Subject: Lexibook: Q3 2024-25 Revenue at €39.3M, up 31.1%. Over 9 months, revenue increases by 23.43%.

14 February 2025 - 5:00PM

UK Regulatory

Subject: Lexibook: Q3 2024-25 Revenue at €39.3M, up 31.1%. Over 9

months, revenue increases by 23.43%.

Les Ulis, February 14, 2024, 7:00 AM

LEXIBOOK: Q3 2024-25 REVENUE AT €39.3M,

GROWING BY 31.1%. OVER 9 MONTHS, REVENUE HAS INCREASED BY 23.43%

THANKS TO SALES GROWTH IN FRANCE AND INTERNATIONALLY, PARTICULARLY

THROUGH ITS NEW SMART TOYS AND LICENSED PRODUCTS. POSITIVE OUTLOOK

FOR 2025-26, BUT WITH CAUTION REGARDING THE IMPACT OF A STRONG

DOLLAR AGAINST THE EURO, AS WELL AS PERSISTENT FREIGHT TENSIONS

THAT COULD PRESSURE MARGINS.

- Q3

2024-25 revenue exceeded expectations, growing by 31.1% to €39.3M

compared to €30.0M in Q3 2023-24. Since the beginning of the

2024-25 fiscal year, cumulative revenue has increased by 23.43%,

reaching €64.37M compared to €52.15M over 9 months.

- This

quarter follows two consecutive quarters of growth, once again

validating the Group's strategic choices to focus on promising

segments, including electronic and musical toys, alarm clocks,

educational products, and cameras. Lexibook thus strengthens its

position as the European leader in its key segments.

- The

Group conducted a large-scale communication campaign in Europe and

the United States during the quarter. These campaigns significantly

boosted sales and Christmas restocking, contributing to

better-than-expected sales across all markets.

- The

first sales of licensed products in the U.S. have supported strong

business growth and indicate sustained sales growth in

2025.

- However,

in 2024, maritime supply tensions resurfaced, particularly due to

the Red Sea conflict, significantly impacting logistics

costs.

- Q4

2024-25 is expected to be at a similar level to 2023-24, bringing

Lexibook Group's total annual revenue for the full fiscal year to

around €70M.

Lexibook (ISIN FR0000033599) today announces its (unaudited)

revenue for the period ending December 31, 2024 (the period from

April 1 to December 31).

|

Consolidated Revenue (€M) |

2023/2024 |

2024/2025 |

Var FY24-FY25 |

|

|

|

|

|

|

1st Quarter |

7.01 |

7.30 |

+4.14% |

|

FOB |

2.21 |

1.18 |

-46.61% |

| Non

FOB |

4.80 |

6.12 |

+27.50% |

|

2nd Quarter |

15.13 |

17.30 |

+14.34% |

|

FOB |

2.85 |

4.27 |

+49.82% |

| Non

FOB |

12.28 |

13.03 |

+6.11% |

|

3rd Quarter |

30.01 |

39.33 |

+31.06% |

|

FOB |

0.88 |

2.20 |

+150.00% |

| Non

FOB |

29.13 |

37.13 |

+27.46% |

|

|

|

|

|

|

Total 9 Months |

52.15 |

64.37 |

+23.43% |

After a dynamic first half of fiscal year

2024-25 with a growth of 10.8%, the third quarter of 2024-25,

traditionally the highest contributor to revenue for the year,

shows an acceleration in growth, up by 31.06%.

The star products continued to perform well, and

the Group benefited from the launch of many new products in its key

segments. Product consumption was better than expected: Lexibook's

product sales across all networks benefited from massive

communication campaigns for the third consecutive year in the EMEA

and USA regions, generating over a billion digital impressions in

2024 alone.

Growth is widespread across all the most

profitable product families, including electronic and musical toys,

educational products, cameras, watches, and walkie-talkies.

