As filed with the Securities and Exchange Commission

January 18, 2024

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ADITXT, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

23219 |

|

82-3204328 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

737 N. Fifth Street, Suite 200

Richmond, VA 23219

(650) 870-1200

(Address and telephone number of registrant’s principal executive offices)

Amro Albanna

Aditxt, Inc.

Chief Executive Officer

737 N. Fifth Street, Suite 200

Richmond, VA 23219

(650) 870-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Richard A. Friedman, Esq. |

| Sean F. Reid, Esq. |

| Sheppard, Mullin, Richter & Hampton LLP |

| 30 Rockefeller Plaza |

| New York, NY 10112 |

| Tel: (212) 653-8700 |

| Fax: (212) 653-8701 |

Approximate date of commencement of proposed sale

to the public:

As soon as practicable after the effective date

of this registration statement becomes effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check

the following box: ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

| |

|

|

|

|

|

Emerging growth company ☒ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section

8(a), may determine.

The information in this

preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JANUARY 18, 2024 |

Aditxt, Inc.

Up to 3,785,569 Shares of Common

Stock

Pursuant to this prospectus, the

selling stockholder identified herein (the “Selling Stockholder”) is offering on a resale basis an aggregate of 3,785,569

shares of common stock, par value $0.001 per share (the “Common Stock”) of Aditxt, Inc. (the “Company,” “we,”

“us” or “our”) consisting of (i) 1,237,114 shares of Common Stock that are issuable upon exercise of pre-funded

warrants (the “Pre-Funded Warrants”) issued pursuant to a securities purchase agreement entered into by and between us and

the Selling Stockholder dated December 29, 2023 (the “Purchase Agreement”), (ii) up to 2,474,228 shares of Common Stock issuable

upon exercise of warrants (the “Common Warrants”) issued pursuant to the Purchase Agreement, and (iii) up to 74,227 shares

of Common Stock issuable upon exercise of warrants (the “Placement Agent Warrants”, together with the Pre-Funded Warrants

and the Common Warrants, the “Warrants”) issued pursuant to the engagement letter dated as of December 3, 2023, as amended

on December 29, 2023, by and between the Company and H.C. Wainwright & Co., LLC (the “Placement Agent”).

We will not receive any of the

proceeds from the sale by the Selling Stockholders of the Common Stock. Upon any exercise of the Warrants by payment of cash, however,

we will receive the exercise price of the Warrants, which, if exercised in cash with respect to the 3,785,569 shares of Common Stock offered

hereby, would result in gross proceeds to us of approximately $12.3 million. However, we cannot predict when and in what amounts or if

the Warrants will be exercised by payments of cash and it is possible that the Warrants may expire and never be exercised, in which case

we would not receive any cash proceeds.

The Selling Stockholders may sell

or otherwise dispose of the Common Stock covered by this prospectus in a number of different ways and at varying prices. We provide more

information about how the Selling Stockholders may sell or otherwise dispose of the Common Stock covered by this prospectus in the section

entitled “Plan of Distribution” on page 86. Discounts, concessions, commissions and similar selling expenses attributable

to the sale of Common Stock covered by this prospectus will be borne by the Selling Stockholders. We will pay all expenses (other than

discounts, concessions, commissions and similar selling expenses) relating to the registration of the Common Stock with the Securities

and Exchange Commission (the “SEC”).

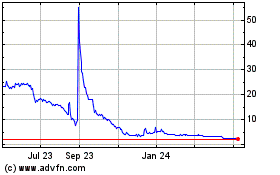

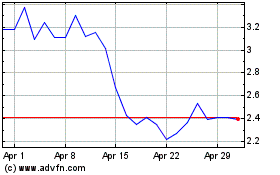

Our Common stock is listed

on The Nasdaq Capital Market under the symbol “ADTX”. On January 16, 2024, the closing price as reported on The Nasdaq Capital

Market was $4.59 per share. There is no established public trading market for the Pre-Funded Warrants and the Common Warrants, and we

do not expect a market to develop. Without an active trading market, the liquidity of the Pre-Funded Warrants and Warrants will be limited.

In addition, we do not intend to list the Pre-Funded Warrants or the Warrants on The Nasdaq Capital Market, any other national securities

exchange or any other trading system.

We are an “emerging growth

company” under the federal securities laws and, as such, are subject to reduced public company reporting requirements.

Investing in our Common Stock

involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus relates to the

resale by the Selling Stockholders identified in this prospectus under the caption “Selling Stockholders,” from time to time,

of up to an aggregate of 3,785,569 shares of Common Stock. We are not selling any shares of Common Stock under this prospectus, and we

will not receive any proceeds from the sale of shares of Common Stock offered hereby by the Selling Stockholders, although we may receive

cash from the exercise of the Warrants.

You should rely only on the information

provided in this prospectus, including any information incorporated by reference. We have not authorized anyone to provide you with any

other information and we take no responsibility for, and can provide no assurances as to the reliability of, any other information that

others may give you. The information contained in this prospectus speaks only as of the date set forth on the cover page and may not reflect

subsequent changes in our business, financial condition, results of operations and prospects.

We are not, and the Selling Stockholders

are not, making offers to sell these securities in any jurisdiction in which an offer or solicitation is not authorized or permitted or

in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an

offer or solicitation. You should read this prospectus, including any information incorporated by reference, in its entirety before making

an investment decision.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements, which reflect the views of our management with respect to future events and financial performance. These forward-looking statements

are subject to a number of uncertainties and other factors that could cause actual results to differ materially from such statements.

Forward-looking statements are identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “projects,” “targets,” and similar expressions.

Such forward-looking statements may be contained in the sections “Risk Factors,” and “Business,” among other places

in this prospectus. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on the information

available to management at this time and which speak only as of this date. We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise. For a discussion of some of the factors that may cause

actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under

“Risk Factors.”

The identification in this document

of factors that may affect future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means

exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. You may rely only

on the information contained in this prospectus.

We have not authorized anyone

to provide information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our Common

Stock means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer

to sell or solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

PROSPECTUS SUMMARY

This summary highlights certain

information about us, this offering and selected information contained elsewhere in this prospectus and in the documents incorporated

by reference. This summary is not complete and does not contain all the information that you should consider before deciding whether to

invest in our securities. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully

the more detailed information contained in or incorporated by reference in this prospectus, including the information contained under

the heading “Risk Factors” beginning on page 13 of this prospectus.

Overview and Mission

We believe the world needs—and

deserves—a new approach to innovating that harnesses the power of large groups of stakeholders who work together to ensure that

the most promising innovations make it into the hands of people who need them most.

We were incorporated in the State

of Delaware on September 28, 2017, and our headquarters are in Richmond, Virginia. The company was founded with a mission of bringing

stakeholders together, to transform promising innovations into products and services that could address some of the most challenging needs.

The socialization of innovation through engaging stakeholders in every aspect of it, is key to transforming more innovations, more rapidly,

and more efficiently.

