ATARI: OPENING OF THE FRIENDLY TENDER OFFER FOR ATARI SHARES

OPENING OF THE FRIENDLY TENDER OFFER FOR

ATARI SHARES

Offer recommended by

Atari’s Board of

Directors

At a price of 0.19

euros per share,

representing in particular

a premium of

over 40% versus

the share price prior to the announcement of the

proposed public tender offer

Press release – Paris, France, December 21, 2022

- 6:00pm CET – Following the compliance decision

issued by the

Autorité des

marchés financiers

(AMF) on December 20,

2022 (visa no.22-497),

the AMF made public today the timetable of the

public tender offer on

ATARI (Euronext Growth Paris - ALATA -

FR0010478248) initiated by

Irata LLC, a company owned by

Atari’s Chairman and CEO, Wade J.

Rosen, which will be opened from

tomorrow, December 22, 2022, until January

26,

2023.

Friendly offer

initiated to acquire control and increase the

managing

shareholder’s

capacity to support the

Company’s development

ambitions

The offer is aligned with the commitment set out

by Irata and Mr. Wade J. Rosen to support Atari’s development

through a friendly and voluntary acquisition of control of the

Company. Atari’s CEO intends to further strengthen his interest in

Atari’s capital in order to support the Company with rolling out

its transformation strategy launched in 2021 and to have the

capacity to support the Company in order to finance it or enable it

to benefit from new financing that it may need to implement its new

strategy in the context of an uncertain macroeconomic environment,

particularly for video games and the blockchain.

The offer is also intended to provide a

liquidity opportunity for Atari’s shareholders in a volatile market

environment.

At December 20, 2022, Irata held 29.19% of

Atari's share capital and 28.89% of its voting rights. Irata also

has the intention to maintain the listing of the Company's shares,

as it has indicated that it does not intend to implement a

squeeze-out procedure following the offer.

Tender

offer recommended by

Atari’s Board of

Directors

Atari’s Board of Directors, which met on October

17, 2022 without the participation of Wade J. Rosen, after

reviewing the report prepared by the independent expert Sorgem and

the documentation notably presenting the terms of the offer,

approved the offer. The directors unanimously considered that the

offer is in the interests of the Company, its shareholders and its

employees, and recommended that shareholders wishing to benefit

from immediate liquidity should tender their shares for the offer.

The Board of Directors confirmed its reasoned opinion as required

on December 14, 2022.

Price of 0.19

euros per share, representing a

premium of over 40%

The price of 0.19 euros per share represents in

particular a premium of +45.6% over the closing price from

September 22, 2022, i.e. the last price observed before the offer

was announced.

The independent expert considered that the

proposed price of 0.19 euros per share represents a premium based

on each of the criteria analyzed, and specifically a +44% premium

versus the central value from its DCF analysis (0.13 euros), as the

primary factor analyzed. It therefore concluded “that the financial

terms of the public tender offer are fair for the Group’s

shareholders”.

Indicative summary timetable

for the offer

December 22, 2022: Opening of the offer

January 26, 2023: Closing of the offer

January 30, 2023: Publication by the AMF and

Euronext Paris of the notice announcing the offer’s result

February 2, 2023: If the Offer proceeds,

settlement and delivery of the initial offer and publication by the

AMF and Euronext Paris of the notice of the offer’s reopening

In accordance with the AMF regulations

applicable, the offer will lapse if, at its closing date, i.e.

January 26, 2023, the Offeror does not hold, acting alone or in

concert, directly or indirectly, a number of Shares representing

more than 50% of the Company’s capital or voting rights.

Shareholder information

Irata’s offer document and Atari’s response

document including the independent expert’s report, as approved by

the AMF on December 20, 2022 under visa no.22-497 and visa

no.22-496 respectively, as well as the documents with other

information detailing the legal, financial and accounting

characteristics in particular of Irata and Atari, are available on

the AMF website (https://www.amf-france.org) and the Atari

investors website (https://atari-investisseurs.fr/en/tenderoffer).

These documents may be obtained free of charge on request from

Atari (25 rue Godot de Mauroy, 75008 Paris, France) and from

Rothschild Martin Maurel (23 bis avenue de Messine, 75008 Paris,

France).

To ensure easy access to the information for

shareholders, a telephone number is available for Atari’s

individual shareholders if they have any questions concerning the

offer: +33 (0)1 45 08 50 91. Answers to frequently asked questions

(“FAQ”) will also be available on the Atari investors website

https://atari-investisseurs.fr/projet-opa/).

IMPORTANT INFORMATION

This press release has been prepared exclusively

for information purposes. It does not constitute a public offer and

is not intended for distribution in any countries other than

France.

It is strongly recommended for investors and

shareholders to review the offer documentation, which includes the

terms and conditions of the offer, in addition to, if applicable,

any amendments or additions made to these documents when they

contain material information relating to Irata, Atari and the

transaction being considered.

This press release is not intended for release,

publication or distribution, directly or indirectly, in any country

where the distribution of this information is subject to legal

restrictions. The release, publication or distribution of this

press release, the offer and its acceptance may be subject to

specific regulations or restrictions in certain countries. The

offer is not intended for any persons subject to such restrictions,

either directly or indirectly, and is not likely to be accepted

from any country where the offer may be subject to such

restrictions. As such, the persons in possession of this press

release must seek advice concerning any local restrictions that may

apply and comply with them. Atari accepts no responsibility for any

breach of these restrictions by any person whatsoever.

This press release does not constitute an offer

to sell or purchase or a solicitation of a sale or purchase of

securities in the United States or any other country. The

securities that may be offered in the context of any transaction

have not been and will not be registered under the U.S. Securities

Act or any securities legislation in any State within the United

States, and Irata does not intend to register all or part of the

offer in the United States or to conduct any public offering of

securities in the United States.

ABOUT ATARI

Atari, which is made up of Atari SA and its

subsidiaries, is a global interactive entertainment and

multiplatform licensing group. An outstanding innovator for video

games founded in 1972, Atari owns and/or manages a portfolio of

more than 200 games and franchises, including world-renowned brands

such as Asteroids®, Centipede®, Missile Command® and Pong®. From

this extensive intellectual property portfolio, Atari delivers

attractive online games for smartphones, tablets and other

connected devices. Atari also develops and distributes interactive

entertainment for Microsoft and Sony gaming consoles. Lastly, Atari

leverages its brand and franchises with licensing agreements

through other media, derivative products and publishing. For more

information, visit: www.atari.com, www.atari.com/news and

www.atari-investisseurs.fr

CONTACTS

Atari -

Investor RelationsTel +33 (0)1 83

64 61 57 – investisseur@atari-sa.com | www.atari.com/news/

Calyptus – Marie CalleuxTel +33

(0)1 53 65 68 68 – atari@calyptus.net

- ATARI_CP_Ouverture-offre_EN_20221221_DEF

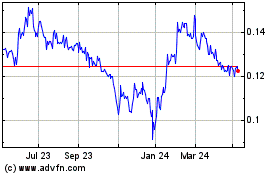

Atari (EU:ALATA)

Historical Stock Chart

From Dec 2024 to Jan 2025

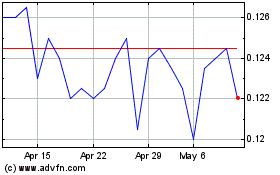

Atari (EU:ALATA)

Historical Stock Chart

From Jan 2024 to Jan 2025