false

0001726711

0001726711

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 19, 2023

Aditxt, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 737 N. Fifth Street, Suite 200 Richmond, VA |

|

23219 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 870-1200

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

ADTX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

On December 19, 2023, Aditxt,

Inc. (the “Company”) entered into a consulting agreement (the “Consulting Agreement”) with an independent

consultant for a term of ninety days. Pursuant to the Consulting Agreement, the independent consultant agreed to provide the Company with

business advisory services, guidance on growth strategies and networking with its clients on a non-exclusive basis for general business

purposes (the “Services”). In consideration for the Services, the Company will issue to the independent consultant 70,000

shares of the Company’s common stock (the “Shares”). The issuance of the Shares will not be registered under the Securities

Act of 1933, as amended (the “Securities Act”), or the securities laws of any state, in reliance on the exemption from registration

under the Securities Act, as provided by Section 4(a)(2) thereof.

The foregoing description

of the Consulting Agreement is not complete and is qualified in its entirety by reference to the full text of the Consulting Agreement,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 3.02 Unregistered Sales of Equity Securities

Reference is made to the disclosure

under Item 1.01 above which is hereby incorporated in this Item 3.02 by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ADITXT, INC. |

| |

|

|

| Date: December 22, 2023 |

By: |

/s/ Amro Albanna |

| |

|

Amro Albanna |

| |

|

Chief Executive Officer |

2

Exhibit 10.1

CONSULTING AGREEMENT

This consulting agreement

(“Agreement”) is entered into as of December 19, 2023 (the “Effective Date”) between [ ] (“Consultant”)

and ADITXT, INC., a Delaware corporation (“COMPANY”) (collectively, the “Parties”).

RECITAL

A. WHEREAS,

COMPANY deems it to be in its best interest to retain Consultant to render to the COMPANY such services as may be needed; and

B. WHEREAS,

the Parties agree, after having a complete understanding of the services desired and the services to be provided, that the COMPANY desires

to retain Consultant to provide such assistance through its services for the COMPANY, and Consultant is willing to provide such services

to the COMPANY; and

NOW, THEREFORE, in consideration

of the mutual promises, conditions, and covenants herein contained, the Parties hereby agree as follows:

1. Duties

and Consultant’s Fee.

(a) Term. The appointment

was effective as of December 19, 2023 and shall automatically terminate on March 19, 2024.

(b) Duties. The Consultant

shall provide the COMPANY with business advisory services, guidance on growth strategies, and networking with its contacts on a non-exclusive

basis for general business purposes. The Consultant will comply in all respects with all applicable federal and state securities laws,

rules and regulations in performing its duties hereunder. The Consultant is not required to work a set number of hours or attend COMPANY’s

meetings. The Consultant is in control of their own business opportunities, permitted to conduct business from locations of the Consultant’s

choice, responsible to pay all of the Consultant’s costs of doing business, including but not limited to health insurance, dental

insurance, workers compensation, off premises liability, and any other expenses, and responsible to timely remit all federal and state

withholding taxes due on commissions earned, Social Security taxes, Medicare taxes, unemployment taxes, and all other applicable taxes.

The Consultant is not now, and shall never become, an affiliate of the COMPANY in any manner.

(c) Consultant’s

Fee; Legends. COMPANY shall issue 70,000 shares of the COMPANY’s common stock (the “Shares”) to Consultant on the

Effective Date in exchange for Consultant’s services as described herein. The Shares are earned in full as of the Effective Date.

The issuance of the Shares is duly authorized and will be validly issued, fully paid and non-assessable, and free from all taxes, liens,

claims and encumbrances with respect to the issue thereof and shall not be subject to preemptive rights or other similar rights of shareholders

of the COMPANY and will not impose personal liability upon the holder thereof. In connection with this Agreement and the issuance of the

Shares, the COMPANY represents and warrants to Consultant that as of the date hereof the common stock of the COMPANY, $0.001 per share

(the “Common Stock”), is not a “penny stock” as defined in SEC Rule 240.3a51-1 (17 CFR § 240.3a51-1). If,

at any time after the date of this Agreement, the Common Stock would be deemed to be a “penny stock” as defined in SEC Rule

240.3a51-1 (the “Trigger Date”), then the remaining Shares held by Consultant as of the Trigger Date (the “Remaining

Shares”) shall automatically be deemed cancelled and extinguished in the entirety as of the Trigger Date, and Consultant shall no

longer have any rights to such Remaining Shares as of the Trigger Date. The COMPANY shall, on the Trigger Date, provide to the Consultant

and the Company’s transfer agent all documentation required by the COMPANY’s transfer agent for the cancellation of the Remaining

Shares. The Consultant understands that, until such time as the Shares have been registered under the Securities Act of 1933, as amended,

or may be sold pursuant to Rule 144, Rule 144A, Regulation S, or other applicable exemption without any restriction as to the number of

securities as of a particular date that can then be immediately sold, the Shares may bear a restrictive legend in substantially the following

form:

“NEITHER THE ISSUANCE NOR

SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE

STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE

REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL MAY

BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT

TO RULE 144, RULE 144A, REGULATION S, OR OTHER APPLICABLE EXEMPTION UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY

BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.”

