cubic meters on the Adriatic Sea, near Porto Recanati. No

timeframe was given for when it will be built.

"We have flexibility" to chose from the company's "vast" origin

of its gas supplies for the LNG terminal, said Mestrallet when

asked where the fossil fuel will come from.

The CEO didn't give the amount the company plans to invest in

Italy in coming years.

-By Liam Moloney, Dow Jones Newswires; 39 06 6976 6920;

liam.moloney@dowjones.com

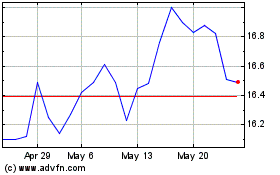

Acea (BIT:ACE)

Historical Stock Chart

From Dec 2024 to Jan 2025

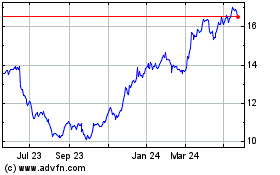

Acea (BIT:ACE)

Historical Stock Chart

From Jan 2024 to Jan 2025