PayPal’s PYUSD Fails To Capture Interest: 90% Of Supply Remains In Paxos’ Wallet

30 August 2023 - 12:00AM

NEWSBTC

Paypal’s Ethereum-based stablecoin PYUSD has failed to capture

crypto investors’ interest. According to data from Nansen, 90% of

the stablecoin’s total supply still remains with its issuer Paxos’

wallet. Paypal’s PYUSD Adoption Setback The payment giant Paypal’s

recently launched stablecoin PYUSD continues to struggle with

adoption and has failed to gain traction since its official launch

on August 7, 2023. Despite PayPal having over 350 million users

worldwide, on-chain data from Nansen has shown that only a small

percentage of its user base is currently using and holding the

PYUSD in self-custody wallets. Related Reading: Shibarium Launch

Proves Positive As Shiba Inu-Based BONE Celebrates New Milestone

“On the surface there’s a lack of demand from crypto users for

PYUSD when other alternatives exist,” said Nansen in a report.

However, it is believed that lack of enthusiasm might involve the

stablecoin’s lack of utility and not being able to earn interest on

the stablecoin, as highlighted by an X (formerly Twitter) user in a

post on August 26, 2023. 🚨Problem: Nobody wants to mint $pyUSD

because there’s not much to do with it and it doesn’t pay any

interest. 💡Solution: – $pyUSD – $crvUSD pool – $CRV gauge approval

from Curve DAO@PayPal 🤝 @CurveFinance $PYPL #DeFi

https://t.co/jVr7sN36KH pic.twitter.com/NUdsKmfY8F — DefiMoon 🦇🔊

(@DefiMoon) August 26, 2023 The stablecoin’s holdings on crypto

exchange wallets are also low, accounting for just about 7% of the

stablecoin’s total supply. This percentage takes into account the

balances on centralized exchanges such as Kraken, Crypto.com, and

Gate.io. Despite the high expectations in the crypto industry

following the release of the stablecoin that it would actually

promote wider adoption and introduce cryptocurrencies to the masses

for the first time, the stablecoin has failed to live up to

expectations and smart money investors seem perfectly comfortable

to circumvent the stablecoin. The largest holder of the

stablecoin holds less than $10,000 worth of PYUSD after the holder

sold about 3 meme coins to purchase the stablecoin. Excluding

contracts or exchanges, not more than 10 holders have a balance

surpassing $1,000. According to Coinmarketcap, PYUSD has a total

supply of 43 million PYUSD tokens and pools in decentralized

exchanges like Uniswap’s PYUSD/USDC and PYUSD/wETH accounts to only

50,000 PYUSD tokens respectively. The PYUSD tokens have been

criticized for being overly centralized, as the majority of its

total supply turns out to be stored on centralized exchanges,

resulting in difficulty in growing its circulation. Despite such a

high total supply, the collective total number of the stablecoin’s

holders according to Etherscan is merely 324 at the time of this

writing. PayPal's stablecoin maintains dollar peg | Source:

PYUSD/USD on Tradingview.com Expectations On Ethereum For The

Stablecoin According to JP Morgan analyst Nikolaos Panigirtzoglou,

following the first week of Paypal’s stablecoin launch, Ethereum

enjoyed no benefit from PYUSD when looking at things such as

increased network activity, increased Total Value Locked (TVL), and

enhancing Ethereum’s network utility as a stablecoin/DeFi platform.

Related Reading: JP Morgan Explains Why Bitcoin Price May Not Fall

Further Crypto experts and enthusiasts have also criticized PayPal

for choosing Ethereum for its stablecoin due to the blockchain’s

high transaction fees. Co-founder of Sei Network Jayendra Jog said,

“The gas fees of using PYUSD will be ridiculous, which will

disincentivize its usage.” He further added, “To help make the user

experience better, PayPal will either need to subsidize transaction

costs or will need to help support PYUSD on other networks with

cheaper gas fees.” Featured image from CNBC, chart from

Tradingview.com

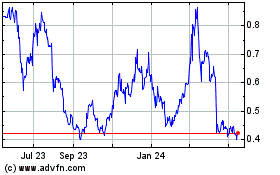

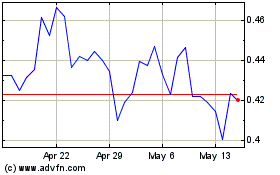

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Curve DAO Token (COIN:CRVUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024