U.S. Dollar Higher Amid Risk Aversion

22 February 2025 - 12:43AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

New York session on Friday amid risk aversion, as U.S. stocks

pulled back after weak consumer sentiment data.

Data from the University of Michigan showed that consumer

sentiment deteriorated much more than previously estimated in the

month of February.

The University of Michigan said its consumer sentiment index for

February was downwardly revised to 64.7 from a preliminary reading

of 67.8. Economists had expected the index to be unrevised.

Shares of UnitedHealth dropped following a report that the U.S.

Department of Justice has launched an investigation into the

company's Medicare billing practices in recent months.

Concerns over U.S. President Donald Trump's tariff threats also

supported the safe-haven currency.

The greenback rose to 1.0449 against the euro, 1.2629 against

the pound and 0.9004 against the franc, from an early 4-day low of

1.0505, more than 2-month low of 1.2678 and more than a 3-week low

of 0.8971, respectively. The currency is poised to challenge

resistance around 1.02 against the euro, 1.22 against the pound and

0.92 against the franc.

The greenback recovered to 0.6370 against the aussie and 0.5746

against the kiwi, from its early more than 2-month lows of 0.6408

and 0.5772, respectively. The greenback may face resistance around

0.61 against the aussie and 0.55 against the kiwi.

The greenback edged up to 1.4208 against the loonie. The

greenback is likely to face resistance around the 1.44 level.

In contrast, the greenback declined to a 2-1/2-month low of

149.27 against the yen. If the currency falls further, it is likely

to test support around the 146.00 region.

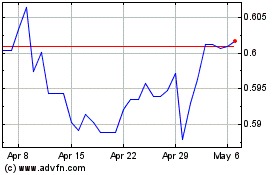

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Jan 2025 to Feb 2025

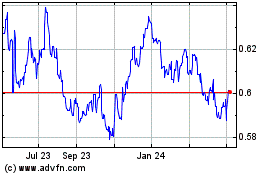

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Feb 2024 to Feb 2025