At inception, the first innovation

we took on was an immune modulation technology titled ADI/Adimune with a focus on prolonging life and enhancing life quality of patients

that have undergone organ transplants. Since then, we expanded our portfolio of innovations, and we continue to evaluate a variety of

promising health innovations.

Our Model

Aditxt is not about a single idea

or a single molecule. It is about making sure the right innovation is made possible. Our business model has three main components as follows:

| |

(1) |

Securing an Innovation: Our process begins with identifying and securing innovations through licensing or acquisition of an innovation asset. Assets come from a variety of sources including research institutions, government agencies, and private organizations. |

| |

(2) |

Growing an Innovation: Once an innovation is secured, we surround it with activation resources that take a systemized approach to bringing that idea to life. Our activation resources include innovation, operations, commercialization, finance, content and engagement, personnel, and administration. |

| |

(3) |

Monetizing an Innovation: Our goal is for each innovation to become commercial-stage and financially and operationally self-sustainable, to create shareholder value. |

We engage various stakeholders

for each of our programs on every level. This includes identifying researchers and research institution partners, such as Stanford University;

leading health institutions to get critical trials underway, such as Mayo Clinic; manufacturing partners who enable us to take innovations

from preclinical to clinical; municipalities and governments, such as the city of Richmond and the state of Virginia and public health

agencies who work with us to launch our program, Pearsanta’s laboratory; and thousands of shareholders around the globe. We seek

to enable promising innovation to become purposeful products that have the power to change lives.

Our Value Proposition

We believe that far too often,

promising treatment or technology does not reach commercialization due to lack of expertise, key resources, or efficiency. As a result,

potentially life-changing and lifesaving treatments are not available to the individuals who so desperately need them.

Aditxt seeks to bring the holistic

concept of an efficient, socialized ecosystem for advancing and accelerating innovations. Our process: We seek to license or acquire promising

innovations. We will then form and build out a subsidiary around each innovation and support the subsidiaries through innovation, operation,

commercialization, content and engagement, finance, personnel, and administration to thrive and grow as a successful, monetizable business.

Since our inception, we have built

infrastructure consisting of innovation, operation, commercialization, content and engagement, finance, personnel, and administration,

to support the rapid transformation of untapped innovations. Each of the main components of our infrastructure has established global

access to partnerships with industry leaders, top-rated research and medical institutions, universities, manufacturing and distribution

companies, and critical infrastructure such as CLIA-certified state-of-the art labs and GMP manufacturing.

The Shifting Landscape of Innovation

Innovation

in general, and health innovations specifically, require significant resources. The convergence of biotech, high-tech, and media offers

new possibilities of accelerating breakthrough innovations faster and more efficiently. This approach reflects our mission of “Making

Promising Innovations Possible, Together”.

People deserve innovative solutions,

which have never been more within reach. We believe the best idea, best product and the best solution will come from creating an ecosystem

where all stakeholders, such as vendors, customers, municipalities, and shareholders contribute. When we disrupt the way we’re innovating,

through our collaborative model, we believe we can move faster and more efficiently to activate viable solutions that have the potential

to make a measurable impact.

Our Growth Strategy

We believe that the era of precision

and personalized medicine is here and that people around the globe would benefit from health diagnostics and treatments that more accurately

pinpoint the problems and more precisely treat the condition. In addition to our current programs, Adimune and Pearsanta, we look to bring

in future health innovations in the areas of software and AI, medical devices, therapeutics, and other technologies that take a fundamentally

different approach to health because they prioritize personalized precision medicine, timely disease root cause analysis, and targeted

treatments.

Year over year, we plan to continue

building our infrastructure and securing more personalized and precision health innovations that align with our mission. These opportunities

may come in different forms such as IP, an early-stage company, or a late-stage company. We will continue to scale our systemized approach

to the innovation process, making large-scale automation and enterprise systems available to our portfolio companies at every stage of

their growth. Specifically, certain subsidiaries will need to grow through further M&A activities, operational infrastructure implementation,

and development or acquisition of critical technologies.

Our Team

Aditxt is led by an entrepreneurial

team with passion for transforming promising innovations into successful businesses. Our leadership come from a variety of different industries,

with collective expertise in founding startup innovation companies, developing and marketing biopharmaceutical and diagnostic products,

designing clinical trials, manufacturing, and management of private and public companies. We have deep experience in identifying and accessing

promising health innovations and developing them into products and services with the ability to scale. We understand the capital markets,

both public and private, as well as M&A and facilitating complex IPOs.

The following are profiles of three subsidiaries we have formed, including the terms of the intellectual property licenses that have been

sublicensed from Aditxt to help build each of the businesses.

THE ADITXT PROGRAMS

ADIMUNE, INC.

Formed in January 2023, Adimune™,

Inc. (“Adimune”) is focused on leading our immune modulation therapeutic programs. Adimune’s proprietary immune modulation

product Apoptotic DNA Immunotherapy™, or ADI-100™, utilizes a novel approach that mimics the way our bodies naturally induce

tolerance to our own tissues. It includes two DNA molecules designed to deliver signals to induce tolerance. ADI-100 has been successfully

tested in several preclinical models (e.g., skin grafting, psoriasis, type 1 diabetes, multiple sclerosis).

In May 2023, Adimune entered into

a clinical trial agreement with Mayo Clinic to advance clinical studies targeting autoimmune diseases of the central nervous system (“CNS”)

with the initial focus on the rare, but debilitating, autoimmune disease Stiff Person Syndrome (“SPS”). According to the National

Organization of Rare Diseases, the exact incidence and prevalence of SPS is unknown; however, one estimate places the incidence at approximately

one in one million individuals in the general population.

Pending approval by the International

Review Board, a human trial for SPS is expected get underway in the second half of 2023 or the first half of 2024 with enrollment of 10-15

patients, some of whom may also have type 1 diabetes. ADI-100 will initially be tested for safety and efficacy. ADI-100 is designed to

tolerize against an antigen known as glutamic acid decarboxylase (“GAD”), which is implicated in type-1 diabetes, psoriasis,

and in many autoimmune diseases of the CNS.

Background

The discovery

of immunosuppressive (anti-rejection and monoclonal) drugs over 40 years ago has made possible life-saving organ transplantation procedures

and blocking of unwanted immune responses in autoimmune diseases. However, immune suppression leads to significant undesirable side effects,

such as increased susceptibility to life-threatening infections and cancers, because it indiscriminately and broadly suppresses immune

function throughout the body. While the use of these drugs has been justifiable because they prevent or delay organ rejection, their use

for treatment of autoimmune diseases and allergies may not be acceptable because of the aforementioned side effects. Furthermore, often

transplanted organs ultimately fail despite the use of immune suppression, and about 40% of transplanted organs survive no more than five

years.

Through

Aditxt, Adimune has the right of use to the exclusive worldwide license for commercializing ADI nucleic acid-based technology (which is

currently at the pre-clinical stage) from Loma Linda University. ADI uses a novel approach that mimics the way the body naturally induces

tolerance to our own tissues (“therapeutically induced immune tolerance”). While immune suppression requires continuous administration

to prevent rejection of a transplanted organ, induction of tolerance has the potential to retrain the immune system to accept the organ

for longer periods of time. ADI may allow patients to live with transplanted organs with significantly reduced immune suppression. ADI

is a technology platform which we believe can be engineered to address a wide variety of indications.

