Celyad Oncology (Euronext: CYAD) (the “Company” or “Celyad

Oncology”), today announces its financial results and recent

business developments for the first half year, ended June 30, 2023.

"Celyad Oncology is now fully focused on

maximizing the potential of its proprietary technology platforms

and intellectual property, enabling the Company to be at the

forefront of developing next-generation CAR T-cell therapies. We

are eager to see the impact of our research efforts on the future

of CAR T-cell treatments, with the goal to broaden the range of

cancer indications and tackle the main limitations of current CAR

T-cell therapies,” commented Georges Rawadi, Celyad Oncology’s

Chief Executive Officer.

First Half 2023 and recent corporate

highlights:

- Georges Rawadi was appointed Chief

Executive Officer of the Company as from April 27, 2023. Georges

Rawadi is a seasoned executive with over 20 years of experience in

pharma/biotech, as research director, business developer, CEO, and

board member. He also has insightful knowledge of both the company

and the CAR-T space as he spent four years at Celyad Oncology

(2014-2018) as Vice-President Business Development &

Intellectual Property (“BD & IP”). Georges Rawadi has a genuine

passion for seeking and creating new business opportunities.

- On May 5th, 2023, the Company

announced voluntary delisting of its American Depositary Shares

representing ordinary shares (“ADSs”) from the Nasdaq Global

Market. Delisting was effective as of July 20, 2023. The Company

continues to be listed on Euronext Brussels and Euronext

Paris.

- On August 24, 2023, the Company

announced that it has obtained commitments from Fortress, Tolefi

and other longstanding existing shareholders to subscribe to a

capital increase of up to €9.8 million in 2 tranches:

- A first tranche of 2.0 million was

disbursed in the context of authorized capital as of September 4,

2023; and

- A second tranche to be subscribed

by Fortress is subject to the approval by the extraordinary

shareholders’ meeting. Following this private placement, the

Company believes that its existing cash and cash equivalents should

be sufficient, based on the current scope of activities, to fund

operating expenses and capital expenditure requirements into the

end of the fourth quarter of 2024.

First Half 2023 and recent operational

highlights:

- Short hairpin ribonucleic

acid (shRNA) non-gene edited technology – During this

first half of 2023, we have collected and presented data validating

our shRNA multiplexing approach:

- We developed a micro-RNA

(miRNA)-based multiplex shRNA platform designed for easy,

efficient, and tunable downregulation of up to four target genes

simultaneously;

- We showed that the downregulation

of each target gene could be fine-tuned, from a moderate

downregulation up to a functional knock-out, without the need of

gene editing thereby avoiding associated potential safety

issues;

- The plug-and-play design of our

platform is designed to allow swapping of each target sequence

without affecting the performance of the technology and

streamlining of the generation of engineered adoptive T-cell

therapies;

- To demonstrate the effectiveness of

our approach, we have been able to simultaneous knock-down in CAR

T-cells several genes involved in different cellular processes such

as alloreactivity (CD3ζ), cell persistence (β2M, CIITA), T-cell

exhaustion (PD-1, LAG-3), or ligand-induced apoptosis (CD95);

- Data were presented at the World

Oncology Cell Therapy Congress in Boston, US (April 25-26, 2023)

and at the CAR-TCR Summit in Boston, US (August 29 – September

1).

- NKG2D-based CAR T-cells and multi-specific CAR T-cell

platform – During this first half of 2023, we have

published data validating our NKG2D-based CAR T-cell approach and

presented data from our multi-specific CAR T-cell platform:

- Results from 16 patients treated in

the dose-escalation segment of the hematological arm of the Phase I

THINK trial were published in The Lancet Haematology Journal

(Lancet Haematol. 2023 Mar;10(3):e191-e202) and provided

proof-of-concept for targeting NKG2D ligands (NKG2DL) with CAR

T-cell therapy;

- We have developed different

CD19/NKG2DL multi-specific CAR T-cells, utilizing both tandem and

dual NKG2D-based CARs that encompass the extracellular domain of

the natural NKG2D receptor fused to an anti-CD19 scFv, or

co-expressed with an anti-CD19 CAR, respectively;

- The majority of our CD19/NKG2DL

multi-specific CAR T-cell candidates were able to secrete

cytokines, proliferate, and eliminate acute lymphoblastic leukemia

tumor cells lacking the CD19 antigen in vitro. Interestingly, some

of these multi-specific CAR T-cells displayed a better in vitro

functionality against wild-type leukemia tumor cells expressing the

CD19 antigen as compared to CD19-specific single targeting CAR

T-cells, highlighting the potential of our approach against both

CD19 positive and CD19 negative cancer cells;

- First in vivo data suggest that our

CD19/NKG2DL multi-specific CAR T-cell candidates have an enhanced

anti-tumor efficacy against heterogeneous lymphoma tumors as

compared to currently existing treatment options;

- We are currently developing several

NKG2D-based multi-specific CAR T-cells for the treatment of diverse

solid cancers where there is a high heterogeneity in antigen

expression;

- Data were presented at the

Immuno-Oncology Summit Europe 2023 held in London, UK (June 20-22,

2023).

