Ethereum Analyst Predicts $3,700 Once ETH Breaks Through Resistance

25 November 2024 - 10:05PM

NEWSBTC

Ethereum has been trading at its highest levels since late July,

hovering around $3,470. This marks a significant rebound for the

second-largest cryptocurrency, which has managed to hold above the

crucial 200-day moving average (MA) at $2,965. By maintaining this

level, Ethereum confirmed a bullish price structure, paving the way

for continued momentum as it approaches its next milestone—yearly

highs near $4,000. Top analyst and investor Carl Runefelt recently

shared his technical analysis on X, pointing out that Ethereum’s

price action has built a solid foundation for further growth.

According to Runefelt, Ethereum is poised for a substantial rally

once it breaks above key resistance levels, signaling increased

confidence among traders and investors. Related Reading: Bitcoin

Realized Profit Hits ATH At $443 Million – Local Top Or

Continuation? This bullish sentiment is further fueled by

Ethereum’s consistent on-chain activity and growing institutional

interest, which continue to support its upward trajectory. However,

breaking past $4,000 will require Ethereum to overcome resistance

zones that have historically triggered pullbacks. As ETH

consolidates gains, market participants are watching closely for

signs of the next breakout, which could set the tone for the

remainder of the year. Ethereum’s recent strength underscores its

role as a market leader and a bellwether for broader cryptocurrency

trends. Ethereum Testing Crucial Supply Ethereum is testing a

crucial supply zone just below the $3,500 level, a key resistance

that could propel the cryptocurrency to yearly highs in the coming

days. This level has become a focal point for traders and

investors, as breaking it would likely signal a bullish

continuation of Ethereum’s recent momentum. Top analyst Carl

Runefelt recently shared his insights on X, emphasizing the

significance of this resistance. According to his technical

analysis, once Ethereum breaks through the $3,500 barrier, it could

rapidly climb to $3,700, potentially within hours. The market

sentiment surrounding Ethereum remains optimistic, with surging

demand as a catalyst for further price gains. Ethereum’s strength

at this critical level is also reigniting speculation about a

possible Altseason. If ETH continues its upward trajectory and

attracts more capital, it could pave the way for other altcoins to

follow suit. Historically, Ethereum’s price action has been a

leading indicator for broader market movements, and this time

appears no different. Related Reading: Bitcoin Rally Benefits From

US Buyers – Coinbase Premium Gap Reveals Strong Demand As ETH

approaches this pivotal moment, all eyes are on its ability to

maintain upward momentum. A strong push past $3,500 would confirm

the bullish structure and set the stage for Ethereum to dominate

market narratives in the weeks ahead. Key Levels To Watch Ethereum

is trading at $3,470, hovering below the crucial $3,500 resistance

level. This local high has become a key area of focus for traders

and analysts, as breaking above it could set the stage for a

significant rally. If Ethereum manages to push through this

resistance with strength, it could trigger a breakout that propels

the price toward $3,900 within days. However, the market remains

cautious about the potential risks associated with this pivotal

moment. A failed breakout at the $3,500 mark could lead to sideways

consolidation as Ethereum seeks stronger buying pressure to resume

its upward momentum. In a more bearish scenario, a substantial

correction could occur, driving ETH back to lower levels to

establish a more solid base of support. Related Reading: XRP

Analyst Sets $2 Target If It Holds Key Level – Can It Reach

Multi-Year Highs? The current price action highlights the

importance of this resistance zone. A clean break above $3,500

would likely confirm Ethereum’s bullish structure and reinforce

confidence in a continued uptrend. On the other hand, any

hesitation or rejection at this level could signal the need for

further consolidation before the next major move. As ETH approaches

this critical juncture, the market is closely watching to determine

its next direction and the potential implications for the broader

crypto landscape. Featured image from Dall-E, chart from

TradingView

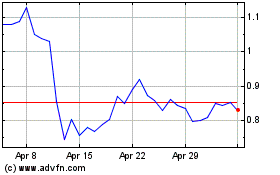

Mina (COIN:MINAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

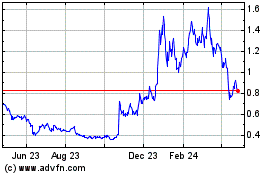

Mina (COIN:MINAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024