Bitcoin Enters ‘Danger Zone’ Post-Halving, Analyst Warns Of Potential Downside

27 April 2024 - 4:50PM

NEWSBTC

Following the halving event on April 19, the price of Bitcoin has

displayed a puzzling performance. BTC initially gained nearly 10%

to trade as high as $67,020 on April 24. However, in the last two

days, the digital asset’s price has declined by 6.49%,

falling below the $63,000 price mark. As expected, such

negative performance has drawn attention from investors and market

speculators. In particular, renowned analyst with X handle Rekt

Capital has provided a theory on Bitcoin’s price fall and perhaps

an insight into the future price movements of the crypto market

leader. Related Reading: Timing The Breakout: When Will Bitcoin

Escape The Post-Halving Consolidation? BTC Potential Price Decline

Ahead? In an X post on April 26, Rekt Capital stated that Bitcoin

has now entered the Post-Halving “Danger Zone.” The analyst

described this phenomenon as a period during which Bitcoin has

historically experienced price corrections after the halving event.

Rekt Capital noted that in 2016, Bitcoin recorded these price

retraces in the three weeks following the Halving event. During

this time, the token’s price declined by 11%. The analyst

postulates that Bitcoin is now in the Post-Halving “Danger Zone” of

the current bull cycle following its price fall over the last two

days. It is worth stating that if Bitcoin mirrors past price

movement in this phase, the token could be heading for $60,000.

However, Rekt Capital states that if the crypto market leader

experiences such a fate, it will be within the next two

weeks. At the time of writing, Bitcoin trades around $62,672

with a decline of 2.44% in the last day. This price fall

underscores BTC’s negative performance in the last month in which

it has lost 11.16% of its market value. BTC trades at $63,023

on the daily chart | Source: BTCUSD chart on Tradingview.com

Related Reading: Forbes Unveils 20 Crypto ‘Zombies,’ Declares

Ripple And XRP Among The Undead Bitcoin ETFs Record Minor Inflow;

Net Outflows Hit $217 Million According to data from SoSoValue, the

Bitcoin Spot ETF market recorded net outflows to the tune of $217

million on April 25. Unsurprisingly, Grayscale’s GBTC accounted for

$138 million of these figures as its total outflows now approach

$17 billion. Notably, for the first time ever, Fidelity’s FBTC and

Valkyrie’s BRRR produced net outflows estimated at $22

million and $20 million, respectively. Meanwhile, ARK Invest’s ARKB

and Bitwise’s BITB also experienced a loss in investment on

Thursday. Interestingly, all other Bitcoin Spot ETFs recorded zero

net flows except Franklin Tempton’s EZBC, which saw a net inflow of

$1.87 million. At the time of writing, the BTC spot ETFs have a

combined value of $128 billion, reflecting a remarkable growth

since their trading debut on January 11. Featured image from The

Economic Times, chart from Tradingview

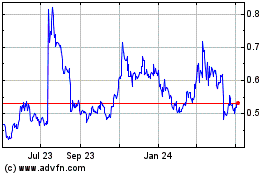

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024