Form 8-K - Current report

28 November 2023 - 9:21AM

Edgar (US Regulatory)

false

0001826397

A1

0001826397

2023-11-22

2023-11-22

0001826397

AGRI:CommonSharesMember

2023-11-22

2023-11-22

0001826397

AGRI:SeriesWarrantsMember

2023-11-22

2023-11-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2023

AGRIFORCE

GROWING SYSTEMS, LTD.

(Exact

Name of Registrant as Specified in Charter)

| British

Columbia |

|

001-40578 |

|

|

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 800-525 West 8th Avenue |

|

|

Vancouver,

BC,

Canada |

|

V5Z 1C6 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (604) 757-0952

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Shares |

|

AGRI |

|

The

Nasdaq Capital Market |

| Series

A Warrants |

|

AGRIW |

|

The

Nasdaq Capital Market |

FORWARD-LOOKING

STATEMENTS

This

Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively, the “Filings”)

contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available

to, Registrant’s management as well as estimates and assumptions made by Registrant’s management. When used in the Filings

the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant’s management

identify forward-looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject

to risks, uncertainties, assumptions and other factors relating to Registrant’s industry, Registrant’s operations and results

of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize,

or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated,

expected, intended or planned.

Although

Registrant believes that the expectations reflected in the forward-looking statements are reasonable, Registrant cannot guarantee future

results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the

United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results.

Item

8.01 Unregistered Sale of Equity Securities

On

November 22, 2023, the Board of Directors of AgriForce Growing Systems Ltd. approved a clawback policy for its executive officers in

the event that in the future there is a restatement of financial information. The policy, which was approved in accordance with Rule

10D-1, promulgated under the Securities Exchange Act of 1934, is attached hereto as Exhibit 99.1.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

November 27, 2023 |

|

| |

|

| AGRIFORCE

GROWING SYSTEMS, LTD. |

|

| |

|

| By: |

/s/

Richard Wong |

|

| Name: |

Richard

Wong |

|

| Interim

Chief Executive Officer and Chief Financial Officer |

|

EXHIBIT

99.1

AGRIFORCE

GROWING SYSTEMS, LTD.

POLICY

FOR THE RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

| 1.1. | In

accordance with Nasdaq Rule 5608, Section 10D and Rule 10D-1 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”) (“Rule 10D-1”),

the Board of Directors (the “Board”) of AgriForce Growing Systems,

Ltd. (the “Company”) has adopted this Policy (the “Policy”)

to provide for the recovery of erroneously awarded Incentive-based Compensation from Executive

Officers. All capitalized terms used and not otherwise defined herein shall have the meanings

set forth below. |

| 2. | RECOVERY

OF ERRONEOUSLY AWARDED COMPENSATION |

| 2.1. | In

the event of an Accounting Restatement, the Company will reasonably promptly recover the

Erroneously Awarded Compensation Received in accordance with Rule 5608 and Rule 10D-1 as

follows: |

| 2.1.1. | After

an Accounting Restatement, the Compensation Committee (the “Committee”)

shall determine the amount of any Erroneously Awarded Compensation Received by each Executive

Officer and shall promptly notify each Executive Officer with a written notice containing

the amount of any Erroneously Awarded Compensation and a demand for repayment or return of

such compensation, as applicable. |

| 2.1.1.1. | For

Incentive-based Compensation based on (or derived from) the Company’s stock price or

total shareholder return, where the amount of Erroneously Awarded Compensation is not subject

to mathematical recalculation directly from the information in the applicable Accounting

Restatement: |

| 2.1.1.2. | The

amount to be repaid or returned shall be determined by the Committee based on a reasonable

estimate of the effect of the Accounting Restatement on the Company’s stock price or

total shareholder return upon which the Incentive-based Compensation was Received. The Company

shall maintain documentation of the determination of such reasonable estimate and provide

the relevant documentation as required to Nasdaq. |

| 2.1.1.3. | The

Committee shall have discretion to determine the appropriate means of recovering Erroneously

Awarded Compensation based on the particular facts and circumstances. Notwithstanding the

foregoing, except as set forth in Section B(2) below, in no event may the Company accept

an amount that is less than the amount of Erroneously Awarded Compensation in satisfaction

of an Executive Officer’s obligations hereunder. |

| 2.1.1.4. | To

the extent that the Executive Officer has already reimbursed the Company for any Erroneously

