KEY FIGURES OF DASSAULT AVIATION

GROUP

|

|

H1 2024 |

H1 2023 |

|

Order intake(new aircraft in units) |

€5,134 million18 Export Rafale11 Falcon |

€1,682 million12 Falcon |

|

Adjusted net sales (*)(new aircraft in units) |

€2,538 million6 Rafale France12 Falcon |

€2,295 million2 Rafale Export2 Rafale France9 Falcon |

|

|

|

|

|

|

as of June 30, 2024 |

as of December 31, 2023 |

|

Backlog(new aircraft in units) |

€41,157 million223

RafaleIncluding 159 Export and 64 France83

Falcon |

€38,508 million211 RafaleIncluding 141 Export and 70 France84

Falcon |

|

|

|

|

|

|

H1 2024 |

H1 2023 |

|

Adjusted net operating income (*)Adjusted operating margin |

€170 million6.7% of net sales |

€151 million6.6% of net sales |

|

Research & Development |

€200 million |

€247 million |

|

Adjusted net income (*)Adjusted net margin |

€442 million17.4% of net sales |

€405 million17.6% of net sales |

|

|

|

|

|

|

as of June 30,2024 |

as of December 31, 2023 |

|

Available cash |

€8,786 million |

€7,294 million |

Note: Dassault Aviation recognizes

Rafale Export contracts in their entirety (including the Thales and

Safran parts).

Main aggregates under IFRS (see tables of

reconciliation in appendix)

|

(*) Consolidated net sales |

€2,538 million |

€2,297 million |

|

(*) Consolidated net operating income |

€169 million |

€152 million |

|

(*) Consolidated net income |

€476 million |

€362 million |

Saint-Cloud, July

23rd,2024 - The Board of

Directors, which met today, under the chairmanship of Mr. Éric

Trappier, approved the 2024 half year financial statement. The

Statutory Auditors have performed a limited review of these

consolidated financial statements and have expressed an unqualified

opinion.

At the end of the Board meeting, Éric Trappier

said:

“The global context in this first half-year

remains marked by the war in Ukraine and the state of war in the

Middle East. In France, the President of the Republic, as head of

the armed forces, wrote to defense manufacturers urging them to

step up their efforts in the context of a war economy. In response

to this call, I instructed Dassault Aviation employees to

prioritize Rafale production, for both France and for Export.

The first half of 2024 saw:

-

the entry into force of the third batch (18 Rafale) of the

Indonesia contract in January. As a result, the Group’s backlog

broke a new record, reaching EUR 41.2 billion on June 30,

2024 (306 aircraft – 159 Rafale Export, 64 Rafale France and 83

Falcon),

-

the first Falcon 6X customer deliveries, after its entry

into service in November 2023,

-

the delivery of 6 Rafale to France and 12 Falcon as the

Group continues to suffer from supply chain

problems,

-

adjusted net sales amounted to EUR 2,538 million

for the half-year, leading to adjusted net operating income of

EUR 170 million and Group adjusted net income of

EUR 442 million, i.e. a net margin of

17.4%.

With 495 aircraft ordered since its launch,

including 18 for Indonesia this half-year, the Rafale has confirmed

its success. Users of our fighter aircraft appreciate its

operational qualities as well as its continuous evolution in line

with new standards currently under development and those to be

introduced in the future. We are preparing for the future of the

Rafale with the F5 standard accompanied by a combat drone, and

remain committed to developing the F4 standard. The Group has

reaffirmed its crucial role as an architect of complex systems.

In the military sector, during the first

half of the year, we:

-

recorded order intake for the third batch (18 Rafale) of the

Indonesia contract,

-

delivered 6 Rafale to France, supported the French and export

fleets and continued work to develop the F4 standard.

In the civilian sector, during the first half of

the year, we:

-

recorded 11 Falcon orders, compared with 12 in the 1st half of

2023, and delivered 12 Falcon, compared with 9 in the 1st half of

2023,

-

delivered the first Falcon 6X to customers and continued the world

tour,

-

continued the development and manufacture of the first Falcon

10X. First deliveries are scheduled for 2027.

Corporate Social Responsibility remains a major

commitment of the Group, particularly for the decarbonization of

its products and processes. The SAF (Sustainable Aviation Fuel)

plan that we have put in place is ramping up by the intensification

of the use of alternative fuels. In 2024, the Group maintained an

attractive remuneration policy. The recruitment target is

approximately 2,000 new employees (of which more than half has been

achieved as of June 30th) with a focus on their integration and

training.

Like other major players in the aerospace

industry, the Group is suffering from a difficult supply chain.