Upcoming anticipated

milestones

- More data and evidence in the

context of the multi-specific CAR platform and shRNA multiplexing

approach in H2 2023, with the aim of a clinical evaluation of

assets and initiation of clinical trials either by the Company

and/or through strategic partnerships afterwards;

- Relocation, in H2 2023, into a new

research facility which fits better its current needs after the

strategic shift. The Company will remain headquartered at the Axis

Parc, Mont-Saint-Guibert, Belgium but with its new business

location at Dumont 9.

Upcoming Conferences

-

The Company will take part in the 4th International Conference on

Lymphocyte Engineering (ICLE) in Munich (September 12-14) and the

annual congress of the Society for Immunotherapy of Cancer (SITC)

in San Diego (November 1-5), as well at several business

conferences in the second half of 2023.

First Half 2023 Financial

Results

Key financial figures for the first half of

2023, compared with the first half of 2022 and full year 2022, are

summarized below:

|

Selected key financial figures (€ millions) |

Half Year 30 June 2023 |

Half Year30 June 2022 |

Full Year31 December 2022 |

|

Revenue |

- |

- |

- |

|

Research and development expenses |

(2.1) |

(10.5) |

(18.9) |

|

General and administrative expenses |

(3.7) |

(6.2) |

(10.5) |

|

Change in fair value of contingent

consideration |

- |

1.1 |

14.7 |

|

Impairment of Oncology intangible assets |

- |

- |

(35.1) |

|

Other income/(expenses) |

2.1 |

1.6 |

9.0 |

|

Operating loss |

(3.7) |

(14.1) |

(40.9) |

|

Loss for the period/year |

(3.7) |

(14.1) |

(40.9) |

|

Net cash used in operations |

(8.3) |

(16.3) |

(28.0) |

|

Cash and cash equivalents |

5.0 |

14.4 |

12.4 |

The Company’s license and collaboration

agreements generated no revenue in the first half of 2023 similar

to the first half of 2022.

The Research and Development (R&D) expenses

have decreased primarily due to the Company’s decision to

discontinue some of preclinical programs and manufacturing and

clinical study activities after the Company’s decision to adopt and

implement a new business strategy. Furthermore, there has been a

decrease of employee expenses and related travel costs which is

mainly related to headcount reduction through 2022, to support the

Group’s reorganization around preclinical and clinical programs, as

well as a decrease of the expenses associated with share-based

payments (non-cash expenses) related to the warrant plan offered to

the Company’s employees, managers and directors.

General and Administrative (G&A) expenses

were €3.7 million in 2023 as compared to €6.2 million in 2022. This

decrease is primarily related to lower insurances costs, the

decrease of employee expenses due to headcount reduction and

management changes through 2022 to support the Company’s

reorganization and the decrease of the expenses associated with the

share-based payments (non-cash expenses) related to the warrants

plan offered to the Company’s employees, managers and

directors.

As of June 30, 2023, there was no change in fair

value of the contingent consideration and other financial

liabilities as Management has determined that there have been no

event (such as a firm sublicense or collaboration contract) that

increases the probability of the projected future cash outflow due

to Celdara Medical, LLC and Dartmouth College, indicating that the

probability is remote, similar to December 31, 2022.

Regarding the other income/other expenses, the

Company recorded €2.1 million in net other income for the first

half of 2023 compared to a net other income of €1.6 million for the

first half of 2022. The net other income for the first half of 2023

is primarily due to the gain on the sale of certain fixed assets to

Cellistic for €1.1 million and grant income from the Walloon Region

of €0.8 million.

Net loss was €3.7 million, or €(0.17) per share,

for the first half of 2023 compared to a net loss of €14.1 million,

or €(0.62) per share, for the same period of 2022.

