Mithra reports full year 2023 financial results

Mithra reports full year 2023 financial

results

- Revenues were

EUR 40.2 million, down from the 2022 result of EUR 67.0 million

which was positively impacted by exceptional upfront cash payments

from partnerships.

- Product sales

were EUR 18.7 million, up +19.3% vs EUR 15.7 million in 2022.

-

ESTELLE® product sales reached EUR 10.4 million in

2023 beating the September 2023 guidance of EUR 8.5 million and up

from EUR 9.2 million in 2022.

- Cash position,

at EUR 9.0 million at end of 2023, is down compared to previous

year (EUR 28.3 million end 2022).

- In an effort to

maximize value for all of Mithra’s stakeholders, the Company has

initiated a Monetization Process to realize value from its assets

involving the sale of various selected assets, particularly Estetra

SRL (which includes the US DONESTA® out-licensing

process), and/or the business as a whole.

- The delay in

the DONESTA® US NDA filing negatively impacted the

process to consummate a US licensing agreement, also negatively

impacting expected revenues.

- Triggered by

the monetization process, management recognized an impairment loss

of EUR 74.1 million on two of those assets (namely the Mithra CDMO

and ZORELINE®). This accounting conclusion does

not affect the management’s commitment to continue to find the best

possible outcome for those assets. Due to these impairments

(non-cash items), among other factors, the net loss for the period

was EUR 173.5 million.

- Post-closing

events include the 06 February 2024 announcement of Mithra’s cash

position of EUR 6.5 million, the 15 February 2024 sale of

balance of shares held in Mayne Pharma for approximately

EUR 12.8 million, the 05 March 2024 announcement of up to EUR

18.5 million bridge facility to initiate a monetization process of

key Mithra assets, and the 05 March 2024 change of management

announcement.

Liege, Belgium, 08 March 2024 – 7:00

CET – Mithra (Euronext Brussels: MITRA), a company

dedicated to Women’s Health, today announces its financial results

for the year which ended on 31 December 2023, prepared in

accordance with IFRS.

Financial Highlights

See "Note regarding basis of preparation" on

page 5 below.

- FY 2023

revenues were EUR 40.2 million compared to EUR

67.0 million in 2022.

-

Out-licencing revenues at EUR 19.0 million were

mostly driven by ESTELLE® in 2023. On top of EUR

3.75 million invoiced to our partner Fuji, another EUR 12.5 million

has been recognized as revenue according to our IFRS 15 accounting

policy (respectively EUR 2.5 million with Gedeon Richter for China

and EUR 10.0 million with Fuji). Balance of out-licencing was

primarily for DONESTA® with EUR 1.5 million

invoiced to our partner Searchlight and EUR 1.13 million recognized

under IFRS for China and Israel.

-

ESTELLE® product sales, at EUR

10.4 million, were above 2022 level (EUR 9.2 million) and above our

latest guidance (EUR 8.5 million) given in September. This is due

to, amongst other items, our first deliveries to our Japan partner

Fuji Pharma.

- Total number of

cycles of ESTELLE® (NEXTSTELLIS®)

sold by our partner in the US Mayne Pharma increased +136% to 385k

cycles. The increase in sales is expected to continue in 2024.

-

ESTELLE® cycle sales in Europe

(DROVELIS® and LYDISILKA® brand

names) increased by 103% to 3.2 million cycles in 2023.

- Novalon

sales of generic products,

including MYRING®, TIBELIA® and

DAPHNE®, were EUR 8.1 million in 2023, up by +28%

compared to the previous year while R&D contracting

revenue from our CDMO remained steady at EUR 2.4

million.

- Cash

collection from out-licensing milestones totalled EUR 56.4

million in 2023; EUR 51.5 million from DONESTA®

(EUR 50.0 million from Gedeon Richter, out of which

EUR 39.7 million was recognized in 2022 according to IFRS

15 and EUR 1.5 million from Searchlight); EUR 4.8 million from

ESTELLE® (EUR 3.8 million from Fuji Pharma and EUR

1.0 million from Gedeon Richter for two LATAM territories

previously recognised under IFRS).