There are many shortages in our production lines due to supplier

inefficiencies in some cases, especially in the aerostructure

sector. These difficulties have given rise to risks affecting

Falcon and Rafale deliveries, and also impact customer support. The

Group is taking internal and external measures to mitigate these

effects and to anticipate sub-contractor inefficiencies. Moreover,

given the links forged with Indian companies as part of the “Make

in India” initiative and the major business opportunities we have

there in the future, India has emerged as an opportunity to expand

our supply chain.”

Éric TRAPPIER, Chairman and Chief Executive

Officer of Dassault Aviation.

1. ORDER INTAKE

Order intake for the 1st half

of 2024 was EUR 5,134 million, vs.

EUR 1,682 million in the 1st half of 2023.

Export order intake stood at

96%.

Order intake was as follows, in millions

of euros:

|

|

H1 2024 |

% |

H1 2023 |

% |

|

Defense |

4,095 |

80% |

739 |

44% |

|

Defense Export |

3,871 |

|

572 |

|

|

Defense France |

224 |

|

167 |

|

|

|

|

|

|

|

|

Falcon |

1,039 |

20% |

943 |

56% |

|

|

|

|

|

|

|

Total order intake |

5,134 |

|

1,682 |

|

|

% Export |

96% |

|

88% |

|

The order intake is entirely composed of firm

orders.

Defense programs

Defense Export order intake

totaled EUR 3,871 million in the 1st

half of 2024, vs. EUR 572 million in the 1st half of

2023. In particular, the Group recorded an order for an additional

18 Rafale for Indonesia.

Defense France order intake

totaled EUR 224 million in the 1st half

of 2024, vs. EUR 167 million in the 1st half of 2023.

Falcon programs

During the 1st half of 2024, 11 Falcon

orders were recorded, compared with 12 orders in the 1st

half of 2023. Falcon order intake amounted to

EUR 1,039 million in the 1st half of the

year compared to EUR 943 million in the 1st half of 2023,

up mainly due to a favorable product mix.

2. ADJUSTED NET SALES

Adjusted net sales for the 1st

half of 2024 totaled EUR 2,538 million,

compared with EUR 2,295 million for the 1st half of 2023.

Export net sales stood at 59% in

the 1st half of 2024.

Consolidated sales were as follows, in

millions of euros:

|

|

H1 2024 |

% |

H1 2023 |

% |

|

Defense |

1,558 |

61% |

1,468 |

64% |

|

Defense Export |

552 |

|

851 |

|

|

Defense France |

1,006 |

|

617 |

|

|

|

|

|

|

|

|

Falcon |

980 |

39% |

827 |

36% |

|

|

|

|

|

|

|

Total adjusted net sales |

2,538 |

|

2,295 |

|

|

% Export |

59% |

|

71% |

|

Defense programs

Defense Export net sales

totaled EUR 552 million

in the 1st half of 2024, vs. EUR 851 million in the 1st

half of 2023.

Defense France net sales

totaled

EUR 1,006 million in

the 1st half of 2024, vs. EUR 617 million in the 1st half

of 2023.

6 Rafale were delivered to

France during the 1st half of 2024, compared with 4 Rafale (2

France and 2 Export) for the 1st half of 2023.

Falcon programs

12 Falcon were delivered

in the 1st half of 2024, compared with 9 in the 1st half of

2023.

Falcon net sales for the 1st

half of 2024 amounted to

EUR 980 million, vs.

EUR 827 million for the 1st half of 2023.

****

The “book-to-bill ratio” (order intake/net

sales) is 2.02 for the 1st half of 2024.

3. BACKLOG

The consolidated

backlog (determined in accordance with IFRS 15) was

EUR 41,157 million as of June 30, 2024,

compared with EUR 38,508 million as of December 31, 2023.

The backlog trend is as follows:

|

|

06/30/2024 |

% |

12/31/2023 |

% |

|

Defense |

36,399 |

88% |

33,862 |

88% |

|

Defense Export |

27,305 |

|

23,986 |

|

|

Defense France |

9,094 |

|

9,876 |

|

|

|

|

|

|

|

|

Falcon |

4,758 |

12% |

4,646 |

12% |

|

|

|

|

|

|

|

Total backlog |

41,157 |

|

38,508 |

|

|

% Export |

75% |

|

71% |

|

The Defense Export backlog

stood at EUR 27,305 million as of June

30, 2024 vs. EUR 23,986 million as of December 31, 2023.

This figure notably includes 159 new Rafale

compared with 141 new Rafale as of December 31, 2023.

The Defense France backlog

stood at EUR 9,094 million as of June

30, 2024, vs. EUR 9,876 million as of December 31, 2023. This

figure includes 64 Rafale, the support contracts

for the Rafale (Ravel), Mirage 2000 (Balzac) and ATL2 (OCEAN),

AlphaJet (AlphaCare) and the Rafale F4 standard.

