IBA Reports Half Year 2024 Results

29 August 2024 - 3:00PM

UK Regulatory

IBA Reports Half Year 2024 Results

GROUP REVENUES UP 21.9%

ACCELERATED BACKLOG CONVERSION IN PROTON

THERAPY AND OTHER ACCELERATORS

STRONG GROSS MARGIN IMPROVEMENT AND BREAKEVEN

REBIT

Louvain-la-Neuve, Belgium, 29 August

2024 - IBA (Ion Beam Applications S.A), the world leader

in particle accelerator technology, today announces its

consolidated results for the first half of 2024.

|

(EUR 000) |

H1 2024 |

H1 2023 |

Variance |

Variance % |

|

Total Revenues |

206 452 |

169 418 |

37 034 |

21.9% |

|

Proton Therapy |

107 724 |

95 082 |

12 642 |

13.3% |

|

Other Accelerators |

70 078 |

41 354 |

28 724 |

69.5% |

|

Dosimetry |

28 649 |

32 982 |

-4 333 |

-13.1% |

|

REBITDA |

6 776 |

-13 859 |

20 635 |

148.9% |

|

% of Revenues |

3.3% |

-8.2% |

|

|

|

REBIT |

43 |

-20 296 |

20 339 |

100.2% |

|

% of Revenues |

0.0% |

-12.0% |

|

|

|

Profit Before Tax |

-6 818 |

-22 656 |

15 838 |

69.9% |

|

% of Revenues |

-3.3% |

-13.4% |

|

|

|

NET RESULT |

-10 302 |

-27 263 |

16 961 |

62.2% |

|

% of Revenues |

-5.0% |

-16.1% |

|

|

Financial summary

- Group H1 revenues increased by 21.9% to EUR 206.5 million (H1

2023: EUR 169.4 million), driven by accelerated backlog conversion

and increasing Services revenues across all businesses

- Gross margin increased to 33.8%, up from 26.6% last year,

driven in particular by an increase in the proportion of Other

Accelerators revenues, improvement of project cost estimates and

better margin mix in Proton Therapy (PT)

- Group REBIT of EUR 0.04 million, a strong improvement on the

same period last year, reflecting a combination of backlog

conversion, improvement in gross margin and the uptick in Services

revenues

- Group order intake of EUR 113.9 million; of which PT was EUR

34.9 million, Other Accelerators was EUR 47.5 million and Dosimetry

was EUR 31.5 million

- Strong acceleration of backlog conversion, but with equipment

and upgrade backlog still standing at EUR 715 million (FY 2023: EUR

720 million). Overall Group Equipment and Services backlog remains

high at EUR 1.4 billion

- Both PT and Other Accelerators Services revenues grew 8.8%

- Total Group net loss of EUR 10.3 million (H1 2023: EUR 27.3

million loss)

- Healthy balance sheet, with EUR 60.2 million gross cash and EUR

21.7 million net cash position. Cash position reflects strong

procurement and backlog conversion activity over the period. EUR 60

million undrawn short-term credit lines available at period

end

- Mid-term guidance reiterated

Business summary

- 14 Other Accelerators systems sold in H1, a significant

increase on the previous year (H1 2023: 8 systems)

- One Proteus®ONE1 system sold in H1 to

Connecticut Proton Therapy Center (H1 2023: Two

Proteus®ONE systems and one

Proteus®PLUS1 system) and a partial

Proteus®PLUS1 equipment batch sold to

CGN

- Post-period, memorandum of understanding (MoU) signed for two

Proteus®ONE proton therapy solutions with the University

of Pennsylvania Health System

- 35 PT projects under construction or installation at the end of

the period with good progress on major Spanish and Chinese

projects

- Strong Industrial Solutions performance, with excellent backlog

conversion and growing Services revenue

- Dosimetry acquisition completed of California-based RadCal

Corporation, specialists in medical imaging Quality Assurance

- IBA and SCK CEN’s joint venture PanTera secured four commercial

agreements for early supply of actinium-225 (225Ac) in a

highly active market

- B Corp certification renewed during the period, with a

significantly improved score of 114 points (2021: 90 points),

placing the Group among the top 10% of those certified

globally

Olivier Legrain, Chief Executive Officer

of IBA, commented: “In the first half of the year, we

have made excellent progress with the acceleration of backlog

conversion. Other Accelerators has had a particularly strong first

half, with a high number of systems sold, strong backlog conversion

and growing Services revenues. In the Proton Therapy division,

alongside the accelerated delivery of projects, there was an uptick

in margins as project costs stabilized after last year’s high

inflation.