Advantages

ADI™

is a nucleic acid-based technology (e.g., DNA-based), which we believe selectively suppresses only those immune cells involved

in attacking or rejecting self and transplanted tissues and organs. It does so by tapping into the body’s natural process of cell

turnover (i.e., apoptosis) to retrain the immune system to stop unwanted attacks on self or transplanted tissues. Apoptosis is a natural

process used by the body to clear dying cells and to allow recognition and tolerance to self-tissues. ADI triggers this process by enabling

the cells of the immune system to recognize the targeted tissues as “self.” Conceptually, it is designed to retrain the immune

system to accept the tissues, similar to how natural apoptosis reminds our immune system to be tolerant to our own “self”

tissues.

While

various groups have promoted tolerance through cell therapies and ex vivo manipulation of patient cells (i.e., takes

place outside the body), to our knowledge, we will be unique in our approach of using in-body induction of apoptosis to promote tolerance

to specific tissues. In addition, ADI treatment itself will not require additional hospitalization but only an injection of minute

amounts of the therapeutic drug into the skin.

Moreover,

preclinical studies have demonstrated that ADI treatment significantly and substantially prolongs graft survival, in addition to successfully

“reversing” other established immune-mediated inflammatory processes.

License Agreement with Loma Linda University (“LLU”)

On March 15, 2018, we entered

into a License Agreement with LLU, which was subsequently amended on July 1, 2020. Pursuant to the LLU License Agreement, we obtained

the exclusive royalty-bearing worldwide license to all intellectual property, including patents, technical information, trade secrets,

proprietary rights, technology, know-how, data, formulas, drawings, and specifications, owned or controlled by LLU and/or any of its affiliates

(the “LLU Patent and Technology Rights”) and related to therapy for immune-mediated inflammatory diseases (the Adi™

technology). In consideration for the LLU License Agreement, we issued 625 shares of Common Stock to LLU.

PEARSANTA, INC.

Formed in January 2023, our

subsidiary Pearsanta™, Inc. (“Pearsanta”) seeks to take personalized medicine to a whole new level by delivering “Health

by the Numbers.” On November 22, 2023, Pearsanta entered into an assignment agreement with FirstVitals LLC, an entity controlled

by Pearsanta’s CEO, Ernie Lee (“FirstVitals”), pursuant to which FirstVitals assigned its rights in certain intellectual

property and website domain to Pearsanta in consideration of the issuance of 500,000 shares of Pearsanta common stock to FirstVitals.

On December 18, 2023, the board of directors of Pearsanta adopted the Pearsanta 2023 Omnibus Equity Incentive Plan (the “Pearsanta

Omnibus Incentive Plan”), pursuant to which it reserved 15 million shares of common stock of Pearsanta for future issuance under

the Pearsanta Omnibus Incentive Plan and the Pearsanta 2023 Parent Service Provider Equity Incentive Plan (the “Pearsanta Parent

Service Provider Plan”) and approved the issuance of 9.32 million shares of Pearsanta common stock under the Pearsanta Parent Service

Provider Plan.

Since its founding, Pearsanta has been building the platform for enabling our vision of lab quality testing, anytime,

anywhere. Our plan for Pearsanta’s platform is for it to be the transactional backbone for sample collection, sample processing

(on- and off-site), and reporting. This will require the development and convergence of multiple components developed by Pearsanta, or

through transactions with third parties, including collection devices, “lab-on-a-chip” technologies, Lab Developed Test (LDT)

assays, a data-driven analysis engine, and telemedicine. According to a comprehensive research report by Market Research Future, the clinical

and consumer diagnostic market is estimated to hit $429.3 billion by 2030.

We believe that timely and personalized

testing enables far more informed treatment decisions. Pearsanta’s platform is being developed as a seamless digital healthcare

solution. This platform will integrate at-location sample collection, Point-of-Care (“POC”) and LDT assays, and an analytical

reporting engine, with telemedicine-enabled visits with licensed physicians to review test results and, if necessary, order a prescription.

Pearsanta’s goal of extending its platform to enable consumers to monitor their health more proactively as the goal is to provide

a more complete picture about someone’s dynamic health status, factoring in genetic makeup and their response to medication. The

POC component of Pearsanta would enable diagnostic testing at-home, at work, in pharmacies, and more to generate results quickly so that

an individual can access necessary treatment faster. With certain infections, prescribing the most effective treatment according to one’s

numbers can prevent hospital emergency room admissions and potentially life-threatening consequences.

Examples of indication-focused

tests for the Test2Treat platform will include the evaluation for advanced urinary tract infections (“UTIs”), COVID-19/flu/respiratory

syncytial virus, sexually transmitted infections, gut health, pharmacogenomics (i.e., how your genes affect the way your body responds

to certain therapeutics), and sepsis. We believe that these offerings are novel and needed as the current standard of care using broad

spectrum antibiotic treatment can be ineffective and potentially life-threatening. For example, improperly prescribed antibiotics may

approach 50% of outpatient cases. Further, according to an article published in Physician’s Weekly, only 1% of board-certified critical

care medicine physicians are trained in infectious disease.

Licensed Technologies – AditxtScoreTM

We intend

to sublicense to Pearsanta an exclusive worldwide sub-license for commercializing the AditxtScore™ technology which provides a personalized

comprehensive profile of the immune system. AditxtScore is intended to detect individual immune responses to viruses, bacteria, peptides,

drugs, supplements, bone marrow and solid organ transplants, and cancer. It has broad applicability to many other agents of clinical interest

impacting the immune system, including those not yet identified such as emerging infectious agents.

AditxtScore

is being designed to enable individuals and their healthcare providers to understand, manage and monitor their immune profiles and to

stay informed about attacks on or by their immune system. We believe AditxtScore can also assist the medical community and individuals

by being able to anticipate the immune system’s potential response to viruses, bacteria, allergens, and foreign tissues such as

transplanted organs. This technology may be able to serve as a warning signal, thereby allowing for more time to respond appropriately.

Its advantages include the ability to provide simple, rapid, accurate, high throughput assays that can be multiplexed to determine the

immune status with respect to several factors simultaneously, in approximately 3-16 hours. In addition, it can determine and differentiate

between distinct types of cellular and humoral immune responses (e.g., T and B cells and other cell types). It also provides for simultaneous

monitoring of cell activation and levels of cytokine release (i.e., cytokine storms).

We are

actively involved in the regulatory approval process for AditxtScore assays for clinical use and securing manufacturing, marketing, and

distribution partnerships for application in the various markets. To obtain regulatory approval to use AditxtScore as a clinical assay,

we have conducted validation studies to evaluate its performance in detection of antibodies and plan to continue conducting additional

validation studies for new applications in autoimmune diseases.