The Falcon backlog stood at

EUR 4,758 million as of June 30, 2024,

vs. EUR 4,646 million as of December 31, 2023. It

includes 83 Falcon, compared with 84 as of

December 31, 2023.

4. ADJUSTED RESULTS

Adjusted net operating

income

Adjusted net operating income for the

1st half of 2024 came to

EUR 170 million, compared with

EUR 151 million in the 1st half of 2023.

R&D expenses in the 1st half of 2024, mainly

related to the Falcon 10X, totaled EUR 200 million

compared with EUR 247 million for the 1st half of

2023.

Operating margin was

6.7%, compared with 6.6% in the 1st half of

2023.

The hedging rate for the 1st half of 2024 was

USD 1.14/EUR, vs. USD 1.20/EUR in the

1st half of 2023.

Adjusted net financial

income

Adjusted net financial income for the

1st half of 2024 was

EUR 106 million, vs.

EUR 110 million for the same period in the previous year,

decreasing due to higher financing component, partially offset by

an increase in financial income.

Adjusted net income

Adjusted net income for the

1st half of 2024 was

EUR 442 million, compared with

EUR 405 million in the 1st half of 2023. The contribution

of Thales to the Group’s net income was EUR 231 million,

compared with EUR 206 million during the 1st half of

2023.

Adjusted net margin thus stood

at 17.4% for the 1st half of 2024 vs. 17.6% for

the 1st half of 2023.

Adjusted net income per share

for the 1st half of 2024 was EUR 5.62 vs.

EUR 4.92 for the 1st half of 2023.

5. 1ST

HALF 2024 CONSOLIDATED RESULTS UNDER IFRS

Consolidated net operating income

(IFRS)

Consolidated net operating

income for the 1st half of 2024 came to

EUR 169 million, compared with

EUR 152 million in the 1st half of 2023.

R&D expenses in the 1st half of 2024, mainly

related to the Falcon 10X, totaled EUR 200 million

compared with EUR 247 million for the 1st half of

2023.

Consolidated operating margin

stood at 6.7%, vs. 6.6% for the 1st half of

2023.

The hedging rate for the 1st half of 2024 was

USD 1.14/EUR, vs. USD 1.20/EUR in the

1st half of 2023.

Consolidated net financial income

(IFRS)

Consolidated net financial

income for the 1st half of 2024 came to

EUR 102 million vs.

EUR 111 million in the 1st half of 2023, decreasing due

to higher financing component, partially offset by an increase in

financial income.

Consolidated net income

(IFRS)

Consolidated net income for the

1st half of 2024 was

EUR 476 million,

compared with EUR 362 million in the 1st half of 2023.

The contribution of Thales to the Group’s net income was

EUR 269 million, compared with EUR 161 million

during the 1st half of 2023.

Consolidated net margin thus

stood at 18.8% for the 1st half of 2024, vs. 15.7%

for the 1st half of 2023.

Consolidated net income per

share for the 1st half of 2024 was

EUR 6.06 vs. EUR 4.40

for the 1st half of 2023.

6. AVAILABLE CASH

The Group uses a specific indicator called

“Available cash,” which reflects the amount of total liquidities

available to the Group, net of financial debts. It includes the

following balance sheet items: cash and cash equivalents, current

financial assets (at market value) and financial debt, excluding

lease liabilities. The calculation of this indicator is detailed in

the consolidated financial statements (Note 7 of the condensed

interim consolidated financial statements).

The Group’s available cash

stands at EUR 8,786 million as of June

30, 2024 vs. EUR 7,294 million as of December 31, 2023.

This increase is mainly due to the advances received on orders.

7. BALANCE SHEET (IFRS)

Total equity stood at

EUR 5,915 million

as of June 30, 2024 vs. EUR 5,742 million as of December

31, 2023.

Borrowings and financial debt amounted to

EUR 236 million as of June 30, 2024, compared with

EUR 262 million as of December 31, 2023. They are

composed of locked-in employee profit-sharing funds for

EUR 53 million and lease liabilities recognized for

EUR 183 million.

Inventories and work-in-progress increased by

EUR 929 million to stand at EUR 6,187 million

as of June 30, 2024.

Advance payments received on orders net of

advance payments to suppliers were up EUR 2,580 million

to stand at EUR 11,650 million.

The derivative financial instruments market

value stood at EUR -40 million as of June 30, 2024, vs.

EUR 29 million as of December 31, 2023.

This Financial Press Release may contain

forward-looking statements which represent objectives and cannot be

construed as forecasts regarding the Company's results or any other

performance indicator. The actual results may differ significantly

from the forward-looking statements due to various risks and

uncertainties, as described in the Half-year financial report.

