U.S. Dollar Weakens Amid Election Uncertainty

05 November 2024 - 11:18PM

RTTF2

The U.S. dollar lost ground against its most major counterparts

on Tuesday, as investors awaited the results from the presidential

election.

Polls show an extremely tight race between Vice President Kamala

Harris and former President Donald Trump, suggesting the outcome of

the presidential election may not be known by the end of the

night.

The results of House and Senate races are also likely to be in

focus, as the makeup of Congress could affect how much the next

president can accomplish.

Traders also continue to look ahead to the Federal Reserve's

monetary policy decision, which is due to be announced on

Thursday.

The Fed is widely expected to lower interest rates by another 25

basis points, but traders will be looking to the accompanying

statement for clues about the likelihood of future rate cuts.

On the U.S. economic front, a report released by the Commerce

Department showed a substantial increase in the size of the U.S.

trade deficit in the month of September, as imports surged and

exports slumped.

The Commerce Department said the trade deficit widened to $84.4

billion in September from a revised $70.8 billion in August.

Economists had expected the trade deficit to jump to $84.1

billion from the $70.4 billion originally reported for the previous

month.

The greenback fell to 1.0912 against the euro and 151.76 against

the yen, off its early highs of 1.0872 and 152.54, respectively.

The currency is seen finding support around 1.10 against the euro

and 144.00 against the yen.

The greenback declined to near 2-week lows of 1.3845 against the

loonie and 0.6640 against the aussie, from an early high of 1.3907

and a 4-day high of 0.6578, respectively. The next possible support

for the greenback is seen around 1.36 against the loonie and 0.68

against the aussie.

The greenback edged down to 0.6011 against the kiwi, reversing

from an early 4-day high of 0.5966. If the currency falls further,

it is likely to test support around the 0.62 region.

The greenback touched 1.3020 against the pound, setting a 6-day

low. The currency may challenge support around the 1.32 level.

In contrast, the greenback recovered against the franc and was

trading at 0.8635. The currency is likely to locate resistance

around the 0.92 level.

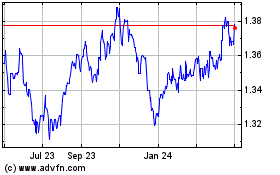

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Oct 2024 to Nov 2024

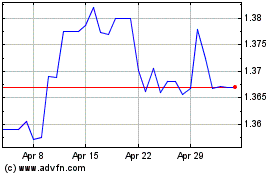

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Nov 2023 to Nov 2024