false

0001859199

0001859199

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): September 30, 2024

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

On

September 30, 2024, reAlpha Tech Corp. (the “Company”) announced that reAlpha AI Labs (“AI Labs”), a research

and development initiative to develop, partner with and potentially invest in artificial intelligence (“AI”) startups, invested

in Xmore AI (“Xmore AI”), a company that provides AI-driven cybersecurity solutions that is developing a software that will

consolidate multiple cybersecurity tools into one platform. The Company believes that this investment in Xmore AI will enhance the cybersecurity

capabilities of its AI-powered homebuying platform, as well as provide Xmore AI additional funds to continue the development of its cybersecurity

software, which will provide AI-driven cybersecurity solutions to enterprises in multiple industries.

On

September 30, 2024, the Company issued a press release announcing the investment of AI Labs in Xmore AI. A copy of the press release is

furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Form 8-K”) and is incorporated herein by reference.

The information set forth

and incorporated into Item 8.01 of this Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Company’s filings under

the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of

any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Forward-Looking Statements

The information in this Form

8-K includes “forward-looking statements”. Forward-looking statements include, among other things, statements about Xmore

AI’s technology and the AI Labs initiative; the anticipated benefits of Xmore AI’s technology and the AI Labs initiative;

the Company’s ability to anticipate the future needs of the short-term rental market; future trends in the real estate, technology

and artificial intelligence industries, generally; and the Company’s future growth strategy and growth rate. In some cases, you

can identify forward-looking statements by terminology such as “may”, “should”, “could”, “might”,

“plan”, “possible”, “project”, “strive”, “budget”, “forecast”,

“expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”,

“predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar

terminology. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the

Company’s limited operating history and that the Company has not yet fully developed its AI-based technologies; the Company’s

ability to commercialize its developing AI-based technologies; whether the Company’s technology and products will be accepted and

adopted by its customers and intended users; the Company’s ability to leverage Xmore AI’s technology and the AI Labs initiative

into its existing business and the anticipated demand for AI Labs collaborations and partnerships; Xmore AI’s ability to develop

its software to consolidate cybersecurity tools to provide AI-driven cybersecurity solutions to enterprises and the anticipated demand

for such software; the inability to maintain and strengthen the Company’s brand and reputation; the inability to accurately forecast

demand for short-term rentals and AI-based real estate focused products; the inability to execute business objectives and growth strategies

successfully or sustain the Company’s growth; the inability of the Company’s customers to pay for the Company’s services;

changes in applicable laws or regulations, and the impact of the regulatory environment and complexities with compliance related to such

environment; and other risks and uncertainties indicated in the Company’s U.S. Securities and Exchange Commission (“SEC”)

filings. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are

subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from

those anticipated in the forward-looking statements. Although the Company believes that the expectations reflected in the forward-looking

statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company’s future results,

level of activity, performance or achievements may differ materially from those contemplated, expressed or implied by the forward-looking

statements, and there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in

the forward-looking statements. For more information about the factors that could cause such differences, please refer to the Company’s

filings with the SEC. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company does not undertake

any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: September 30, 2024 |

REALPHA TECH CORP. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

reAlpha Invests in Xmore AI to Advance AI-Powered

Cybersecurity Solutions

Xmore AI Joins reAlpha AI Labs to Address

the $22B+ Global Market for Cybersecurity AI Solutions1

Dublin, Ohio – September 30, 2024

– reAlpha Tech Corp. (“reAlpha”) (Nasdaq: AIRE), a real estate technology company developing and commercializing

artificial intelligence (“AI”) technologies, today announced the selection of Xmore AI as the first company to secure investment

from its newly launched reAlpha AI Labs, reAlpha’s research and development initiative.

Xmore AI, co-founded by Dr. Benjamin Yan and Adrian

Self, leverages over a decade of research in AI-driven cybersecurity and has developed a platform that consolidates multiple cybersecurity

tools into a seamless, AI-driven solution, ensuring that enterprises can operate securely in a rapidly evolving digital environment. Dr.