Advantages

The sophistication

of the AditxtScore technology includes the following:

| |

● |

greater sensitivity/specificity. |

| |

● |

20-fold higher dynamic range, greatly reducing signal to noise compared to conventional assays. |

| |

● |

ability to customize assays and multiplex a large number of analytes with speed and efficiency. |

| |

● |

ability to test for cellular immune responses (i.e., T and B cells and cytokines). |

| |

● |

proprietary reporting algorithm. |

License Agreement with Leland Stanford Junior University (“Stanford”)

On February 3, 2020, we entered

into an exclusive license agreement (the “February 2020 License Agreement”) with Stanford with regard to a patent concerning

a method for detection and measurement of specific cellular responses. Pursuant to the February 2020 License Agreement, we received an

exclusive worldwide license to Stanford’s patent with regard to use, import, offer, and sale of Licensed Products (as defined in

the agreement). The license to the patented technology is exclusive, including the right to sublicense, beginning on the effective date

of the agreement, and ending when the patent expires. Under the exclusivity agreement, we acknowledged that Stanford had already granted

a non-exclusive license in the Nonexclusive Field of Use, under the Licensed Patents in the Licensed Field of Use in the Licensed Territory

(as those terms are defined in the “February 2020 License Agreement”). However, Stanford agreed not to grant further licenses

under the Licensed Patents in the Licensed Field of Use in the Licensed Territory. On December 29, 2021, we entered into an amendment

to the February 2020 License Agreement which extended our exclusive right to license the technology deployed in AditxtScoreTM and

securing worldwide exclusivity in all fields of use of the licensed technology.

ADIVIR, INC.

Formed in April of 2023, Adivir™,

Inc., is Aditxt’s most recently formed wholly owned subsidiary, dedicated to the clinical and commercial development efforts of

innovative antiviral products. These products have the potential to address a wide range of infectious diseases, including those that

currently lack viable treatment options.

Background

On April

18, 2023, we entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Cellvera Global Holdings LLC (“Cellvera

Global”), Cellvera Holdings Ltd. (“BVI Holdco”), Cellvera, Ltd. (“Cellvera Ltd.”), Cellvera Development

LLC (“Cellvera Development” and together with Cellvera Global, BVI Holdco, Cellvera Ltd. and Cellvera Development (the “Sellers”),

AiPharma Group Ltd. (“Seller Owner” and collectively with the Sellers, “Cellvera”), and the legal representative

of Cellvera, pursuant to which, the Company will purchase Cellvera’s 50% ownership interest in G Response Aid FZE (“GRA”),

certain other intellectual property and all goodwill related thereto (the “Acquired Assets”). Unless

expressly stated otherwise herein, capitalized terms used but not defined herein have the meanings ascribed to them in the Asset Purchase

Agreement. Pursuant to the Asset Purchase Agreement, the consideration for the Acquired Assets consists of (A) $24.5 million,

comprised of: (i) the forgiveness of the Company’s $14.5 million loan to Cellvera Global, and (ii) approximately $10 million in

cash, and (B) future revenue sharing payments for a term of seven years. GRA holds an exclusive, worldwide license for the antiviral medication,

Avigan® 200mg, excluding Japan, China and Russia. The other 50% interest in GRA is held by Agility, Inc. (“Agility”).

Additionally,

upon the closing, the Share Exchange Agreement previously entered into as of December 28, 2021, between Cellvera Global Holdings, LLC

f/k/a AiPharma Global Holdings, LLC (together with other affiliates and subsidiaries) and the Company, and all other related agreements

will be terminated.

The obligations

of the Company to consummate the Closing are subject to the satisfaction or waiver, at or prior to the Closing of certain conditions,

including but not limited to, the following:

| |

(i) |

Satisfactory completion of due diligence; |

| |

(ii) |

Completion by the Company of financing sufficient to consummate the transactions contemplated by the Asset Purchase Agreement; |

| |

(iii) |

Receipt by the Company of all required Consents from Governmental Bodies for the Acquisition, including but not limited to, any consents required to complete the transfer and assignment of Cellvera’s membership interests in GRA; |

| |

(iv) |

Receipt of executed payoff letters reflecting the amount required to be fully pay all of each of Seller’s and Seller Owner’s Debt to be paid at Closing; |

| |

(v) |

Receipt by the Company of a release from Agility; |

| |

(vi) |

Execution of an agreement acceptable to the Company with respect to the acquisition by the Company of certain intellectual property presently held by a third party; |

| |

(vii) |

Execution of an amendment to an asset purchase agreement previously entered into by Cellvera with a third party that effectively grants the Company the rights to acquire the intellectual property from the third party under such agreement; |

| |

(viii) |

Receipt of a fairness opinion by the Company with respect to the transactions contemplated by the Asset Purchase Agreement; and |

| |

(ix) |

Receipt by the Company from the Seller Owner of written consent, whether through its official liquidator or the Board of Directors of Seller Owner, to the sale and purchase of the Acquired Assets and Assumed Liabilities pursuant to the Assert Purchase Agreement. |

There

can be no assurance that the conditions to closing will be satisfied or that the proposed acquisition will be completed as proposed or

at all.

Our commitment to building our

antiviral portfolio is strategic and timely. We believe that there has never has there been a more important time to address the growing

global need to uncover new treatments or commercialize existing ones that treat life-threatening global viral infections.

Recent Developments

Merger Agreement with Evofem Biosciences, Inc.

As previously reported in a Current

Report on Form 8-K, on December 11, 2023, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Adicure,

Inc., a majority owned subsidiary of the Company (“Merger Sub”) and Evofem Biosciences, Inc. (“Evofem”), pursuant

to which, Merger Sub will be merged into and with Evofem (the “Merger”), with Evofem surviving the Merger as a wholly

owned subsidiary of the Company. Evofem is a commercial-stage women’s health company with a strong focus on innovation. Evofem is

the creator of an FDA-approved hormone-fee contraceptive gel, Phexxi®.

At the effective time of the

Merger (the “Effective Time”), (i) all issued and outstanding shares of common stock of Evofem (“Evofem Common Stock”),

other than any shares of Evofem Common Stock held by the Company or Merger Sub immediately prior to the Effective Time, will be converted

into the right to receive an aggregate of 610,000 shares of our Common Stock; and (ii) all issued and outstanding shares of Series E-1

Preferred Stock of Evofem (the “Evofem Unconverted Preferred Stock”), other than any shares of Evofem Unconverted Preferred

Stock held by the Company or Merger Sub immediately prior to the Effective Time, will be converted into the right to receive an aggregate

of 2,327 shares of our Series A-1 Convertible Preferred Stock, having such rights, powers, and preferences set forth in the form of Certificate

of Designation of Series A-1 Convertible Preferred Stock, the form of which is attached as Exhibit C to the Merger Agreement. For

additional information regarding the rights, powers and preferences of the Series A-1 Convertible Preferred Stock, see “Description

of Capital Stock—Series A-1 Convertible Preferred Stock”.