Awarded Compensation Received under any duplicative recovery obligations established by the

Company or applicable law, it shall be appropriate for any such reimbursed amount to be credited

to the amount of Erroneously Awarded Compensation that is subject to recovery under this

Policy. |

| 2.1.1.5. | To

the extent that an Executive Officer fails to repay all Erroneously Awarded Compensation

to the Company when due, the Company shall take all actions reasonable and appropriate to

recover such Erroneously Awarded Compensation from the applicable Executive Officer. The

applicable Executive Officer shall be required to reimburse the Company for any and all expenses

reasonably incurred (including legal fees) by the Company in recovering such Erroneously

Awarded Compensation in accordance with the immediately preceding sentence. |

| 2.2. | Notwithstanding

anything herein to the contrary, the Company shall not be required to take the actions contemplated

above if the Committee determines that recovery would be impracticable and the following

conditions are met: |

| 2.3. | The

Committee has determined that the direct expenses paid to a third party to assist in enforcing

the Policy would exceed the amount to be recovered. Before making this determination, the

Company must make a reasonable attempt to recover the Erroneously Awarded Compensation, documented

such attempt(s) and provided such documentation to Nasdaq; and |

| 2.4. | Recovery

would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly

available to employees of the Company, to fail to meet the requirements of Section 401(a)(13)

or Section 411(a) of the Internal Revenue Code of 1986, as amended, and regulations thereunder. |

| 3. | DISCLOSURE

REQUIREMENTS |

| 3.1. | The

Company shall file all disclosures with respect to this Policy required by applicable SEC

rules. |

| 4. | PROHIBITION

OF INDEMNIFICATION |

| 4.1. | The

Company shall not be permitted to insure or indemnify any Executive Officer against (i) the

loss of any Erroneously Awarded Compensation that is repaid, returned or recovered pursuant

to the terms of this Policy, or (ii) any claims relating to the Company’s enforcement

of its rights under this Policy. Further, the Company shall not enter into any agreement

that exempts any Incentive-based Compensation that is granted, paid or awarded to an Executive

Officer from the application of this Policy or that waives the Company’s right to recovery

of any Erroneously Awarded Compensation, and this Policy shall supersede any such agreement

(whether entered into before, on or after the Effective Date of this Policy). |

| 5. | ADMINISTRATION

AND INTERPRETATION |

| 5.1. | This

Policy shall be administered by the Committee, and any determinations made by the Committee

shall be final and binding on all affected individuals. The Committee is authorized to interpret

and construe this Policy and to make all determinations necessary, appropriate, or advisable

for the administration of this Policy and for the Company’s compliance with Nasdaq

Rules, Section 10D, Rule 10D-1 and any other applicable law, regulation, rule or interpretation

of the SEC or Nasdaq. |

| 6.1. | The

Committee may amend this Policy from time to time in its discretion and shall amend this

Policy as it deems necessary. Notwithstanding anything in this section to the contrary, no

amendment or termination of this Policy shall be effective if such amendment or termination

would (after taking into account any actions taken by the Company contemporaneously with

such amendment or termination) cause the Company to violate any federal securities laws,

SEC rule or Nasdaq rule. |

| 7.1. | This

Policy shall be binding and enforceable against all Executive Officers and, to the extent

required by applicable law or guidance from the SEC or Nasdaq, their beneficiaries, heirs,

executors, administrators or other legal representatives. The Committee intends that this

Policy will be applied to the fullest extent required by applicable law. Any employment agreement,

equity award agreement, compensatory plan or any other agreement or arrangement with an Executive

Officer shall be deemed to include, as a condition to the grant of any benefit thereunder,

an agreement by the Executive Officer to abide by the terms of this Policy. Any right of

recovery under this Policy is in addition to, and not in lieu of, any other remedies or rights

of recovery that may be available to the Company under applicable law, regulation or rule

or pursuant to the terms of any policy of the Company or any provision in any employment

agreement, equity award agreement, compensatory plan, agreement or other arrangement. |

For

purposes of this Policy, the following capitalized terms shall have the meanings set forth below.