Yan is a Professor of Computer Science and Engineering at Michigan State University. Adrian Self, a cybersecurity professional with extensive

experience in blockchain security and embedded systems, complements Dr. Yan’s expertise with his hands-on approach to security assessments

and technology integration. This investment marks a strategic milestone for reAlpha AI Labs to accelerate the development of AI technologies

and advance technology innovation in the real estate industry.

Mike Logozzo, President and Chief Operating Officer

of reAlpha, emphasized the broader impact of Xmore AI’s technology: “At reAlpha AI Labs, we aim to create an environment where

innovative AI startups can thrive. Xmore AI’s focus on cybersecurity aligns with our vision and we believe Xmore AI’s technology

will enhance the security and scalability across our AI homebuying platform and our recently acquired portfolio companies.” reAlpha’s

recently acquired portfolio companies include Naamche, Hyperfast, Be My Neighbor, and AiChat.

“Xmore AI represents the next generation

of forward-thinking innovation we envisioned to collaborate with when we launched reAlpha AI Labs,” said Vinayak Grover, Associate

Vice President of AI Labs at reAlpha. “Their expertise in cybersecurity, particularly for AI operations, will be critical as AI

becomes more integrated into enterprise systems.”

In addition to enhancing reAlpha’s AI homebuying

platform through its AI-cybersecurity expertise, Xmore AI is developing a software that will consolidate multiple cybersecurity tools

to provide AI-cybersecurity solutions to enterprises in multiple industries. At the core of Xmore AI’s innovation is its ability

to address the unique vulnerabilities created by the rapid expansion of AI across industries. We believe Xmore AI is well-positioned to

address critical challenges like data privacy, compliance, and risk management, by providing innovative solutions designed to meet the

evolving needs of the cybersecurity landscape.

“With AI becoming more integrated into how

businesses operate, it is essential that cybersecurity evolves alongside it,” said Dr. Yan, co-founder and Chief Executive Officer

of Xmore AI. “Through our partnership with reAlpha AI Labs, we believe we are in a position to deliver scalable, cutting-edge security

solutions that protect enterprises from the emerging risks of AI integration.”

Launched earlier this year, reAlpha AI Labs is

designed to support innovative AI startups with funding, technical resources, and strategic partnerships. By providing early-stage funding

along with access to reAlpha’s extensive network, the program is committed to accelerating the growth and efficacy of AI-driven

solutions.

| 1 | https://market.us/report/ai-in-cybersecurity-market/ |

The incubation of Xmore AI not only highlights

reAlpha AI Labs’ commitment to cybersecurity, but it also marks reAlpha AI Labs' broader mission to drive AI advancements across

sectors like real estate, fintech, and enterprise technology.

About reAlpha Tech Corp.

reAlpha Tech Corp. (Nasdaq: AIRE) is a real estate

technology company developing an end-to-end commission-free homebuying platform. Utilizing the power of AI and an acquisition-led growth

strategy, reAlpha’s goal is to offer a more affordable, streamlined experience for those on the journey to homeownership. For more

information, visit www.reAlpha.com.

About Xmore AI

Xmore AI is developing a software that will offer

innovative AI-driven cybersecurity solutions by consolidating multiple cybersecurity tools into a single platform, which will provide

real-time risk analysis, vulnerability detection, and IT operations management, all while ensuring privacy by keeping data within the

enterprise.

About the reAlpha Platform

reAlpha (previously called “Claire”),

announced on April 24, 2024, is reAlpha’s generative AI-powered, commission-free, homebuying platform. The tagline: No fees. Just

keys.™ – reflects reAlpha’s dedication to eliminating traditional barriers and making homebuying more accessible and

transparent.

reAlpha’s introduction aligns with major

shifts in the real estate sector after the National Association of Realtors agreed to settle certain lawsuits upon being found to have

violated antitrust laws, resulting in inflated fees paid to buy-side agents. This development is expected to result in the end of the

standard six percent sales commission, which equates to approximately $100 billion in realtor fees paid annually. The reAlpha platform

offers a cost-free alternative for homebuyers by utilizing an AI-driven workflow that assists them through the homebuying process.

