Tron Rises 24% Amid New Developments – Will The Uptrend Continue?

22 August 2024 - 5:00AM

NEWSBTC

Tron (TRX) investors continue to feel bullish even as the market

dips after certain on-chain developments help investor sentiment

remain high. According to CoinGecko, the token has increased more

than 24% since last week, a sign that investors on the platform

have held TRX and accumulated to capture more gains. Related

Reading: Cardano (ADA) Nears Key Level As Analyst Eyes Over 100%

Upside – Details Tron’s developments will help TRX hold against the

downward trajectory the market has taken today. However, questions

remain about whether the token will continue to go against the

broader market or follow the dip. Tron On-chain Developments

Drive TRX Sky High With Tron’s focus on stablecoin development made

apparent by Tron founder Justin Sun last month, yesterday saw a big

win for the platform as Tether minted over $1 billion USDT without

paying any gas fees on the platform. This placed Tron in the

crosshairs of critics as they questioned the “no gas fee”

transaction with an individual pointing out that they are charged a

dollar for a simple swap approval. Our team is developing a

new solution that enables gas-free stablecoin transfers. In other

words, transfers can be made without paying any gas tokens, with

the fees being entirely covered by the stablecoins themselves. —

H.E. Justin Sun 孙宇晨(hiring) (@justinsuntron) July 6, 2024 Despite

this, Tron handled a third of Visa’s annual settlement volume while

gaining over half a billion dollars in fees in as little as 3

months. This, according to Tron, makes it clear that “blockchain is

more than just a buzzword.” TODAY: $1B USDT minted on TRON They

paid $0.00 in fees. Wow pic.twitter.com/NuNYRuj1Yc — Arkham

(@ArkhamIntel) August 20, 2024 TRX To Face Possible Downturn Soon?

The token’s current position is an awkward balance between the

bulls attempting to break through the $0.1665 ceiling and the bears

also attempting the reverse by eyeing the $0.1583 floor. As

it currently stands, TRX is on an untenable position as it forces

the bulls to continue buying without regard to the token’s overall

momentum. The relative strength index (RSI) supports this as it

nears to push the limits of the bullish momentum, with a possible

cool-down period in the next couple of days. Accounting the

market’s general momentum, we might see TRX stabilize on its

current trading range between $0.1583 and $0.1665 in the short

term. The RSI’s near maxed-out value indicates a possible

retracement to the $0.1532 floor before opening the floodgates to

the $0.1665. Related Reading: End Of The Slump? Floki Eyes A

46% Price Surge — Analyst This scenario is possible as TRX will

eventually lose its current momentum to follow the consensus dip

within the broader market. The dip, although bearish in some

regards, will allow the bulls to rest before building up the

momentum for bigger gains. With improving macroeconomic

conditions also supporting this bullish thesis, we might more gains

as capital from private equity flows to more risky investment

products like crypto. For now, monitoring the broader market will

benefit investors as TRX moves to more sustainable levels. Featured

image from Zipmex, chart from TradingView

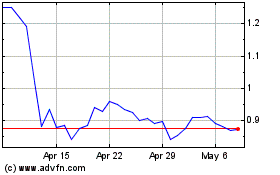

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024