- R&D

expenses (excluding depreciation) decreased slightly (EUR

52.9 million in 2023 versus EUR 53.7 million in 2022) coming in

below the guidance of EUR 60 million given in May 2023. The stable

level of spend is a product of the continued strategy to focus on

core R&D projects (DONESTA® and

ESTELLE®) and discontinuing or pausing other

research activities outside Mithra’s core scope.

-

REBITDA was EUR -48.2 million in 2023 compared to

EUR -12.3 million in 2022 year mostly due to lower out-licencing

revenue and, to a lesser extent, an increase in G&A expenses

and lower other operating income.

-

Share-based payments expenses include the one-time

(non-cash) expense of EUR 4.1 million relating to the 20 million

warrants issued to Armistice Capital, LLC; the remaining being the

balance of costs relating to previously awarded plans.

-

Impairment on non-current assets: due to current

cash runway situation, focus for non-core assets has now shifted to

short-term sale or disposal. Accordingly, an impairment loss of EUR

74.1 million for two such assets has been recorded in FY 2023

financial statements: EUR 47.7 million for Mithra CDMO and EUR 26.4

million for ZORELINE®. This accounting conclusion

does not affect the management’s commitment to continue to find the

best possible outcome for those assets.

- Deferred

tax assets: Balance of deferred tax assets previously

recognized within Mithra CDMO and Novalon have been reversed as

essentially relating to expected future taxable profit of

ZORELINE®, now most likely to be sold in the short

term.

- Cash

position, at EUR 9.0 million at end 2023, is down compared

to previous year (EUR 28.3 million end 2022) as revenue cash

collection, capital increases and draw-down on existing financing

lines did not compensate for expenses as well as reimbursement of

several credit lines with some of our lenders.

-

Equity was EUR -103.2 million at the end of 2023,

down EUR 136.9 million compared to end 2022 (EUR 33.7 million). The

total comprehensive loss for the period (EUR 167.1 million)

was only partially compensated by a capital increase of

EUR 2.5 million with Highbridge and Whitebox, a loan

conversion by a lender under the convertible loan facility (EUR 1.2

million) and several contributions in kind against the issuance of

new shares for interest to the lenders for a total of EUR 3.5

million (net of transaction costs) and by the private placement in

equity with Armistice Capital LLC for EUR 18.4 million (net of

transaction costs of EUR 1.6 million).

Operational highlights

- Mithra

announced positive preclinical data from its CSF-1R inhibitor

program following the earlier announcement of its initial

pre-clinical study successes. This was achieved in partnership with

BCI Pharma and focused on tyrosine kinases inhibitors, a new

development axis in the treatment of many pathologies including

endometriosis, oncology and inflammatory disorders.

- Mithra

announced promising topline safety results from

DONESTA® Phase 3 Study

in North America positive topline safety results for its E4 COMFORT

clinical trial in the United States and Canada aiming at evaluating

the efficacy and safety of DONESTA® for the

treatment of Vasomotor Symptoms (VMS) in post-menopausal

women.

- Mithra

and the University of Liège secure proof-of-concept for novel

manufacturing process of E4 delivering an improved

manufacturing methodology to boost robustness and productivity

while ensuring a limited environmental footprint. The new

metal-free process is based on the thermolysis of a key sulfoxide

derivative of estrone.

- Mithra

granted an additional patent for

NEXTSTELLIS® (3 mg drospirenone and 14.2

mg estetrol (E4) tablets) in the United States by the United States

Patent and Trademark Office. The new patent will provide

NEXTSTELLIS® contraceptive with oral-dosage-unit

protection in the US market until 2036. The patent is a

continuation of U.S. Patent No. 11,147,771 and was listed in the

FDA’s Orange Book.