Net cash used in operations, was €8.3 million

for the first half of 2023 compared to €16.3 million for the first

half of 2022. The decrease of €8.0 million is primarily driven by

the sale of the manufacturing activities in 2022 combined with

global decrease on preclinical and clinical activities, insurance

costs, headcount, management changes costs and associated impact on

the change in working capital.

As of June 30, 2023, the Company had cash and

cash equivalents of €5.0 million. No capital increase has occurred

in the first half of 2023.

As of June 30, 2023, the total number of basic

shares outstanding were 22.6 million similar to December 31,

2022.

Conference Call and Webcast

Details

A conference call will be held on Tuesday 5th of

September at 1:00 p.m. CET / 7:00 a.m. EDT discuss half year 2023

financial results and provide an update on the Company’s recent

changes and upcoming milestones.

Participants may access the conference call by

dialing +1-877-407-9716 or +1-201-493-6779 (United States,

International), +32 (0) 800-73-904 (Belgium Fixed) or +32 (0)

800-73-566 (Belgium Mobile). Participants may ask for instant

telephone access to the event via the “Call me” link or attend the

conference live webcast.

Archived recording will be available in the

"Events" section of the Celyad website after the event.

Financial Calendar 2023

|

|

Third Quarter 2023 Business Update |

The financial calendar is communicated on an

indicative basis and may be subject to change.

About Celyad Oncology

Celyad Oncology is a cutting-edge biotechnology

company dedicated to pioneering the discovery and advancement of

revolutionary technologies for chimeric antigen receptor (CAR)

T-cells. Its primary objective is to unlock the potential of its

proprietary technology platforms and intellectual property,

enabling to be at the forefront of developing next-generation CAR

T-cell therapies. By fully leveraging its innovative technology

platforms, Celyad Oncology aims to maximize the transformative

impact of its candidate CAR T-cell therapies and redefine the

future of CAR T-cell treatments. Celyad Oncology is based in

Mont-Saint-Guibert, Belgium. For more information, please visit

www.celyad.com.

Forward-looking statements

This release may contain forward-looking

statements, within the meaning of applicable securities laws,

including the Private Securities Litigation Reform Act of 1995, as

amended, including, without limitation, statements regarding

beliefs about and expectations for the Company’s updated strategic

business model, including associated potential benefits,

transactions and partnerships, statements regarding the potential

value of the Company’s IP, and statements regarding the

continuation of the Company’s existence. The words “will,”

“potential,” “continue,” “target,” “project,” “should” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Any forward-looking statements in this release

are based on management’s current expectations and beliefs and are

subject to a number of known and unknown risks, uncertainties and

important factors which might cause actual events, results,

financial condition, performance or achievements of Celyad Oncology

to differ materially from those expressed or implied by such

forward-looking statements. Such risks and uncertainties include,

without limitation, risks related to the material uncertainty about

the Company’s ability to continue as a going concern; the Company’s

ability to realize the expected benefits of its updated strategic

business model; the Company’s ability to develop its IP assets and

enter into partnerships with outside parties; the Company’s ability

to enforce its patents and other IP rights; the possibility that

the Company may infringe on the patents or IP rights of others and

be required to defend against patent or other IP rights suits; the

possibility that the Company may not successfully defend itself

against claims of patent infringement or other IP rights suits,

which could result in substantial claims for damages against the

Company; the possibility that the Company may become involved in

lawsuits to protect or enforce its patents, which could be

expensive, time-consuming, and unsuccessful; the Company’s ability

to protect its IP rights throughout the world; the potential for

patents held by the Company to be found invalid or unenforceable;

and other risks identified in Celyad Oncology’s U.S. Securities and

Exchange Commission (SEC) filings and reports, including in the

latest Annual Report on Form 20-F filed with the SEC and subsequent

filings and reports by Celyad Oncology. These forward-looking

statements speak only as of the date of publication of this

document and Celyad Oncology’s actual results may differ materially

from those expressed or implied by these forward-looking

statements. Celyad Oncology expressly disclaims any obligation to

update any such forward-looking statements in this document to

reflect any change in its expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based, unless required by law or regulation.

