Safran Launches EUR1 Billion Buyback, Raises Guidance on Strong Demand

27 July 2023 - 3:35PM

Dow Jones News

By Mauro Orru

Safran is launching a share buyback program of up to 1 billion

euros ($1.11 billion) and raised its guidance for the year after

posting improved earnings and revenue in the first half, as

narrowbody air traffic is translating into strong demand for spare

parts.

The French aerospace-industry supplier on Thursday posted

adjusted revenue of EUR5.68 billion for the three months ended June

30, up 26.5% in reported terms and 27% organically.

"We are on track to meet our delivery commitments despite

continuing industry-wide supply chain challenges," Chief Executive

Olivier Andries said.

In the first half, adjusted recurring operating income, a

closely watched metric that excludes items such as capital gains or

impairments, came in at EUR1.40 billion, up 33% in reported terms

and 27.3% organically.

Free cash flow fell to EUR1.46 billion from EUR1.67 billion.

For the year, Safran now expects adjusted recurring operating

income of roughly EUR3.1 billion compared with about EUR3 billion

it previously expected, and free cash flow of at least EUR2.7

billion as opposed to at least EUR2.5 billion previously. It

continues to expect adjusted revenue of at least EUR23 billion.

Safran is aiming to complete its buyback program by the end of

2025.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

July 27, 2023 01:20 ET (05:20 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

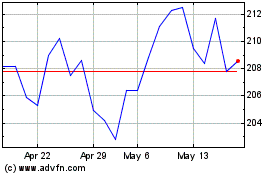

Safran (EU:SAF)

Historical Stock Chart

From Jan 2025 to Feb 2025

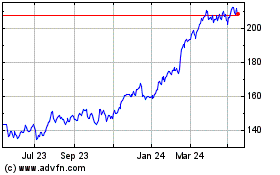

Safran (EU:SAF)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Safran SA (Euronext): 0 recent articles

More Safran SA News Articles