- Mithra

received guidance from the FDA for the

DONESTA® NDA marketing

authorization filing in the US and received positive DSMB opinion

on the DONESTA® European

Phase 3 trial. Mithra received feedback regarding its new

drug application (NDA) marketing authorization filing for

DONESTA® in the United States. This follows an

agreement in principle with the FDA for Mithra to conduct

additional endometrial data analyses with a formal NDA submission

now planned for Q4 2024 to allow for the time required to perform

these additional analyses pursuant to FDA guidance. Pending

regulatory approval, DONESTA® is expected to

target a US market of nearly 63 million women between the ages of

45 and 65 years-old and experiencing vasomotor symptoms of

menopause (VMS). Mithra also received a positive review from the

independent Data and Safety Monitoring Board (DSMB) on its phase 3

program for DONESTA®.

- Mithra

completed its pediatric study of

ESTELLE® in adolescent

patients, evaluating the safety, compliance, and

pharmacokinetic profile of ESTELLE® in more than

100 participants aged 12 to 17 years old. The primary endpoint of

the study, which was conducted in Estonia, Finland, Georgia,

Latvia, Poland and Sweden, was to evaluate the safety of

ESTELLE® in post-menarchal subjects.

- Mayne

Pharma and Mithra announced the US launch of

HALOETTE®, a vaginal hormonal

contraceptive ring, resulting in a EUR 1.6 million milestone

payment. HALOETTE® is a generic version of

NUVARING®. According to IQVIA,

NUVARING® US brand and generic sales were

approximately USD 564 million for the 12 months ended November

2022.

- Mithra

signs license agreement for the commercialization of

DONESTA® with Gedeon Richter, Searchlight

and Rafa Laboratories expanding its potential reach to Canada,

Israel, Europe, the CIS countries, Latin America, Australia and New

Zealand.

- Mithra

received EUR 3.75 million milestone payments from Fuji Pharma under

its ESTELLE® licensing agreement

in Japan. A payment of EUR 1.25 million was triggered by

completion of the interim clinical study reports of Phase 3 trials

investigating ESTELLE® for the treatment of

patients with dysmenorrhea or endometriosis. An additional EUR 2.5

million payment was made in October following the submission of an

application for marketing approval in Japan in a drive to help

combat dysmenorrhea.

- Mithra

and Gedeon Richter signed a supply agreement for production of API

for ESTELLE® and

DONESTA® in August. The agreement

specifies that Gedeon Richter will manufacture and supply the

Estetrol (E4) native estrogen for Mithra’s leading products.

- Mithra

and Gedeon Richter signed a binding Head of Terms to commercialize

ESTELLE® and

DONESTA® in China. Upon

the finalization of the license agreements, Gedeon Richter will

have the exclusive commercial rights for both products in China.

Under the head of terms, Gedeon Richter to perform and fund the

clinical studies required to obtain marketing approvals in China;

upon the closing of the two licencing agreements, Mithra to receive

a combined milestone payment of EUR 4.5 million.

Events beyond the reporting

period

- Mithra

provided an update on its current cash position and its

plans to address its runway and creating and optimizing value for

all its stakeholders on 06 February, 2024.

-

Announced the sale of all 4,221,815 shares it held in Mayne

Pharma Group Limited on 15 February 2024. The shares were

sold at a price of A$ 5.03 per share for aggregate net proceeds of

A$ 21,129,551 (approx. EUR 12.8 million).

- Reported

the last patient-out in the DONESTA®

C301 Endometrial Safety Study. was reached on 8 February

2024. This marks the completion of patient treatments and

the initiation of the data management/reporting

phase.

- On 05

March 2024, Mithra announced the initiation of a monetization

process and signing of a new secured bridge loan facility expected

to fund that process through 30 April. The monetization

process and Facility are further to Mithra’s 06 February 2024

announcement on its cash position. In an effort to maximize value

for all of Mithra’s stakeholders, the Company has initiated a

monetization process to realize value from its assets involving the

sale of various selected assets, particularly Estetra SRL, and/or

the business as a whole. The Company is finalizing negotiations

with an internationally recognized investment bank to help conduct

the Monetization Process in collaboration with DC Advisory and

Alvarez & Marsal, who are advising on liquidity management and

advising on monetization, among other things. Parties interested in

participating in the Monetization Process should contact Ed Kulik

of DC Advisory (Ed.Kulik@dcadvisory.com) and Thomas Dillenseger of

Alvarez & Marsal

(TDillenseger@alvarezandmarsal.com).

