UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-38309

AGM

GROUP HOLDINGS INC.

c/o Creative Consultants (Hong Kong) Limited

Room 1502-3 15/F., Connuaght Commercial Building,

185 Wanchai Road

Wanchai, Hong Kong

+86-010-65020507 – telephone

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

On July 15, 2024, AGM Group Holdings Inc. (the

“Company”) received a written notice from the Listing Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”)

notifying the Company that, based on the closing bid price of the Company’s ordinary shares (the “Ordinary Shares”),

for the last 30 consecutive trading days, the Company no longer complies with the minimum bid price requirement for continued listing

on the Nasdaq Capital Market. Nasdaq Listing Rule 5450(a)(1) requires listed securities to maintain a minimum bid price of $1.00

per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to

meet the Minimum Bid Price Requirement exists if the deficiency continues for a period of 30 consecutive trading days.

Pursuant to the Nasdaq Listing Rules, the Company

has been provided an initial compliance period of 180 calendar days to regain compliance with the Minimum Bid Price Requirement. To regain

compliance, the closing bid price of the Ordinary Shares must be at least $1.00 per share for a minimum of 10 consecutive trading days

prior to January 13, 2025, and the Company must otherwise satisfy The Nasdaq Capital Market’s requirements for listing.

If the Company does not regain compliance by January

13, 2025, the Company may be eligible for an additional 180 calendar day compliance period. To qualify, the Company would be required,

among other things, to meet the continued listing requirement for market value of publicly held shares, which the Company does not currently

meet, as well as all other standards for initial listing on the Nasdaq Capital Market, with the exception of the Minimum Bid Price Requirement,

and would need to provide written notice of its intention to cure the bid price deficiency during the second compliance period.

If the Company does not regain compliance within the allotted compliance period(s), including any extensions that may be granted by Nasdaq,

Nasdaq will provide notice that the Company’s Ordinary Shares will be subject to delisting. The Company would then be entitled to

appeal Nasdaq’s determination to a Nasdaq Listing Qualifications Panel and request a hearing.

The Company intends to monitor the closing bid

price of the Ordinary Shares and consider its available options to resolve the noncompliance with the Minimum Bid Price Requirement. There

can be no assurance that the Company will be able to regain compliance with the Nasdaq Capital Market’s continued listing requirements

or that Nasdaq will grant the Company a further extension of time to regain compliance, if applicable.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AGM GROUP HOLDINGS INC. |

| |

|

|

| Date: July 19, 2024 |

By: |

/s/ Bo Zhu |

| |

Name: |

Bo Zhu |

| |

Title: |

Chief Executive Officer,

Chief Strategy Officer and Director |

2

Exhibit 99.1

AGM Group Announces Receipt of Notification from

Nasdaq

BEIJING, July 19, 2024 /PRNewswire/ -- AGM Group

Holdings Inc. (“AGMH” or the “Company”) (NASDAQ: AGMH), an integrated technology company focusing on providing fintech

software services and producing high-performance hardware and computing equipment, today announced that it has received a written notification

(the “Notification Letter”) on July 15, 2024, from the Listings Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”).

The Notification Letter advised that for the last 30 consecutive business the minimum closing bid price per share for the Company’s ordinary

shares was below the $1.00 per share requirement for continued listing under Nasdaq Listing Rule 5550(a)(2).

The

Nasdaq notification letter has no current effect on the listing or trading of the Company’s

securities on Nasdaq.

Pursuant

to the Nasdaq Listing Rules 5810(c)(3)(A), the Company is provided with a compliance period of 180 calendar days, or until January 13,

2025, to regain compliance under the Nasdaq Listing Rules. If at any time during this compliance period, the closing bid price of the

Company’s ordinary shares is US$1.00 per share or higher for a minimum

of ten consecutive business days, Nasdaq will provide the Company written confirmation of compliance and the matter will be closed.

In the event the Company does not regain compliance

by January 13, 2025, it may be eligible for an additional 180 calendar day period to regain compliance.

The Company intends to actively monitor the bid

price for its shares and will evaluate available options to regain compliance with the continued listing requirements.

About AGM Group Holdings Inc.

Incorporated in April 2015 and headquartered in

Beijing, China, AGM Group Holdings Inc. (NASDAQ: AGMH) is an integrated technology company focusing on producing high-performance hardware

and computing equipment. AGMH’s mission is to become one of the key participants and contributors in the global fintech and blockchain

ecosystem. For more information, please visit www.agmprime.com.

Forward Looking Statements

This news release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements

can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates” and similar statements. All statements other than statements of historical

fact in this press release are forward-looking statements and involve certain risks and uncertainties that could cause actual results

to differ materially from those in the forward-looking statements. These forward-looking statements are based on management’s current

expectations, assumptions, estimates and projections about the Company and the industry in which the Company operates, but involve a number

of unknown risks and uncertainties, Further information regarding these and other risks is included in the Company’s filings with

the U.S. Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements to reflect subsequent

occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that

the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out

to be correct, and actual results may differ materially from the anticipated results. You are urged to consider these factors carefully

in evaluating the forward-looking statements contained herein and are cautioned not to place undue reliance on such forward-looking statements,

which are qualified in their entirety by these cautionary statements.

For more information, please contact:

In China:

At the Company:

Email: ir@agmprime.com

Website: http://www.agmprime.com

Seaquant Consulting

Ms. Kristy Li

Email: kristy@sea-quant.com

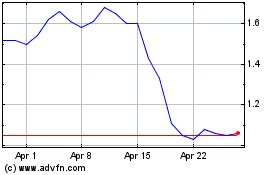

AGM (NASDAQ:AGMH)

Historical Stock Chart

From Nov 2024 to Dec 2024

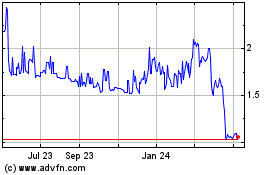

AGM (NASDAQ:AGMH)

Historical Stock Chart

From Dec 2023 to Dec 2024