The

closing of the Merger is subject to the satisfaction or waiver of a number of conditions. Including but not limited to: (i) approval by

our shareholders and the Evofem shareholders of the transactions contemplated by the Merger Agreement; (ii) the registration statement

on Form S-4 pursuant to which the shares of our Common Stock issuable in the Merger having been declared effective by the SEC; (iii) all

preferred stock of Evofem subject to certain exceptions shall have been converted to Evofem common stock; (iv) Evofem shall have received

agreements from all holders of Evofem warrants which provide: (a) waivers with respect to any fundamental transaction, change in control

or other similar rights that such warrant holder may have under any such Evofem warrants, and (b) an agreement to such Evofem warrants

to exchange such warrants for not more than an aggregate (for all holders of Evofem warrants) of 551 shares of our preferred stock of

Evofem; (v) the Company shall have obtained agreements from the holders of certain convertible notes and purchase rights of Evofem

to exchange such convertible notes and purchase rights for not more than an aggregate (for all holders of Evofem convertible notes) of

86,153 shares of our preferred stock; and (vi) we shall have received waivers form the holders of certain of our securities which contain

prohibitions on variable rate transactions.

The

Merger Agreement may be terminated at any time prior to the consummation of the Closing by mutual written consent of us and Evofem. The

Merger Agreement may also be terminated by us or Evofem if (i) the Merger shall not have been consummated on or before 5:00 p.m. Eastern

Time on May 8, 2024; (ii) if any judgment, law or order prohibiting the Merger or the transactions contemplated in connection therewith

has become final and non-appealable; (iii) the required vote of Evofem stockholders was not obtained; or (iv) in the event of any

Terminable Breach (as defined in the Merger Agreement). We may also terminate the Merger Agreement if (i) prior to approval by the required

vote of Evofem’s shareholders if the Evofem board of directors shall have effected a change in recommendation with respect to the

Merger; or (ii) in the event that we determine, in our reasonable discretion, that the acquisition of Evofem could result in a material

adverse amount of cancellation of indebtedness income to us. Evofem may terminate the Merger Agreement if (i) prior to approval by the

required vote of Evofem’s shareholders if the Evofem board of directors determines to terminate the Merger Agreement in connection

with a superior proposal in order to enter into a definitive agreement for such superior proposal provided that Evofem has paid the termination

fee of $4 million; (ii) our Common Stock is no longer listed for trading on Nasdaq; or (iii) we have not made a loan to Evofem of no less

than $3 million prior to January 31, 2024.

In

connection with the Merger Agreement, we entered into an Assignment Agreement dated December 11, 2023 (the “Assignment Agreement”),

with Evofem and the holders (the “Holders”) of certain senior indebtedness of Evofem (the “Notes”), pursuant to

which the Holders assigned the Notes to us in consideration for the issuance by us of (i) an aggregate principal amount of $5 million

in our secured notes due on January 2, 2024 (the “January 2024 Secured Notes”), (ii) an aggregate principal amount of $8 million

in secured notes of the Company due on September 30, 2024 (the “September 2024 Secured Notes”), (iii) an aggregate principal

amount of $5 million in ten-year unsecured notes (the “Unsecured Notes”), and (iv) payment of $154,480 in respect of net sales

of Phexxi in respect of the calendar quarter ended September 30, 2023, which amount is due and payable on December 14, 2023. The January

2024 Secured Notes are secured by certain intellectual property assets of the Company and its subsidiaries pursuant to an Intellectual

Property Security Agreement entered into in connection with the Assignment Agreement. The September 2024 Secured Notes are secured by

the Notes and certain associated security documents pursuant to a Security Agreement entered into in connection with the Assignment Agreement.

On January 2, 2024, we

entered into amendments to the January 2024 Secured Notes (“Amendment No. 1 to January 2024 Secured Notes”) with the

Holders, pursuant to which the maturity date of the January 2024 Notes was extended to January 5, 2024. On January 5, 2024, we entered

into amendments to the January 2024 Secured Notes (“Amendment No. 2 to January 2024 Secured Notes”) and amendments

to the September 2024 Secured Notes (“Amendment No. 1 to September 2024 Secured Notes”) with the Holders, pursuant

to which the Company and the Holders agreed that in consideration of a principal payment in the aggregate amount of $1 million on the

January 2024 Secured Notes and in increase in the aggregate principal balance of $250,000 on the September 2024 Secured Notes, that the

maturity date of the January 2024 Secured Notes would be further extended to January 31, 2024.

In

connection with the Merger Agreement and the transactions contemplated thereby, on December 22, 2023, we entered into an Exchange Agreement

(the “Exchange Agreement”) with the holders of an aggregate of 22,280 shares of Series F-1 Convertible Preferred Stock of

Evofem, pursuant to which such holders agreed to exchange their respective shares of Evofem Series F-1 Preferred Stock for an aggregate

of 22,280 shares of a new series of our convertible preferred stock of the Company designated as Series A-1 Convertible Preferred Stock.

On December 26, 2023, in connection with the Exchange Agreement, we entered into a Registration Rights Agreement with the holders, pursuant

to which we agreed to prepare and file with the SEC covering the resale of the shares of our Common Stock issuable upon conversion of

the Series A-1 Convertible Preferred Stock (i) on the later of (x) the 15th calendar day after the closing date, or (y)

the 2nd business day following the Stockholder Approval Date (as defined in the Exchange Agreement”), with respect

to the initial registration statement and (ii) on the date on which the Company is required to file any additional Registration Statement

pursuant to the terms of the Registration Rights Agreement with respect to any additional Registration Statements that may be required

to be filed by the Company (the “Filing Deadline”). Pursuant to the Registration Rights Agreement, we are required (i) to

have the initial Registration Statement declared effective by the SEC on the earlier of (x) the 60th calendar day after the

Filing Deadline (or the 90th calendar day after the Filing Deadline if subject to a full review by the SEC), and (y)

the 2nd business day after the date we are notified by the SEC that such Registration Statement will not be reviewed,

and (ii) with respect to any additional Registration Statements that may be required to be filed, the earlier of (x) the 60th calendar

day following the date on which we were required to file such additional Registration Statement (or the 90th calendar

day if subject to a full review by the SEC), and (y) the 2nd business day after the date we are notified by the SEC that

such Registration Statement will not be reviewed. In the event that we fail to file the Registration Statement by the Filing Deadline,

have it declared effective by the Effectiveness Deadline, or the prospectus contained therein is not available for use or the investor

is not otherwise able to sell its Warrant Shares pursuant to Rule 144, we will be required to pay the investor an amount equal to 2%

of the stated value of such Holder’s Series A-1 Preferred Stock on the date of such failure and on every thirty date anniversary

until such failure is cured. For additional information regarding the rights, powers and preferences of the Series A-1 Convertible

Preferred Stock, see “Description of Capital Stock—Series A-1 Convertible Preferred Stock”.

Asset Purchase Agreement

with MDNA Life Sciences, Inc.