-

Management Changes: Appointment of Christophe

Maréchal1 and Xavier Paoli as co-CEOs following, 05 March 2024

termination of the management agreement of former CEO.

Financial

results Note

regarding basis of preparation: The consolidated financial results

of Mithra Pharmaceuticals SA and its subsidiaries (“Mithra”)

included in this release have been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union. These include International Financial Reporting

Standards (IFRS) and the related interpretations issued by the

International Accounting Standards Board (IASB), and the IFRS

Interpretations Committee (IFRIC), effective at the reporting date

and adopted by the European Union.

These consolidated financial results have been

prepared on the basis of a going concern. However, as announced on

06 February 2024 and 05 March 2024, there are material

uncertainties about Mithra's ability to continue in operation

beyond 30 April 2024. As of 07 March 2024, Mithra has approximately

EUR 9.0 million in cash and cash equivalents including the first

drawdown under the bridge facility. Its lenders have provided a

committed bridge facility of up to EUR 13.5 million, plus an

uncommitted "accordion" facility for a further EUR 5 million, in

each case subject to milestones, as described in that 05 March 2024

press release, in order to fund a monetization process. However, as

noted in that release there is a risk that Mithra will not be able

to draw the full amount, for instance if it is not able to initiate

a Monetization Process. Even if a Monetization Process is

initiated, there is a material risk that that process will not be

successful, in whole or in part, or may not significantly reduce

Mithra's existing indebtedness. If Mithra is not able to draw funds

under the new bridge facility or is otherwise not able to raise or

generate sufficient cash, this will adversely affect Mithra's

continued operations and ability to operate as a going concern.