“While the Dosimetry business was affected

during the period by scheduled timing impacts, with slower backlog

conversion in the first half and some market effects, we are

expecting this to accelerate in the second half of the year,

boosted also by the acquisition of RadCal. We are also pleased with

the strong progress made by our joint venture PanTera, which is

seeking to address the global supply shortage of

actinium-225.

“Following the encouraging first half, our

strong pipeline across all business units underpins our confidence

for the remainder of the year and we expect a second half weighting

of financial performance. Looking further ahead, we continue to

reshape our businesses and provide them with more accountability in

order to capitalize on future growth opportunities while

safeguarding our core values across IBA. We are committed to

delivering strong results as we continue to innovate to serve our

customers in all four businesses. Alongside this, we remain

confident on delivering our mid-term guidance with strong progress

already being made towards meeting our targets.”

***ENDS***

Olivier Legrain, Chief Executive Officer, Henri

de Romrée, Deputy Chief Executive Officer and Soumya Chandramouli,

Chief Financial Officer, will host a conference call and webcast to

present the Interim results, followed by a Q&A session.

The conference call will be held on

Thursday, 29 August 2024 at 3pm CEST / 2pm

BST / 9am EDT / 6am PDT as a Teams

webinar and can be accessed via this link.

If you would like to join by phone only, please

dial (Phone conference ID 533 540 829#)

Belgium:

+32 2 890 97 20

UK:

+44 20 3321 5200

NL:

+31 20 708 6901

LU:

+352 27 87 00 02

US:

+1 347-991-7591

FR:

+33 1 70 99 53 51

The presentation will be available on IBA’s

investor relations website and on:

https://www.iba-worldwide.com/iba-half-year-2024-results-presentation-and-press-release

shortly before the call.

To ensure a timely connection, it is recommended

that users register at least 10 minutes prior to the scheduled

webcast.

For participants who do not have the Teams

application installed, please follow the process described in this

link to access the conference.

Financial calendar

Business Update Q3

2024

21 November 2024

Full Year Results

2024 20

March 2025

Capital Markets Day

Q2 2025

Business Update First Quarter

2025 22

May 2025

Annual General

Meeting 11

June 2025

Half Year Results 2025

28 August 2025

About IBA

IBA (Ion Beam Applications S.A.) is the world

leader in particle accelerator technology. The company is the

leading supplier of equipment and services in the field of proton

therapy, considered to be the most advanced form of radiation

therapy available today. IBA is also a leading player in the fields

of industrial sterilization, radiopharmaceuticals and dosimetry.

The company, based in Louvain-la-Neuve, Belgium, employs

approximately 2,000 people worldwide. IBA is a certified B

Corporation (B Corp) meeting the highest standards of verified

social and environmental performance.

IBA is listed on the pan-European stock exchange

EURONEXT (IBA: Reuters IBAB.BR and Bloomberg IBAB.BB). More

information can be found at: www.iba-worldwide.com

For further information, please

contact:

IBA

Soumya Chandramouli

Chief Financial Officer

+32 10 475 890

Investorrelations@iba-group.com

Olivier Lechien

Corporate Communication Director

+32 10 475 890

communication@iba-group.com

For media and investor enquiries:

ICR Consilium

Amber Fennell, Angela Gray, Lucy Featherstone

+44 (0) 20 3709 5700

IBA@icrhealthcare.com

1 Proteus®ONE and Proteus®PLUS

are the brand names of Proteus®235

- 240829-IBA-HY24-results-EN-3

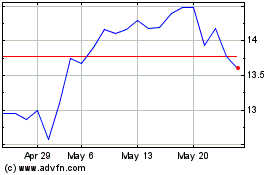

Ion Beam Applications (EU:IBAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ion Beam Applications (EU:IBAB)

Historical Stock Chart

From Dec 2023 to Dec 2024