U.S. Dollar Higher On Growth Concerns

01 July 2022 - 10:06PM

RTTF2

The U.S. dollar moved up against its major counterparts in the

European session on Friday, as European stocks fell on growing

worries about a recession in the wake of a faster policy tightening

by major central banks to curb soaring inflation.

Eurozone inflation touched a new record high in June, putting

pressure on the European Central Bank to hike interest rates

aggressively in the coming months.

Tepid outlook from Micron Technology also weighed on shares. The

company provided a disappointing revenue guidance for the current

quarter and said the demand had "weakened considerably in a very

short period of time."

The U.S. Federal Reserve raised rates by 75 basis points last

month and the markets are expecting another hike of the same size

at the end of this month.

Data showing a drop in U.S. manufacturing activity to a two-year

low in June added to worries.

The Institute for Supply Management's manufacturing PMI slid to

53.0 in June from 56.1 in May. Economists had expected the index to

dip to 54.9.

The greenback touched more than 2-week highs of 1.0365 against

the euro and 1.1976 against the pound, following its early lows of

1.0485 and 1.2178, respectively. The greenback may find upside

target around 1.02 against the euro and 1.18 against the pound.

The greenback moved up to an 8-day high of 0.9633 against the

franc, from a low of 0.9542 hit at 5 pm ET. Next immediate

resistance for the currency is seen around the 0.98 level.

Extending early rally, the greenback firmed to more than 2-year

highs of 0.6764 against the aussie and 0.6147 against the kiwi. The

greenback is likely to face resistance around 0.66 against the

aussie and 0.60 against the kiwi.

Against the loonie, the greenback was up at a 1-week high of

1.2966. The currency may challenge resistance around the 1.32

level.

In contrast, the greenback held steady against the yen, after

hitting a 4-day low of 134.74 at 2 am ET. At yesterday's close, the

pair was worth 135.66.

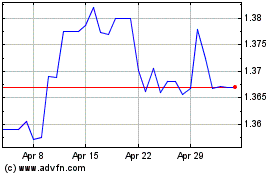

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

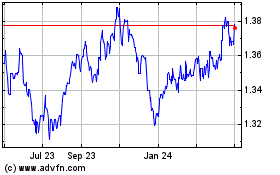

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024