1. Consolidated statement

of profit or loss

|

Thousands of euro (€) |

2023 |

2022 |

|

|

|

|

|

Revenue |

40,155 |

66,997 |

|

Cost of sales |

(21,950) |

(19,623) |

|

Gross profit |

18,205 |

47,374 |

|

Research and development expenses |

(63,170) |

(64,041) |

|

General and administrative expenses |

(22,085) |

(14,675) |

|

Selling expenses |

(2,271) |

(2,100) |

|

Impairment on non-current assets |

(74,147) |

- |

|

Other operating income |

4,336 |

7,196 |

|

Loss from operations |

(139,132) |

(26,245) |

|

Change in fair value of contingent consideration payable |

(1,510) |

28,335 |

|

Net fair value gains/(losses) on financial assets at fair value

through profit or loss |

- |

- |

|

Financial income |

1,745 |

9,852 |

|

Financial expenses |

(22,899) |

(23,422) |

|

Loss before taxes |

(161,795) |

(11,480) |

|

Income taxes |

(11,707) |

(48,139) |

|

NET LOSS FOR THE PERIOD |

(173,502) |

(59,620) |

2. Consolidated statement

of financial position

|

|

As at 31 December |

|

Thousands of euro (€) |

2023 |

2022 |

|

ASSETS |

|

|

|

Property, plant and equipment |

13,405 |

40,717 |

|

Right-of-use assets |

38,083 |

65,534 |

|

Goodwill |

5,233 |

5,233 |

|

Other intangible assets |

108,713 |

134,905 |

|

Deferred income tax assets |

1,289 |

16,354 |

|

Contract assets |

179 |

2.828 |

|

Derivatives financial assets |

349 |

- |

|

Investment in equity securities |

16,015 |

21,437 |

|

Other non-current assets |

9,874 |

9,544 |

|

Non-current assets |

193,139 |

296,552 |

|

|

|

|

|

|

|

|

|

Inventories |

48,289 |

50,312 |

|

Contract assets |

19,536 |

44,988 |

|

Derivatives financial assets |

47 |

- |

|

Trade and other receivables |

16,556 |

22,277 |

|

Other short-term deposits |

- |

- |

|

Cash and cash equivalents |

8,980 |

28,285 |

|

Current assets |

93,408 |

145,863 |

|

|

|

|

|

TOTAL ASSETS |

286,546 |

442,414 |

|

|

As at 31 December |

|

Thousands of euro (€) |

2023 |

2022 |

|

EQUITY AND LIABILITIES |

|

|

|

Share capital |

50,594 |

41,228 |

|

Additional paid-in-capital |

424,858 |

408,647 |

|

Other reserves |

10,586 |

(19,934) |

|

Accumulated deficit |

(589,294) |

(396,254) |

|

Equity attributable to equity holders |

(103,255) |

33,687 |

|

|

|

|

|

|

|

|

|

Subordinated loans |

9,791 |

10,710 |

|

Other loans |

137,739 |

127,052 |

|

Lease liabilities |

31,631 |

38,253 |

|

Refundable government advances |

7,647 |

8,127 |

|

Other financial liabilities |

73,731 |

74,210 |

|

Derivatives financial liabilities |

13,636 |

15,261 |

|

Contract liabilities |

10,300 |

- |

|

Provisions |

266 |

266 |

|

Deferred tax liabilities |

1,081 |

4,420 |

|

Non-current liabilities |

285,822 |

278,298 |

|

|

|

|

|

|

|

|

|

Current portion of subordinated loans |

1,252 |

1,252 |

|

Current portion of other loans |

19,001 |

45,980 |

|

Current portion of lease liabilities |

6,450 |

5,179 |

|

Current portion of refundable government advances |

2,507 |

1,417 |

|

Current portion of other financial liabilities |

15,698 |

15,959 |

|

Derivatives financial liabilities |

- |

2,561 |

|

Trade and other payables |

59,072 |

58,082 |

|

Current liabilities |

103,981 |

130,431 |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

286,546 |

442,414 |

3. Consolidated statement

of cash flows

|

|

As at 31 December |

|

Thousands of euro (€) |

2023 |

2022 |

|

Cash and cash equivalents at beginning of year |

28,285 |

32,872 |

|

Net cash (used in)/ provided by operating activities |

(2,184) |

(56,819) |

|

Net cash (used in)/ provided by investing activities |

3,452 |

(25,490) |

|

Net cash (used in)/provided by financing activities |

(20,538) |

77,869 |

|

Net increase/(decrease) in cash and cash equivalents |

(19,270) |

(4,440) |

|

Effects of exchange rate changes on cash and cash equivalents |

(35) |

(147) |

|

Cash and cash equivalents at end of period |

8,980 |

28,285 |

Statement of profit and

loss

The Group reported a net loss of EUR 173.5

million in 2023, compared to a net loss of EUR 59.6 million in

2022. The main contributor to this difference was an impairment

loss of EUR 74.1 million registered on the value of Mithra CDMO and

ZORELINE® assets.

Revenues were EUR 40.2 million compared with EUR

67.0 million in 2022. The revenues breakdown as follows:

- Overall product

sales of EUR 18.7 million were largely driven by

ESTELLE® (EUR 10.4 million), which are higher than

in 2022 (EUR 9.2 million) and

MYRING® (EUR 6.0 million) that improves the

revenue on our generic portfolio to EUR 8.3 million compared to EUR

6.5 million in 2022.

- Out-licensing

revenue for the year was EUR 19 million from

ESTELLE® and DONESTA® milestones

(EUR 16.3 million and EUR 2.6 million, respectively). For

ESTELLE®, on top of EUR 3.75 million invoiced to

our Partner Fuji, another EUR 12.5 million has been recognized as

revenue according to our IFRS 15 accounting policy (respectively

EUR 2.5 million with Gedeon Richter for China and EUR 10.0 million

with Fuji). Balance of out-licencing was primarily for

DONESTA® with EUR 1.5 million invoiced to our

partner Searchlight and EUR 1.13 million recognised under IFRS for

China and Israel.

- Revenues from

the R&D contracting activities of the CDMO were stable at EUR

2.4 million compared to EUR 2.3 million in 2022.

