DeFi TVL drops by $45B, erasing gains since Trump election

11 March 2025 - 1:02AM

Cointelegraph

The total value of cryptocurrencies locked (TVL) in

decentralized finance (DeFi) protocols has lost all its gains since

Donald Trump was elected the US President in November 2024.

Since the US election, DeFi TVL rose to as high as $138 billion

on Dec. 17 but has retracted to $92.6 billion by March 10, as noted

by analyst Miles Deutscher.

Solana has borne the brunt of criticism

as its memecoin popularity faded, but

Ethereum has faced its own challenges in recent cycles, failing

to reach a new all-time high while Bitcoin

soared past $109,000 on Jan. 20, the day Trump took office.

Ethereum’s TVL has dropped by $45 billion from cycle highs,

DefiLlama data shows.

Source: Miles

Deutscher

Ether’s (ETH) record high

price of $4,787 from November 2021 remains unbroken despite

positive industry developments, such as spot exchange-traded funds

(ETFs) launching in the US and Trump’s executive order

for a strategic Bitcoin reserve.

Related: Bitcoin risks weekly close below $82K on US BTC

reserve disappointment

Ethereum’s $1.8 billion weekly net exchange

outflow

Nearly 800,000 Ether, worth approximately $1.8 billion,

left exchanges in the week starting March 3, resulting in the

highest seven-day net outflow recorded since December 2022,

according to IntoTheBlock data.

The outflows are unusual given Ethereum’s 10% price decline

during the period, hitting a low of $2,007, per CoinGecko.

Typically, exchange inflows

signal selling pressure, while outflows suggest long-term

holding or movement into decentralized finance (DeFi) applications,

such as staking or yield farming.

“Despite ongoing pessimism around Ether prices, this trend

suggests many holders see current levels as a strategic buying

opportunity,” IntoTheBlock stated in a March 10 X post.

Before March 3, Ethereum experienced net exchange inflows daily,

indicating that investors were selling during the downturn, said

Juan Pellicer, senior research analyst at IntoTheBlock, in comments

to Cointelegraph. He noted that ETH’s drop to $2,100 may have

triggered accumulation, which then led investors to withdraw funds

from exchanges.

Pectra upgrade meets own roadbumps

Ethereum’s rollup-centric roadmap has reduced congestion and gas

fees but introduced liquidity fragmentation.

The upcoming Pectra upgrade aims to address this by enhancing

layer 2 efficiency and interoperability. By doubling the number of

blobs, it reduces transaction costs and helps consolidate

liquidity. Additionally, account abstraction allows smart contract

wallets to function more seamlessly across Ethereum and layer-2

networks, simplifying bridging and fund management.

The Pectra upgrade rollout encountered

setbacks on March 5 when it launched on the Sepolia testnet.

Ethereum developer Marius van der Wijden reported errors on Geth

nodes and empty blocks being mined due to a deposit contract

triggering an incorrect event type. A fix has been deployed.

Magazine: Pectra hard fork explained — Will it get

Ethereum back on track?

...

Continue reading DeFi TVL drops by $45B, erasing

gains since Trump election

The post

DeFi TVL drops by $45B, erasing gains since Trump

election appeared first on

CoinTelegraph.

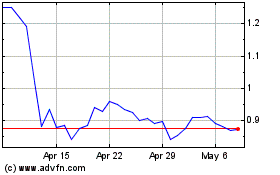

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025