Cardano (ADA) NVT Ratio Now Highest Since June: What Does It Mean?

30 October 2024 - 8:00PM

NEWSBTC

On-chain data shows that Cardano’s Network Value to Transactions

(NVT) Ratio has surged recently. Here’s what this could imply for

ADA’s price. Cardano NVT Ratio Has Surged To Its Highest Level

Since June In a new post on X, the market intelligence platform

IntoTheBlock discusses the latest trend in Cardano’s NVT Ratio. The

“NVT Ratio” here refers to an on-chain indicator that keeps track

of the ratio between the ADA market cap and transaction volume.

When the value of this metric is high, it means the value of the

network is high compared to its ability to transact coins.

Generally, this can signal that the coin’s price is overvalued.

Related Reading: Ethereum Bullish Signal: Whales Withdraw $750

Million In ETH From Exchanges On the other hand, the low indicator

implies the market cap may be undervalued compared to the

blockchain’s volume, so ADA’s price could be due to a rebound. Now,

here is a chart that shows the trend in the Cardano NVT Ratio over

the last few months: As is visible in the above graph, the Cardano

NVT Ratio has witnessed a notable surge recently, even though the

coin’s price has been following an overall bearish trajectory. This

would suggest that the transaction volume has tanked on the

network. Following this latest increase, the indicator has spiked

to the highest level since June, implying that the cryptocurrency

hasn’t been this overvalued in six months. The reason behind this

trend is likely to be the lackluster price action the coin has

witnessed for a while now. Other assets, such as Bitcoin, have

started to pop off recently. At the same time, ADA has remained a

sideways movement, so ADA investors may be fed up and leave to

explore greener pastures. Related Reading: “Time To Get Ready For

Another Bull Run,” Bitcoin Analyst Says— Here’s Why “Historically,

elevated NVT ratios often precede price pullbacks,” notes the

analytics firm. Thus, the recent spike in the indicator could spell

further trouble for the already struggling coin. The Cardano NVT

Ratio could now be to keep an eye on in the coming days, as any

more jumps in the metric may confirm a bearish outcome. However,

there is also the possibility that the trend will see a reversal,

with enough activity returning on the network to justify its

current market cap. ADA Price The cryptocurrency sector as a whole

has been rising during the past day, and Cardano has followed suit.

Although the coin’s surge has been smaller than Bitcoin’s, the

asset has climbed above the $0.348 level. The chart below shows the

coin’s recent trajectory. Featured image from Shutterstock.com,

IntoTheBlock.com, chart from TradingView.com

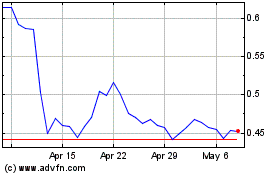

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024