R&D expenses (including depreciation)

decreased slightly to EUR 63.2 million. The stable level of

research expenses is due to the continued focus on our core R&D

projects, namely the DONESTA® Phase II and III clinical studies and

the ESTELLE® post-approval safety study (PASS).

G&A and selling expenses increased +44% to

EUR 24.4 million due to a higher impact of share-based payments

accounting entries (charge of EUR 4.5 million compared to charge of

EUR 2.0 million in 2022); increase in professional services to

assist us in our attempt to strengthen our balance sheet and

refocus on innovative R&D, but also relating to administration

of our financial liabilities and uncomfortable cash position; and,

to a lesser extent, an increase in insurance costs and salaries

indexation.

Impairment on non-current assets: as focus for

non-core assets has now shifted to short-term sale or disposal of

those assets, an impairment loss of EUR 74.1 million for two such

assets has been recorded in FY 2023 financial statements: EUR 47.7

million for Mithra CDMO and EUR 26.4 million for ZORELINE®.

Other operating income of EUR 4.3 million

(compared to EUR 7.2 million in 2022) mostly consists of an R&D

tax credit for EUR 1.3 million which is directly related to R&D

expenses level and of EUR 1.4 million exemption from the

withholding tax on professional income for R&D staff. Main

reason for lower other operating income is that last year included

a reinvoicing of costs of EUR 2.2 million that did not repeat in

2023.

The negative impact of approximately EUR -1.5

million for change in fair value related to contingent

consideration payable ESTELLE® is the consequence of the update of

both the discount rate and the timing effect.

The decrease in financial income to EUR 1.7

million from EUR 9.9 million in 2022 is explained by the lower

impact of the remeasurement of refundable government advances

measured at amortized cost following the update of forecasts (EUR

0.5 million in 2023 vs EUR 3.6 million last year). Last year also

included EUR 3.0 million of dividend from Mayne Pharma as well as a

realized gain of EUR 2.5 million following the early repurchase of

EUR 34.1 million tranche of our convertible bonds due in 2025 at a

discount to par, via the convertible loan signed with Highbridge

Capital Management, LLC (“Highbridge“) and funds managed by

Whitebox Advisors, LLC (“Whitebox”).

Financial expenses remained stable compared to

last year, albeit at a high level. The group recorded a tax loss of

EUR -11.7 million for 2023 as the balance of deferred tax assets

previously recognised within Mithra CDMO and Novalon have been

reversed as essentially relating to expected future taxable profit

of ZORELINE® now most likely to be sold in the short term.

Statement of financial

position

As of 31 December 2023, the statement of

financial position shows a total of EUR 193.1 million in

non-current assets-- the majority of which are other intangible

assets (EUR 108.7 million); right-of-use assets (EUR 38.1 million);

investments in equity securities (EUR 16.0 million); property,

plant and equipment (EUR 13.4 million) and deferred tax assets (EUR

1.3 million).

In 2023, new additions to the other intangible

assets have been limited to a total of EUR 4.2 million

(EUR 33.3 million in 2022) and almost offset by EUR 3.5

million of depreciation. Main change of 2023 was the result of the

impairment testing of our CDMO and ZORELINE® that led to a one-time

depreciation of EUR 27.0 million (EUR 0.6 million and EUR 26.4

million respectively for the CDMO and ZORELINE®).

The same impairment testing also led to a

one-time depreciation of EUR -47.2 million on our CDMO Tangible

fixed assets (Property, plant and equipment and the right-of-use

assets). Otherwise, limited additions during the year (EUR 1.2

million) were more than offset by depreciation of the period

(EUR 8.2 million). Deferred tax assets decreased to EUR 1.3

million as balance of deferred tax assets previously recognised

within Mithra CDMO and Novalon have been reversed as essentially

relating to expected future taxable profit of our complex

therapeutics products now most likely to be sold in the short

term.

Contract assets amount decreased to EUR 19.7

million (non-current and current) versus EUR 47.8 million in 2022.