2. No

Obligation. Consultant agrees that it is not an agent of COMPANY and may not bind or obligate COMPANY. Neither COMPANY nor Consultant

is obligated to deal exclusively with the other.

3. Status

of Consultant. Consultant is an independent contractor and is not and shall not be considered COMPANY’s agent for any purposes

whatsoever. Consultant is not granted any right or authority to assume or create any obligations or liability, express or implied, on

COMPANY’s behalf, or to negotiate on behalf of or bind COMPANY in any manner whatsoever.

4. Severable

Provisions. The provisions of this Agreement are severable and if any one or more of its provisions is determined to be illegal or

otherwise unenforceable, in whole or in part, the remaining provisions and any partially unenforceable provision to the extent enforceable

in any jurisdiction nevertheless shall be binding and enforceable.

5. Binding

Agreement. The rights and obligations of COMPANY under this Agreement shall inure to the benefit of, and shall be binding on, COMPANY

and its successors and assigns, and the rights and obligations (other than obligations to perform services) of Consultant under this Agreement

shall inure to the benefit of, and shall be binding upon, Consultant and his heirs, personal and legal representatives, executors, successors

and administrators.

6. Notices.

All notices and other communications pursuant to this Agreement shall be in writing and shall be deemed to be sufficient if contained

in a written instrument and shall be deemed given if delivered personally, telecopied, emailed, or sent by nationally-recognized, overnight

courier or mailed by registered or certified mail (return receipt requested), postage prepaid, to the Parties at their respective addresses

(or at such other address for a party as shall be specified by like notice). All such notices and other communications shall be deemed

to have been received (i) in the case of personal delivery, on the date of such delivery, (ii) in the case of a telecopy, when the party

receiving such telecopy shall have confirmed receipt of the communication, (iii) in the case of delivery by nationally-recognized, overnight

courier, on the Business Day following dispatch, and (iv) in the case of mailing, on the third Business Day following such mailing. For

purposes of this Agreement, “Business Day” shall mean any day, other than a Saturday, Sunday or national legal holiday.

7. Waiver.

The failure of either party to enforce any provision of this Agreement shall not in any way be construed as a waiver of any such provision

as to any future violation thereof, or prevent that party thereafter from enforcing each and every other provision of this Agreement.

The rights granted the parties herein are cumulative and the waiver of any single remedy shall not constitute a waiver of such party’s

right to assert all other legal remedies available to it under the circumstances.

8. Miscellaneous.

This Agreement may not be modified or terminated orally. No modification, termination or attempted waiver shall be valid unless in writing

and signed by the party against whom the same is sought to be enforced.

9. Governing

Law. This Agreement shall be governed by and construed according to the laws of the State of Delaware. Any action brought by either

party against the other concerning the transactions contemplated by this Agreement shall be brought only in the Court of Chancery of the

State of Delaware or, to the extent such court does not have subject matter jurisdiction, the United States District Court for the District

of Delaware or, to the extent that neither of the foregoing courts has jurisdiction, the Superior Court of the State of Delaware. The

parties to this Agreement hereby irrevocably waive any objection to jurisdiction and venue of any action instituted hereunder and shall

not assert any defense based on lack of jurisdiction or venue or based upon forum non conveniens. Each party hereby irrevocably

waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof

(certified or registered mail, return receipt requested) to such party at the address in effect for notices to it under this agreement

and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall

be deemed to limit in any way any right to serve process in any manner permitted by law. In the event Consultant is subject to any action,

claim, or proceeding resulting from this Agreement, the COMPANY agrees to indemnify and hold harmless the Consultant from any such action,

claim, or proceeding. Indemnification shall include all fees, costs and reasonable attorneys’ fees that the Consultant may incur.

In claiming indemnification hereunder, the Consultant shall provide the COMPANY written notice of any claim that the Consultant reasonably

believes falls within the scope of this Agreement. The Consultant shall control such defense and all negotiations relative to the settlement

of any such claim. Any settlement intended to bind the Consultant shall not be final without the Consultant’s written consent. Any

liability of the Consultant and its officers, directors, controlling persons, employees or agents under this Agreement shall not exceed

the amount of fees actually paid to Consultant by the Company pursuant this Agreement.

10. Captions

and Paragraph Headings. Captions and paragraph headings used herein are for convenience and are not a part of this Agreement

and shall not be used in construing it.

[signature page to follow]

IN WITNESS WHEREOF, the Parties

have executed this Agreement on the Effective Date.

COMPANY

ADITXT, INC.

| By: |

|

|

| Name: |

Amro Albanna |

|

| Title: |

Chief Executive Officer |

|

Address for Notices

E-Mail:

CONSULTANT

[ ]

Address for Notices

E-Mail:

-4-

v3.23.4

Cover

|

Dec. 19, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2023

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt, Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

737 N. Fifth Street

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23219

|

| City Area Code |

650

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

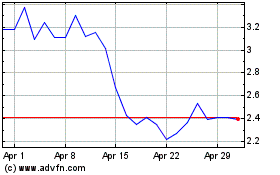

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Apr 2024 to May 2024

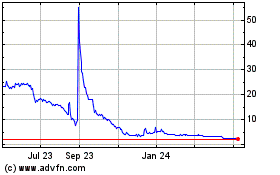

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From May 2023 to May 2024