Vivendi to Push Ahead With Full Takeover of Lagardere -- Update

09 December 2021 - 8:17PM

Dow Jones News

By Ed Frankl

Vivendi SE said Thursday that it will acquire activist investor

Amber Capital's stake in Lagardere SA in the coming days, before

launching a takeover bid for the remainder of the media group's

capital.

The French conglomerate said it will acquire Amber's 17.5%

holding in Lagardere at a price of 24.10 euros ($27.34) a share,

having agreed the offer in September.

Vivendi will then pursue a full takeover of Lagardere, which the

company intends to file with French market authorities by February

2022.

Vivendi will propose a tender offer for all Lagardere shares at

EUR24.10 per share, the same price per share it paid to Amber

Capital, the company said.

Lagardere's shares were up 4.3% at 0825 GMT, hitting just below

the asking price at EUR24.08. Vivendi shares were flat.

Vivendi does not intend to implement a mandatory squeeze-out of

Lagardere--forcing minority shareholders to sell their

stock--following its offer, it said.

The transaction for Amber Capital's holding is due to take place

by Dec. 15, with Vivendi holding 45.1% of Lagardere's capital at

its close.

France's markets regulator obliges companies exceeding a 30%

threshold in another listed company to submit a tender offer for

all remaining shares, although exemptions are possible.

Lagardere has previously welcomed Vivendi's investment, saying

it underscored Vivendi's confidence in a deal that would complement

its own activities.

Lagardere's shares have climbed more than 17.5% in the year to

date, as coronavirus restrictions that cut air-passenger

traffic--key to Lagardere's travel retail business--have eased.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

December 09, 2021 04:02 ET (09:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

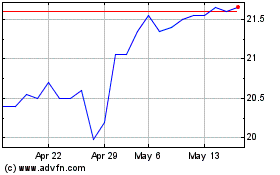

Lagardere (EU:MMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lagardere (EU:MMB)

Historical Stock Chart

From Feb 2024 to Feb 2025