| 8.1. | “Accounting

Restatement” means an accounting restatement due to the material noncompliance

of the Company with any financial reporting requirement under the securities laws, including

any required accounting restatement to correct an error in previously issued financial statements

that is material to the previously issued financial statements (a “Big R” restatement),

or that would result in a material misstatement if the error were corrected in the current

period or left uncorrected in the current period (a “little r” restatement). |

| 8.2. | “Clawback

Eligible Incentive Compensation” means all Incentive-based Compensation Received

by an Executive Officer (i) on or after October 2, 2023, (ii) after beginning service as

an Executive Officer, (iii) who served as an Executive Officer at any time during the applicable

performance period relating to any Incentive-based Compensation (whether or not such Executive

Officer is serving at the time the Erroneously Awarded Compensation is required to be repaid

to the Company), (iv) while the Company has a class of securities listed on a national securities

exchange or a national securities association, and (v) during the applicable Clawback Period

(as defined below). |

| 8.3. | “Clawback

Period” means, with respect to any Accounting Restatement, the three completed

fiscal years of the Company immediately preceding the Restatement Date (as defined below),

and if the Company changes its fiscal year, any transition period of less than nine months

within or immediately following those three completed fiscal years. |

| 8.4. | “Erroneously

Awarded Compensation” means, with respect to each Executive Officer in connection

with an Accounting Restatement, the amount of Clawback Eligible Incentive Compensation that

exceeds the amount of Incentive-based Compensation that otherwise would have been Received

had it been determined based on the restated amounts, computed without regard to any taxes

paid. |

| 8.5. | “Executive

Officer” means each individual who is currently or was previously designated

as an “officer” of the Company as defined in Rule 16a-1(f) under the Exchange

Act. For the avoidance of doubt, the identification of an executive officer for purposes

of this Policy shall include each executive officer who is or was identified pursuant to

Item 401(b) of Regulation S-K or Item 6.A of Form 20-F, as applicable, as well as the principal

financial officer and principal accounting officer (or, if there is no principal accounting

officer, the controller). |

| 8.6. | “Financial

Reporting Measures” means measures that are determined and presented in accordance

with the accounting principles used in preparing the Company’s financial statements,

and all other measures that are derived wholly or in part from such measures. Stock price

and total shareholder return (and any measures that are derived wholly or in part from stock

price or total shareholder return) shall, for purposes of this Policy, be considered Financial

Reporting Measures. For the avoidance of doubt, a Financial Reporting Measure need not be

presented in the Company’s financial statements or included in a filing with the SEC. |

| 8.7. | “Incentive-based

Compensation” means any compensation that is granted, earned or vested based

wholly or in part upon the attainment of a Financial Reporting Measure. |

| 8.8. | “Received”

means, with respect to any Incentive-based Compensation, actual or deemed receipt, and Incentive-based

Compensation shall be deemed received in the Company’s fiscal period during which the

Financial Reporting Measure specified in the Incentive-based Compensation award is attained,

even if the payment or grant of the Incentive-based Compensation to the Executive Officer

occurs after the end of that period. |

| 8.9. | “Restatement

Date” means the earlier to occur of (i) the date the Board, a committee of

the Board or the officers of the Company authorized to take such action if Board action is

not required, concludes, or reasonably should have concluded, that the Company is required

to prepare an Accounting Restatement, or (ii) the date a court, regulator or other legally

authorized body directs the Company to prepare an Accounting Restatement. |

| 9. | This

policy is effective as of December 1, 2023. |

Exhibit

A

ATTESTATION

AND ACKNOWLEDGEMENT OF POLICY FOR THE RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

By

my signature below, I acknowledge and agree that:

I

have received and read the attached Policy for the Recovery of Erroneously Awarded Compensation (this “Policy”),

and I agree that the Policy supersedes any clawback provision set forth in my existing employment agreement with the Company.

I

hereby agree to abide by all of the terms of this Policy both during and after my employment with the Company, including, without limitation,

by promptly repaying or returning any Erroneously Awarded Compensation to the Company as determined in accordance with this Policy.

Signature:

________________________________

Printed

Name: _____________________________

Date:

____________________________________

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AGRI_CommonSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AGRI_SeriesWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

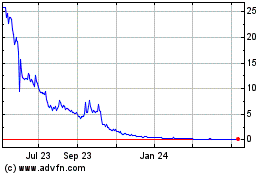

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From Nov 2024 to Dec 2024

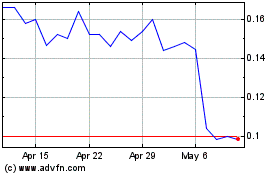

AgriFORCE Growing Systems (NASDAQ:AGRI)

Historical Stock Chart

From Dec 2023 to Dec 2024