CONTACTS:

Corporate Communication

Stéphane Fort - Tel. +33 (0)1 47 11 86 90 -

stephane.fort@dassault-aviation.com

Mathieu Durand - Tel. +33 (0)1 47 11 85 88 -

mathieu.durand@dassault-aviation.com

Investor Relations

Nicolas Blandin - Tel. +33 (0)1 47 11 40 27 -

nicolas.blandin@dassault-aviation.com

APPENDIX

FINANCIAL REPORTING

IFRS 8 “Operating Segments” requires the

presentation of information per segment according to internal

management criteria.

The entire activity of the Dassault Aviation

Group relates to the aerospace sector. The internal reporting made

to the Chairman and Chief Executive Officer, and to the Chief

Operating Officer, as used for the strategy and decision-making,

includes no performance analysis, under the terms of IFRS 8, at a

lower level to this domain.

DEFINITION OF ALTERNATIVE PERFORMANCE

INDICATORS

To reflect the Group’s actual economic

performance, and for monitoring and comparability reasons, the

Group presented an adjusted income statement of:

-

foreign exchange gains/losses resulting from the exercise of

hedging instruments which do not qualify for hedge accounting under

IFRS standards. This income, presented as net financial income in

the consolidated financial statements, is reclassified as net sales

and thus as net operating income in the adjusted income

statement;

- the

value of foreign exchange derivatives which do not qualify for

hedge accounting, by neutralizing the change in fair value of these

instruments (the Group considering that gains or losses on hedging

should only impact net income as commercial flows occur), with the

exception of derivatives allocated to hedge balance-sheet positions

whose change in fair value is presented as net operating

income;

-

amortization of assets valued as part of the purchase price

allocation (business combinations), known as “PPA”;

-

adjustments made by Thales in its financial reporting.

The Group also presents the “available cash”

indicator which reflects the amount of the Group’s total

liquidities, net of financial debt. It covers the following balance

sheet items:

-

cash and cash equivalents;

-

other current financial assets (mainly time deposits);

-

financial debt, excluding lease liabilities.

The calculation of this indicator is detailed in

the condensed interim consolidated financial statements (see Note

7).

Only consolidated financial statements are

audited by statutory auditors. Adjusted financial data are subject

to the verification procedures applicable to all information

provided in the half-yearly report.

IMPACT OF ADJUSTMENTS

The impact of the adjustments of income

statement aggregates for the 1st half of 2024 is set out below:

|

(in EUR thousands) |

Consolidated income statement H1 2024 |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

Adjusted income statement H1 2024 |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

2,538,156 |

|

|

|

|

2,538,156 |

|

Net operating income |

168,190 |

|

|

1,059 |

|

170,039 |

|

Net financial income |

101,942 |

|

4,418 |

|

|

106,360 |

|

Share in net income of equity associates |

274,719 |

|

|

1,977 |

-40,417 |

236,279 |

|

Income tax |

-69,444 |

|

-1,141 |

-187 |

|

-70,772 |

|

Net income |

476,197 |

|

3,277 |

2,849 |

-40,417 |

441,906 |

|

Group share of net income |

476,197 |

|

3,277 |

2,849 |

-40,417 |

441,906 |

|

Group share of net income per equity (in euros) |

6.06 |

|

|

|

|

5.62 |

The impact of the adjustments of income

statement aggregates for the 1st half of 2023 is set out below:

|

(in EUR thousands) |

Consolidated income statement H1 2023 |

Foreign exchange derivatives |

PPA |

Adjustments applied by Thales |

Adjusted income statement H1 2023 |

|

Foreign exchange gain/loss |

Change in fair value |

|

Net sales |

2,297,181 |

-1,941 |

|

|

|

2,295,240 |

|

Net operating income |

151,593 |

-1,941 |

|

1,465 |

|

151,117 |

|

Net financial income |

110,957 |

1,941 |

-3,397 |

|

|

109,501 |

|

Share in net income of equity associates |

165,514 |

|

|

1,489 |

42,720 |

209,723 |

|

Income tax |

-66,360 |

|

877 |

-288 |

|

-65,771 |

|

Net income |

361,704 |

0 |

-2,520 |

2,666 |

42,720 |

404,570 |

|

Group share of net income |

361,704 |

|

-2,520 |

2,666 |

42,720 |

404,570 |

|

Group share of net income per equity (in euros) |

4.40 |

|

|

|

|

4.92 |

- Half Year Financial Release 2024

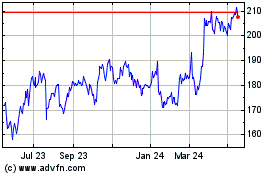

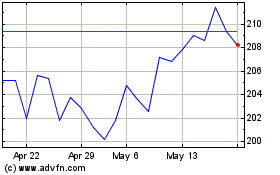

Dassault Aviation (EU:AM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dassault Aviation (EU:AM)

Historical Stock Chart

From Jan 2024 to Jan 2025