South Korean Won Falls To 2-day Low Against US Dollar

25 September 2009 - 9:25AM

RTTF2

During early Asian deals on Friday, the South Korean won edged

down against the US dollar and the Japanese yen as a fall in

regional stock prices reduced the appeal of the nation's assets.

The won thus touched a 2-day low against the dollar.

The South Korean market is down in the red today, with investors

pressing heavy sales across the board on weak cues overnight from

Wall Street and on concerns the U.S. government may soon scale down

stimulus measures.

The benchmark KOSPI index, which fell to 1,662.5 after opening

at 1,686.4, is currently down 23.31 points, or 1.35%, at 1671.07.

On Thursday, the KOSPI had drifted down 17.6 points, or 1%, to

1,693.9.

Against the US dollar, the South Korean won touched a 2-day low

of 1199.1 in early Asian trading on Friday. On the downside,

support is seen around the 1210.0 level for the won. The dollar-won

pair closed Thursday's North American session at 1194.40.

The South Korean won traded down against the Japanese yen during

early Asian deals on Friday. At 9:35 pm ET, the won touched a low

of 13.21 against the yen, compared to 13.0860 hit late New York

Thursday. The next downside target level for the South Korean

currency is seen around 13.31.

The Bank of Japan board members said that the Japanese economy

was finally starting to show signs of bottoming out, minutes from

the August 10-11 monetary policy meeting revealed today. The

members added that output was recovering faster than expected,

fueling the recovery.

However, uncertainty persists regarding the paces of recovery

for overseas economies, the board said, so they agreed to continue

to provide ample liquidity. The board also agreed that it was

important to continue to monitor the effect of supply and demand on

prices, and that there was some upside risk for prices in the

current easy global policy.

Across the Atlantic, the US Commerce Department is set to

release its durable goods orders report, which gives the value of

orders placed for goods designed to last for more than 3 years, at

8:30 AM ET. Economists look forward to a 0.5% increase in the

durable goods orders for August.

The final reading of the University of Michigan's consumer

sentiment index for September is due to be released at 10:00 AM ET.

The report is expected to show that the consumer sentiment index

rose to 70.5 in the month.

The Commerce Department is due to release its new home sales

report for August at the same time. The consensus estimate calls

for an increase of 1.9% in new homes sales in the month to

441,000.

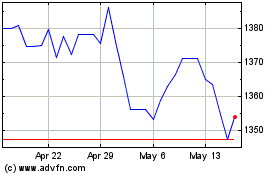

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Dec 2024 to Jan 2025

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Jan 2024 to Jan 2025