Bitcoin Reserve Idea Sparks Cautious Response From Japan PM: Report

27 December 2024 - 9:00AM

NEWSBTC

According to a recent report by Japanese cryptocurrency publication

CoinPost, Japan’s Prime Minister Shigeru Ishiba has taken a

cautious stance on the proposal to establish a national Bitcoin

(BTC) reserve. Ishiba Hesitant On Bitcoin Reserve Plans While

some policymakers in Japan are advocating for the country to follow

the lead of nations like the United States in exploring

cryptocurrency reserves, Ishiba has expressed reservations, citing

a lack of sufficient information to make an informed decision. The

idea of a national Bitcoin reserve in Japan gained momentum after

Satoshi Hamada, a member of the Japanese House of Councilors from

the Party to Protect the People from NHK, floated the proposal

during recent parliamentary discussions. Hamada argued that

Japan should explore diversifying its foreign exchange reserves by

including crypto assets like Bitcoin, in line with what is

reportedly being discussed in the US. Hamada stated: I think Japan

should follow the example of the United States and consider turning

some of its foreign exchange reserves into crypto assets such as

Bitcoin. Responding, the Japanese Prime Minister said that his

government simply lacks enough information about the US and other

countries’ plans for a strategic Bitcoin reserve. As a result,

Japan cannot commit to creating a BTC reserve just yet. Related

Reading: US Bitcoin Reserve Will Push Price Above $1 Million,

Expert Predicts Ishiba reportedly said that he does not have enough

understanding of the “movements” taken by the US with regard to

establishing a Bitcoin reserve. He concluded, saying that “it is

difficult for the government to express its views.” Further, with

regard to the idea of converting some of its foreign exchange

reserves into digital assets such as BTC, Ishiba cleared the air

saying cryptocurrencies do not fall under the foreign exchange

category. A Strategic Reserve May Shoot Up Bitcoin’s Price Earlier

this month, Federal Reserve (Fed) Chairman Jerome Powell reiterated

that the Fed itself cannot hold Bitcoin. However, reports suggest

that the incoming administration under Republican president-elect

Donald Trump may push forward with plans to establish a Bitcoin

reserve. The Bitcoin Act of 2024, introduced by pro-crypto American

Senator Cynthia Lummis, advocates for the US Treasury and Federal

Reserve to acquire 200,000 BTC annually over five years, ultimately

amassing one million BTC. Such a move could significantly impact

the cryptocurrency market by reducing Bitcoin’s circulating supply,

potentially driving up its price. Related Reading: US Strategic

Bitcoin Reserve Could Push Price To $500,000: Expert Bitcoin price

can go even higher if other countries around the world create their

own BTC reserves, culminating in an unofficial international race

among nations to accumulate as much BTC as they can. The world is

already seeing nations attempting to add BTC to their treasury

reserves. Recently, SkyBridge Capital Founder and Managing Partner,

Anthony Scaramucci, stated that if the US goes ahead with its plans

of creating a strategic Bitcoin reserve, there is no way that China

will not create one of its own. At press time, BTC trades at

$95,503, down 3.3% in the past 24 hours. Featured image from

Unsplash, chart from Tradingview.com

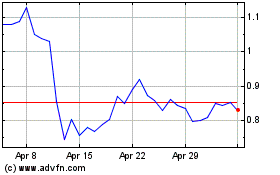

Mina (COIN:MINAUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

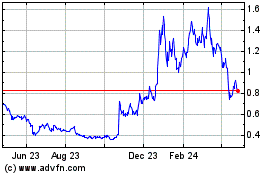

Mina (COIN:MINAUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024