Bitcoin Falls Under $35,000 But 86% Of Supply Remains Unmoved – Temporary Setback?

05 November 2023 - 6:00AM

NEWSBTC

A look into the Bitcoin price action shows a consolidation under

the $35,000 support level has resumed, but the majority of holders

are holding steady. Onchain data has revealed that the number of

Bitcoin unmoved in a 3-month timeframe has reached a record high of

88.5%. The upside potential remains huge despite the ongoing

consolidation, as the top crypto is still up by 26% since the

beginning of October. Related Reading: RUNE Solid 100% Rally Hits

Barrier: THORChain Price Nears Key Resistance BTC Price Drops Below

$35,000 But Investor Sentiment Remains Bullish Bitcoin managed to

push above $35,000 a few times this week, propelling millions

of BTC wallets into profitability. The crypto has since dropped

below $35,000, but long-term investors remain optimistic, according

to on-chain analytics of Bitcoin movement. One particular metric

that speaks a lot about the current Bitcoin cycle is Glassnode’s

HODL Waves. HODL Waves change color based on their age in wallets.

Bitcoins start at red immediately after they’re transferred into

wallets and gradually transition to purple as they continue to

remain unmoved. This metric, which tracks the age of Bitcoins

on the move and on wallets, has shown almost 90% of BTC total

supply has remained idle in the past three months. The

hilarious thing is that 88.5% of the #bitcoin supply hasn’t moved

in the last three months. Wall Street is gonna have to really pump

this thing to get hodlers to part with their coins. $BTC

pic.twitter.com/CtD7GoA9ka — Dylan LeClair 🟠 (@DylanLeClair_)

November 2, 2023 A similar metric from IntoTheBlock has shown

retail traders joining the long-term holder bandwagon as investors

start to hold on to their assets in the prospect of a BTC spot ETF

approval by the SEC. IntoTheBlock’s holding metric puts the number

of addresses holding Bitcoin for more than one year at an all-time

high of 34 million addresses. Related Reading: This Chainlink

Metric Just Hit Meteoric Levels – Good News For LINK Price? BTC

market cap currently at $679.499 billion on the daily chart:

TradingView.com Investors Anticipate SEC Approval Of Spot Bitcoin

ETFs Several factors have contributed to the increase in long-term

confidence of Bitcoin investors, one of which is the commencement

of a spot ETF trading in the US. The industry expects the SEC’s

approval of spot Bitcoin ETFs to ignite the next bullish run for

the price of Bitcoin. A top executive at Valkyrie Investments is

very confident these ETF applications will be approved by the end

of the month. However, Singapore-based QCP Capital attributed the

recent spike in Bitcoin to macro forces like the drop in US bond

yields, not the excitement around spot ETFs. Low bond yields force

investors to look into higher-yield investments like BTC. Overall,

Bitcoin looks to remain in a consolidation phase until buyers step

back in or some catalyst drives the next rally. The last time

Bitcoin’s supply reached 88% for this metric was during a

consolidation in late 2022, where bears got the better and Bitcoin

dipped below $20,000. A continued consolidation could see Bitcoin

follow this pattern, breaking below its current range to reach

$30,000. Featured image from Shutterstock

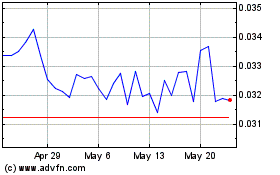

JUST (COIN:JSTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

JUST (COIN:JSTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about JUST (Cryptocurrency): 0 recent articles

More JUST News Articles