Is Ethereum Ready To Break Out? Key Indicators Suggest Strong Market Confidence

24 December 2024 - 8:30AM

NEWSBTC

Ethereum (ETH) has remained a focal point in the cryptocurrency

market, even as its price action continues to lag behind Bitcoin’s

recent bullish trajectory. Despite failing to secure a new all-time

high, Ethereum has shown multiple positive indicators that suggest

a strong foundation for future growth. Analysts believe that these

metrics reflect underlying market confidence, driven by both

institutional and retail investors. Related Reading: 7.8M Ethereum

Leaves Binance In Two Months—What Does This Mean for ETH? Key

Market Indicators Highlight Ethereum Potential According to

CryptoQuant analyst EgyHash, numerous factors are currently shaping

the Ethereum market sentiment. Although Bitcoin has seen a stronger

uptrend after the US elections, Ethereum’s technical indicators

show both traders and long-term holders of the cryptocurrency are

steadily accumulating it. All these are evident in Ethereum’s

Estimated Leverage Ratio, funding charges, and regional trading

premiums—all three of which are signs of Ethereum’s survivability

in a downturn. EgyHash in a post on the CryptoQuant QuickTake

platform revealed that the Estimated Leverage Ratio for Ethereum

currently remains at “elevated levels.” This ratio reflects the

amount of leverage traders are taking on in derivatives markets

relative to their holdings. A consistently high leverage ratio

suggests a “sustained appetite for risk” among market participants,

indicating confidence in Ethereum’s potential upward trajectory,

EgyHash revealed. Ethereum’s Silent Surge: Key Metrics Turn Bullish

“These factors point to a persistent bullish outlook for Ethereum,

as market participants appear ready to maintain, and potentially

increase, their exposure to the asset.” – By @EgyHashX Link

👇https://t.co/biIhFoyzBd pic.twitter.com/3kfghQ7EDX —

CryptoQuant.com (@cryptoquant_com) December 23, 2024 . Funding

Rates, Premiums, And Institutional Inflows Hint at Bullish Trend

Additionally, funding rates for ETH derivatives remain moderately

positive. Funding rates are periodic payments exchanged between

long and short traders based on the price difference between the

futures contract and the spot price. Positive funding rates suggest

that long positions dominate the market, but without reaching

overheated levels that could trigger large-scale liquidations.

EgyHash wrote: This moderation suggests there is still room for a

healthy price increase without an imminent risk of large-scale

liquidations. Another noteworthy observation comes from the Korea

Premium Index for ETH. This index measures the price gap between

Ethereum trading on South Korean exchanges compared to global

markets. A positive premium indicates heightened buying activity in

the South Korean market. Historically, spikes in the Korea Premium

Index have coincided with periods of strong upward momentum for

Ethereum, suggesting that regional demand is playing a key role in

supporting the asset’s price. EgyHash also mentioned that

Ethereum’s appeal among institutional investors has remained

strong, even through periods of market correction. Fund holdings

for ETH have continued to rise steadily, signaling sustained

confidence from institutional players who often take a long-term

view on asset performance. These rising fund inflows suggest that

institutional investors are accumulating ETH in anticipation of

future price appreciation. Furthermore, retail traders and smaller

investors have also contributed to Ethereum’s stability. Featured

image created with DALL-E, Chart from TradingView

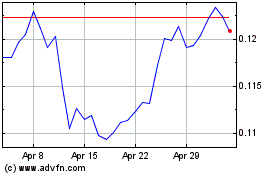

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024