As previously

reported in a Current Report on Form 8-K, on December 17, 2023, the Company entered into an Asset Purchase Agreement (the “Purchase

Agreement”) with Pearsanta, Inc., our majority owned subsidiary (“Pearsanta”)

and MDNA Life Sciences, Inc. (“MDNA”), pursuant to which Pearsanta agreed to acquire certain intellectual property and other

specified assets relating to MDNA’s early cancer detection platform (the “Acquired Assets”). MDNA’s Mitomic™

technology provides a tool for identifying biomarkers associated with various diseases that lead to mtDNA mutations. The Acquired Assets

include, but are not limited to, the following:

| ● | The

Mitomic Endometriosis Test (MET™) is in development as a blood-based assay for diagnosis

of endometriosis. This test aims to provide early diagnostic insights, potentially reducing

delays in diagnosing endometriosis. |

| ● | The

Mitomic Prostate Test (MPT™) is currently under development as a blood-based assay

for diagnosis of prostate cancer. We believe that this test holds the potential to provide

more specific and clinically informative data especially in the prostate-specific antigen

(PSA) grey zone. It aims to address the challenges of over-diagnosis and mitigate risks associated

with low-grade cancers. |

Pursuant

to the Purchase Agreement, the consideration for the transaction was to consist of: (i) an upfront working capital payment of $500,000

(the “Upfront Working Capital Payment”), which is payable upon the satisfaction of certain conditions set forth in the Purchase

Agreement, (ii) a working capital payment at closing of $500,000, (iii) 50,000 shares of

our Common Stock, (iv) a warrant to purchase 50,000 shares of our Common Stock exercisable for a term of 5 years at an exercise price

equal to the opening price per share of our Common Stock as of the Closing Date (as defined below), and (v) 5,000 shares of Pearsanta

Series A Preferred Stock, par value $0.001 per share (the “Pearsanta Preferred Stock”), provided, however, that if the value

of such Pearsanta Preferred Stock, on an as-converted basis, at the time of the pricing of the Pearsanta common stock in connection with

the sale of shares of Pearsanta common stock to the public in a firm-commitment underwritten public offering pursuant to an effective

registration statement under the Securities Act of 1933, as amended does not equal $25,000,000, an additional amount of Pearsanta Preferred

Stock (“Additional Pearsanta Preferred Stock”) so that the sum of the value of the Pearsanta Preferred Stock plus the Additional

Pearsanta Preferred Stock (if any) shall equal $25,000,000. The Pearsanta Preferred Stock shall have such rights, powers, and preferences

as set forth in the form of Certificate of Designation of Series A Preferred Stock, the form of which is attached as Exhibit D to the

Purchase Agreement.

On January

4, 2024, we entered into a First Amendment to Asset Purchase Agreement with Pearsanta and MDNA, pursuant to which the parties agreed to:

(i) the removal of the Upfront Working Capital Payment, (ii) the removal of the Closing Working Capital Payment (as defined in the Purchase

Agreement”), and (iii) to increase the maximum amount of payments to be made by us under the Transition Services Agreement (as defined

below) from $2.2 million to $3.2 million.

On January

4, 2024, Pearsanta and MDNA entered into a Transition Services Agreement (the “Transition Services Agreement”), pursuant to

which MDNA agreed that it would perform, or cause certain of its affiliates or third parties to perform, certain services as described

in the Transition Services Agreement for a term of three months in consideration for the payment by Pearsanta of certain fees as provided

in the Transition Services Agreement, in an amount not to exceed $3.2 million.

On January 4,

2024, we completed its acquisition of the Acquired Assets and issued to MDNA 50,000 shares of our Common Stock, a warrant to purchase

50,000 shares of our Common Stock, and the Pearsanta Preferred Stock.

Set forth below is a summary

of the rights, powers and preferences of the Pearsanta Series A Convertible Preferred Stock:

Series A Convertible Preferred Stock

On

January 2, 2024, we filed a Certificate of Designations for the Pearsanta Series A Preferred Stock with the Secretary of State of Delaware

(the “Series A Certificate of Designations”). The following is only a summary of the Series A Certificate of Designations,

and is qualified in its entirety by reference to the full text of the Series A Certificate of Designations, a copy of which is filed as

an exhibit to the Purchase Agreement.

Designation,

Amount, and Par Value. The number of Series A Preferred Stock designated is 5,000 shares. The shares of Series A Preferred

Stock have a par value of $0.001 per share and a stated value of $5,000 per share.

a)

Conversion. each outstanding share of Series A Preferred Stock shall be mandatorily and automatically converted, with no

further action on the part of the holders thereof, into 1,000 fully paid and nonassessable shares of Common Stock (1:1,000) (the “Conversion

Ratio”) upon the consummation of a firm underwritten initial public offering of the Common Stock for cash effected pursuant

to a registration statement or similar document filed by or on behalf of the Company under the Securities Act (a “Qualifying

IPO”). If the product of (i) the number of shares of Common Stock issued upon conversion based on the Conversion Ratio and (ii)

the initial trading price upon a Qualifying IPO (“IPO Price”), is less than $25,000,000 then the Conversion Ratio shall

be adjusted to 1:X (such ratio, the “Adjusted Conversion Ratio”) where:

X = (25,000,000/ IPO Price) / 5000

and

the number of shares of Common Stock issued or issuable upon conversion of the Series A Preferred Stock shall be determined based on such

Adjusted Conversion Ratio.

Dividends.

Holders of Series A Preferred Stock shall be entitled to receive, and the Corporation shall pay, dividends on shares of Series

A Preferred Stock equal (on an as-if-converted-to-Common-Stock basis) to and in the same form as dividends actually paid on shares of

the Common Stock

Liquidation. In

the event of a liquidation, the holders the Series A Preferred Stock shall be entitled to receive in cash out of the assets of the Company,

the same amount that a holder of Common Stock would receive if the Series A Preferred Stock were fully converted (disregarding for such

purposes any conversion limitations hereunder) to Common Stock which amounts shall be paid pari passu with all holders of Common

Stock.

Company

Redemption. At any time prior to a Qualified IPO, the Company may redeem all, or any portion, of the Series A Preferred Stock

for cash, at a price per share of Series A Preferred Stock equal to the Stated Value per share.

Voting

Rights. The holders of the Series A Preferred Stock shall have no voting power and no right to vote on any matter at any

time, either as a separate series or class or together with any other series or class of share of capital stock, and shall not be entitled

to call a meeting of such holders for any purpose nor shall they be entitled to participate in any meeting of the holders of Common Stock,

except as expressly provided in the Series A Certificate of Designations and where required by the DGCL.

December 2023 PIPE

As previously reported in a Current

Report on Form 8-K, on December 29, 2023, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with

the Selling Stockholder for the issuance and sale in a private placement of (i) pre-funded warrants

(the “Pre-Funded Warrants”) to purchase up to 1,237,114 shares of our Common Stock at an exercise price of $0.001 per share,

and (ii) warrants (the “Common Warrants”) to purchase up to 2,474,228 shares of our Common Stock, at a purchase price of $4.85

per share. The Common Warrants are exercisable immediately upon issuance at an exercise price of $4.60 per share and have a term of exercise

equal to three years from the date of issuance. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until

the Pre-Funded Warrants are exercised in full. A holder of Pre-Funded Warrants or Warrants (together with its affiliates) may not exercise

any portion of a warrant to the extent that the holder would own more than 4.99% (or, at the election of the holder 9.99%) of the Company’s

outstanding common stock immediately after exercise.