|

Investor Contact: |

Media Contact: |

|

David GeorgesVP Finance and Administrationinvestors@celyad.com |

Caroline LonezR&D Communications and Business

Developmentcommunications@celyad.com |

|

|

|

Source: Celyad Oncology SA

Celyad Oncology

SAInterim Consolidated Statement of Comprehensive

Income (Unaudited)

|

(€'000) |

For the Six-month period endedJune 30,

2023 |

For the Six-month period endedJune 30,

2022 |

|

Revenue |

44 |

|

- |

|

|

Cost of sales |

(44 |

) |

- |

|

|

Gross profit |

- |

|

- |

|

|

Research and Development expenses |

(2 139 |

) |

(10 527 |

) |

|

General & Administrative expenses |

(3 665 |

) |

(6 245 |

) |

|

Change in fair value of contingent consideration |

- |

|

1 128 |

|

|

Other income |

2 123 |

|

1 781 |

|

|

Other expenses |

(64 |

) |

(214 |

) |

|

Operating Loss |

(3 745 |

) |

(14 077 |

) |

|

Financial income |

26 |

|

148 |

|

|

Financial expenses |

(21 |

) |

(127 |

) |

|

Loss before taxes |

(3 740 |

) |

(14 056 |

) |

|

Income taxes |

- |

|

- |

|

|

Loss for the period |

(3 740 |

) |

(14 056 |

) |

|

Basic and diluted loss per share (in €) |

(0.17 |

) |

(0.62 |

) |

|

Other comprehensive income/(loss) |

|

|

|

Items that will not be reclassified to profit and

loss |

- |

|

- |

|

|

Remeasurement of post-employment benefit obligations, net of

tax |

- |

|

- |

|

|

Items that may be subsequently reclassified to profit or

loss |

(1 |

) |

(9 |

) |

|

Currency translation differences |

(1 |

) |

(9 |

) |

|

Other comprehensive income / (loss) for the period, net of

tax |

(1 |

) |

(9 |

) |

|

Total comprehensive loss for the period |

(3 741 |

) |

(14 065 |

) |

|

Total comprehensive loss for the period attributable to

Equity Holders |

(3 741 |

) |

(14 065 |

) |

Celyad Oncology

SAInterim Consolidated Statement of Financial

Position (Unaudited)

|

(€’000) |

June 30,2023 |

December 31,2022 |

|

NON-CURRENT ASSETS |

4 484 |

|

4 891 |

|

|

Goodwill and Intangible assets |

645 |

|

864 |

|

|

Property, Plant and Equipment |

848 |

|

309 |

|

|

Non-current Grant receivables |

2 782 |

|

3 454 |

|

|

Other non-current assets |

209 |

|

264 |

|

|

CURRENT ASSETS |

7 694 |

|

14 825 |

|

|

Trade and Other Receivables |

879 |

|

1 118 |

|

|

Current Grant receivables |

1 217 |

|

- |

|

|

Other current assets |

622 |

|

1 017 |

|

|

Short-term investments |

- |

|

- |

|

|

Cash and cash equivalents |

4 976 |

|

12 445 |

|

|

Assets held for sale |

- |

|

245 |

|

|

TOTAL ASSETS |

12 178 |

|

19 716 |

|

|

EQUITY |

1 019 |

|

4 317 |

|

|

Share Capital |

78 585 |

|

78 585 |

|

|

Share premium |

6 317 |

|

6 317 |

|

|

Other reserves |

35 242 |

|

34 800 |

|

|

Capital reduction reserve |

234 562 |

|

234 562 |

|

|

Accumulated deficit |

(353 687 |

) |

(349 947 |

) |

|

NON-CURRENT LIABILITIES |

5 067 |

|

4 973 |

|

|

Lease liabilities |

351 |

|

118 |

|

|

Recoverable Cash advances (RCAs) |

4 486 |

|

4 584 |

|

|

Contingent consideration payable and other financial

liabilities |

- |

|

- |

|

|

Post-employment benefits |

13 |

|

13 |

|

|

Other non-current liabilities |

217 |

|

258 |

|

|

CURRENT LIABILITIES |

6 092 |

|

10 426 |

|

|

Lease liabilities |

185 |

|

137 |

|

|

Recoverable Cash advances (RCAs) |

763 |

|

437 |

|

|

Trade payables |

3 411 |

|

4 752 |

|

|

Other current liabilities |

1 733 |

|

5 100 |

|

|

TOTAL EQUITY AND LIABILITIES |

12 178 |

|

19 716 |

|

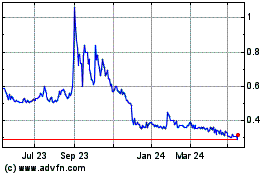

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

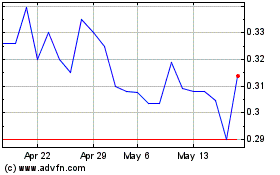

Celyad Oncology (EU:CYAD)

Historical Stock Chart

From Nov 2023 to Nov 2024