New contract assets recognized (essentially EUR 10 million for Fuji

and EUR 3.5 million relating to ESTELLE® & DONESTA® in China)

were more than offset by unbilled revenues recognised in prior

year(s) and invoiced in 2023 (EUR 40.7 million for Gedeon

Richter).

Current assets at the end of 2023 are about EUR

93.4 million and include, besides contract assets explained here

above, Cash and cash equivalents of EUR 9.0 million, Trade &

other receivables of EUR 16.6 million, and Inventories of EUR 48.3

million.

Total equity at year-end is negative at EUR

-103.3 million as the total comprehensive loss for the period (EUR

167.1 million) was only partially compensated by several capital

increases for a total amount of EUR 25.6 million (net of

transaction costs).

Non-current liabilities increased to EUR 285.8

million at the end of 2023, compared to EUR 278.3 million end

of 2022. The main changes during the period relate to the access in

June 2023 to a new tranche of the amended loan facility concluded

with funds managed by Highbridge and Whitebox (“Convertible loans”

in the above table) for an amount of EUR 12.5 million and the

recognition of a contract liability of EUR 10.3 million with Gedeon

Richter for DONESTA®.

Current liabilities decreased to EUR 104.0

million at the end of 2023, compared to EUR 130.4 million in

2022. The decrease of the Current liabilities is mainly explained

by the reimbursement of straight loans at maturity for an amount of

EUR 26.8 million.

Alternative performance

measures

Mithra uses some alternative performance

measures (APMs) that are not defined in IFRS but that provide

helpful additional information to better assess how the business

has performed over the period. Mithra decided to use REBITDA and

EBITDA in order to provide information on recurring items, but

those measures should not be viewed in isolation or as an

alternative to the measures presented in accordance with IFRS.

REBITDA is an alternative performance measure

calculated by excluding the non-recurring items and the

depreciation & amortization from EBIT (loss from operations)

from the consolidated statement of profit or loss prepared in

accordance with IFRS. The Group considers share-based payments as

non-recurring item above EBITDA.

EBITDA is an alternative performance measure

calculated by excluding the depreciation and amortization from EBIT

(loss from operations) from the consolidated statement of profit or

loss prepared in accordance with IFRS.

Financial highlights are presented as follows in

the first section of this press release (management figures):

|

|

Year ended 31 December |

|

Thousands of euro (€) |

2023 |

2022 |

|

|

|

|

|

Revenue |

40,155 |

66,997 |

|

Cost of sales |

(21,189) |

(19,112) |

|

Gross profit |

18,966 |

47,886 |

|

Research and development expenses |

(52,869) |

(53,668) |

|

General and administrative expenses |

(16,450) |

(11,707) |

|

Selling expenses |

(2,213) |

(2,029) |

|

Other operating income |

4,336 |

7,196 |

|

REBITDA |

(48,231) |

(12,322) |

|

Share-based payments expenses |

(4,540) |

(1,983) |

|

EBITDA |

(52,771) |

(14,305) |

|

Depreciation |

(12,214) |

(11,940) |

|

Non-recurring items |

(74,147) |

- |

|

Loss from operations |

(139,132) |

(26,245) |

|

Change in fair value of contingent consideration payable |

(1,510) |

28,335 |

|

Net fair value gains/(losses) on financial assets at fair value

through profit or loss |

- |

- |

|

Financial income |

1,745 |

9,852 |

|

Financial expenses |

(22,899) |

(23,422) |

|

Loss before taxes |

(161,795) |

(11,480) |

|

Income taxes |

(11,707) |

(48,139) |

|

NET LOSS FOR THE PERIOD |

(173,502) |

(59,620) |

Please refer to the table below for the

reconciliation to loss from operations as presented within

consolidated statement of profit or loss:

|

|

Year ended 31 December |

|

Thousands of euro (€) |

2023 |

2022 |

|

Loss from operations |

(139,132) |

(26,245) |

|

Depreciation |

12,214 |

11,940 |

|

Non-recurring items – impairment charges on non-current assets |

74,147 |

- |

|

Share-based payments expenses |

4,540 |

1,983 |

|

REBITDA |

(48,231) |

(12,322) |

|

Share-based payments expenses |

(4,540) |

(1,983) |

|

EBITDA |

(52,771) |

(14,305) |

Annual report 2023The auditor, BDO

Réviseurs d’Entreprises SRL, has stated that the statutory audit is

still ongoing as of the date of this press release. Based on the

unfinished status of the audit procedures and the uncertainty about

the evolution of the group in the coming weeks, the auditor is not

yet able to provide information on the audit opinion he intends to

issue on the consolidated financial statements.