Pursuant

to the Purchase Agreement, we also agreed to reduce the exercise price of 106,594 outstanding warrants to purchase Common Stock of the

Company (“Outstanding Warrants”) held by the Purchaser to $4.60 per share in consideration for the cash payment by the Purchaser

of $0.125 per share of Common Stock underlying the Outstanding Warrants, effective immediately. As of the date of this prospectus, none

of the repriced Outstanding Warrants have been exercised.

In connection with the Private

Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”), dated as of December 29,

2023, with the Selling Stockholder, pursuant to which we agreed to prepare and file a registration statement with the Securities and Exchange

Commission (the “SEC”) registering the resale of the shares of Common Stock underlying the Pre-Funded Warrants and

the Common Warrants no later than 10 trading days after the date of the Registration Rights Agreement, and to use best efforts to have

the registration statement declared effective as promptly as practical thereafter, and in any event no later than 45 days following the

date of the Registration Rights Agreement (or 75 days following the date of the Registration Rights Agreement in the event of a “full

review” by the SEC).

On

January 3, 2024, we entered into a settlement agreement and general release with the Selling Stockholder, pursuant to which we agreed

to settle an action filed in the United States District Court in the Southern District of New York by the Selling Stockholder against

the Company (the “Action”) in consideration of the issuance by us of shares of our Common Stock (the “Settlement

Shares”), which will be issued within two business days following court approval of a joint motion to be filed by the Selling Stockholder

and the Company. The number of Settlement Shares to be issued will be equal to $1.6 million divided by the closing price of our Common

Stock on the day prior to court approval of the joint motion. On January 17, 2024, we issued 296,296 Settlement Shares. Following the

issuance of the Settlement Shares, the Selling Stockholder will file a dismissal stipulation in the Action.

The

private placement closed on January 4, 2024. The net proceeds to us from the private placement were approximately $5.5 million, after

deducting placement agent fees and expenses and estimated offering expenses payable by us. The Company used a portion of the proceeds

from the December 2023 PIPE to repay outstanding loans from our Chief Executive Officer, including accrued interest. In addition, the

Company also used a portion of the proceeds to satisfy outstanding obligations under the August Loan Agreement and the October MCA Agreement.

As of the date of this prospectus, we are one payment in arrears on the August Loan Agreement.

Note Exchange

On

December 29, 2023, we entered into an Exchange Agreement with the holder of our secured promissory note in the principal amount of $2.625

million (the “Note”), pursuant to which the holder agreed, subject to the terms and conditions set forth therein, to exchange

the Note, including all accrued but unpaid interest thereon, for an aggregate of 2,625 shares of a new series of convertible preferred

stock of the Company, designated as Series B-2 Convertible Preferred Stock. For additional information regarding the rights, powers

and preferences of the Series B-2 Convertible Preferred Stock, see “Description of Capital Stock—Series A-1 Convertible

Preferred Stock”.

Nasdaq Compliance

As

previously reported in a Current Report on Form 8-K, on September 29, 2023, we received written notice from The Nasdaq Capital Market

(“Nasdaq”) that the Hearing Panel had granted us an exception through December 26, 2023 to allow us to complete its

plan to demonstrate compliance with Nasdaq Listing Rule 5550(b)(1) (the “Stockholders’ Equity Rule”) and Nasdaq Listing

Rule 5550(a)(4) (the “Public Float Rule”). On November 21, 2023, we received written notice from Nasdaq that we had regained

compliance with the Public Float Rule. On December 29, 2023, we received written notice from Nasdaq that we had regained compliance with

the Stockholders’ Equity Rule, but will be subject to a Mandatory Panel Monitor for a period of one year.

Corporate Information

We were incorporated as a Delaware

corporation on September 28, 2017. Our principal executive offices are located at 737 N. Fifth Street, Suite 200 Richmond, VA 23219, and

our telephone number is (650) 870-1200.

Our Common Stock trades on The

Nasdaq Capital Market under the symbol “ADTX.”

THE OFFERING

| Common Stock to be offered by the Selling Stockholder |

|

Up to 3,785,569 shares of Common Stock |

| |

|

|

| Common stock outstanding prior to this offering |

|

1,665,214 shares of Common Stock. |

| |

|

|

| Common stock to be outstanding after this offering |

|

5,154,487 shares of Common Stock, assuming the exercise of all of the Warrants |

| |

|

|

| Use of proceeds |

|

We

will not receive any proceeds from the sale of the shares of Common Stock by the Selling Stockholders, except for the Warrant

exercise price paid for the Common Stock offered hereby and issuable upon the exercise of the Warrants. See “Use of

Proceeds” on page 40 of this prospectus. |

| |

|

|

| Risk Factors |

|

See “Risk Factors” beginning on page 13 of this prospectus, as well as other information included in this prospectus, for a discussion of factors you should read and consider carefully before investing in our securities. |

| |

|

|

| Nasdaq Capital Markets symbol |

|

Our common stock is listed on The Nasdaq Capital Markets under the symbol “ADTX”. There is no established trading market for the Common Warrants or the Pre-Funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Common Warrants or the Pre-Funded Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the Common Warrants and Pre-Funded Warrants will be extremely limited. |

The number of shares of our

Common Stock to be outstanding after this offering as shown above is based on 1,665,214 shares outstanding as of January 17, 2023 and

excludes as of that date:

| |

● |

5,097,451 shares of our Common Stock issuable upon exercise of warrants, subject to vesting having a weighted average exercise price of $14.03 per share; and |

| |

● |

45,573 shares of our Common Stock issuable upon exercise of outstanding options under our 2017 Equity Incentive Plan and 2021 Equity Incentive Plan or the 2017 Plan and the 2021 plan, respectively, subject to vesting; |

| |

● |

5,018,019 shares of our Common Stock issuable upon conversion of outstanding Series A-1 Convertible Preferred Stock; and |

| |

● |

557,325 shares of our Common Stock issuable upon conversion of outstanding Series B-2 Convertible Preferred Stock;. |

RISK FACTORS

An investment in our securities

involves a high degree of risk. This prospectus contains a discussion of the risks applicable to an investment in our securities. Prior

to deciding about investing in our securities, you should carefully consider the specific factors discussed within this prospectus. The

risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us

or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause

you to lose all or part of your investment in the offered securities.

Risks Related to Our Financial Position and Need

for Capital

Our financial situation creates doubt whether

we will continue as a going concern.