Homebuyers using the reAlpha platform’s

conversational interface will be able to interact with Claire, reAlpha’s AI buyer’s agent, to guide them through every step

of their homebuying journey, from property search to closing the deal. By offering support 24/7, Claire is poised to make the homebuying

process more efficient, enjoyable, and cost-efficient. Claire matches buyers with their dream homes using over 400 data attributes and

provides insights into market trends and property values. Additionally, Claire can assist with questions, booking property tours, submitting

offers, and negotiations.

Currently, the reAlpha platform is under limited

availability for homebuyers located in 20 counties in Florida, but reAlpha is actively seeking new MLS and brokerage licenses that will

enable expansion into more U.S. states.

Forward-Looking Statements

The information in this press release includes

“forward-looking statements”. Forward-looking statements include, among other things, statements about Xmore AI’s technology

and the reAlpha AI Labs initiative; the anticipated benefits of Xmore AI’s technology and the reAlpha AI Labs initiative; reAlpha’s

ability to anticipate the future needs of the short-term rental market; future trends in the real estate, technology and artificial intelligence

industries, generally; and reAlpha’s future growth strategy and growth rate. In some cases, you can identify forward-looking statements

by terminology such as “may”, “should”, “could”, “might”, “plan”, “possible”,

“project”, “strive”, “budget”, “forecast”, “expect”, “intend”,

“will”, “estimate”, “anticipate”, “believe”, “predict”, “potential”

or “continue”, or the negatives of these terms or variations of them or similar terminology. Factors that may cause actual

results to differ materially from current expectations include, but are not limited to: reAlpha’s limited operating history and

that reAlpha has not yet fully developed its AI-based technologies; reAlpha’s ability to commercialize its developing AI-based technologies;

whether reAlpha’s technology and products will be accepted and adopted by its customers and intended users; reAlpha’s ability

to leverage Xmore AI’s technology and the reAlpha AI Labs initiative into its existing business and the anticipated demand for reAlpha

AI Labs collaborations and partnerships; Xmore AI’s ability to develop its software to consolidate cybersecurity tools to provide

AI-cybersecurity solutions to enterprises and the anticipated demand for such software; the inability to maintain and strengthen reAlpha’s

brand and reputation; the inability to accurately forecast demand for short-term rentals and AI-based real estate focused products; the

inability to execute business objectives and growth strategies successfully or sustain reAlpha’s growth; the inability of reAlpha’s

customers to pay for reAlpha’s services; changes in applicable laws or regulations, and the impact of the regulatory environment

and complexities with compliance related to such environment; and other risks and uncertainties indicated in reAlpha’s U.S. Securities

and Exchange Commission (“SEC”) filings. Forward-looking statements are based on the opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual

events or results to differ materially from those anticipated in the forward-looking statements. Although reAlpha believes that the expectations

reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct.

reAlpha’s future results, level of activity, performance or achievements may differ materially from those contemplated, expressed

or implied by the forward-looking statements, and there is no representation that the actual results achieved will be the same, in whole

or in part, as those set out in the forward-looking statements. For more information about the factors that could cause such differences,

please refer to reAlpha’s filings with the SEC. Readers are cautioned not to put undue reliance on forward-looking statements, and

reAlpha does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Media

irlabs on behalf of reAlpha

Fatema Bhabrawala

fatema@irlabs.ca

3

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

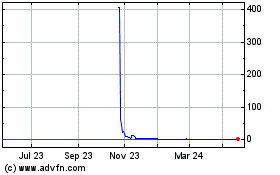

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

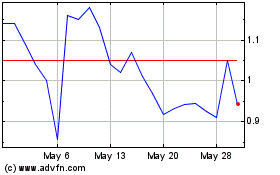

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Jan 2024 to Jan 2025