Licensed products also contributed to this growth, both from very

dynamic existing licenses like Frozen, Paw Patrol, and Spiderman,

as well as new licenses like Super Mario, Miraculous, Harry Potter,

and Stitch, which has shown exceptional performance. Sales of less

profitable tablets are now being replaced by sales in higher-margin

segments.

Beyond the French market, the strong sales

growth is also widespread in all countries where the Group operates

internationally. FOB revenue (revenue invoiced directly from HK on

full-container FOB HK deliveries) has increased by 150%, thanks to

historical clients and the conquest of new international accounts.

Non-FOB revenue still represents the majority of sales in the

quarter, growing by 27.46%, due to excellent resales of Lexibook

products internationally.

Finally, the Group's digitalization is paying

off: digital sales are growing significantly both in France and

across European markets.

However, in 2024, tensions in maritime supply

chains resurfaced due to the Red Sea conflict. This led to extended

transit times and a 238% increase in freight costs compared to

2023, particularly for the average price of 40-foot containers,

which rose from $1500 to over $5300. This trend is expected to

continue into 2025 and could continue to pressure margins.

Following the completion of the Public Tender

Offer, the concert composed of the members of the Le Cottier family

group and the companies Doodle and Lawrence Rosen LLC now holds

6,101,028 LEXIBOOK shares representing 8,428,110 voting rights, or

78.59% of the company's capital.

Outlook

Q4 is traditionally a low-contributing quarter

in terms of revenue and is expected to be at a similar level to

last year. The Group's annual revenue for the full fiscal year is

expected to be around €70M.

The Group has also showcased its 2025

collections at the London and Nuremberg Toy Fairs. The reception

was positive and suggests that activity in 2025-26 will follow the

trend of 2024-25.

As Lexibook is highly exposed to currency

fluctuations, particular attention is being paid to exchange rate

developments. Several factors, including the results of the US

elections, severely impact the euro against the US dollar (a sharp

drop from 1.12US$ to 1.00€ at the end of September 2024 to 1.02US$

on January 10, 2025), which could severely weigh on the Group's

margins if the trend does not reverse quickly.

For 2025, Lexibook's room for adjusting its

prices is limited, so the Group fears a deterioration of its

margins if the dollar remains at this level or appreciates

further.

Finally, a new concern arises from the Trump

administration's decision on new 10% tariffs, effective February 4,

2025, on products manufactured in China entering the U.S. This will

have a direct impact on sales and margins in the U.S. market

starting in 2025.

Financial Calendar

2024/2025

- Q4 2024-2025 Revenue and Annual

Results as of March 31, 2025: June 30, 2025

- Availability of the Universal

Registration Document as of March 31, 2025: June 30, 2025

About Lexibook

Lexibook®, owner of over 22 registered

international brands such as Powerman®, Decotech®, Karaoke Micro

Star®, Chessman®, Cyber Arcade®, Lexitab®, iParty®, FlashBoom®,

etc., Lexibook® is the leader in smart electronic entertainment

products for children. This success is based on a proven strategy

that combines strong international licenses with high-value-added

consumer electronics products. This strategy, complemented by a

constant innovation policy, allows the Group to thrive

internationally and continuously develop new product ranges under

its brand names. With more than 35 million products on the market,

the company now sells a product every 10 seconds worldwide!

Lexibook's share capital consists of 7,763,319 shares listed on the

Alternext market in Paris (Euronext). ISIN: FR0000033599 – ALLEX;

ICB: 3743 – Consumer electronics. For more information:

www.lexibook.com and www.decotech-lights.com.

Contacts

LEXIBOOK Aymeric Le Cottier – CEO -

aymericlecottier@lexibook.com

- Communique_CA_Q3_2024-2025_Full_EN

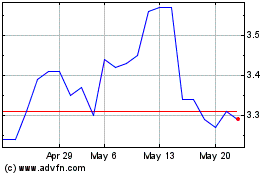

Lexibook Linguistic Elec... (EU:ALLEX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Lexibook Linguistic Elec... (EU:ALLEX)

Historical Stock Chart

From Mar 2024 to Mar 2025