Bitcoin To Hit $225,000 By End Of Year, Predicts Venerable US Investment Bank

03 January 2025 - 10:30PM

NEWSBTC

In a newly released investor note, one of the oldest US investment

banks H.C. Wainwright & Co. —established in 1868—is projecting

substantial upswing for the Bitcoin price. According to the note,

the institution has revised its previous Bitcoin price target for

the end of 2025 from $145,000 to $225,000, underpinned by a

confluence of historical trends, macroeconomic indicators, and

emerging regulatory and institutional factors. “We estimate BTC

will reach a cycle high of $225,000 by YE2025,” stated the firm,

referencing both market cycles and the potential for a more

supportive digital-asset regulatory landscape in the United States

in 2025 under a new administration. Why Bitcoin Could $225,000 By

Year End H.C. Wainwright’s analysis highlights several pivotal

forces propelling Bitcoin’s growth trajectory. One significant

catalyst is the wider availability of spot Bitcoin exchange-traded

funds (ETFs) in the US, a development that could unlock new waves

of institutional capital. The firm also cites “accelerating

institutional investor and corporate adoption” as a major

contributor to its bullish outlook. Related Reading: Bitcoin

Coinbase Premium Sinks To Lowest Since FTX Crash: Bottom In? On top

of that, the investment bank’s models assume an overall market

backdrop that improves in tandem with global liquidity and that any

regulatory overhang will abate. H.C. Wainwright is careful to note

that the forecast is sensitive to macroeconomic conditions,

particularly measured by M2 money supply, which has trended

downward since October. Though projecting a lofty six-figure price

by 2025, H.C. Wainwright acknowledged that Bitcoin’s path toward

$225,000 is unlikely to be a smooth ride. In the report, the bank

cautioned: “~20-30% drawdowns during bull markets are not uncommon

[…] We estimate BTC could retrace back down to the mid-$70,000

range in early 1Q25 before resuming its uptrend.” They attribute

these possible pullbacks to Bitcoin’s historical volatility and its

correlation with global liquidity trends. Related Reading: 2025

Bitcoin Predictions: Top Fund Manager Shares His Outlook If Bitcoin

reaches $225,000 per coin, H.C. Wainwright projects a total Bitcoin

market capitalization of approximately $4.5 trillion—around 25% of

gold’s current $18 trillion market cap. This scenario translates to

a 113% increase over current levels. However, the note adds a

striking scenario that is not yet factored into its core forecast:

“Our new 2025 price target does not factor in the potential for the

US government to officially adopt BTC as a treasury reserve asset

at the federal level next year. If implemented, we believe it is

plausible that BTC could significantly exceed our base case price

target.” The institution’s analysis also extends to the broader

crypto market. Historically, Bitcoin’s dominance (its share of

total crypto market cap) tends to fall during market peaks, and it

dipped into the low 40% range near the last bull cycle peak in

November 2021. Looking forward, H.C. Wainwright expects Bitcoin’s

dominance to decline to 45% by the end of 2025, down from around

56% currently. Under that assumption, the firm sees the total

crypto market swelling from $3.6 trillion today to approximately

$10 trillion by year’s end 2025. H.C. Wainwright’s coverage

universe of publicly traded Bitcoin mining companies stands to

benefit from the anticipated price surge. “If our predictions are

correct, there is the potential for significant upward estimate

revisions for our coverage universe over the course of next year.”

At press time, BTC traded at $96,221. Featured image created with

DALL.E, chart from TradingView.com

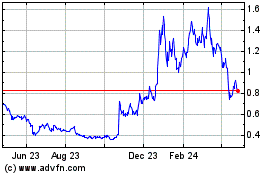

Mina (COIN:MINAUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

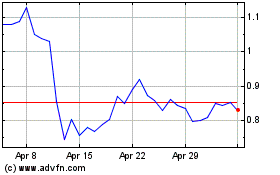

Mina (COIN:MINAUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025