We were incorporated in September

2017 and have a limited operating history and our business is subject to all the risks inherent in the establishment of a new business

enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently

encountered in connection with development and expansion of a new business enterprise. Since inception, we have incurred losses and expect

to continue to operate at a net loss for at least the next several years as we commence our research and development efforts, conduct

clinical trials, and develop manufacturing, sales, marketing, and distribution capabilities. Our net loss attributable to common stockholders

for the years ended December 31, 2022 and 2021 was $27,612,199 and $46,269,097, respectively, and our accumulated deficit as of December

31, 2022 was $95,040,362. Our net loss attributable to common stockholders for the nine months ended September 30, 2023 and 2022 was $21,579,795

and $19,466,710, respectively, and our accumulated deficit as of September 30, 2023 was $116,620,157. There can be no assurance that the

products under development by us will be approved for sale in the U.S. or elsewhere. Furthermore, there can be no assurance that if such

products are approved, they will be successfully commercialized, and the extent of our future losses and the timing of our profitability

are highly uncertain. If we are unable to achieve profitability, we may be unable to continue our operations. There can be no assurances

that we will be able to achieve a level of revenues adequate to generate sufficient cash flow from operations or additional financing

through private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent

that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional

working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms.

These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available,

we may be forced to discontinue operations, which would cause investors to lose their entire investment.

If we fail to obtain the capital necessary to

fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment.

We will need to continue to seek

capital from time to time to continue development of our lead drug candidate beyond our initial combined Phase I/IIa clinical trial and

to acquire and develop other product candidates. Once approved for commercialization, we cannot provide any assurances that any revenues

it may generate in the future will be sufficient to fund our ongoing operations.

Our business or operations may

change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required

to maintain operations, fund expansion, develop new or enhance products, acquire complementary products, business or technologies, or

otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a change in preferred

treatment modalities. In addition, we may need to accelerate the growth of our sales capabilities and distribution beyond what is currently

envisioned, and this would require additional capital. However, we may not be able to secure funding when we need it or on favorable terms.

We may not be able to raise sufficient funds to commercialize the product candidates we intend to develop.

If we cannot raise adequate funds

to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development activities, clinical

studies, or future operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may

require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights

to future product candidates or certain major geographic markets. This could result in sharing revenues which we might otherwise retain

for ourselves. Any of these actions may harm our business, financial condition, and results of operations.

The amount of capital we may need

depends on many factors, including the progress, timing and scope of our product development programs; the progress, timing and scope

of our preclinical studies and clinical trials; the time and cost necessary to obtain regulatory approvals; the time and cost necessary

to further develop manufacturing processes and arrange for contract manufacturing; our ability to enter into and maintain collaborative,

licensing and other commercial relationships; and our partners’ commitment of time and resources to the development and commercialization

of our products.

Our obligations to

certain of our creditors are secured by security interests in our assets, so if we default on those obligations, our creditors could foreclose

on some or all of our assets.

Our obligations

to certain of our creditors are secured by security interests in our assets. As of December 31, 2023, approximately $24 million was owed

to such secured creditors. Of this amount, $5 million has a maturity date of January 31, 2024. In addition, under certain other agreements,

we are required to pay $248,000 on a weekly basis to such creditors. If we default on our obligations under these agreements, our secured

creditors could foreclose on its security interests and liquidate some or all of these assets, which would harm our financial condition

and results of operations and would require us to reduce or cease operations and possibly seek Bankruptcy Protection.

In the event we pursue

Bankruptcy Protection, we will be subject to the risks and uncertainties associated with such proceedings.

In the event we file for relief

under the United States Bankruptcy Code, our operations, our ability to develop and execute our business plan and our continuation as

a going concern will be subject to the risks and uncertainties associated with bankruptcy proceedings, including, among others: our ability

to execute, confirm and consummate a plan of reorganization; the additional, significant costs of bankruptcy proceedings and related fees;

our ability to obtain sufficient financing to allow us to emerge from bankruptcy and execute our business plan post-emergence, and our

ability to comply with terms and conditions of that financing; our ability to continue our operations in the ordinary course; our ability

to maintain our relationships with our consumers, business partners, counterparties, employees and other third parties; our ability to

obtain, maintain or renew contracts that are critical to our operations on reasonably acceptable terms and conditions; our ability to

attract, motivate and retain key employees; the ability of third parties to use certain limited safe harbor provisions of the United States

Bankruptcy Code to terminate contracts without first seeking Bankruptcy Court approval; the ability of third parties to force us to into

Chapter 7 proceedings rather than Chapter 11 proceedings and the actions and decisions of our stakeholders and other third parties who

have interests in our bankruptcy proceedings that may be inconsistent with our operational and strategic plans. Any delays in our bankruptcy

proceedings would increase the risks of our being unable to reorganize our business and emerge from bankruptcy proceedings and may increase

our costs associated with the bankruptcy process or result in prolonged operational disruption for us. Also, we would need the prior approval

of the bankruptcy court for transactions outside the ordinary course of business during the course of any bankruptcy proceedings, which

may limit our ability to respond timely to certain events or take advantage of certain opportunities. Because of the risks and uncertainties

associated with any bankruptcy proceedings, we cannot accurately predict or quantify the ultimate impact of events that could occur during

any such proceedings. There can be no guarantees that if we seek Bankruptcy Protection we will emerge from Bankruptcy Protection as a

going concern or that holders of our Common Stock will receive any recovery from any bankruptcy proceedings.

In the event we are

unable to pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully emerge from

such proceedings, it may be necessary to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy Code for all or

a part of our businesses.

In the event we are unable to

pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully emerge from such proceedings,

it may be necessary for us to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy Code for all or a part of our

businesses. In such event, a Chapter 7 trustee would be appointed or elected to liquidate our assets for distribution in accordance with

the priorities established by the United States Bankruptcy Code. We believe that liquidation under Chapter 7 would result in significantly

smaller distributions being made to our stakeholders than those we might obtain under Chapter 11 primarily because of the likelihood that

the assets would have to be sold or otherwise disposed of in a distressed fashion over a short period of time rather than in a controlled

manner and as a going concern.

We will need to raise substantial additional

capital, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us

to delay, limit or terminate our product development efforts or cease operations.

We do not expect that our current

cash position will be sufficient to fund our current operations for the next 12 months. Our operating plan may change because of many

factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt

financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances

and licensing arrangements or a combination of these approaches. In any event, we will require additional capital to obtain regulatory

approval for, and to commercialize, our product candidates. Raising funds in the current economic environment may present additional challenges.

Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions

are favorable or if we have specific strategic considerations.

Any additional fundraising efforts

may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our product

candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us,

if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our stockholders and the issuance of

additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our shares to

decline. The sale of additional equity or convertible securities may dilute our existing stockholders. The incurrence of indebtedness

would result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations

on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other

operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through

arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable and we may be required to

relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have

a material adverse effect on our business, operating results and prospects.

If we are unable to obtain funding

on a timely basis, we may be required to significantly curtail, delay, or discontinue one or more of our research or development programs

or the commercialization of any product candidate or be unable to expand our operations or otherwise capitalize on our business opportunities,

as desired, which could materially affect our business, financial condition and results of operations.

Even if we can raise additional funding, we