Ethereum Spot ETFs Outshine Bitcoin Counterparts With Double Market Inflows – Details

10 February 2025 - 4:30AM

NEWSBTC

The Ethereum Spot ETFs began February 2025 on a strong positive

note, recording net inflows double the size in the Bitcoin ETF

market in the first week of the month. Interestingly, this

development coincided with a bearish trading week for Ethereum,

during which its price declined by 16.18%. Related Reading:

Ethereum Spot ETFs Suffer $186 Million Outflows As New Year

Struggles Persist – Details Ethereum Spot ETFs Register $420

Million Inflows Amid Price Fall As prices of Ethereum struggled to

find market stability in the past week, the Ethereum Spot ETFs

experienced an increased level of market interest translating into

a net inflow of $420 million. Data from SoSoValue show the ETH ETFs

pulled inflows significantly larger than the $203 million

registered by the Bitcoin Spot ETFs despite the premier

cryptocurrency having a better price performance. Commenting

on this eye-catching development, Coinbase analysts have attributed

Ethereum ETF performance to a spiked interest in ETH as a preferred

asset for CME basis trade over Bitcoin. For context, the CME

basis trade is a common trading strategy where market participants

go long on an asset in the spot market and short in the future

market with intentions to profit from the difference in market

prices. According to data from Coinbase, CME ETH basis trade

produced a higher gain (16%) than that of Bitcoin (10%) over the

last week translating into an increased market institutional

interest in the Spot ETFs. Of the reported net inflows in the

Ethereum ETF market, BlackRock’s ETHA remains investors’ favorite

with total net deposits of $286.81 million. Unsurprisingly,

Fidelity’s FETH came second with aggregate investments of $97.28

million. Grayscale’s ETHE, ETH, Bitwise’s ETHW, and 21 Shares’ CETH

also recorded modest net inflows between $4 million -$18 million.

Meanwhile, Invesco’s QETH, Franklin Templeton’s EZET, and VanEck’s

ETHV all record zero net flows. Over the last trading week, the

Ethereum Spot ETFs saw their net assets decline to $9.88 billion

despite a net positive flow. At the time of writing, these ETFs now

control 3.17% of the ETH market cap. Related Reading: Ethereum

Price Could Be Primed For Another 100% Move After Printing

Capitulation Candle ETH Price Overview At press time,

Ethereum trades at $2,681 following a 1.46% rise in the last 24

hours. However, daily trading volume is down by 45.15% and is now

valued at $16 billion. According to its daily trading chart, the

Ethereum Relative Strength Index is currently at 34.03 heading in

an upward direction. This data suggests strong potential for a

price reversal following last week’s price crash. In driving any

price rally, market bulls will encounter strong resistance in the

$3400 price zone, pushing past which could allow a return to the

local market peak of $4,000. Featured image from ShutterStock,

chart from Tradingview

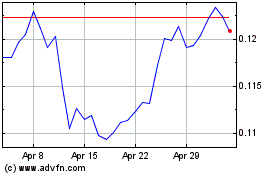

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025