Financial CalendarThe following

are anticipated dates in the Company's 2024 financial calendar and

subject to change:

- 16 April 2024: 2023 Annual

Report

- 16 May 2024: Annual General

Shareholders’ Meeting

- 26 September 2024: Half Year Report

2024

For more information, please

contact:

|

Mithra Pharmaceuticals SAAlex Sokolowski, PhDHead

of IR &

Communicationsinvestorrelations@mithra.com

+32 (0)4 349 28 22 |

Frédérique Depraetere Communications Directorinfo@mithra.com+32

(0)4 349 28 22 |

About Mithra Mithra

Pharmaceuticals SA (Euronext: MITRA) is a Belgian biopharmaceutical

company dedicated to transforming women’s health by offering new

choices through innovation, with a particular focus on

contraception and menopause. Mithra’s goal is to develop products

offering better efficacy, safety and convenience, meeting women’s

needs throughout their life span. Mithra explores the potential of

the unique native estrogen estetrol in a wide range of applications

in women health and beyond. After having successfully launched the

first estetrol-based product in 2021, the contraceptive pill

ESTELLE®, Mithra is now focusing on its second product DONESTA®,

the next-generation hormone therapy. Mithra also offers partners a

complete spectrum of solutions from early drug development,

clinical batches and commercial manufacturing of complex polymeric

products (vaginal ring, implants) and complex liquid injectables

and biologicals (vials, pre-filled syringes or cartridges) at its

technological platform Mithra CDMO. Active in more than 100

countries around the world, is headquartered in Liège, Belgium.

www.mithra.com

ESTELLE®, NEXTSTELLIS®, LYDISILKA®, MYRING®,

HALOETTE®, ZORELINE®, TIBELIA® and DONESTA® are registered

trademarks of Mithra Pharmaceuticals or one of its affiliates.

DROVELIS® is a registered trademark of Richter

Gedeon Nyrt. DAPHNE® is a registered trademark of Ceres Pharma.

NUVARING® is a registered trademark of Organon NV.

Important informationThe

contents of this announcement include statements that are, or may

be deemed to be, "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the words "believes",

"estimates," "anticipates", "expects", "intends", "may", "will",

"plans", "continue", "ongoing", "potential", "predict", "project",

"target", "seek" or "should", and include statements the Company

makes concerning the intended results of its strategy. By their

nature, forward-looking statements involve risks and uncertainties,

and readers are cautioned that any such forward-looking statements

are not guarantees of future performance. The Company's actual

results may differ materially from those predicted by the

forward-looking statements. The Company undertakes no obligation to

publicly update or revise forward-looking statements, except as may

be required by law.

|

Subscribe to our mailing list on investors.mithra.com to receive

press releases by email or follow us on social media:LinkedIn • X •

Facebook |

1 Acting through CMM&C SRL.

- 2024-03-08_Mithra_Press-release_FY2023-Results_FR

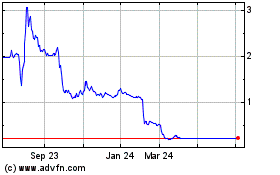

Mithra Pharmaceuticals (EU:MITRA)

Historical Stock Chart

From Dec 2024 to Jan 2025

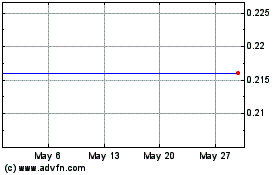

Mithra Pharmaceuticals (EU:MITRA)

Historical Stock Chart

From Jan 2024 to Jan 2025