Adyen Ebitda Hurt by Higher Wages, Inventory Writeoffs -- Update

17 August 2023 - 4:58PM

Dow Jones News

By Ian Walker

Adyen has reported a fall in earnings before interest, taxes,

depreciation and amortization for the first half year due to higher

wages as the company invested in its global team, and inventory

write-offs.

The Dutch payments company said Thursday that earnings before

interest, taxes, depreciation and amortization for the half

year--one of the company's preferred metrics--was 320.0 million

euros ($348.1 million) compared with EUR356.3 million for the

comparable period a year earlier.

Ebitda margin was 43% compared to 59%.

Net profit was EUR282.17 million compared with EUR282.14 million

and a forecast of EUR304.9 million, taken from FactSet and based on

two analysts estimates.

Total revenue fell to EUR853.55 million compared with EUR3.95

billion, while net revenue rose to EUR739.1 million from EUR608.5

million. Net sales consensus was EUR773.8 million, taken from

FactSet and based on 10 analysts forecasts.

The company added 551 full-time employees to the team in the

first half year, 75% of which were in tech roles.

"With an evergrowing opportunity ahead, we are making the

necessary investments to capitalize on it and reiterate our

financial objectives," the company said.

Adyen has a target to grow net revenue and achieve a compound

annual growth rate of between the mid-twenties and low-thirties in

the medium term by executing its sales strategy.

Ebitda margin is targeted at above 65% in the longer term.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

August 17, 2023 02:43 ET (06:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

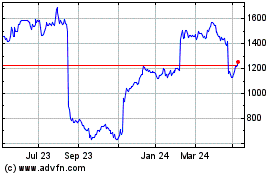

Adyen NV (EU:ADYEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Adyen NV (EU:ADYEN)

Historical Stock Chart

From Dec 2023 to Dec 2024